Net Operating Loss Carryback Templates

Are you a corporation expecting a net operating loss carryback? Are you looking to extend the time for payment of taxes? Look no further! Our collection of documents will provide you with the necessary instructions and forms to successfully navigate this process.

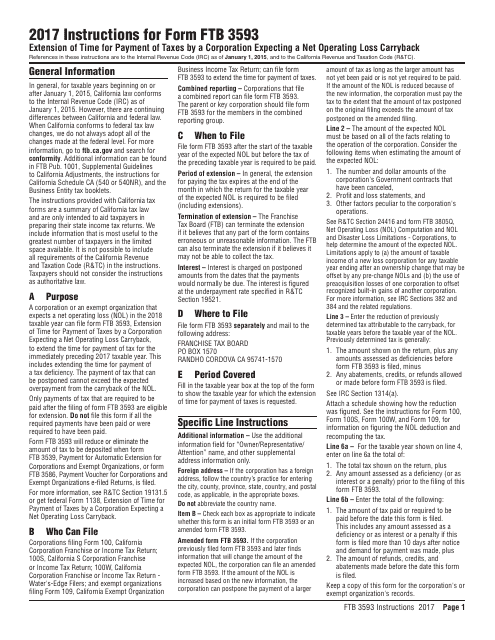

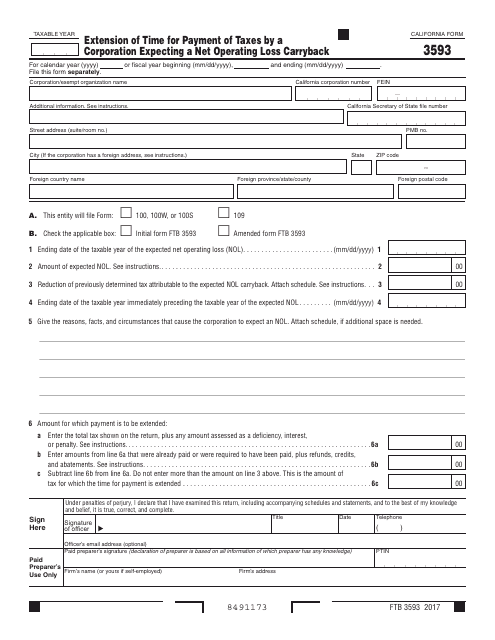

Our comprehensive collection includes instructions for Form FTB3593 and Form FTB3593 itself, specifically designed for corporations in California. These documents will guide you through the steps to request an extension of time for payment of taxes if you are expecting a net operating loss carryback.

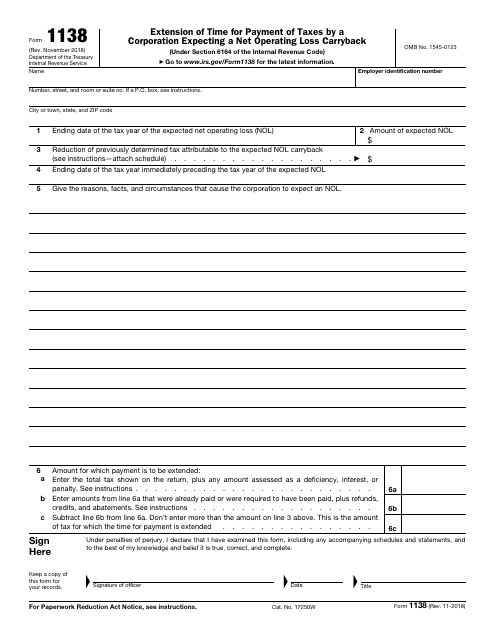

But that's not all! We also have IRS Form 1138, which is required for corporations expecting a net operating loss carryback at the federal level. With this form, you can ensure that your taxes are paid in a timely manner, giving you peace of mind.

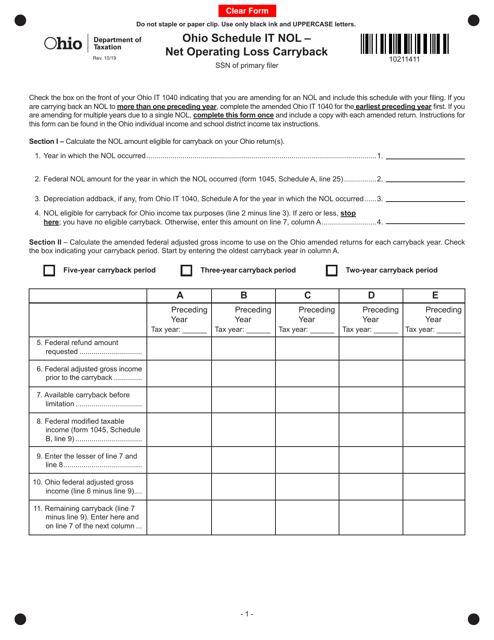

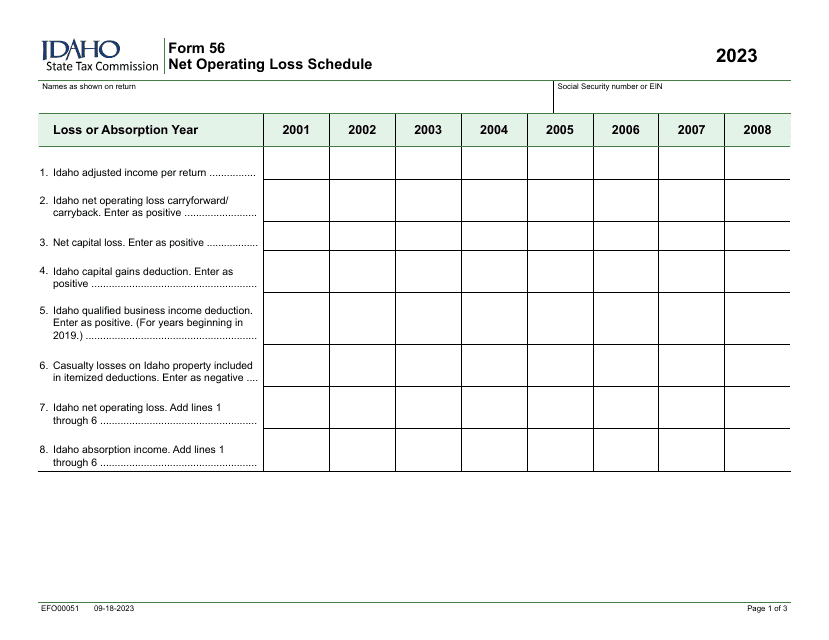

If you're a corporation based in Ohio, we have you covered too. Our collection includes Schedule IT NOL, a specific form for reporting and carrying back net operating losses in the state. By utilizing this document, you can maximize your tax savings and improve your financial situation.

No matter where you are located or what specific forms you need, our collection of net operating loss carryback documents has got you covered. Let us take the hassle out of tax season and help you navigate this complex process with ease. Start exploring our collection today!

Documents:

7

This Form is used for requesting an extension of time to pay taxes by a corporation in California that expects a net operating loss carryback. It provides instructions on how to properly complete the form and submit it to the relevant tax authorities.

This form is used for corporations in California that are expecting a net operating loss carryback and need an extension of time to pay their taxes.

This form is used for corporations expecting a net operating loss carryback to request an extension of time to pay their taxes.