Foreign Person Templates

Are you a foreign person with income sourced from the United States? If so, you've come to the right place! Our website is dedicated to providing you with all the information and resources you need to navigate your tax obligations as a foreign person earning income in the U.S.

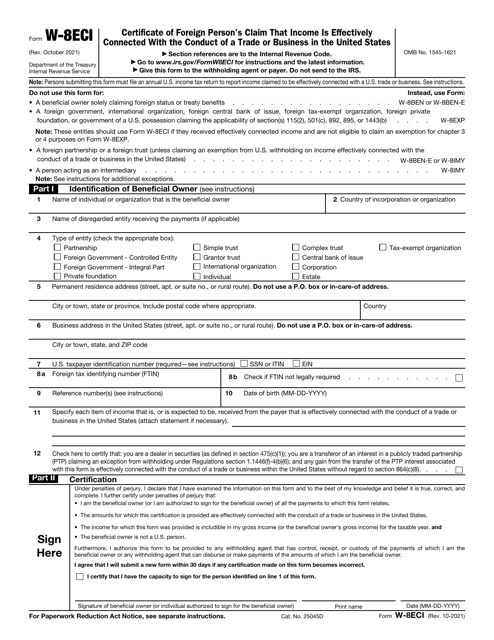

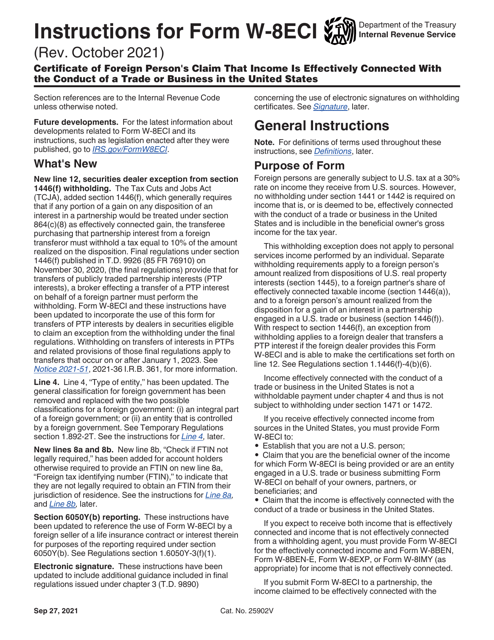

As a foreign person, it's essential to understand the intricacies of U.S. tax laws and regulations. Our collection of documents includes IRS forms, instructions, and statements that cater specifically to the needs and requirements of foreign persons like yourself. We have a range of resources designed to help you accurately report and withhold taxes on your U.S. sourced income.

