Corporate Partner Templates

Welcome to our Corporate Partner Documents Collection!

As a corporate partner, it's crucial to stay up-to-date with the latest tax requirements and guidelines. Our comprehensive collection of documents is designed to assist you in navigating through the complex world of corporate partnership taxation.

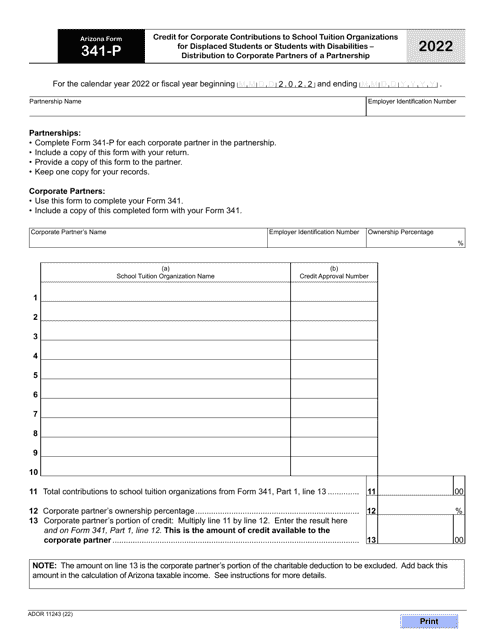

Our Corporate Partner Documents Collection is a valuable resource for both established businesses and newcomers to the corporate partnership landscape. It includes a wide range of documents, such as tax forms, instructions, and attachments, tailored to the specific needs of corporate partners.

