Fuel Bond Templates

Looking for a surefire way to secure your fuel distribution business? Look no further than the Fuel Bond collection. Also known as the Fuel Distributors Bond or the Motor FuelsSurety Bond, this collection of documents is your key to meeting the compliance requirements set forth by various states.

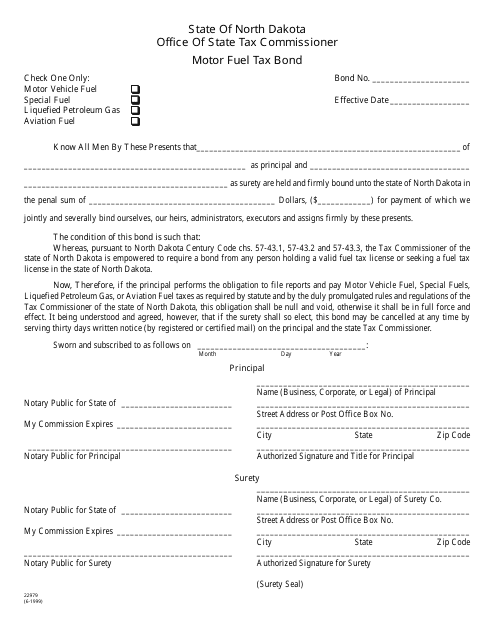

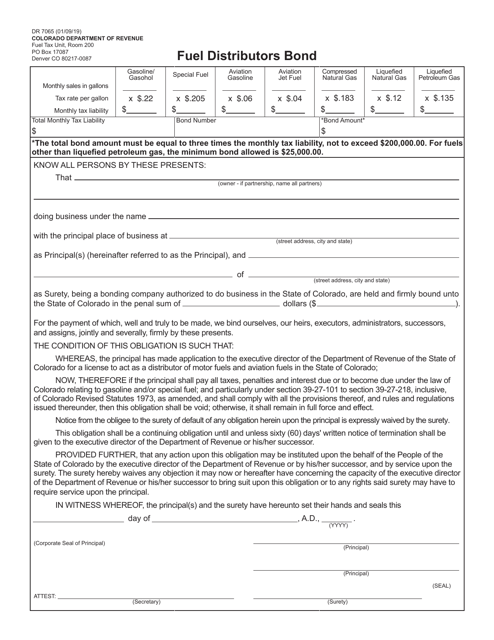

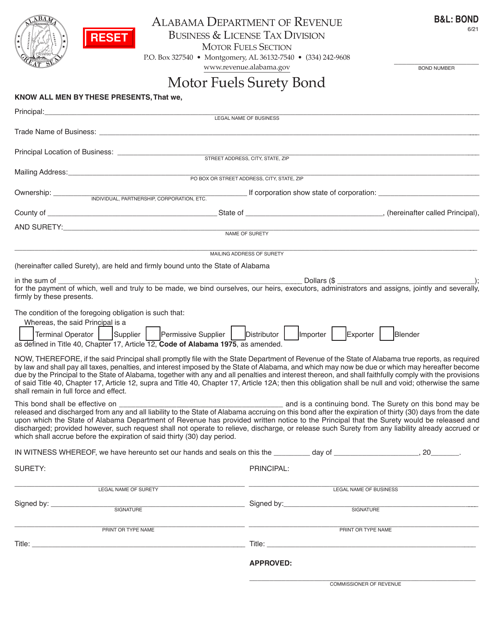

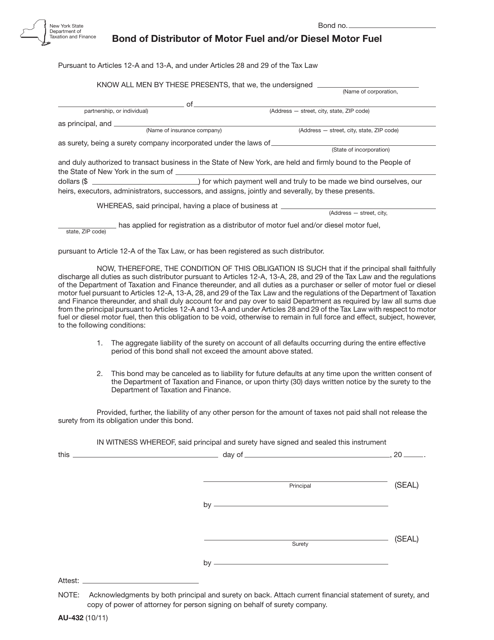

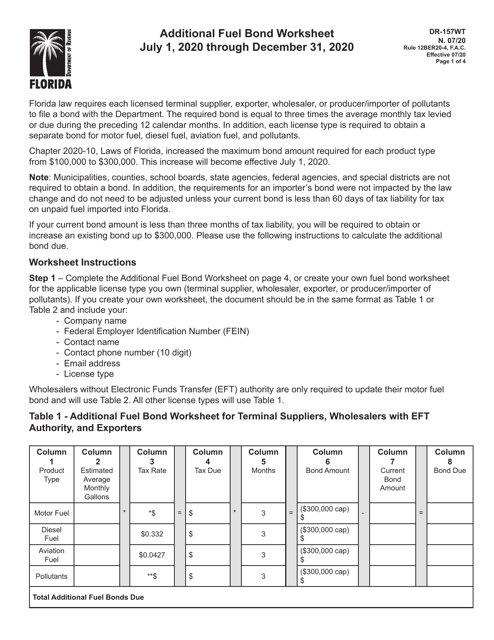

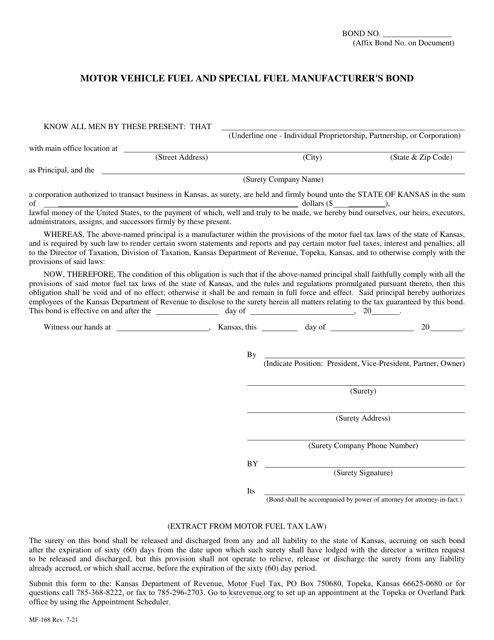

Whether you're based in North Dakota, Colorado, Alabama, Florida, or Kansas, our Fuel Bond collection has got you covered. Our comprehensive forms, such as the Form 22979 Motor Fuel Tax Bond, the Form DR7065 Fuel Distributors Bond, the Form B&L: BOND Motor Fuels Surety Bond, the Form DR-157WT Additional Fuel Bond Worksheet, and the Form MF-168 Motor Vehicle Fuel and Special Fuel Manufacturer's Bond, ensure that your fuel distribution business operates smoothly and within the legal framework.

Don't take any chances with your fuel business. With the Fuel Bond collection, you can guarantee your compliance and peace of mind.

Documents:

6

This Form is used for obtaining a motor fuel tax bond in North Dakota.

This form is used for distributors of motor fuel and/or diesel motor fuel in New York to submit a bond. It is required by the state to ensure compliance with tax obligations related to fuel distribution.

This form is used for calculating additional fuel bonds in the state of Florida. It is a worksheet that helps businesses determine the amount of bond required for the purchase and storage of additional fuel in the state.