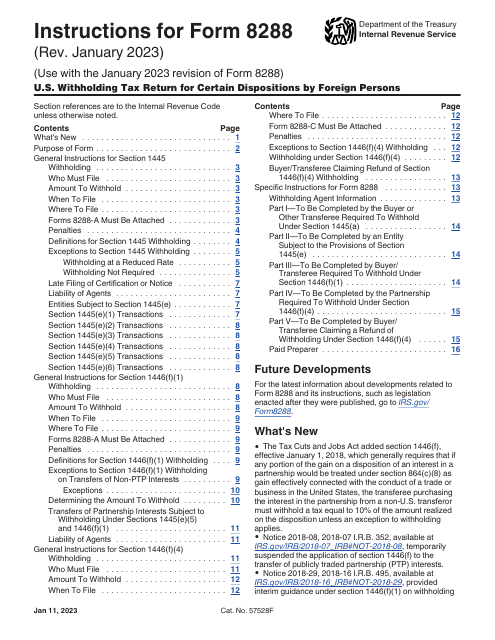

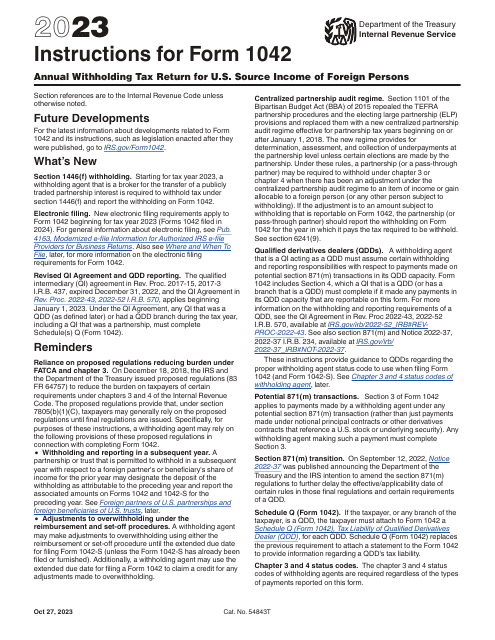

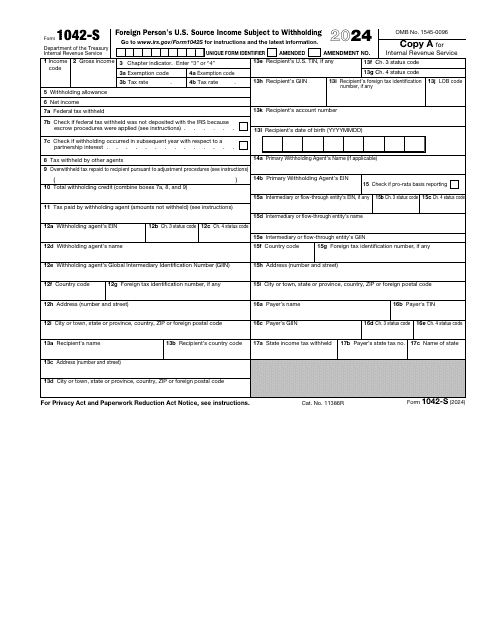

Whether you're looking for guidance on completing IRS Form 1042-S, the form that reports foreign persons' U.S. source income subject to withholding, or need assistance with IRS Form 1042, the annual withholding tax return for U.S. source income of foreign persons, we've got you covered. Our comprehensive library of documents provides step-by-step instructions and explanations to ensure you understand your obligations and can fulfill them accurately.

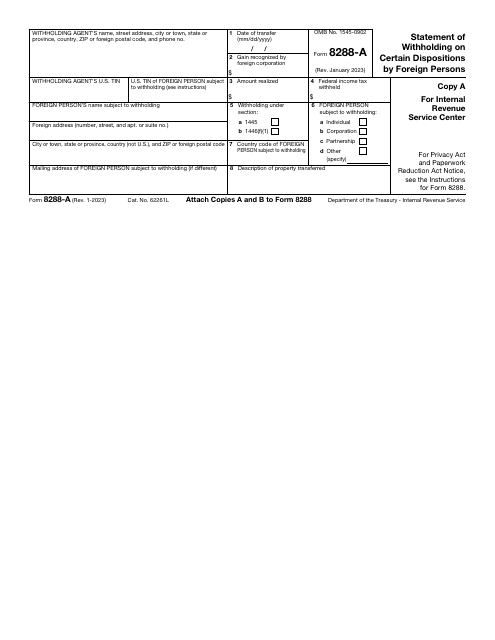

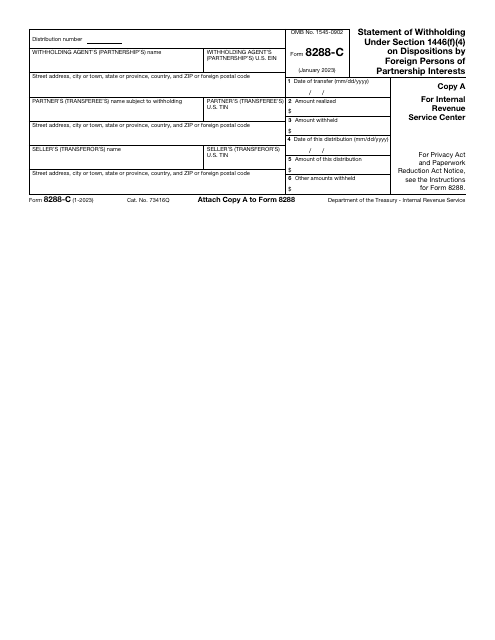

In addition to the aforementioned forms, we also offer IRS Form 8288-C, the statement of withholding under Section 1446(F)(4) on dispositions by foreign persons of partnership interests. This form is vital for foreign persons who have disposed of their partnership interests in the U.S. and need to report withholding information.

Navigating the U.S. tax system as a foreign person can be complex, but with our extensive collection of resources, you can easily stay compliant and fulfill your obligations. Rest assured that we are here to provide you with the guidance and support you need throughout the process.

Don't let the intricacies of U.S. tax laws overwhelm you. Explore our foreign person document collection today and gain the knowledge and confidence to handle your U.S. tax obligations efficiently.

