Historic Rehabilitation Tax Credit Templates

Are you a property owner looking to renovate an old building? Or perhaps a real estate developer interested in preserving the history and character of a historic property? If so, you may be eligible for the Historic Rehabilitation Tax Credit, also known as the Historic Tax Rehabilitation Credit or Rehabilitated Historic Tax Credit.

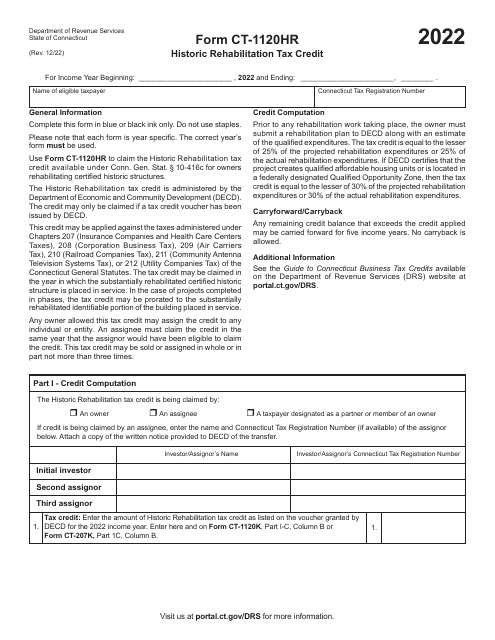

Historic Rehabilitation Tax Credits provide a financial incentive for individuals and businesses to revitalize and restore historic properties. These tax credits are offered by various states in the United States, such as North Carolina, Alabama, Connecticut, and Georgia, to encourage the preservation and rehabilitation of historically significant buildings.

By taking advantage of these credits, you can not only bring new life to a historic property but also enjoy substantial financial benefits. Whether you're restoring a building for commercial purposes or turning it into a residential space, the Historic Rehabilitation Tax Credit can help offset the costs associated with the renovation process.

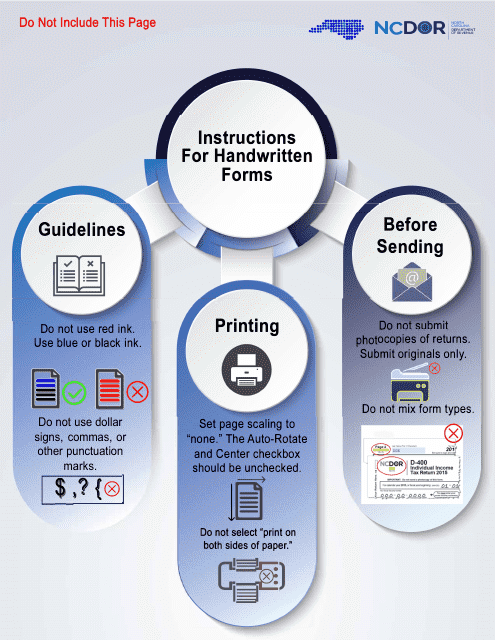

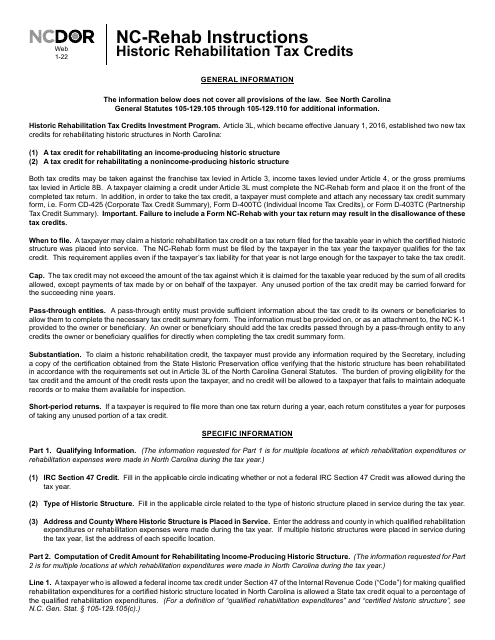

To make the most of these tax credits, it's essential to familiarize yourself with the application process and requirements. Each state may have its own set of forms, such as Form NC-REHAB Historic Rehabilitation Tax Credits in North Carolina or Schedule HTC Historic Tax Rehabilitation Credit in Alabama. Additionally, you may need to refer to instructions specific to your state, such as the Instructions for Form NC-REHAB Historic Rehabilitation Tax Credits.

Preserving our nation's architectural heritage is not only a noble endeavor but also a smart business decision. With the Historic Rehabilitation Tax Credit, you can combine your passion for history with financial benefits. Explore the possibilities and take the first step towards breathing new life into a piece of our shared past.

Documents:

7

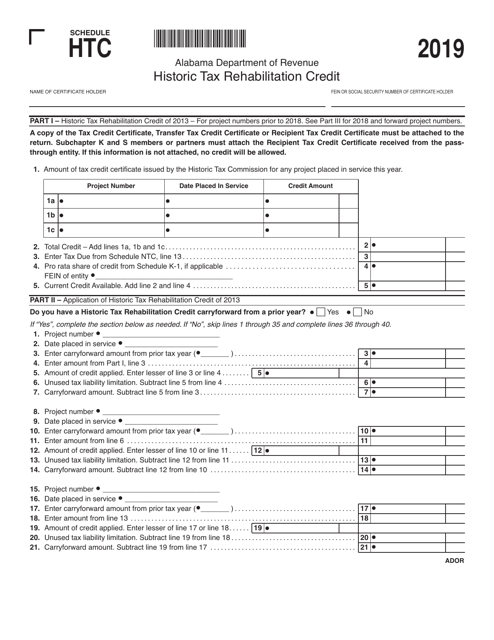

This document is used to schedule the HTC Historic Tax Rehabilitation Credit for properties in Alabama. It helps property owners to determine the amount of tax credit they may be eligible for based on the rehabilitation work done on historic properties.

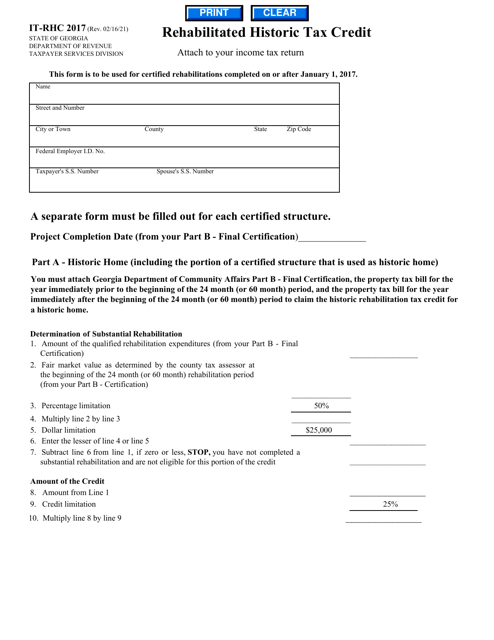

This form is used for claiming the Rehabilitated Historic Tax Credit in Georgia, United States. The credit is available for individuals and businesses who have made qualified expenses for rehabilitating historic properties.