Housing Credit Templates

The Housing Credit, also known as housing credits, is a crucial financial assistance program aimed at promoting affordable housing in the United States, Canada, and other countries. Through this program, individuals, developers, and organizations can access tax credits and incentives to finance and develop low-income housing projects.

The Housing Credit offers a range of benefits, including tax credits, deductions, and grants, to encourage the construction, rehabilitation, and preservation of affordable housing. These incentives are designed to attract private investment in the housing market, enabling the development of safe and affordable homes for individuals and families in need.

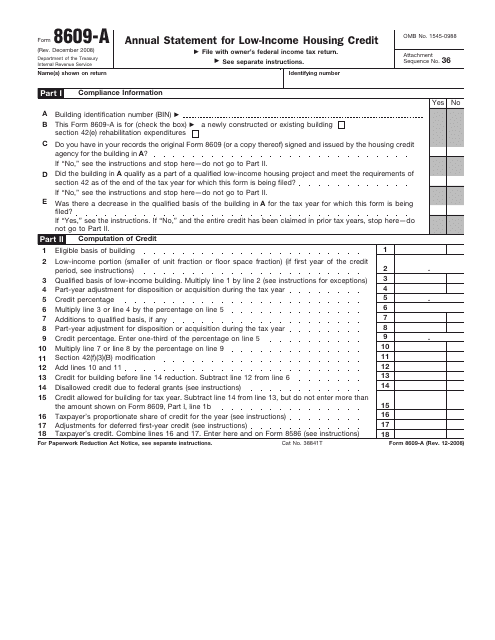

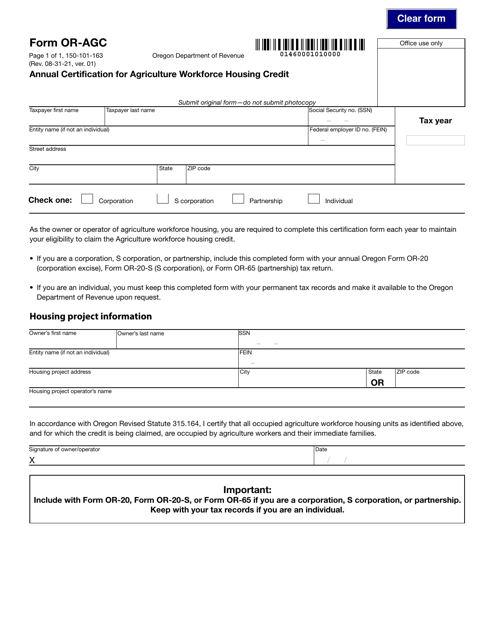

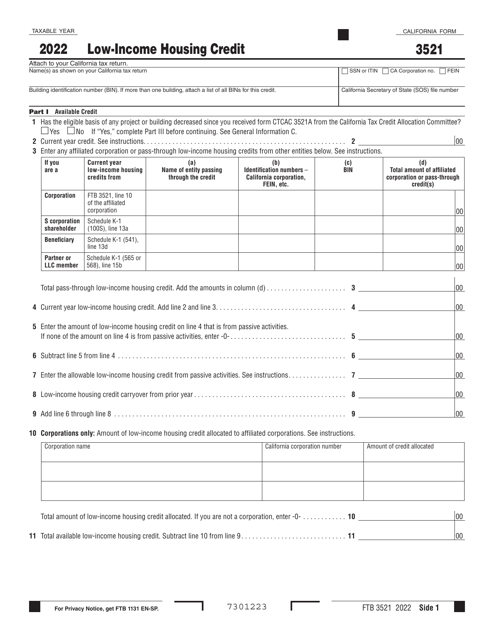

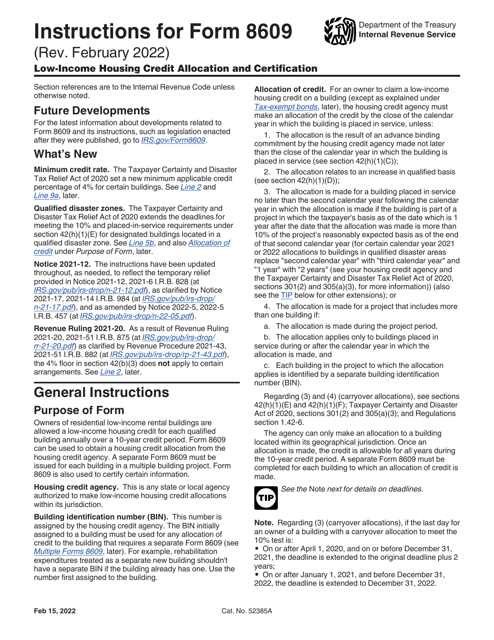

One of the primary documents associated with the Housing Credit is the IRS Form 8609-A Annual Statement for Low-Income Housing Credit. This form is utilized by developers to claim credits for qualifying properties and report their compliance with program requirements. Similarly, the Form OR-AGC Annual Certification for Agriculture Workforce Housing Credit - Oregon is specific to the state of Oregon, providing developers with the necessary documentation to access housing credits for agricultural housing projects.

