Unemployment Compensation Templates

Unemployment Compensation, also known as unemployment benefits or jobless benefits, is a government program that provides financial assistance to eligible individuals who have become unemployed through no fault of their own. This program aims to provide temporary income support to help individuals meet their basic needs while they search for new employment opportunities.

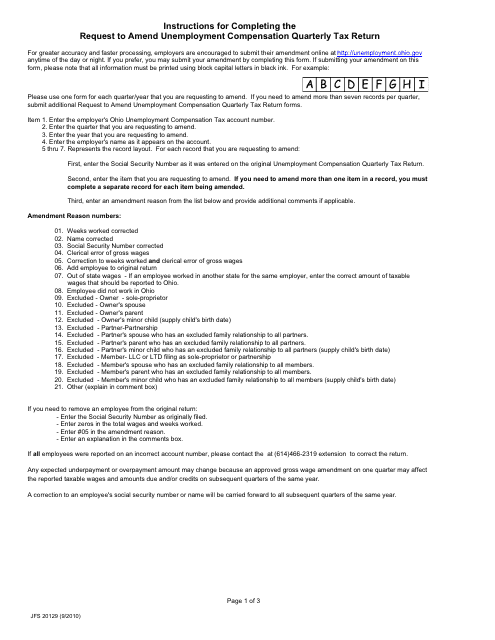

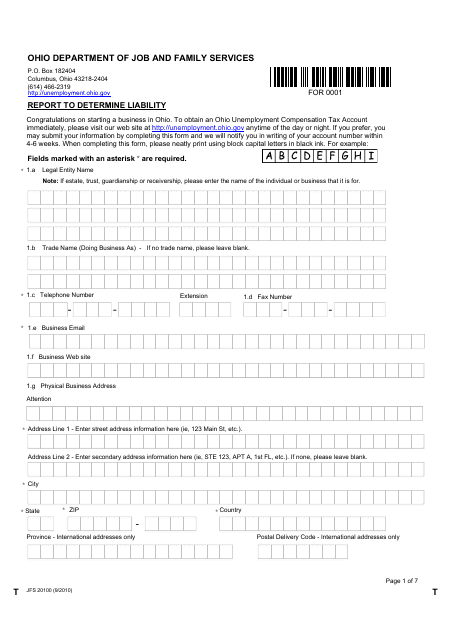

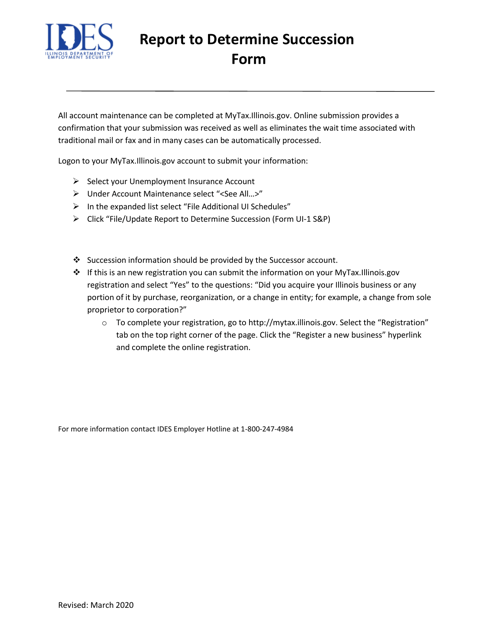

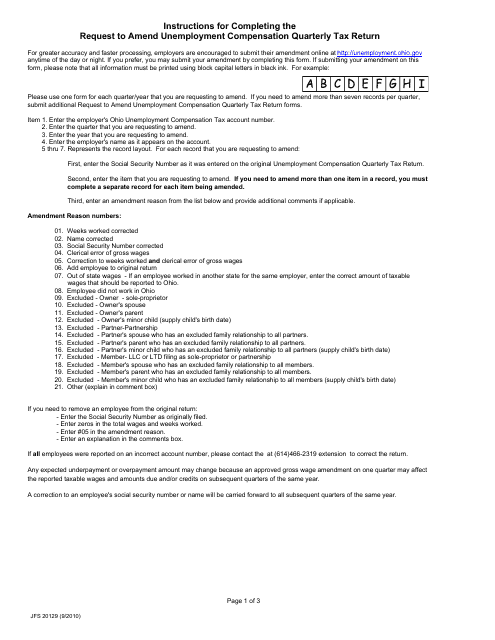

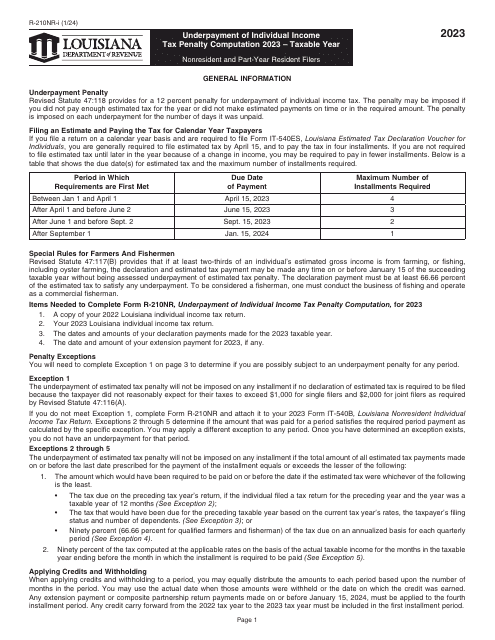

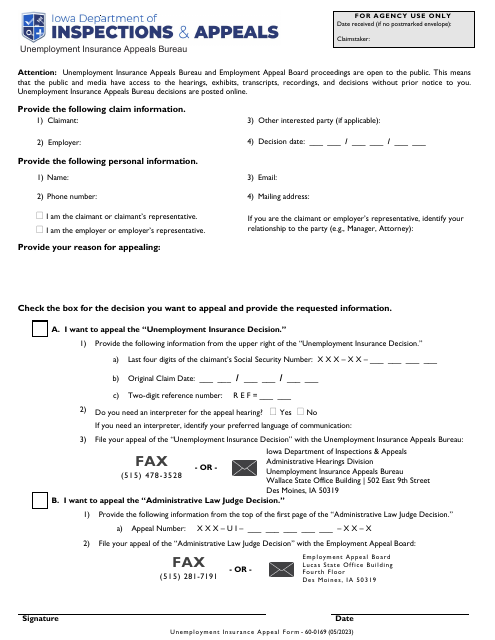

Unemployment compensation is administered at the state level, with each state having its own specific rules, guidelines, and forms. These forms, such as the Ohio Form JFS20129 Request to Amend