Asset Report Templates

Are you looking for an efficient way to manage your assets and keep track of their value? Look no further! Our asset reporting solution is just what you need. Whether you call it an asset report, asset reporting, assets report, reportable assets, or reporting assets, we have got you covered.

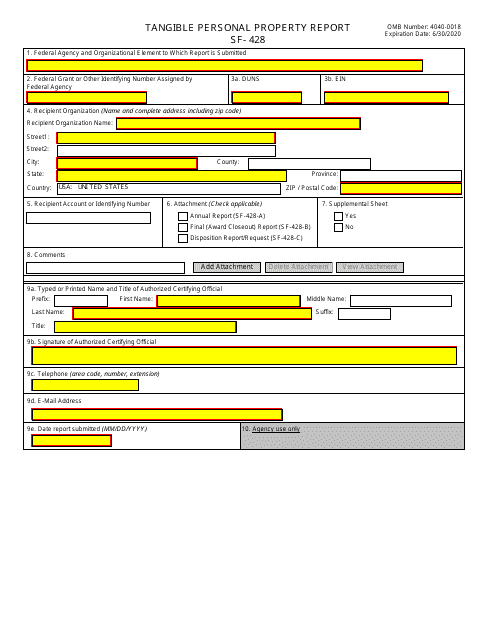

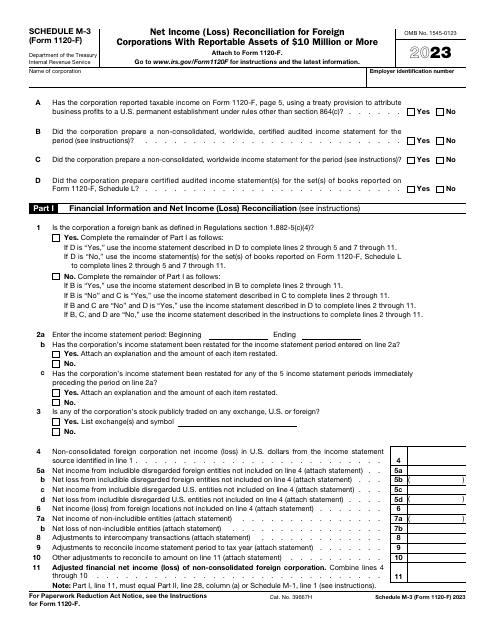

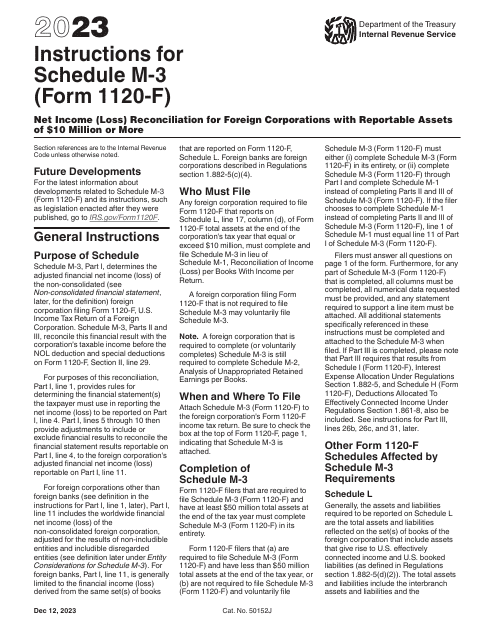

With our comprehensive asset reporting system, you can easily document and evaluate your tangible and intangible assets. Our platform integrates seamlessly with various reporting forms and instructions, including the Form SF-428 Tangible Personal Property Report and the Instructions for IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations With Reportable Assets of $10 Million or More.

Speaking of reportable assets, our asset reporting system also supports the IRS Form 1120-F Schedule M-3 Net Income (Loss) Reconciliation for Foreign Corporations with high-value assets. This form is essential for accurately reporting your financial position to the IRS.

