Retention Credit Templates

Are you looking for ways to receive financial incentives for retaining employees in your business? Look no further! Our retention credit program offers eligible businesses the opportunity to earn tax credits for their efforts in promoting job retention.

Whether you're based in Indiana or New York, our retention credit program is designed to support businesses of all sizes and industries. By taking advantage of this program, you can potentially reduce your tax liability and receive substantial financial incentives.

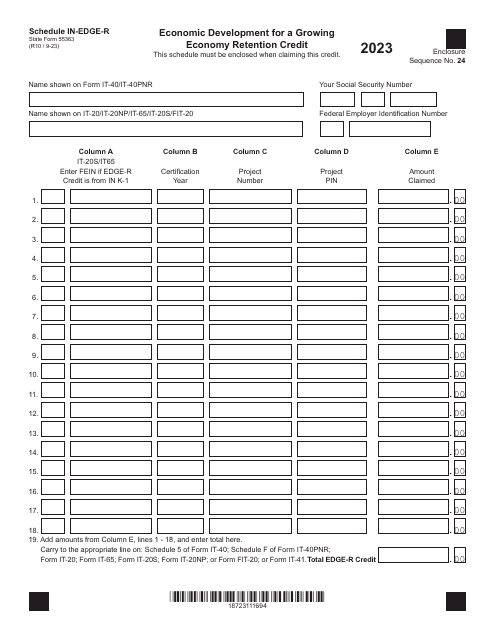

Our retention credit program, also known as the Economic Development for a Growing Economy Retention Credit, is available to businesses that meet specific criteria. These criteria may include the number of employees retained, the length of time employees have been employed, and the wages paid to these employees.

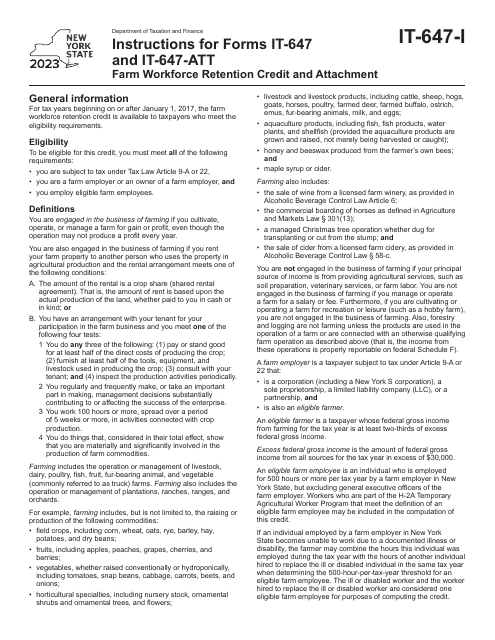

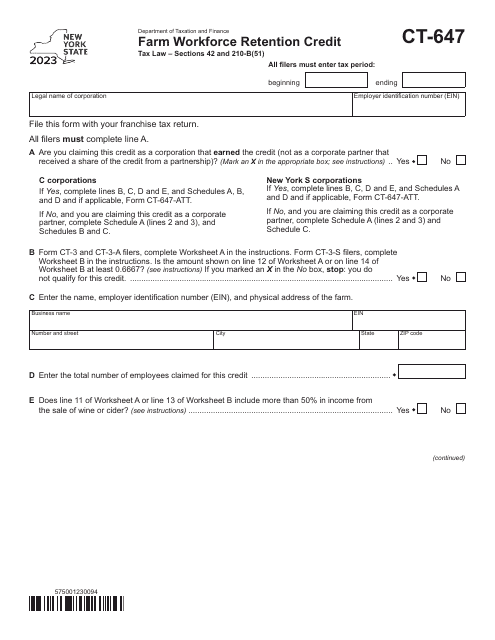

To apply for the retention credit, businesses must complete the necessary forms and provide the required documentation. In Indiana, businesses can use State Form 55363 Schedule IN-EDGE-R, while in New York, they will need to complete Form IT-647 and Form CT-647.

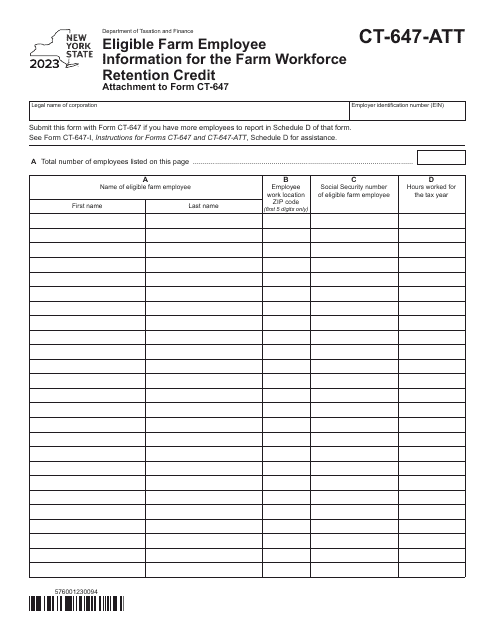

For businesses in New York, there are additional forms to fill out, such as Form CT-647-ATT, which requires information about eligible farm employees. The Farm Workforce Retention Credit is specifically designed for agricultural businesses in the state.

If you're ready to take advantage of this opportunity, contact us today to learn more about our retention credit program. Our team of experts can guide you through the application process and help you maximize your tax credits. Don't miss out on this chance to receive financial incentives for retaining your valuable employees.

Documents:

6