Property Tax Refund Templates

Are you looking for information on how to claim a property tax refund? Or maybe you're interested in learning about the different forms you need to fill out in order to apply for a property tax refund? Look no further! Our website is your one-stop destination for all things related to property tax refunds.

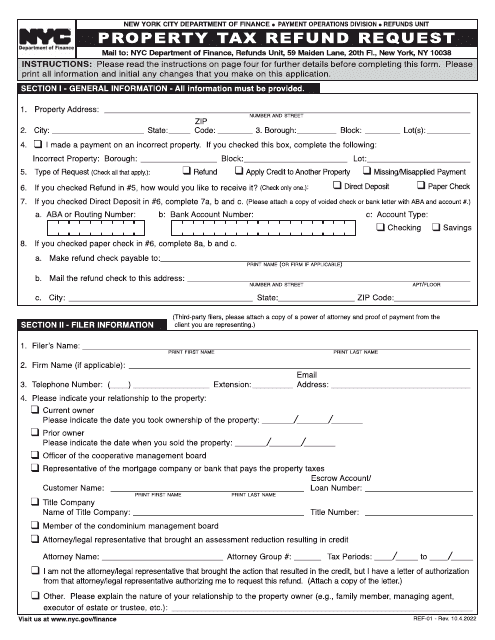

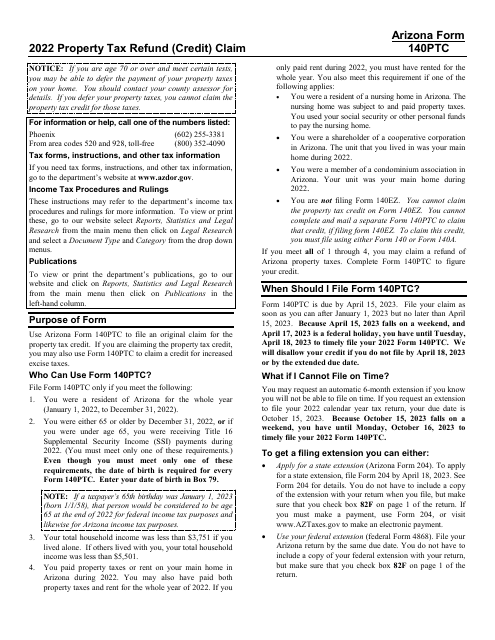

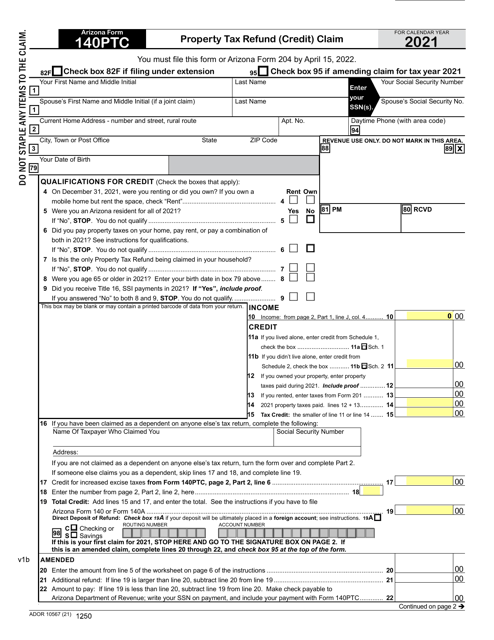

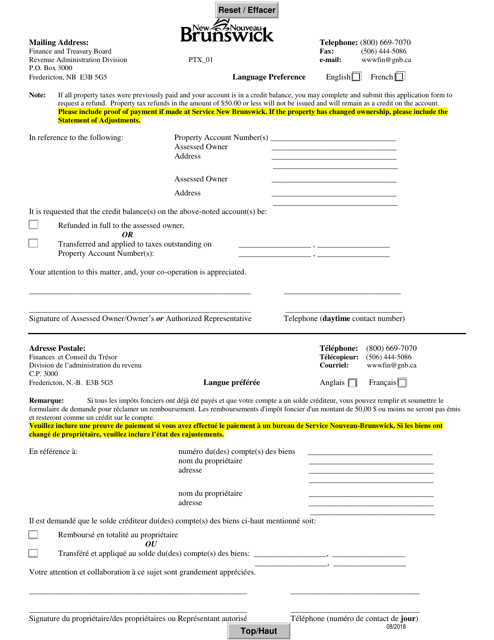

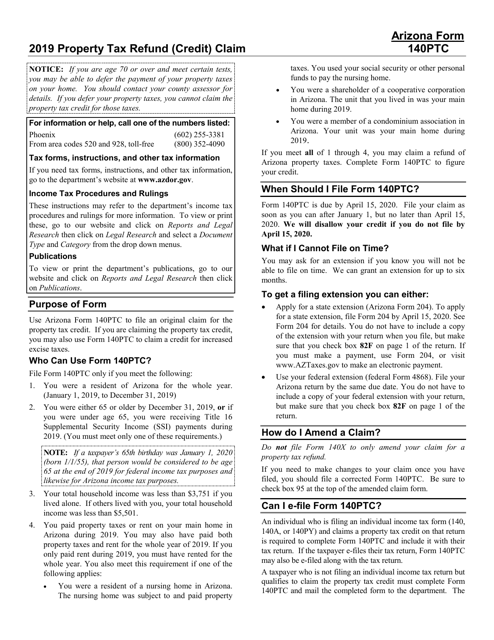

Whether you're a resident of Arizona or New Brunswick, Canada, we have the resources you need to navigate the process of applying for a property tax refund. Our collection of documents includes instructions for various forms, such as the Arizona Form 140PTC, ADOR10567 Property Tax Refund (Credit) Claim. We also provide information on the Form PTX_01 Application for Property Tax Refund/Transfer, which is specific to New Brunswick, Canada and is available in both English and French.