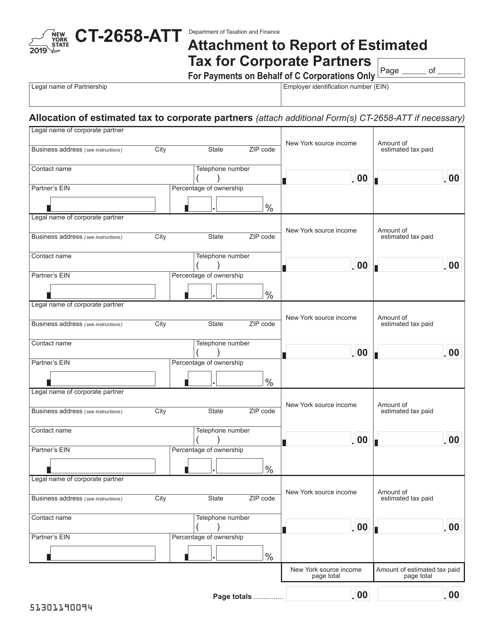

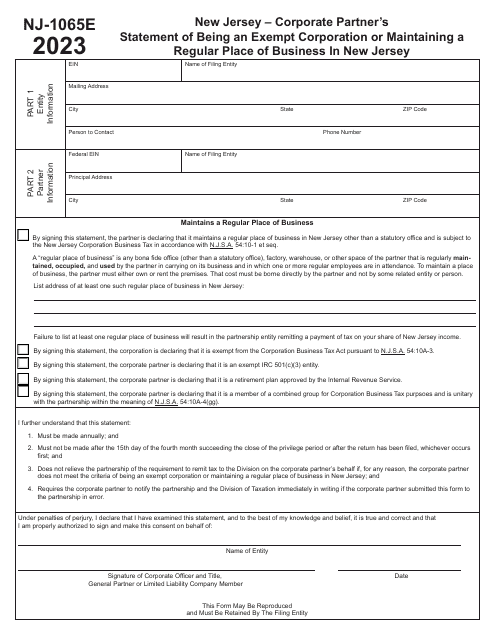

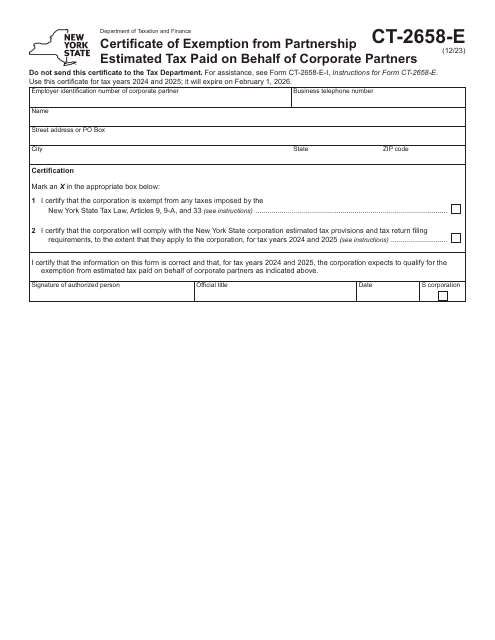

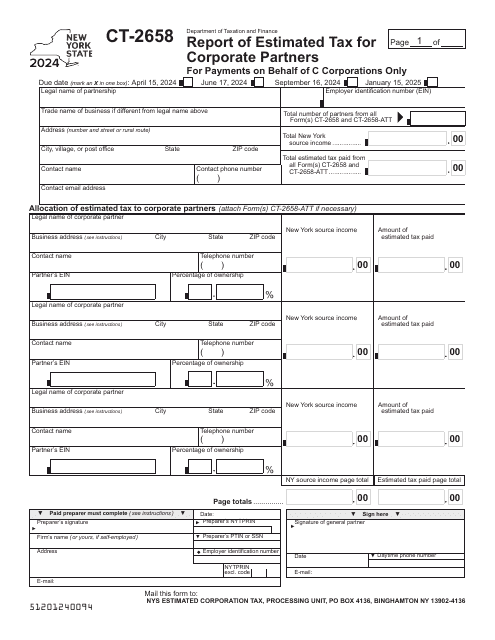

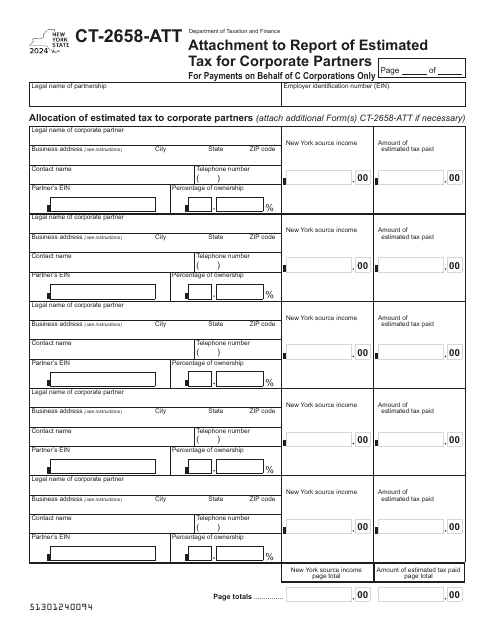

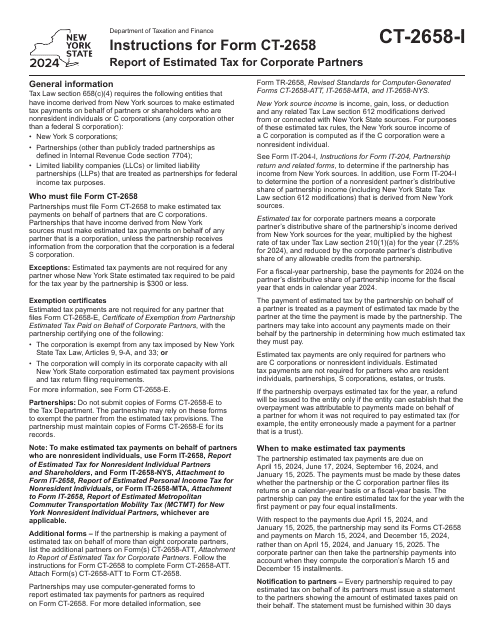

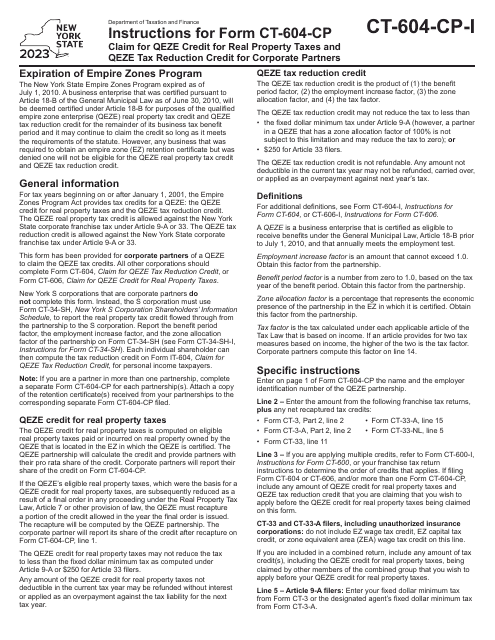

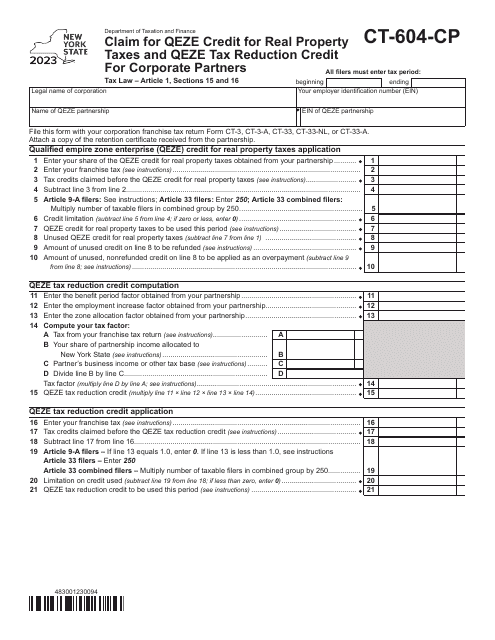

Stay compliant with state-specific regulations by accessing forms like the "Form NJ-1065E Exempt Corporate Partner Statement" from New Jersey or the "Form CT-2658 Report of Estimated Tax for Corporate Partners" from New York. These documents provide the necessary framework to accurately report your corporate partnership income and taxes.

Complementing these forms, our collection also includes detailed instructions on how to properly complete various tax forms. For instance, the "Instructions for Form CT-2658 Report of Estimated Tax for Corporate Partners" guides you through the process of estimating and paying your taxes as a corporate partner in New York.

