Tipped Employees Templates

Are you an employer with tipped employees? Looking for information on how to properly handle employee tips? You've come to the right place. Our collection of documents, also known as tipped employees or employee tips, contains all the essential resources you need to navigate the intricacies of managing tipped employees.

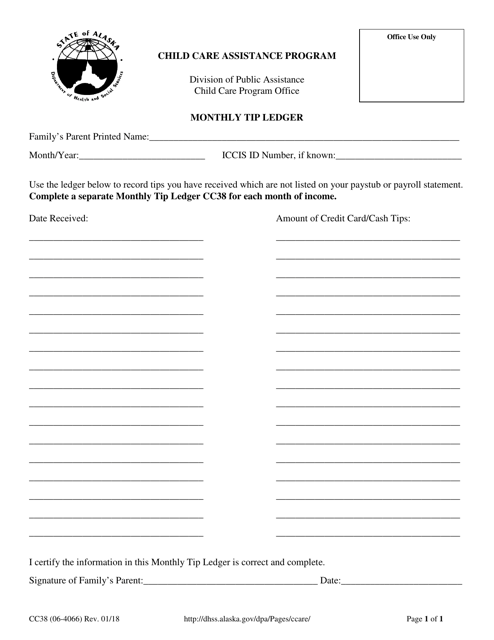

One of the key documents in this collection is the Form CC38 Monthly Tip Ledger - Alaska. This form is specifically designed for employers in Alaska to keep track of their employees' tips on a monthly basis. It ensures accurate reporting and compliance with state regulations.

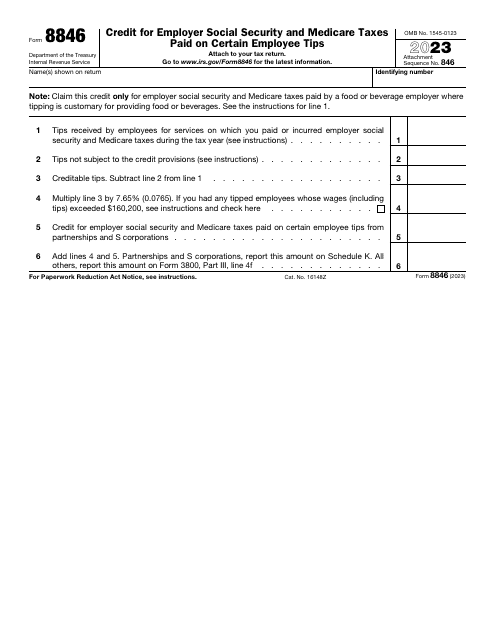

If you're concerned about the taxes associated with employee tips, you'll find valuable information in the IRS Form 8846 Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips. This form outlines the eligibility requirements for claiming a tax credit on the employer's share of Social Security and Medicare taxes paid on tipped income.

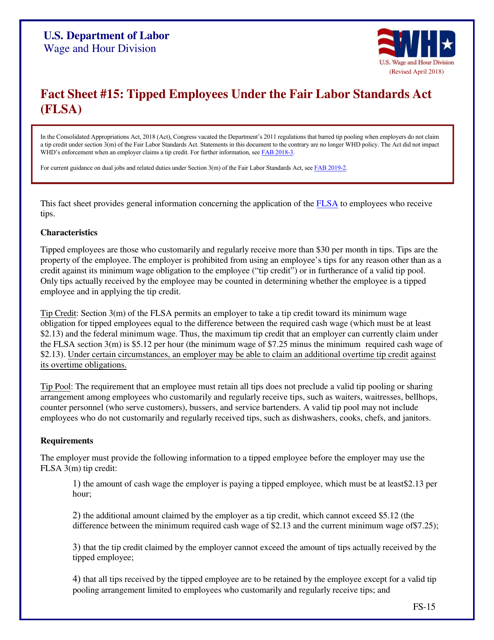

For a comprehensive overview of the Fair Labor Standards Act (FLSA) regulations regarding tipped employees, check out Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act (Flsa). It covers topics such as minimum wage requirements, tip pooling, and record-keeping obligations.

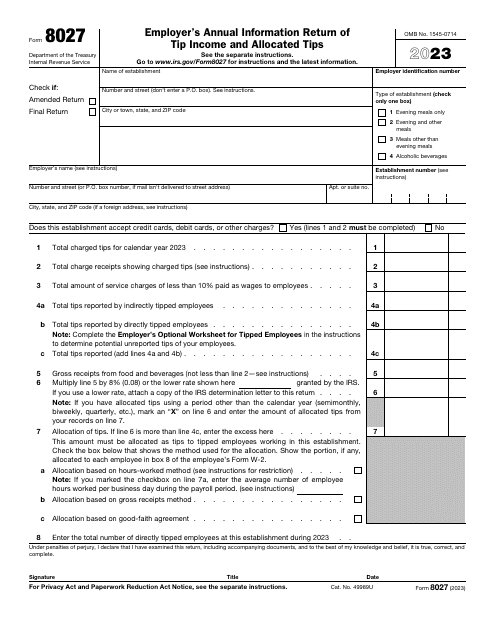

Another important IRS form in this collection is the IRS Form 8027 Employer's Annual Information Return of Tip Income and Allocated Tips. This document is used by employers to report the tip income and allocated tips of their employees. It helps ensure accurate reporting and compliance with tax regulations.

Whether you're in the hospitality industry or any other field where tipping is customary, our collection of documents for tipped employees provides the guidance and resources you need to navigate the legal and financial aspects of managing employee tips. Stay compliant, minimize tax liabilities, and ensure fairness for your employees with the help of our comprehensive collection of documents related to tipped employees.

Documents:

9

This Form is used for keeping a monthly record of tips in Alaska. Keep track of your tips with this ledger.

This fact sheet provides information about the rules and regulations for tipped employees under the Fair Labor Standards Act (FLSA). It explains the minimum wage requirements, tip credit, and other guidelines for employers and employees in the United States.

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.