Nonresident Tax Templates

Documents:

110

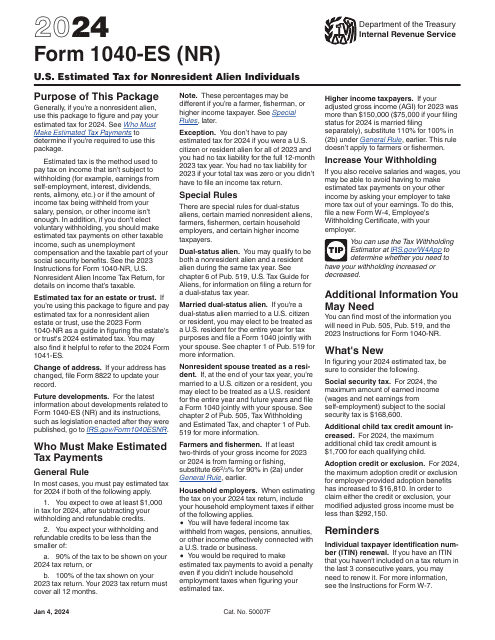

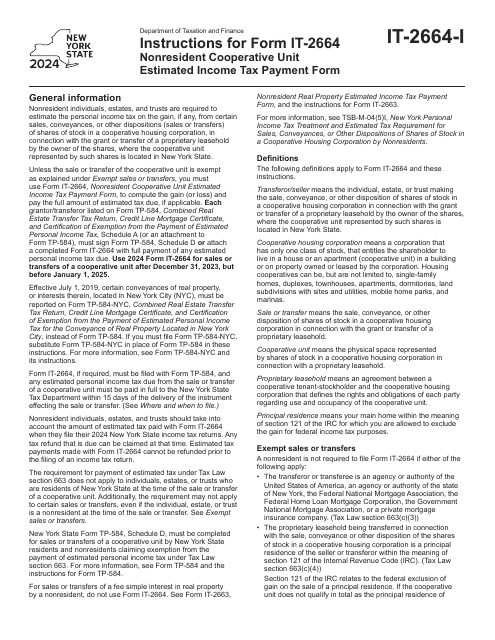

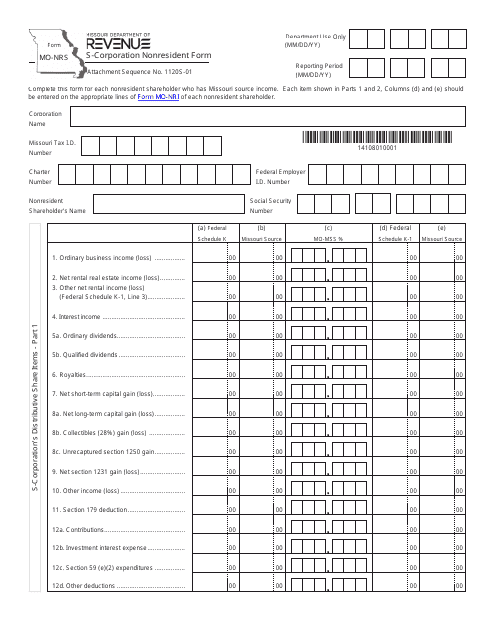

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

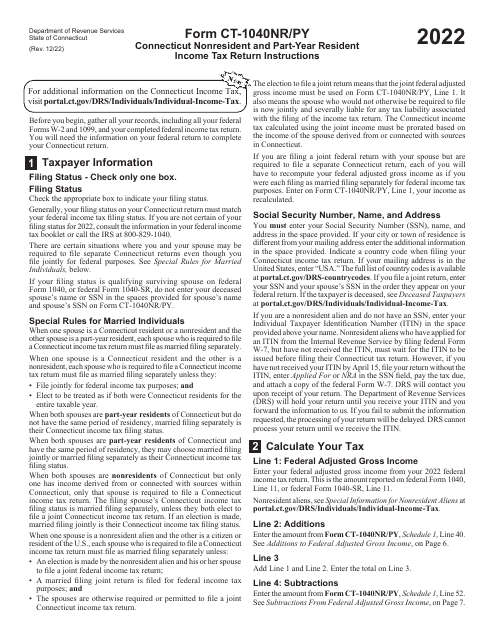

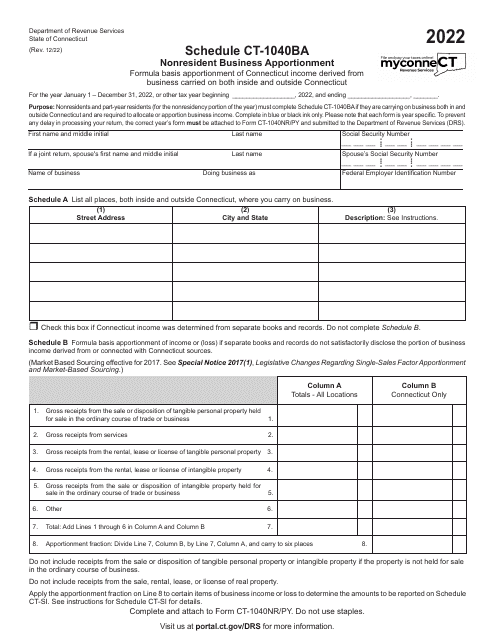

This Form is used for filing the Connecticut Nonresident and Part-Year Resident Income Tax Return for individuals who are nonresidents or part-year residents in Connecticut. It provides instructions on how to accurately complete and submit the CT-1040NR/PY form.