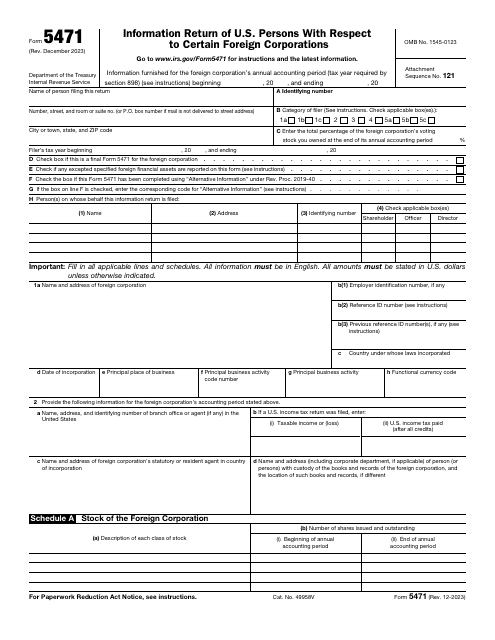

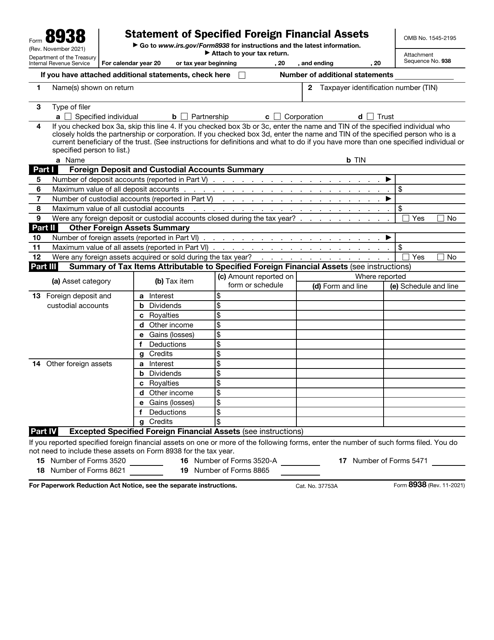

If you have specified foreign financial assets that need to be disclosed, we have got you covered as well. Our asset reporting solution supports the IRS Form 8938 Statement of Specified Foreign Financial Assets, ensuring compliance with tax regulations.

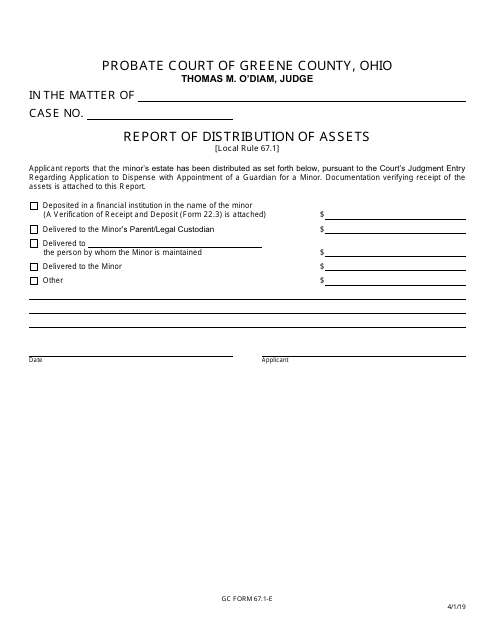

Moreover, our system is versatile enough to accommodate various asset distribution scenarios. For example, the GC Form 67.1-E Report of Distribution of Assets in Greene County, Ohio, can be easily generated using our platform.

Don't let the complexity of asset reporting overwhelm you. Our user-friendly asset reporting system simplifies the process, allowing you to effortlessly manage and report on your assets. Start streamlining your asset reporting today with our innovative solution.

Documents:

