Job Creation Tax Credit Templates

Are you a business owner looking to boost job growth in your area? Look no further than the Job Creation Tax Credit program. This program, also known as the Job Creation Tax Credit, is designed to incentivize businesses to create new employment opportunities by offering them tax credits. By taking advantage of this program, you can not only contribute to the economic growth of your community but also receive significant tax benefits.

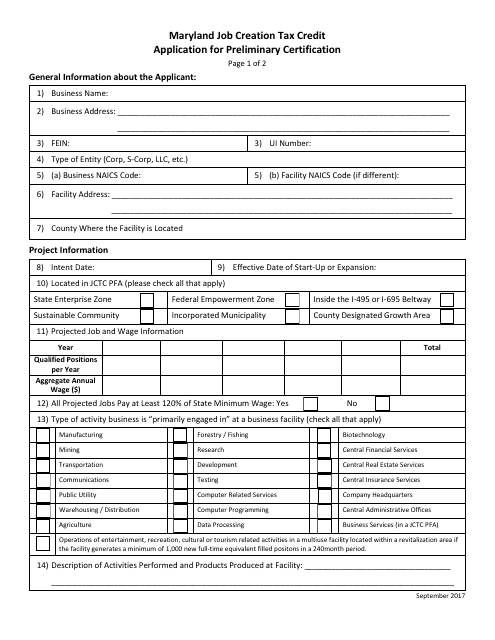

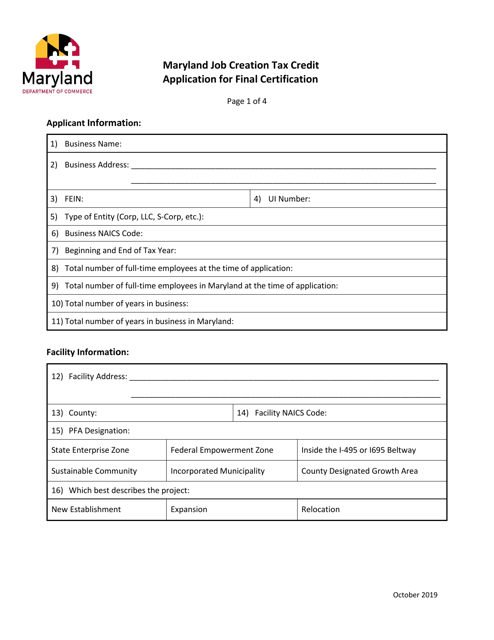

To participate in the Job Creation Tax Credit program, businesses are required to complete an application for preliminary certification. This application, specific to your state, serves as the first step towards eligibility for the tax credits. Once preliminary certification is approved, businesses can then proceed to apply for final certification. This comprehensive application assesses the job creation efforts of the business and determines the exact amount of tax credits they can receive.

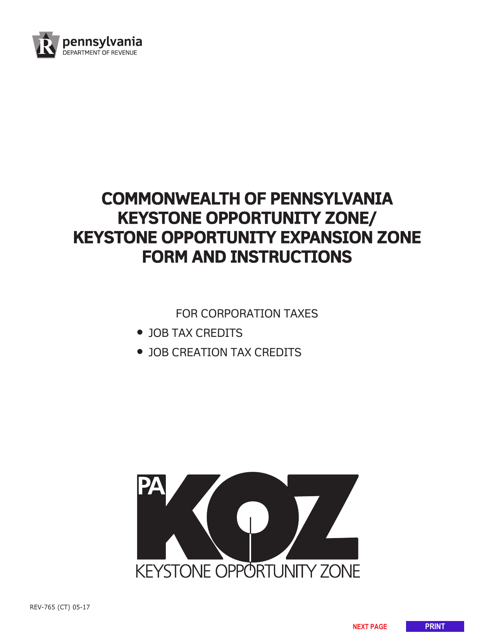

In some states, such as Pennsylvania, businesses may be eligible for additional tax credits through programs like the Keystone Opportunity Zone Job Creation Tax Credit or the Keystone Opportunity Expansion Zone Job Creation Tax Credit. These programs provide further financial incentives for businesses to expand their operations and create more jobs.

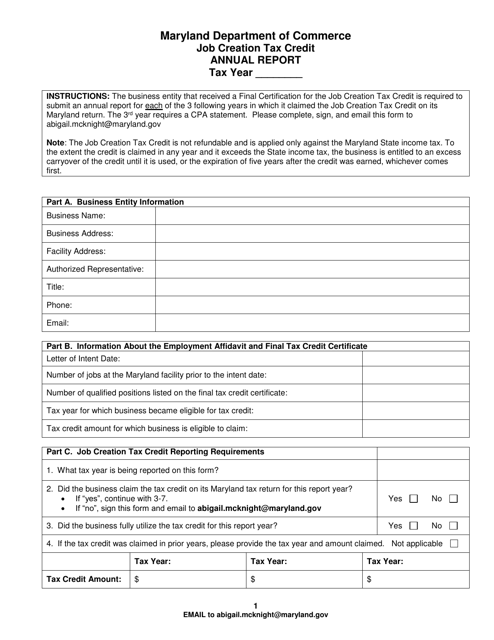

Once certified, businesses must file an annual report to ensure compliance with the program's requirements. This Job Creation Tax Credit Annual Report reflects the actual job creation and retention figures, allowing businesses to track their progress and continue benefiting from the tax credits.

Don't miss out on the opportunity to grow your business while enjoying substantial tax benefits. Take advantage of the Job Creation Tax Credit program and make a positive impact on your community.

Documents:

5

This form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit in Maryland.

This Form is used for filing the annual report for Keystone Opportunity Zone Job Creation Tax Credit or Keystone Opportunity Expansion Zone Job Creation Tax Credit in Pennsylvania.

This document provides an annual report on the Job Creation Tax Credit in the state of Maryland. It highlights the progress and impact of the tax credit in promoting job creation and economic growth.