Request for Abatement Templates

Are you facing a penalty or interest from the IRS or your state tax authority? Do you believe that you have valid reasons to request a refund or reduction of these charges? If so, you may need to submit a request for abatement.

A request for abatement is an official document used to appeal penalties or interest charges imposed by tax authorities. It allows you to present your case and provide supporting documentation to prove that the charges should be reduced or eliminated. This can help you save money and resolve any issues with your tax liabilities.

At Templateroller.com, we understand the complexity of dealing with tax penalties and interest charges. That's why we have compiled a comprehensive collection of documents related to the request for abatement process. Whether you are dealing with the IRS or a state tax authority, our documents can provide valuable guidance and assistance in preparing your request.

Some of the documents you can find in our request for abatement collection include:

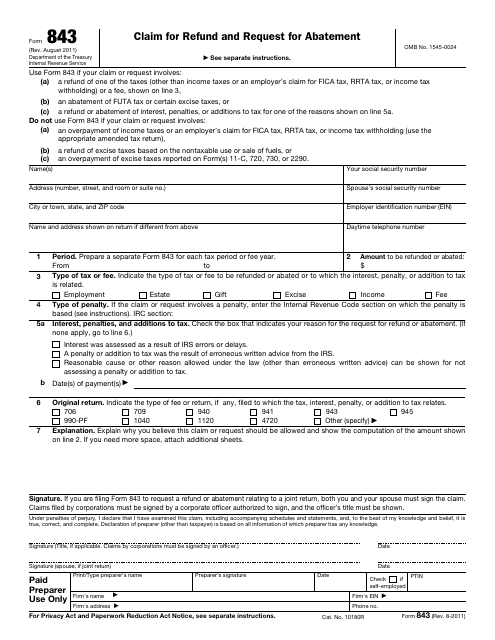

- IRS Form 843 Claim for Refund and Request for Abatement

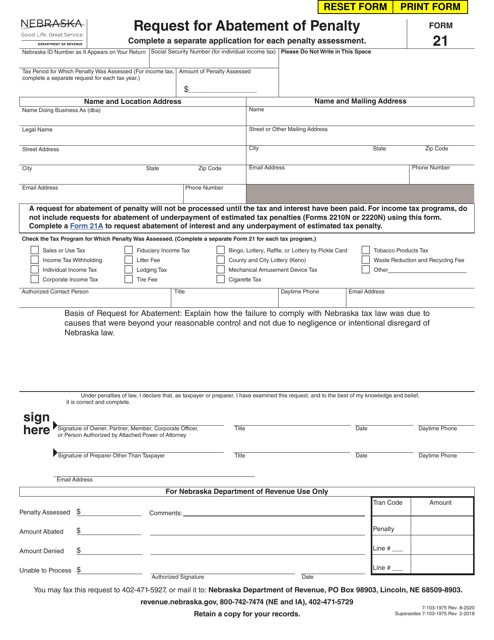

- Form 21 Request for Abatement of Penalty - Nebraska

- Instructions for IRS Form 843 Claim for Refund and Request for Abatement

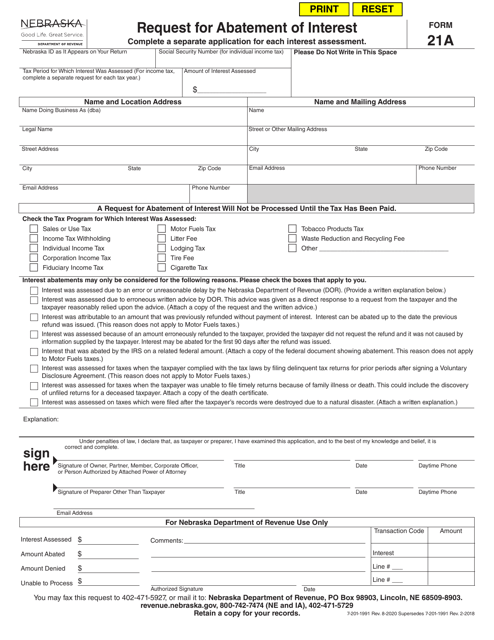

- Form 21A Request for Abatement of Interest - Nebraska

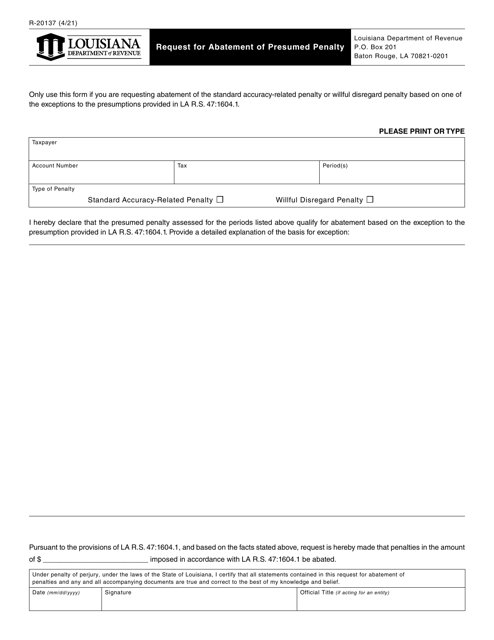

- Form R-20137 Request for Abatement of Presumed Penalty - Louisiana

Our collection also includes various other documents and resources that can help you understand the request for abatement process and increase the chances of a successful outcome. We provide clear instructions, tips, and examples to help you navigate through the complex requirements and properly present your case.

Don't let tax penalties and interest charges burden you financially. Take control of your situation and explore our request for abatement collection today. With our comprehensive resources, you can confidently prepare and submit your request, knowing that you have followed the correct procedures and provided the necessary documentation to support your case.

Note: The documents provided on Templateroller.com are for informational purposes only and should not be considered legal advice. We recommend consulting with a qualified tax professional to ensure that your request for abatement is tailored to your specific circumstances.

Documents:

7

This form is used for claiming a refund and requesting a reduction in penalties or interest from the Internal Revenue Service (IRS).

This form is used for requesting the abatement of a presumed penalty in the state of Louisiana.