Tax Report Templates

Are you looking for information on tax reporting? Our website is here to provide you with all the essential knowledge and resources you need regarding tax reports, tax reporting documents, and tax report forms. Whether you are an individual, a business owner, or a tax professional, understanding the intricacies of tax reporting is crucial for compliance and financial planning.

Tax reports encompass a wide range of forms and documents, each serving a specific purpose in reporting various types of taxes. From income taxes to sales taxes, property taxes to estate taxes, our website covers it all. We provide helpful information about tax report templates, which can simplify the process of preparing your tax reports accurately and efficiently.

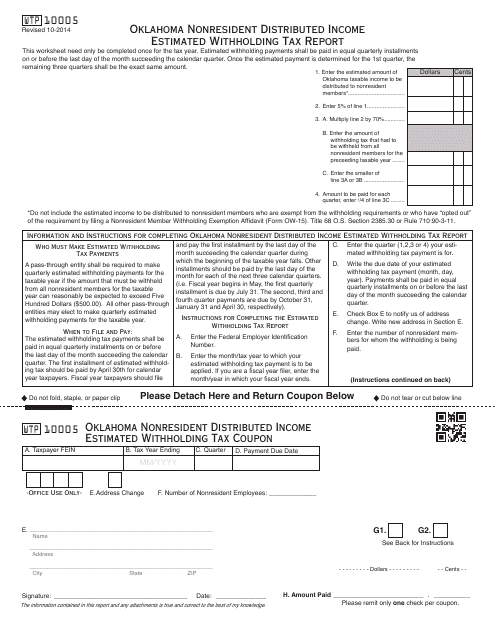

One commonly used tax reporting document is the "Form WTP10005 Oklahoma Nonresident Distributed Income Estimated Withholding Tax Report" for individuals who have income from Oklahoma but are nonresidents. This form helps in reporting the estimated withholding tax on distributed income.

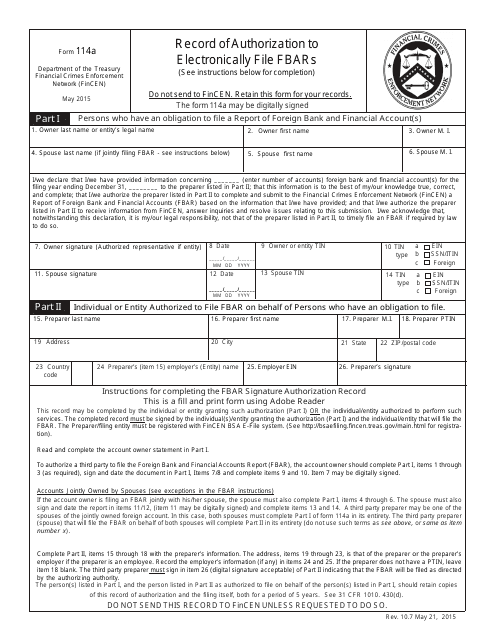

For individuals with foreign financial accounts, the "FinCEN Form 114 Report of Foreign Bank and Financial Accounts" is essential. It ensures compliance with regulations related to reporting foreign accounts to the Financial Crimes Enforcement Network (FinCEN) of the United States Department of the Treasury.

Businesses may need to file forms specific to their state, such as the "Form 2041 Use Tax Protest Payment Report" in Missouri. This form allows businesses to protest their use tax liability and report their payments accurately.

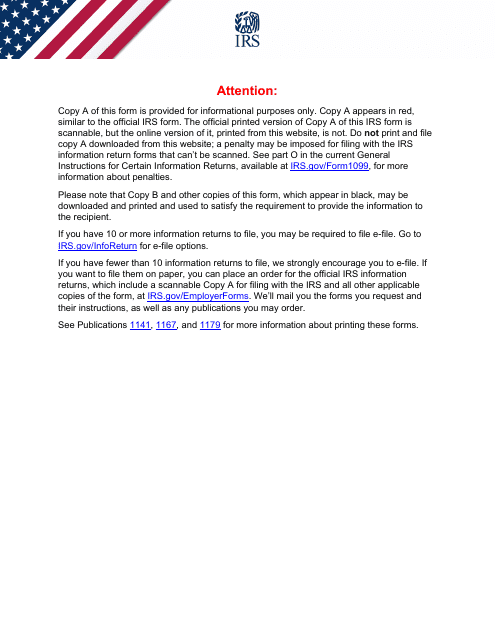

International businesses dealing with foreign entities and withholding taxes rely on the "IRS Form 1042-T Annual Summary and Transmittal of Forms 1042-s." This form summarizes all the Forms 1042-S, which report income subject to withholding under the Internal Revenue Code.