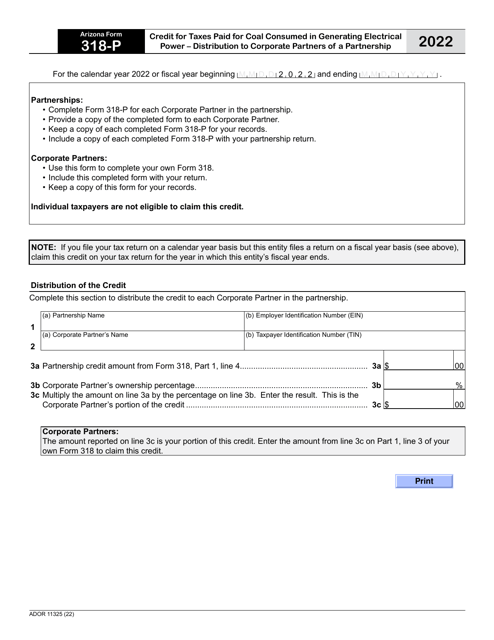

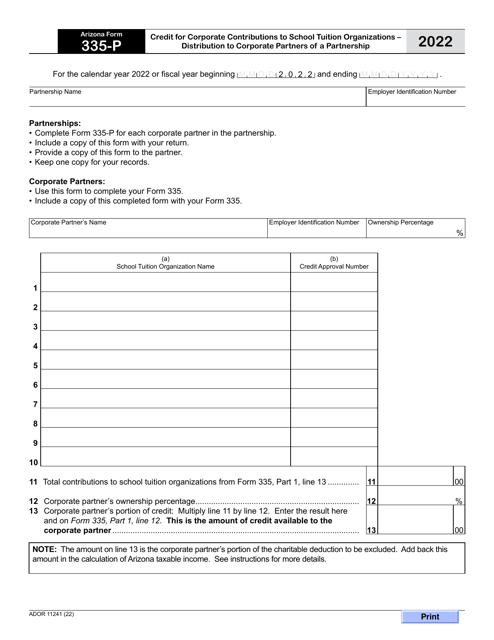

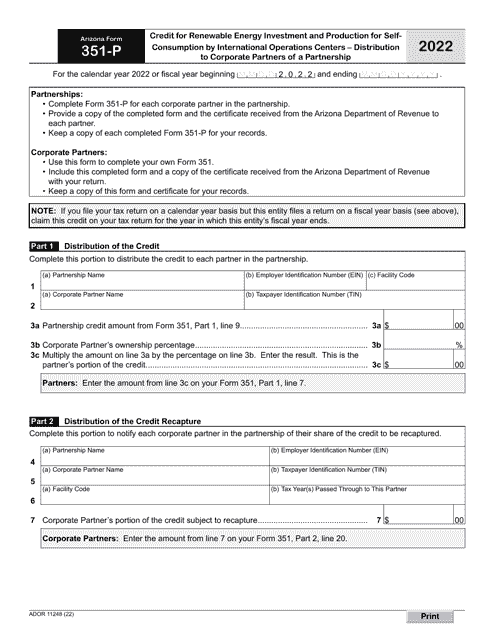

Recognizing the unique circumstances of different corporate partnerships, we understand the importance of providing specialized documentation. That's why we offer documents like the "Arizona Form 318-P Credit for Taxes Paid for Coal Consumed in Generating Electrical Power - Distribution to Corporate Partners of a Partnership." These forms cater to specific scenarios that may arise within the corporate partnership realm.

With our Corporate Partner Documents Collection, you can simplify the tax filing process and ensure compliance with the regulations specific to your state. Trust our comprehensive collection to provide you with the necessary tools and resources to navigate the intricacies of corporate partnership taxation.

Access our Corporate Partner Documents Collection today and streamline your corporate partnership tax obligations!

Documents:

36

This document is an attachment form to be used by corporate partners in New York when reporting estimated taxes.

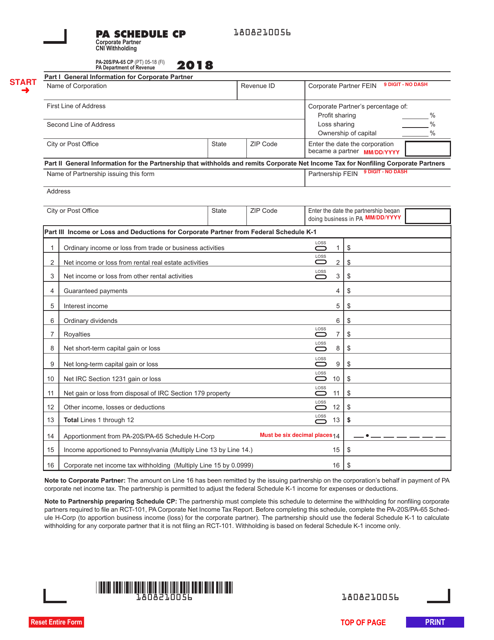

This form is used for reporting corporate partner CNI withholding in Pennsylvania for Schedule CP.