23

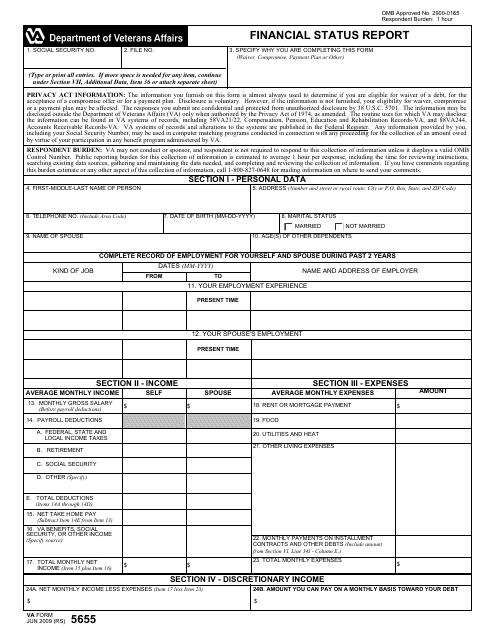

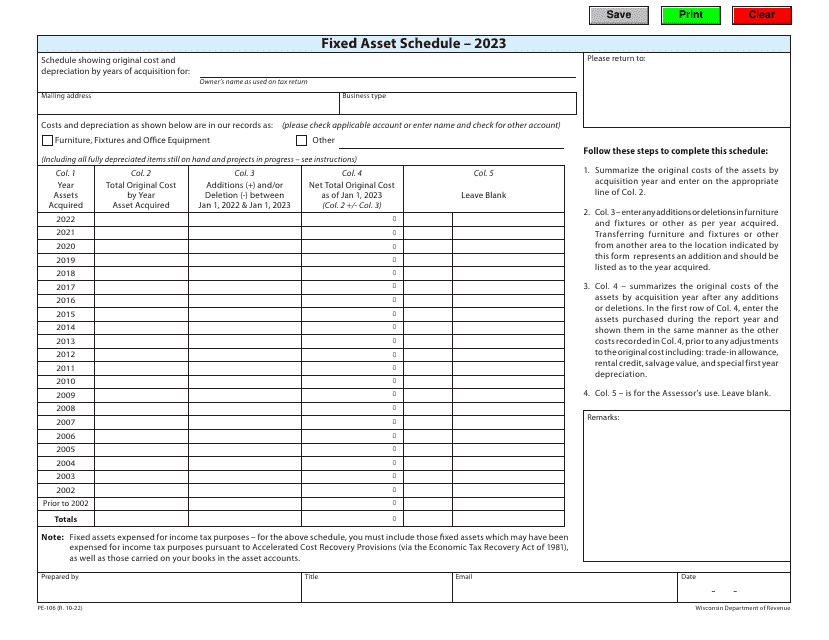

This document is used to determine eligibility for claiming a payment plan, acceptance of a compromise offer, or as debt waiver.

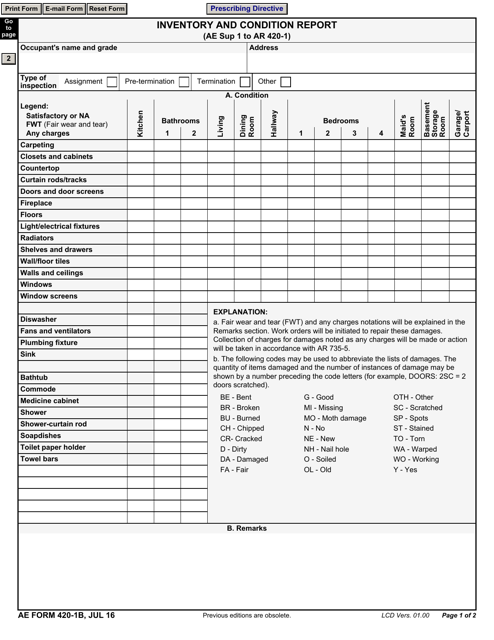

This Form is used for maintaining an inventory and reporting the condition of items.

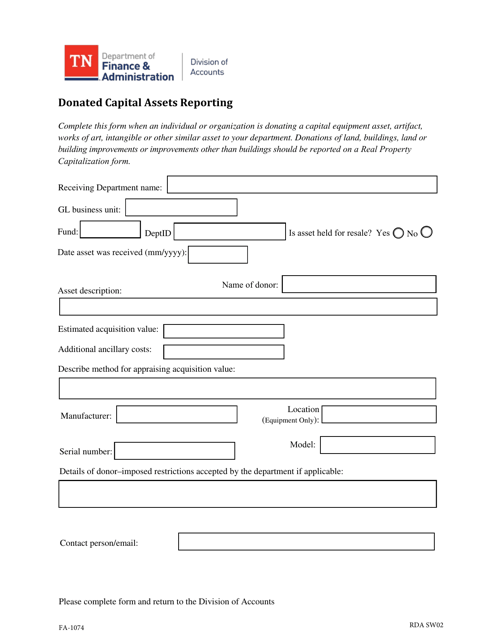

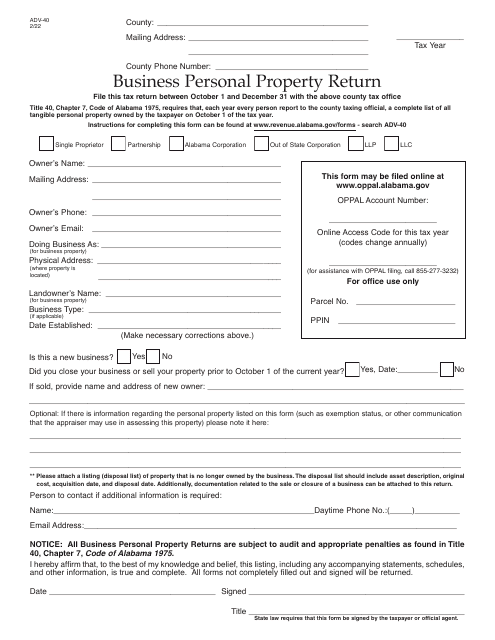

This document is used for reporting donated capital assets in Tennessee. It is a form that must be filled out to provide information about any capital assets that have been donated to an organization in the state.