Estate taxes are another critical aspect of tax reporting. The "Form ECIT Estate County Inheritance Tax Report" is used in Nebraska to report inheritance tax related to estates.

Our website aims to provide you with comprehensive information and guidance on tax reporting, including an extensive collection of tax reporting forms and resources. Whether you're an individual navigating your personal taxes or a business owner handling complex tax reports, our platform will equip you with the knowledge and tools you need to fulfill your tax reporting obligations accurately. Start exploring our website now to access the resources you need for seamless tax reporting.

Documents:

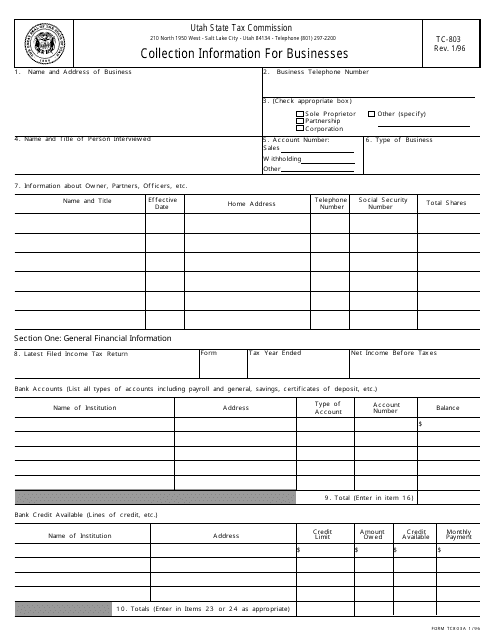

943

This form is used for businesses in Utah to provide collection information.

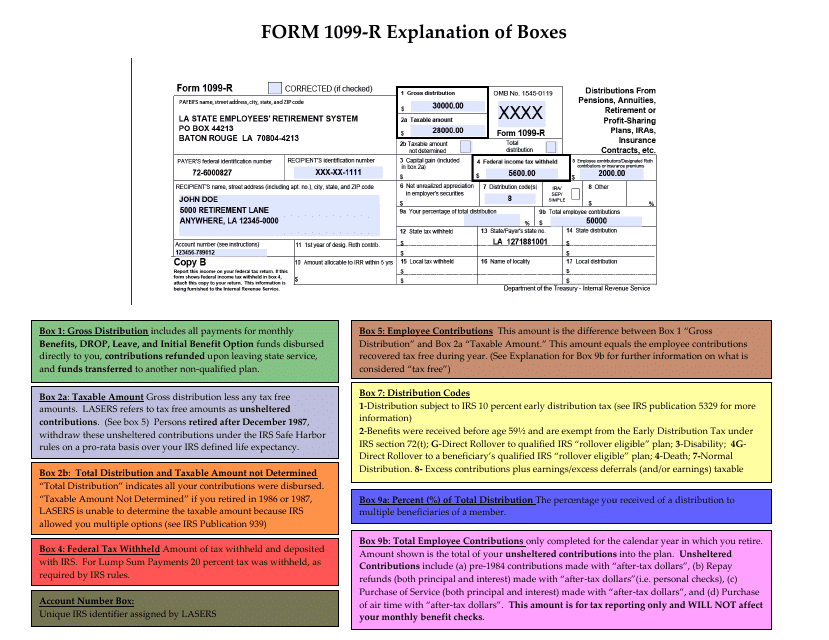

This document provides instructions for IRS Form 1099-R, which is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and other types of retirement accounts. The document explains the different boxes on the form and how to fill them out accurately.

Use this document for releasing your authorization to an individual or organization to complete and file the FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). You can file using a third-party preparer.

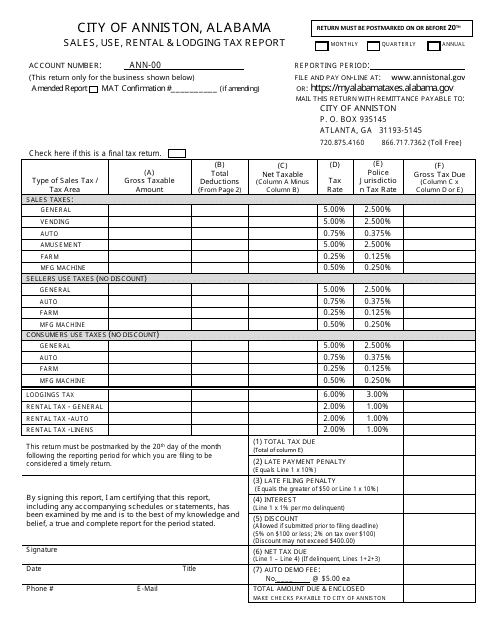

This document is used for reporting sales, use, rental, and lodging taxes in the City of Anniston, Alabama.