Documents:

32

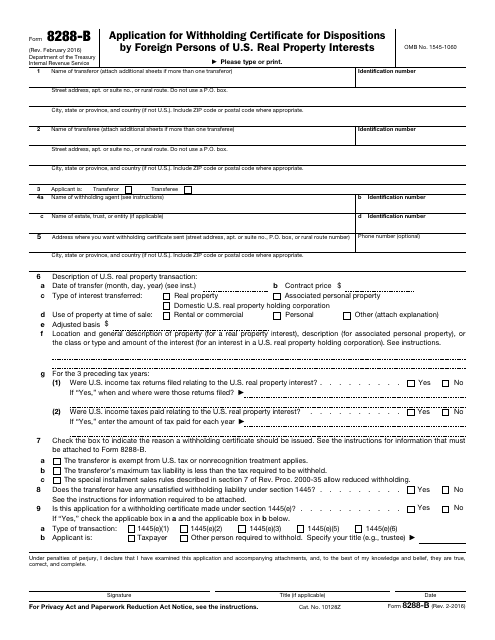

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

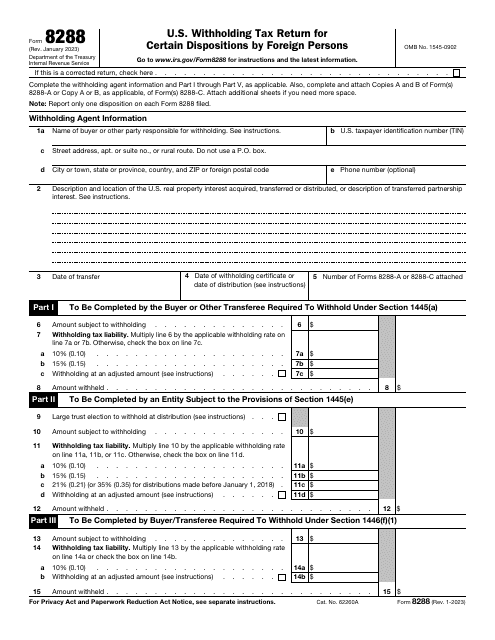

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

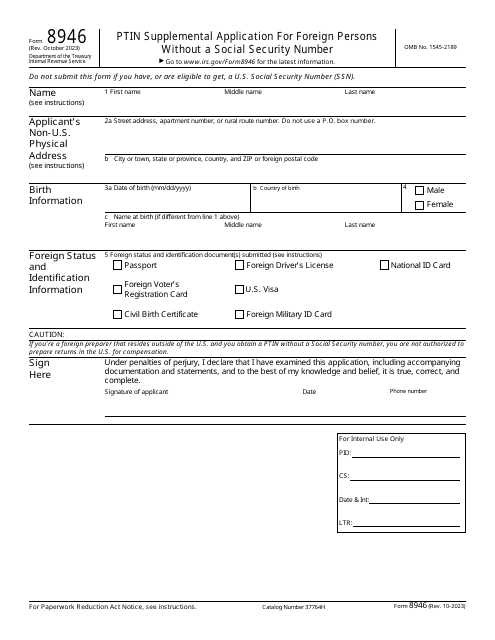

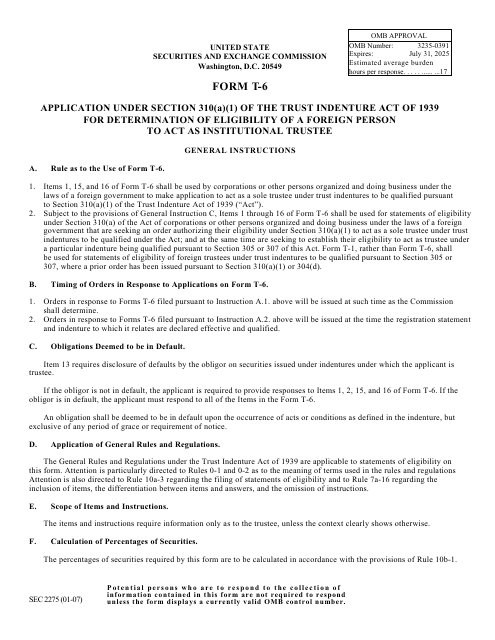

This document is used for applying for determination of eligibility for a foreign person to act as an institutional trustee under Section 310(A)(1) of the Trust Indenture Act of 1939.