Income Payments Templates

Are you looking for information on income payments? Our website is dedicated to providing you with comprehensive resources and knowledge about income payments. Whether you are an individual, a business owner, or a tax professional, understanding the intricacies of income payments is crucial for financial planning and compliance.

Income payments refer to various financial transactions where individuals or entities receive money as compensation for their services, investments, or other sources. These payments can come in the form of salaries, wages, dividends, interest, rental income, and more. It's essential to comprehend the different types of income payments to effectively manage your finances and ensure compliance with tax regulations.

On our website, you will find a wide range of documents related to income payments. These documents provide detailed information about reporting, calculating, and understanding different types of income payments. They also include forms and guidelines required for filing income tax returns and other necessary paperwork.

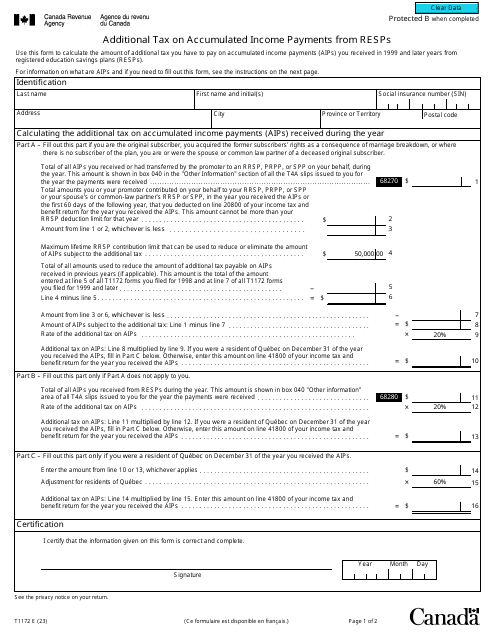

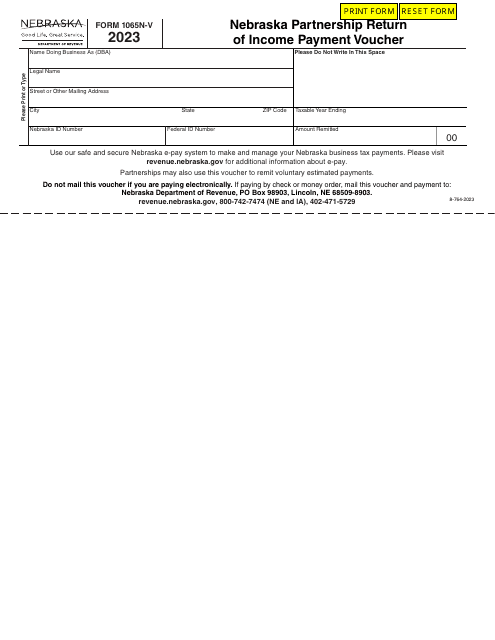

For instance, some of the documents in our collection include Form T1172: Additional Tax on Accumulated Income Payments From RESPs in Canada. This document specifically pertains to taxation on income generated from Registered Education Savings Plans (RESPs). Alternatively, you may refer to the Form 1065N-V Nebraska Partnership Return of Income Payment Voucher, which is used in Nebraska for reporting income payments and calculating taxes for partnerships.

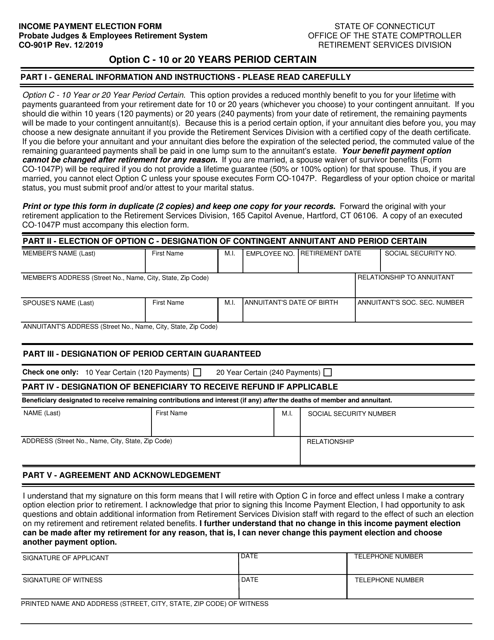

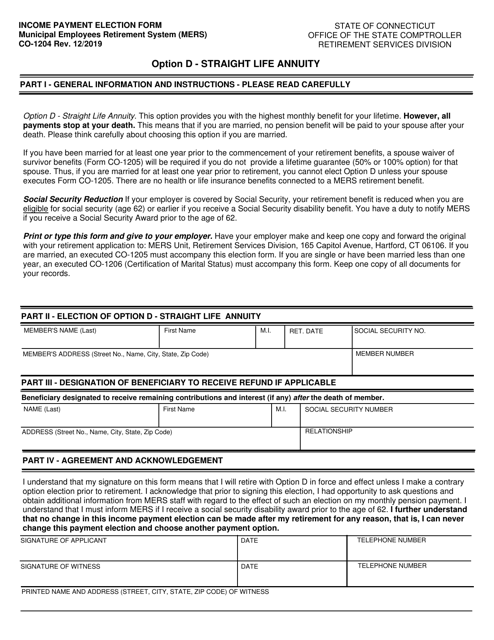

We also offer resources like the Form CO-901P Income Payment Election Form - Option C - 10 to 20 Years Period Certain in Connecticut. This document assists individuals in choosing an income payment plan that suits their needs. Similarly, the Form CO-1204 MERS Income Payment Election Form - Option D - Straight Life Annuity is available for those who prefer a lifetime income payment option.

In addition to these specific documents, we provide various other resources related to income payments. These include guides, articles, and frequently asked questions to help you navigate the complexities associated with income payments effectively.

Stay informed and make informed decisions about income payments with our comprehensive collection of documents and resources. Explore our website to access the information you need for financial planning, tax compliance, and more. Start your journey towards financial independence and stability by utilizing the valuable resources available on our website.

Documents:

5

This Form is used for making an income payment election with Option C for a 10 to 20 years period certain in Connecticut.

This Form is used for making an income payment election for MERS retirement benefits. Option D is for selecting a Straight Life Annuity payment option. This form is specific to residents of Connecticut.

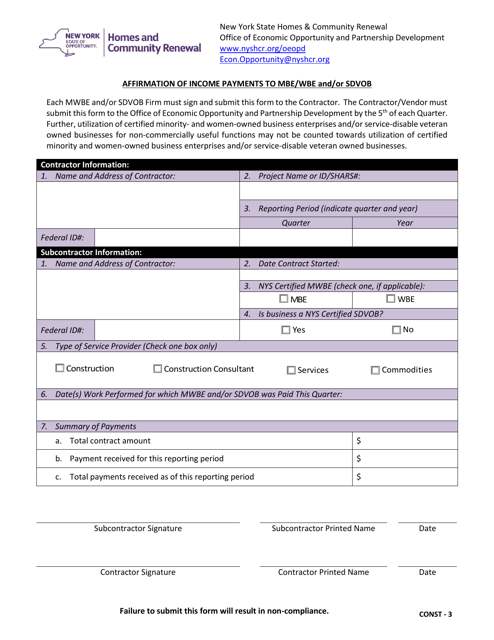

This form is used for affirming income payments to MBE/WBE and/or SDVOB in the state of New York.