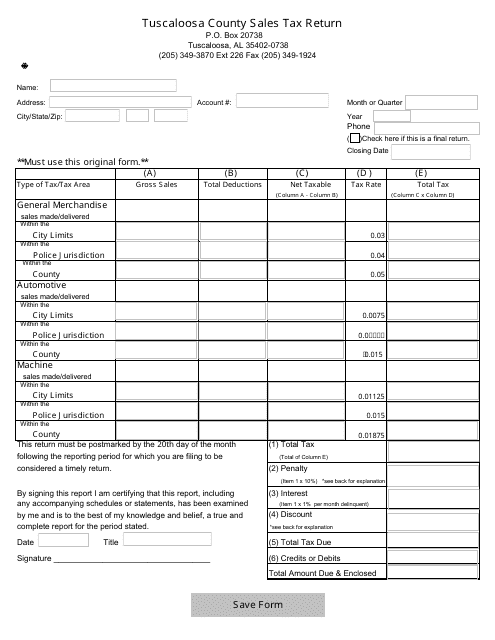

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

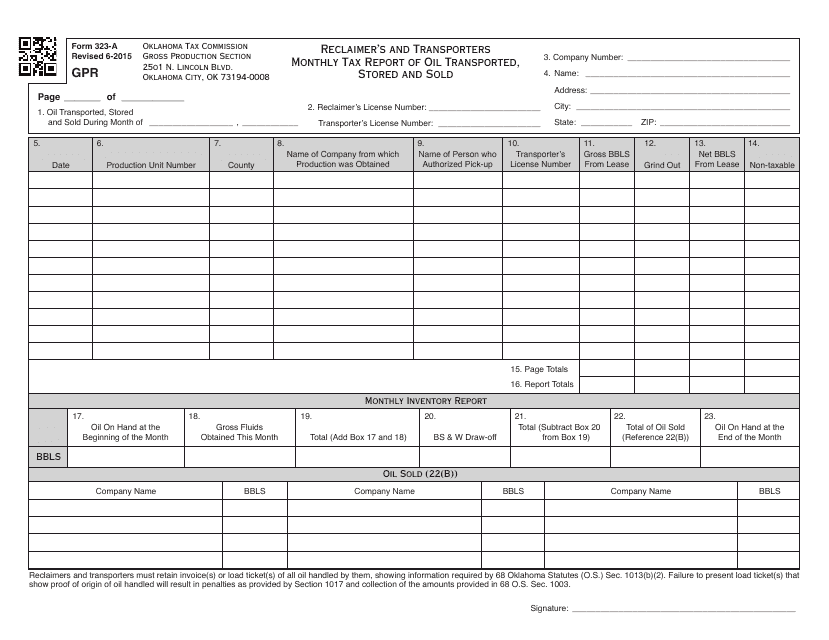

This form is used for reporting monthly taxes on oil transported, stored, and sold in Oklahoma by reclaimers and transporters.

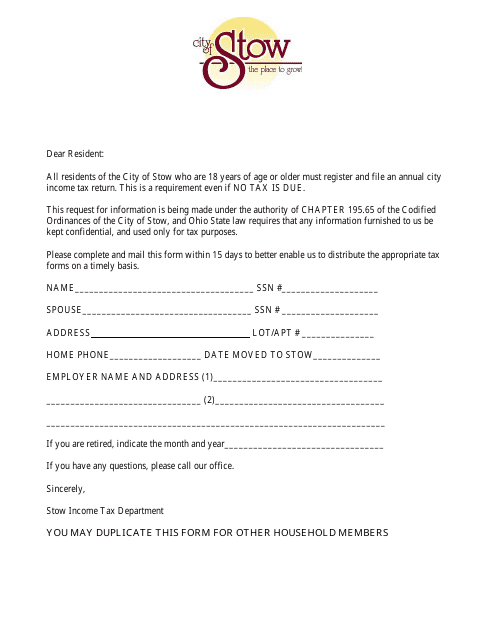

This Form is used for filing your income tax return in the City of Stow, Ohio.

