Public Charity Templates

Welcome to our webpage dedicated to public charities! Whether you're interested in starting your own nonprofit organization or simply want to learn more about the important work being done by public charities, you've come to the right place.

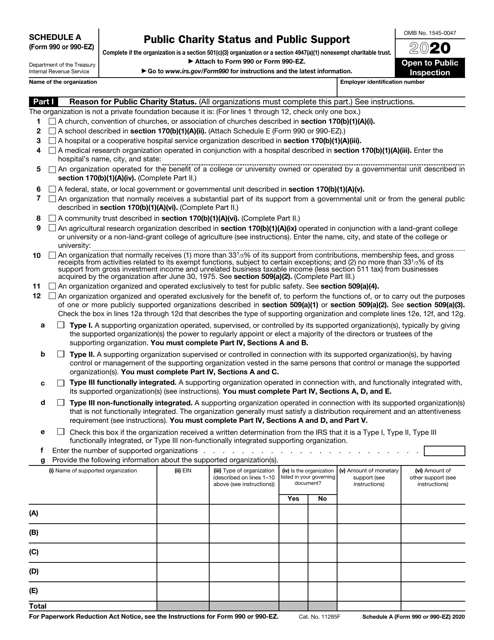

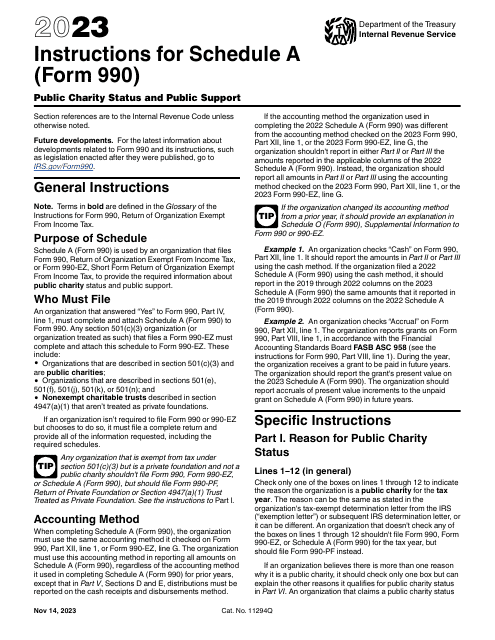

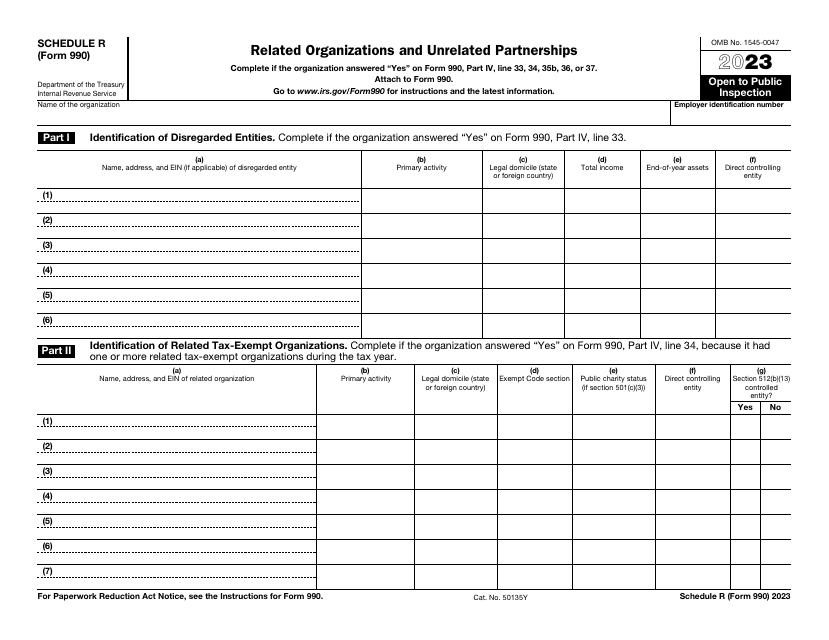

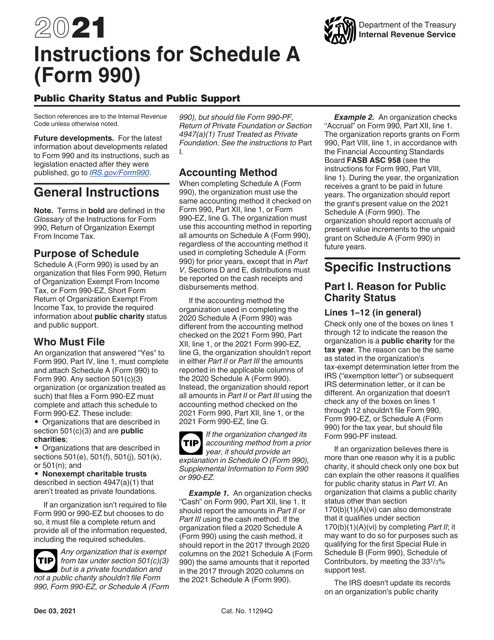

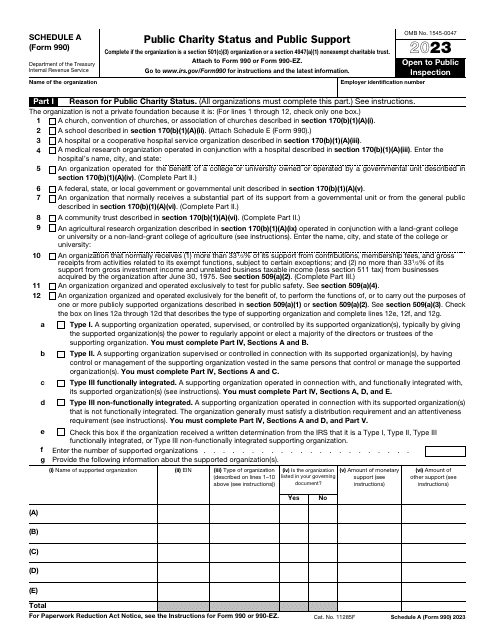

At our site, you'll find a wealth of information about public charities and the regulations that govern them. One of the key documents you'll encounter is the IRS Form 990 (990-EZ) Schedule A Public Charity Status and Public Support. This document provides valuable insights into the financial and operational aspects of public charities, helping donors and stakeholders make informed decisions about their contributions.

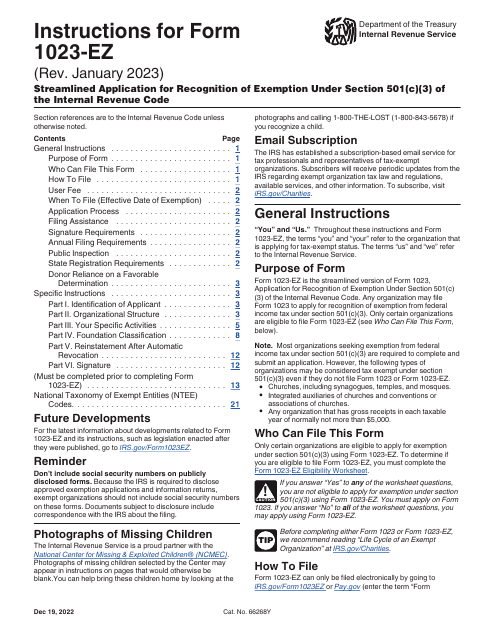

If you're considering establishing a public charity, you'll definitely want to explore the Instructions for IRS Form 1023-EZ Streamlined Application for Recognition of Exemption Under Section 501(C)(3) of the Internal Revenue Code. This document outlines the steps required to apply for tax-exempt status, allowing your organization to receive donations and operate as a legitimate public charity.