Not sure if you qualify for a property tax refund? Don't worry, we've got you covered. Our website also offers guidance on eligibility criteria and what documents you need to support your claim. We understand that the property tax refund process can be complex, but our goal is to simplify it for you.

So, whether you're a homeowner in Arizona, a property owner in New Brunswick, Canada, or simply someone looking to learn more about property tax refunds, our website is here to assist you. Explore our collection of instructions and forms to get started on your property tax refund journey today!

Note: If you want specific names of example documents in the text, please provide the names for replacement.

Documents:

10

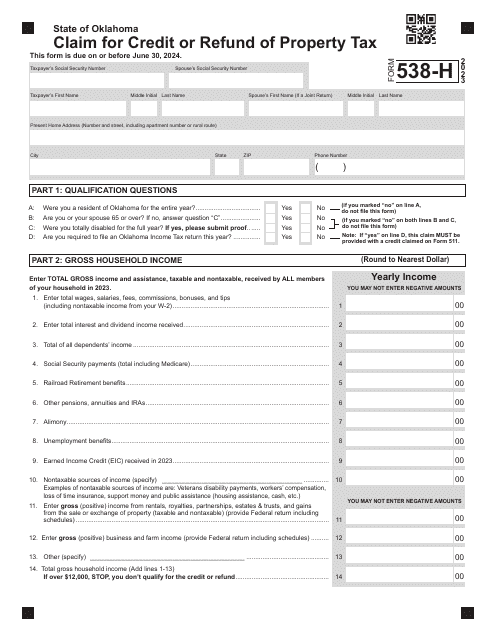

This form is used for applying for a property tax refund or transfer in New Brunswick, Canada. It is available in both English and French.

This document is used for claiming a property tax refund (credit) in the state of Arizona. It provides instructions on how to complete and submit the Form 140PTC, which is required to apply for the refund.

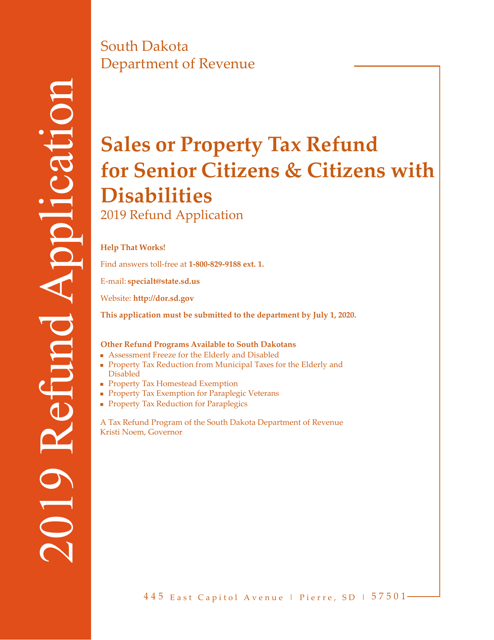

This document for senior citizens and citizens with disabilities in South Dakota who want to claim a refund for sales or property tax.