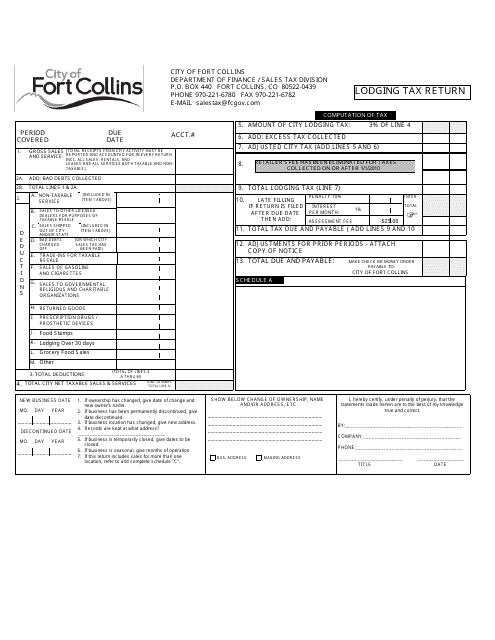

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

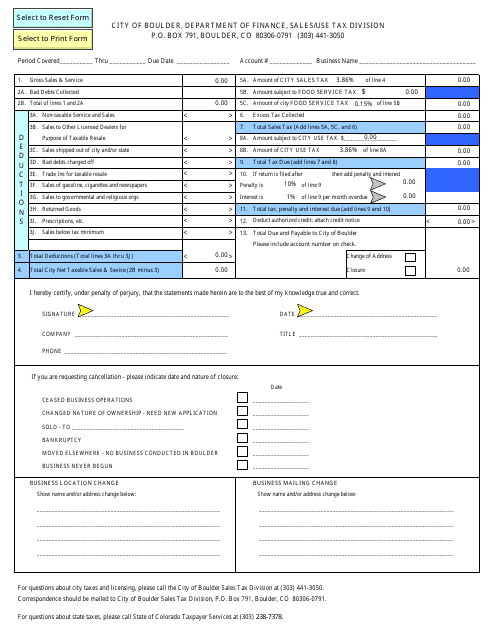

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

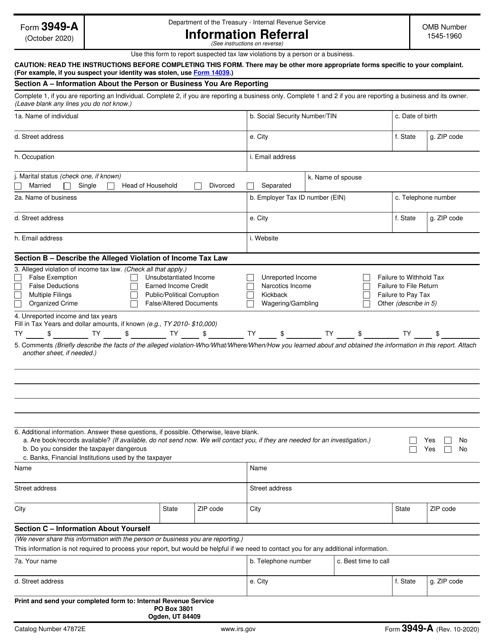

This is a fiscal IRS form any individual is free to use to report an alleged tax violation.

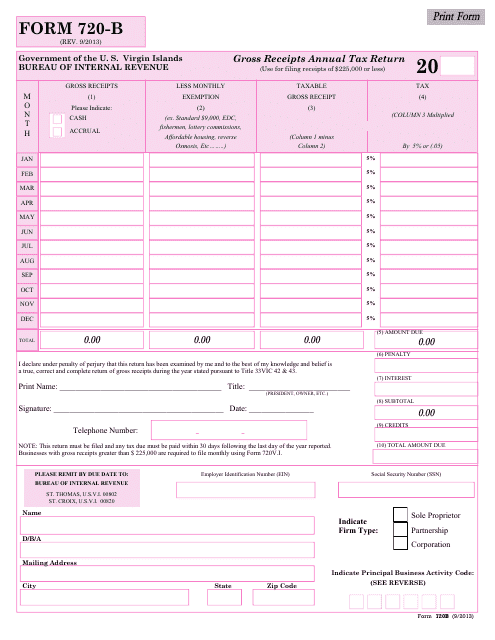

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

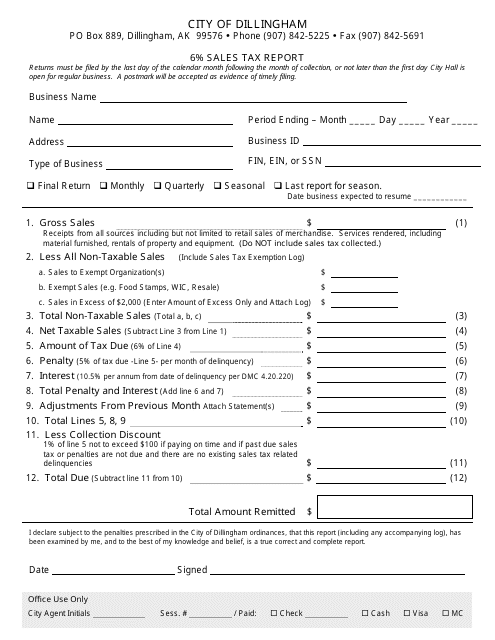

This form is used for reporting sales tax in Dillingham, Alaska. Businesses are required to fill out this form to show their sales tax amount, which is typically 6% of their total sales.