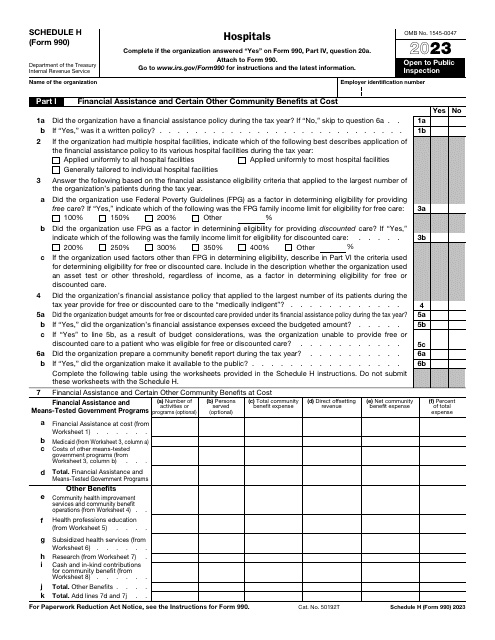

For those interested in the healthcare sector, the IRS Form 990 Schedule H Hospitals contains specific instructions for hospitals that operate as public charities. This document sheds light on the unique accounting and reporting requirements for hospitals, ensuring transparency and accountability in the provision of healthcare services.

We understand that navigating the world of public charities can be complex, which is why our webpage aims to provide clear and concise information. From detailed instructions to informative resources, we strive to empower individuals and organizations with the knowledge needed to make a positive impact in their communities.

So whether you're a current or aspiring public charity, or simply someone interested in supporting the incredible work being done by these organizations, we invite you to explore our webpage and discover the vital role that public charities play in society.

[]

Documents:

9

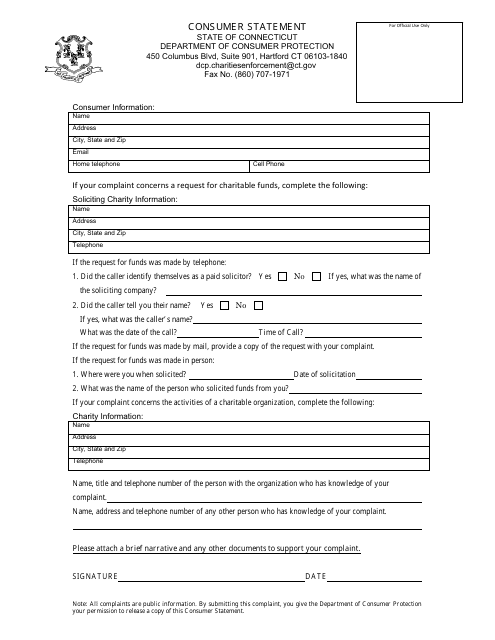

This document provides information regarding public charities and solicitors in Connecticut, including regulations and guidelines.

This Form is used for reporting public charity status and public support on the IRS Form 990. It provides instructions on how to complete Schedule A of the form.