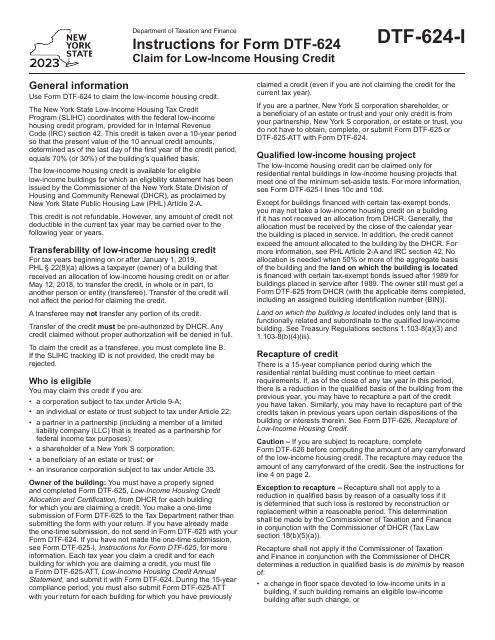

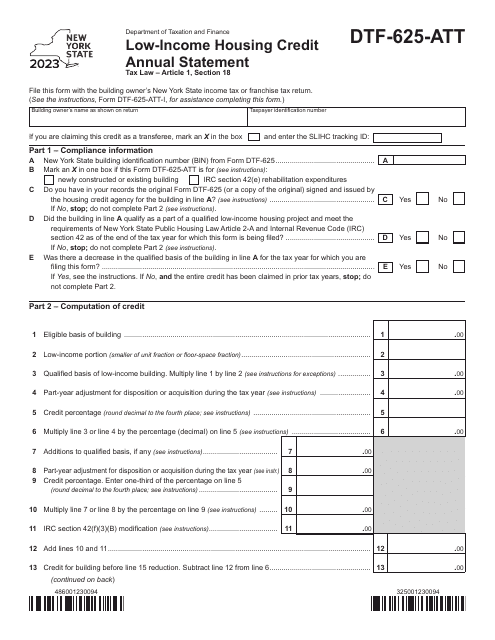

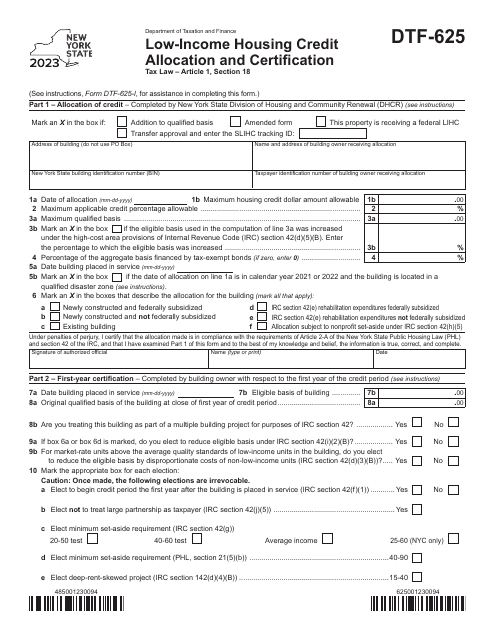

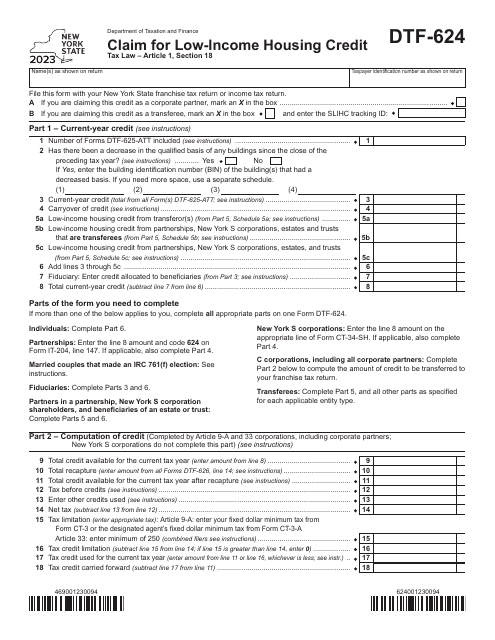

Furthermore, the Instructions for Form DTF-624 Claim for Low-Income Housing Credit - New York and the Form DTF-625-ATT Low-Income Housing Credit Annual Statement - New York pertain to New York-specific documents. These forms outline the procedures for claiming and reporting low-income housing credits in the state of New York.

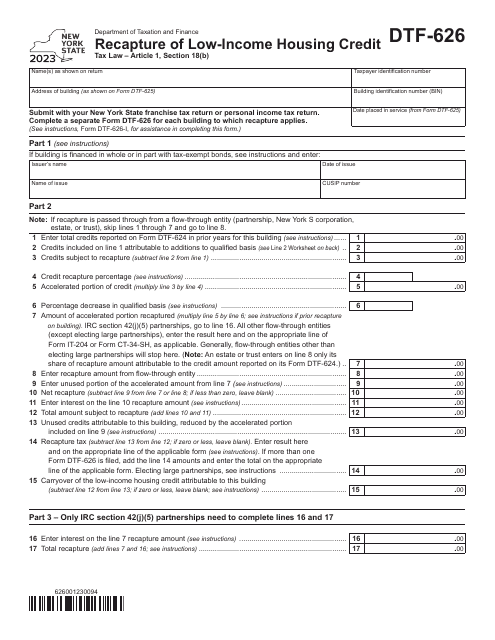

In some cases, the Form DTF-626 Recapture of Low-Income Housing Credit - New York may also be required. This document provides detailed instructions for recapturing housing credits that were initially claimed but no longer qualify for the program.

The Housing Credit plays a vital role in addressing the housing needs of low-income individuals and families. By providing financial incentives and tax benefits, this program encourages the development of affordable housing and helps to alleviate housing challenges faced by communities across the nation.

Documents:

11

This document is used for reporting the annual statement for the Low-Income Housing Credit, as required by the IRS.