This form is used for reporting estimated withholding tax on distributed income for nonresidents in Oklahoma.

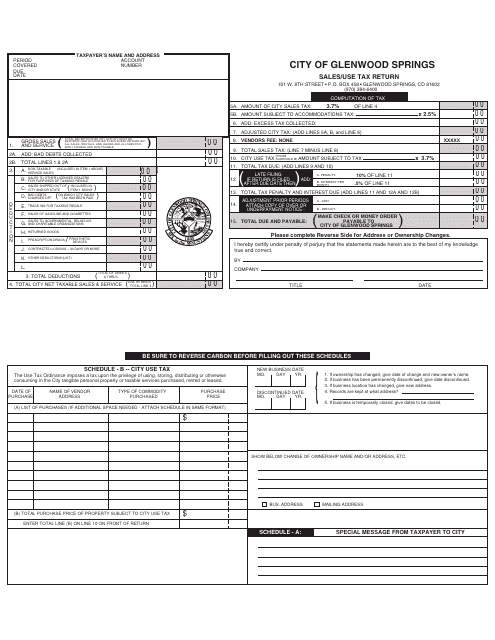

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

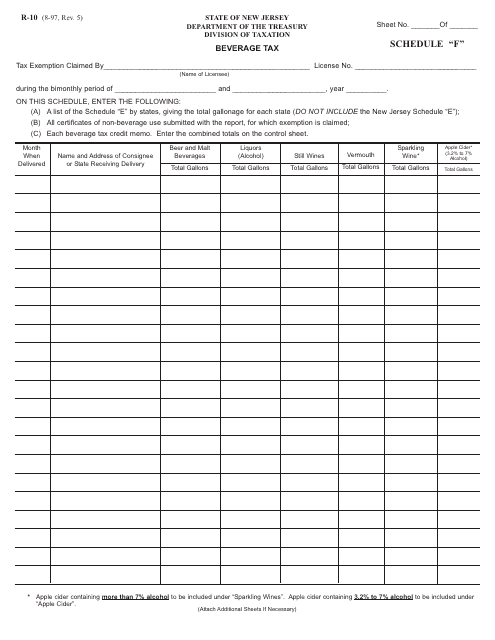

This form is used for reporting beverage taxes in New Jersey

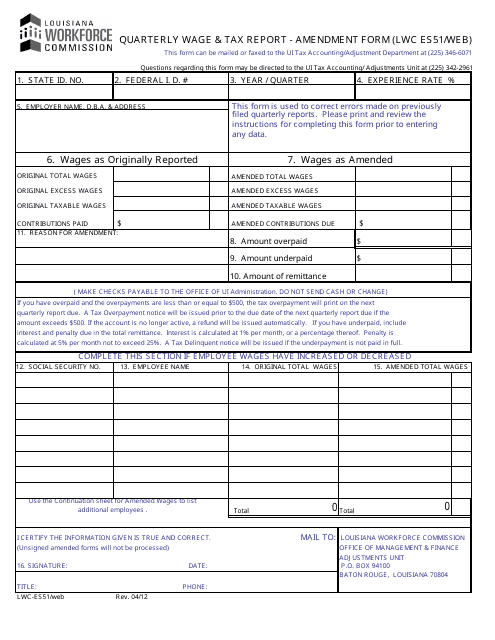

This form is used for amending the quarterly wage and tax report in the state of Louisiana.

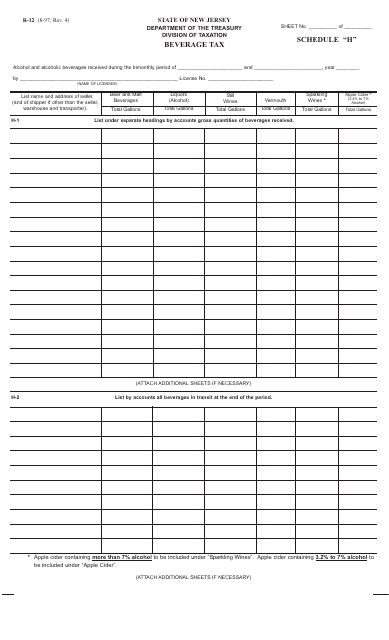

This form is used for reporting and paying beverage taxes in the state of New Jersey.