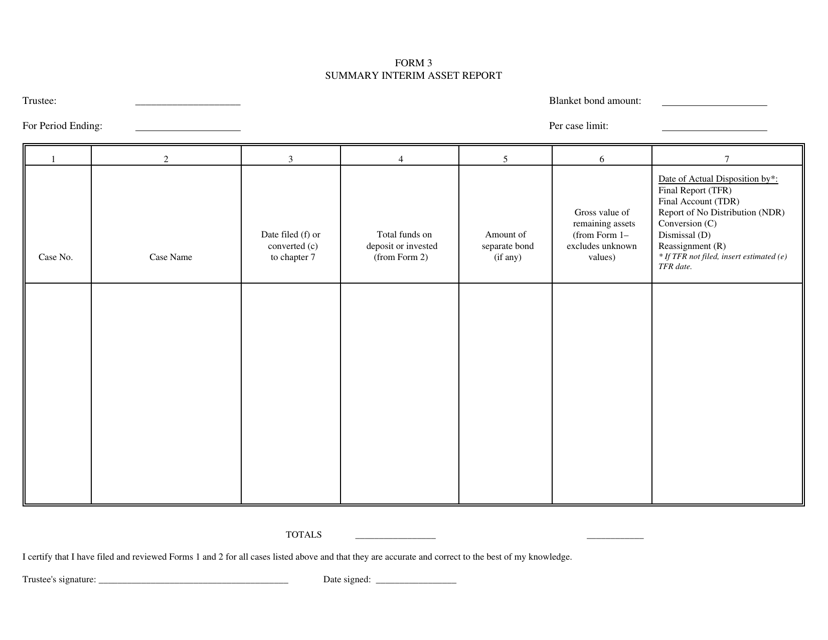

This document is used for providing a summary of the interim asset report.

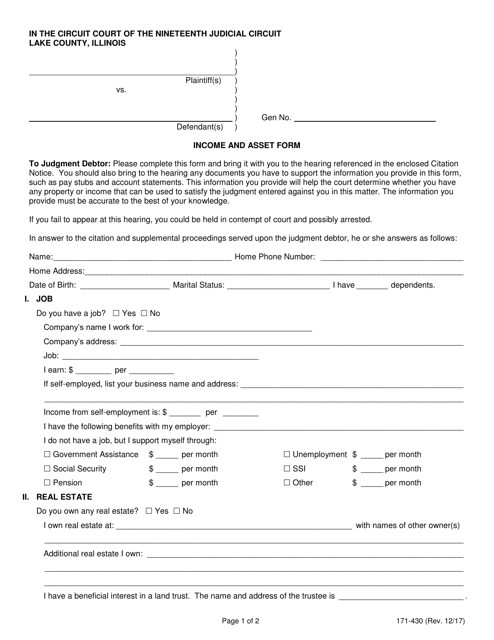

This form is used for reporting income and assets in Lake County, Illinois.

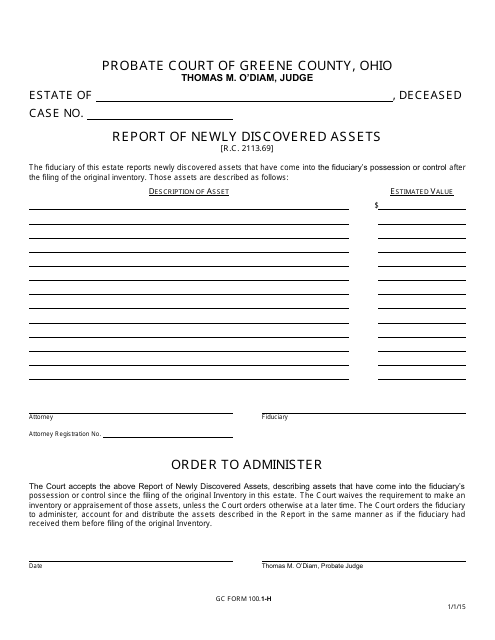

This document is used for reporting newly discovered assets in Greene County, Ohio.

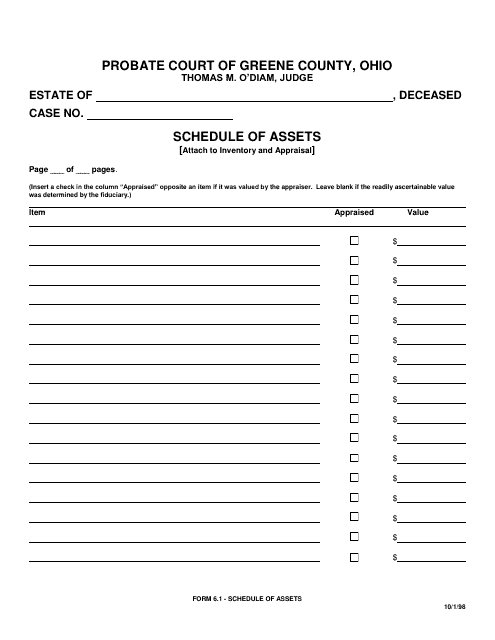

This Form is used for creating a schedule of assets in Greene County, Ohio. It helps document and categorize property and assets within the county.

This Form is used for reporting the distribution of assets in Greene County, Ohio. It provides a detailed record of how assets are distributed among individuals or organizations.