Depreciation Spreadsheet Templates

Depreciation spreadsheets are used to calculate and track the depreciation of assets over time. They help businesses and individuals keep a record of the decrease in value of their assets, which is important for financial and tax purposes. These spreadsheets typically include information such as the initial cost of the asset, its useful life, the chosen depreciation method, and the accumulated depreciation over a given period. By using a depreciation spreadsheet, individuals and businesses can accurately calculate the depreciation expense and the net book value of their assets over time.

Documents:

1

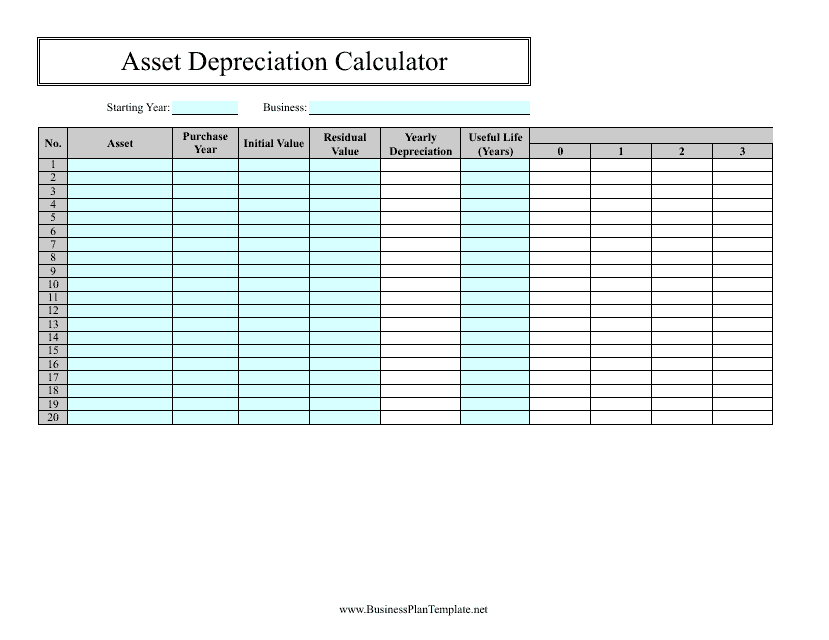

This document is a spreadsheet template that helps calculate asset depreciation. It assists in determining the decrease in value of assets over time.