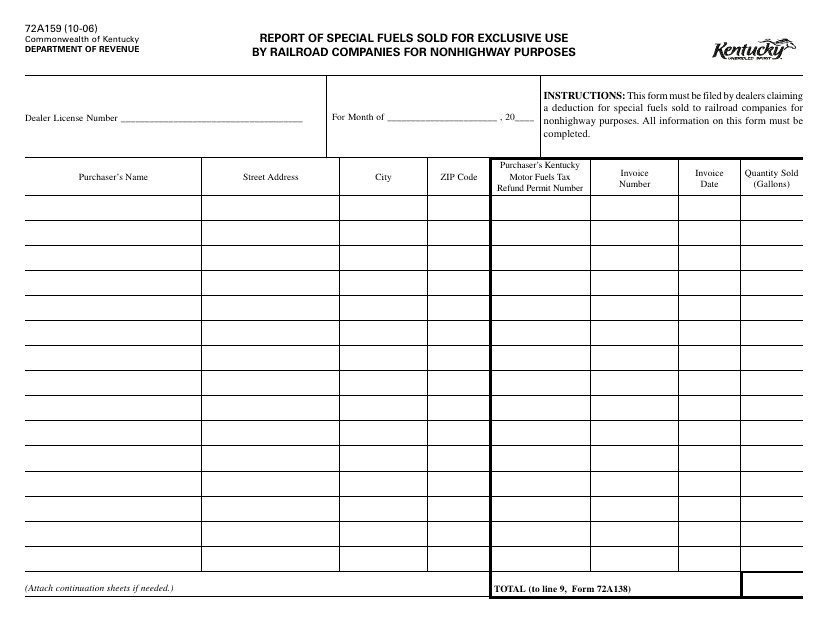

This form is used for reporting special fuels sold specifically for nonhighway purposes to railroad companies in Kentucky.

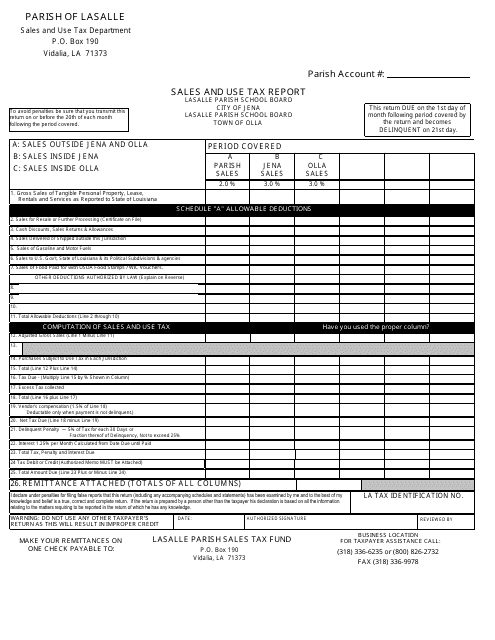

This document is used for reporting sales and use tax in LaSalle Parish, Louisiana.