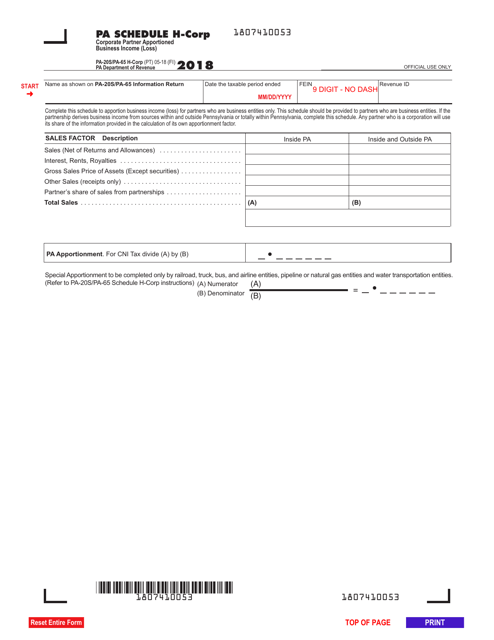

This form is used for reporting the apportioned business income or loss of a corporate partner in Pennsylvania.

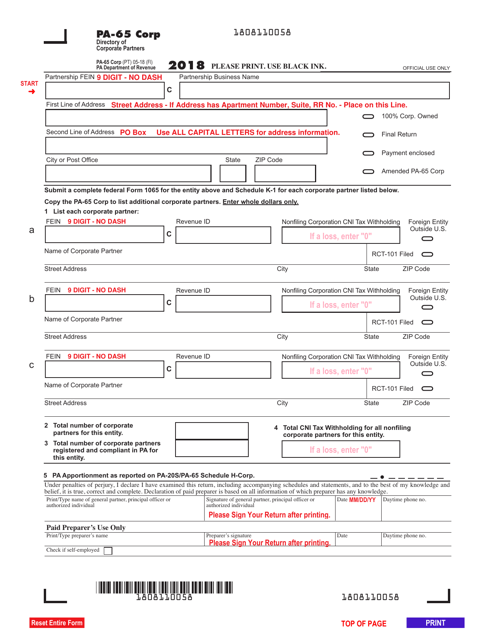

This document is used for submitting information about corporate partners in Pennsylvania.