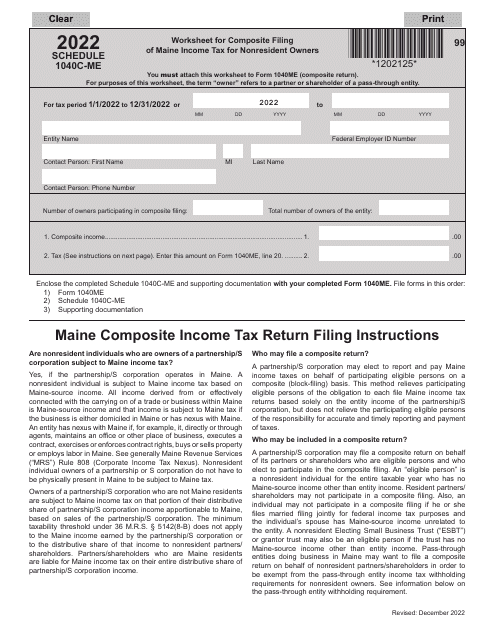

This type of document is used for completing the Schedule 1040C-ME worksheet in Maine for nonresident owners who need to file composite income tax.

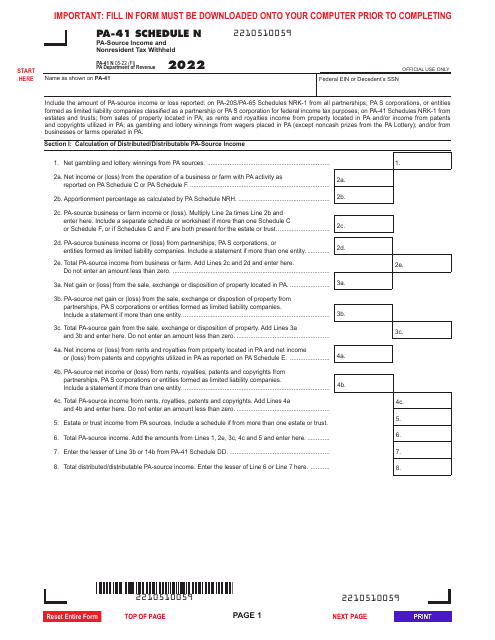

This form is used for reporting Pennsylvania-source income and the nonresident tax withheld.

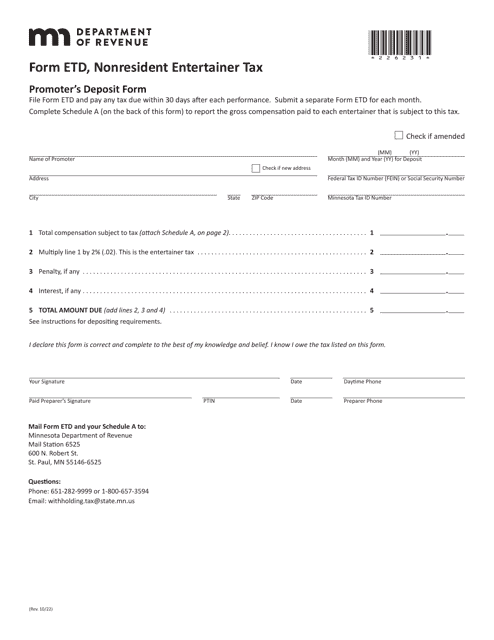

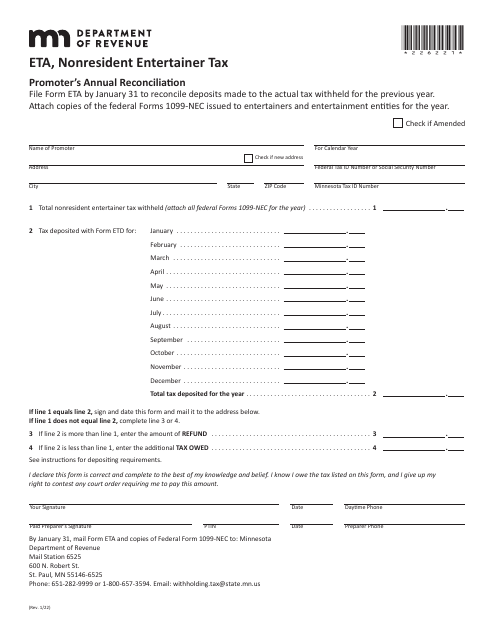

This Form is used for reporting and paying taxes for nonresident entertainers in the state of Minnesota.