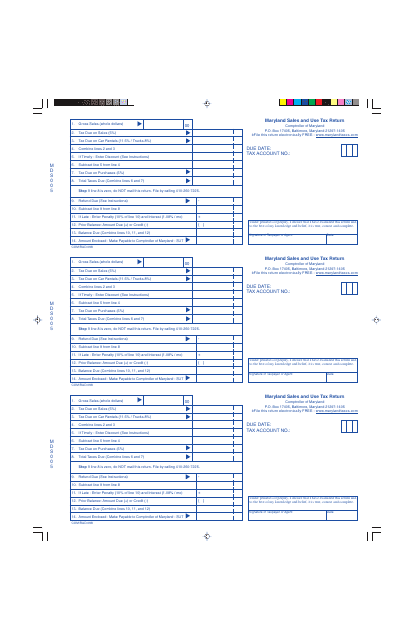

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

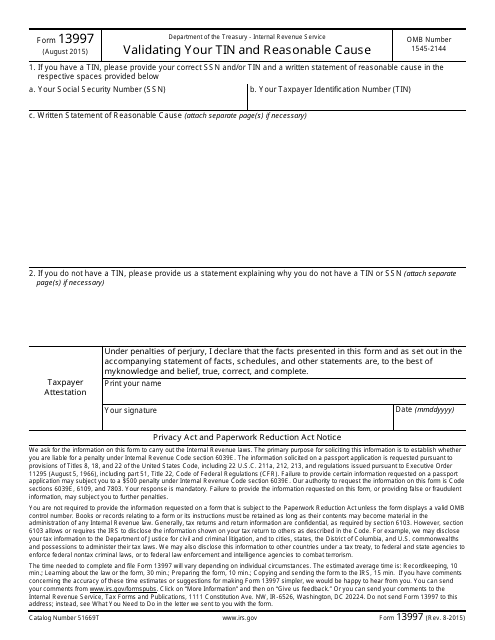

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

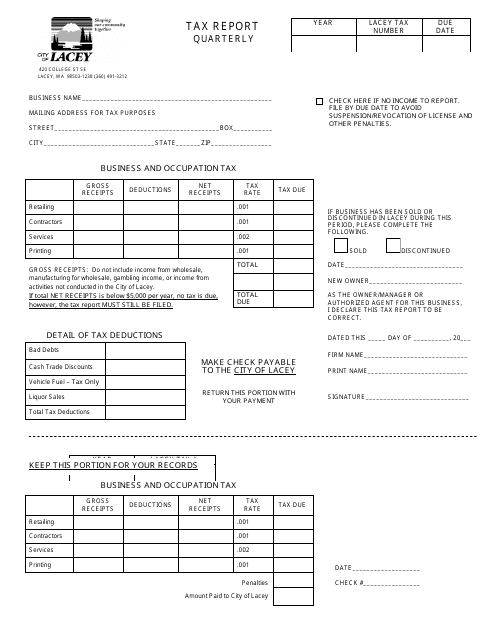

This document is a tax report for the City of Lacey, Washington on a quarterly basis. It is used to report and pay taxes owed to the city.

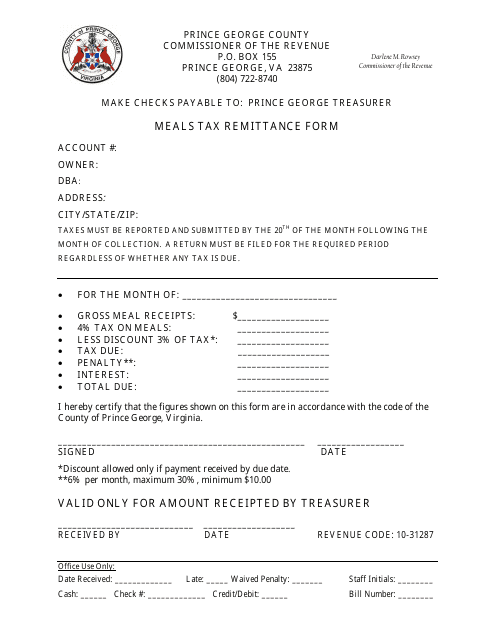

This form is used for remitting the meals tax in Prince George County, Virginia.

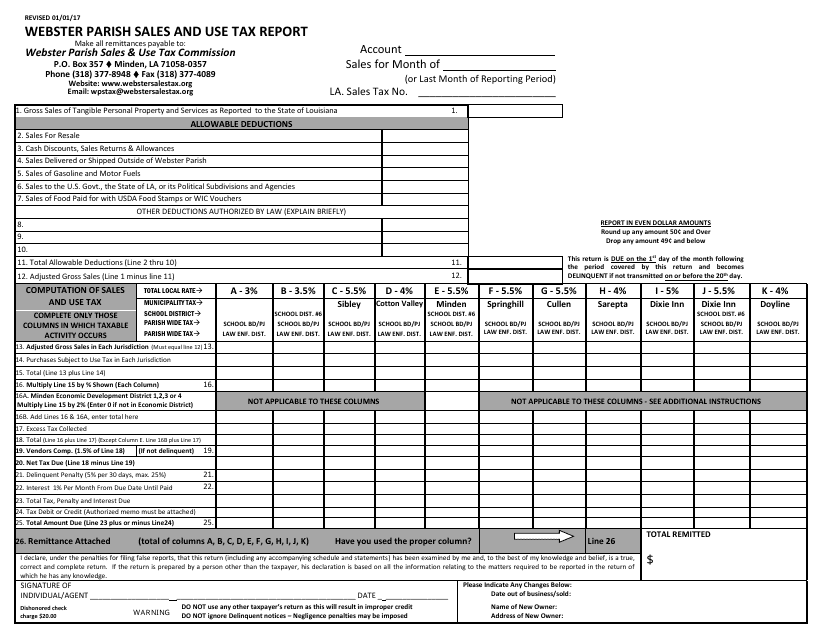

This document is used for reporting sales and use tax in Webster Parish, Louisiana.

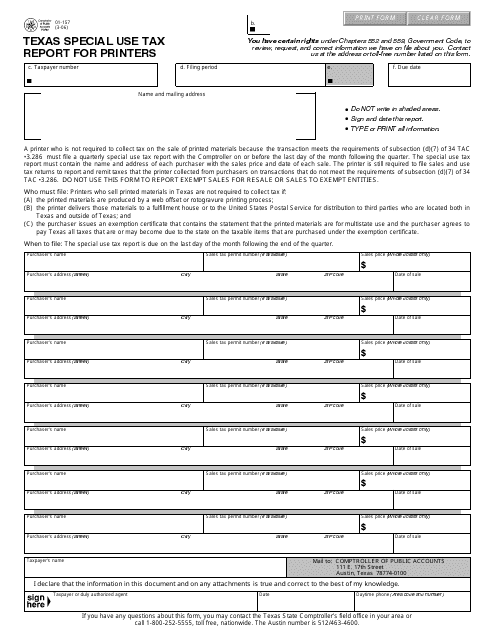

This form is used for reporting special use tax for printers in Texas.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