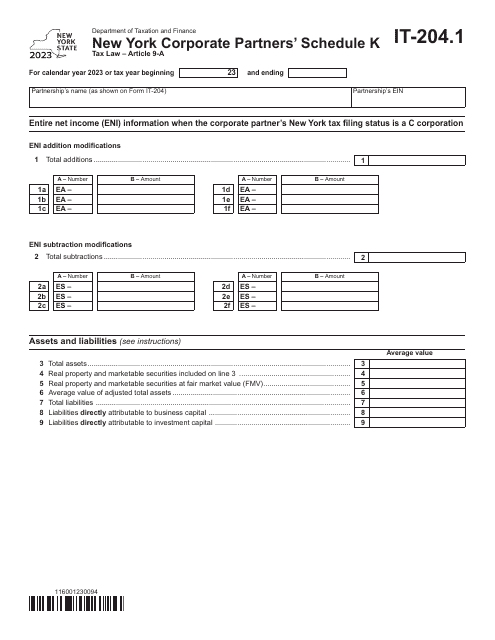

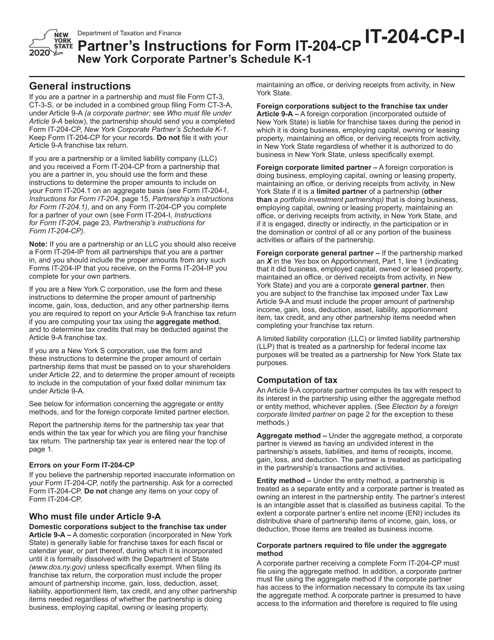

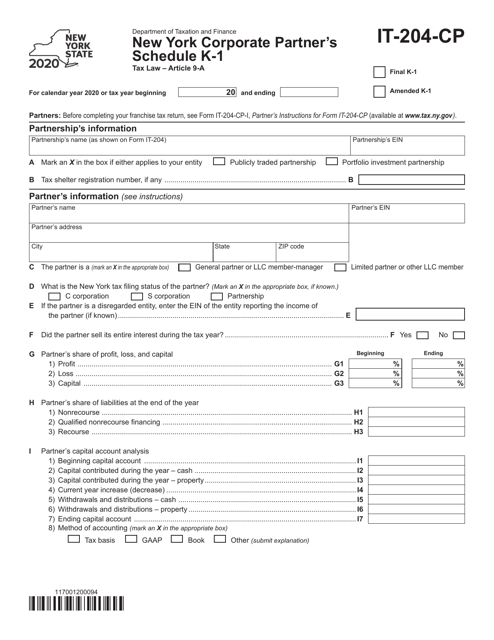

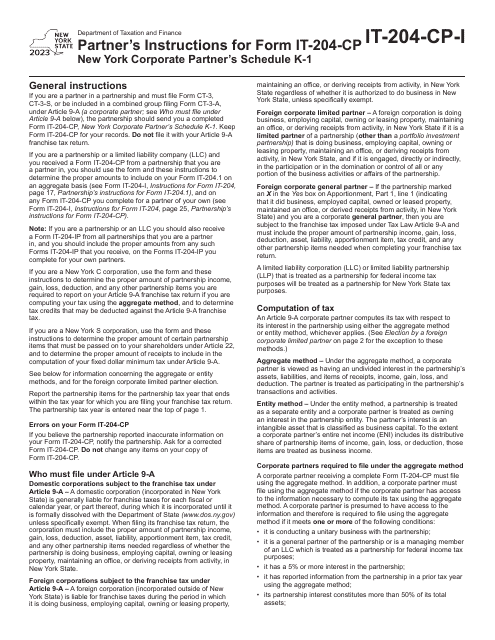

This form is used for reporting a New York corporate partner's share of income, deductions, and credits on Schedule K-1.

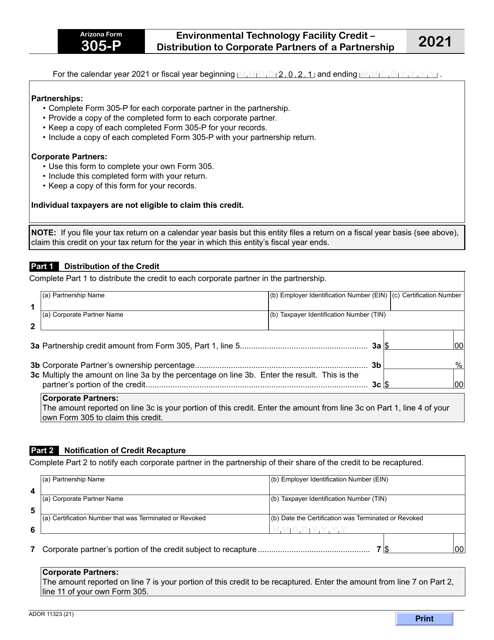

This form is used for claiming the Environmental Technology Facility Credit in Arizona. It is specifically for distributing the credit to corporate partners of a partnership.