Lifetime Learning Credit Templates

The Lifetime Learning Credit, also known as Lifetime Learning Credits, is a valuable resource for individuals looking to offset the cost of higher education. Whether you're pursuing a degree, completing continuing education courses, or acquiring new skills, this tax credit can help ease the financial burden.

The Lifetime Learning Credit provides eligible students and their families with a tax credit based on qualified education expenses. It allows for a credit of up to a certain amount per year, reducing the amount of tax owed to the IRS. This credit is available for both undergraduate and graduate programs, as well as vocational schools and other eligible educational institutions.

With the Lifetime Learning Credit, you can claim a tax credit for a percentage of the qualified education expenses you incurred during the tax year. These expenses can include tuition, fees, and required course materials. Unlike other education tax credits, this credit can be claimed for an unlimited number of years, allowing individuals to continue their education without worrying about losing out on tax benefits.

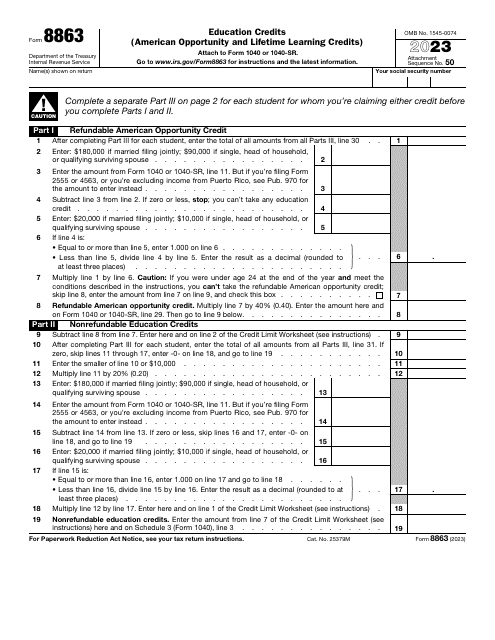

To take advantage of the Lifetime Learning Credit, you'll need to fill out IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits). This form provides detailed instructions on how to claim the credit and calculate the amount you're eligible for. Be sure to keep track of your educational expenses and retain any necessary documentation to support your claim.

Whether you're a student, parent, or lifelong learner, the Lifetime Learning Credit can make a significant difference in your educational journey. It's a flexible tax benefit that supports lifelong learning and encourages individuals to invest in their knowledge and skills. Take advantage of this opportunity to reduce your tax liability and further your education without breaking the bank.

Documents:

10

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.