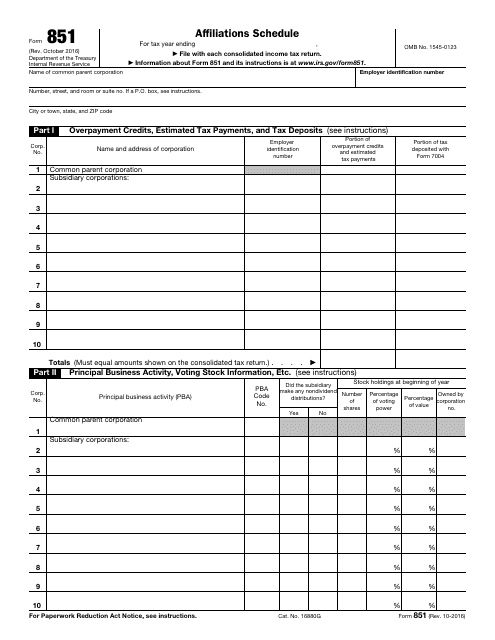

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations.

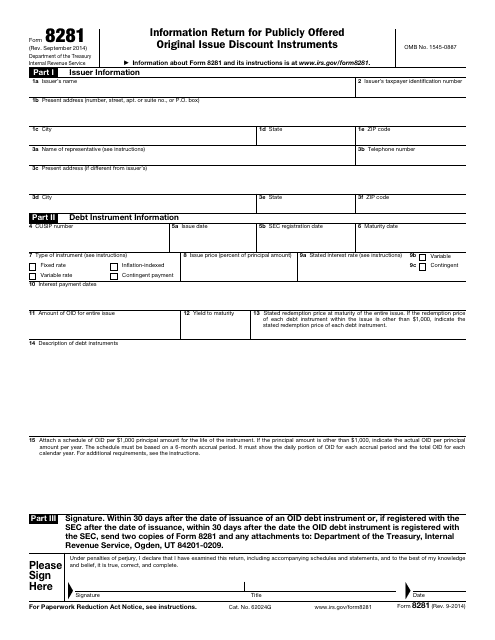

This is a written form filled out and filed by the taxpayers that issued publicly offered debt instruments with an original issue discount.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

This form is used for providing a summary report of carriers to the Internal Revenue Service (IRS). It includes information such as carrier name, address, and total taxable amounts for various services.

This document is for reporting activities of terminal operators to the IRS.

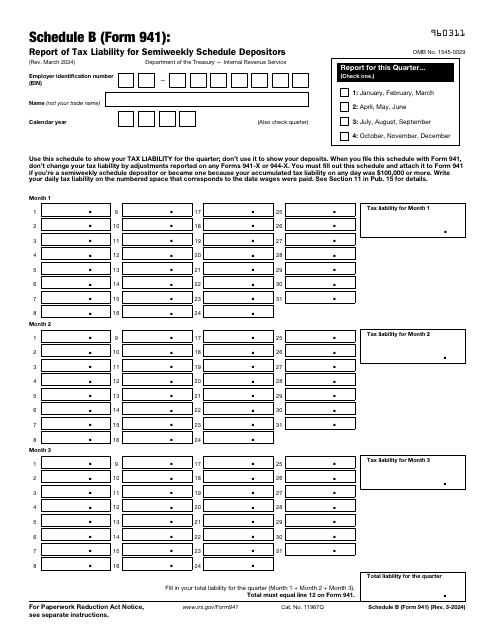

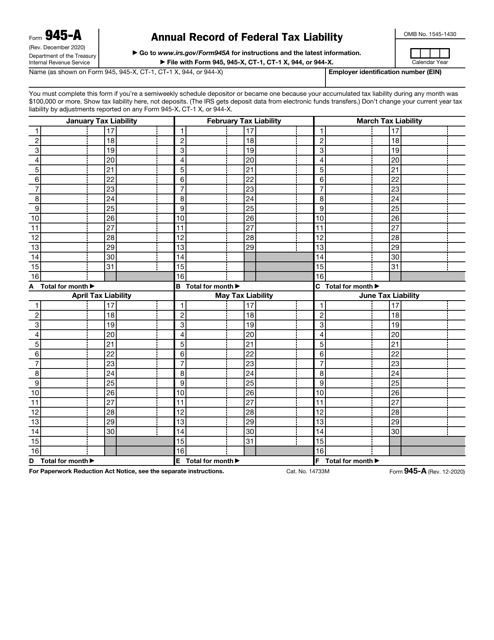

This is a formal document employers use to reconcile their tax liability over the course of the calendar year.