Unemployment Compensation Quarterly Tax Return or the Louisiana Form R-210NR Underpayment of Individual Income, are essential for individuals to apply for and receive unemployment benefits.

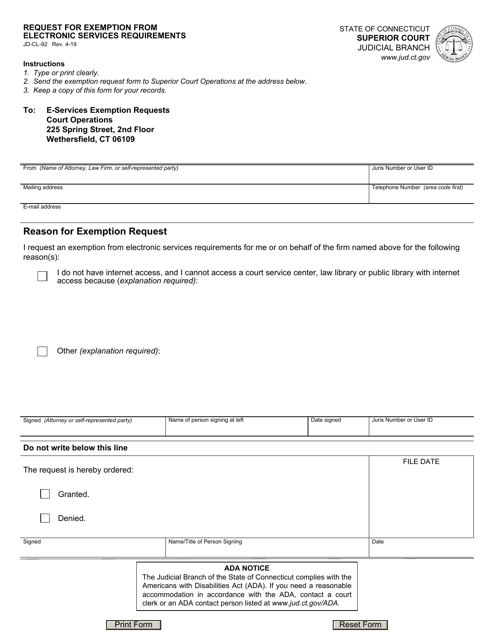

In some states, individuals may be required to request an exemption from electronic services requirements, as indicated by the Connecticut Form JD-CL-92 Request for Exemption From Electronic Services Requirements. This form allows individuals to receive paper documentation instead of electronic notifications.

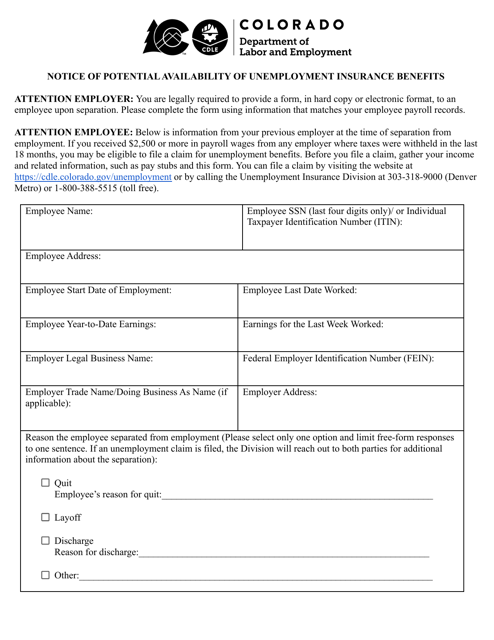

Furthermore, individuals may receive a Notice of Potential Availability of Unemployment Insurance Benefits, as issued by the Colorado government. This notice serves as an alert to inform individuals of the potential eligibility and availability of unemployment insurance benefits.

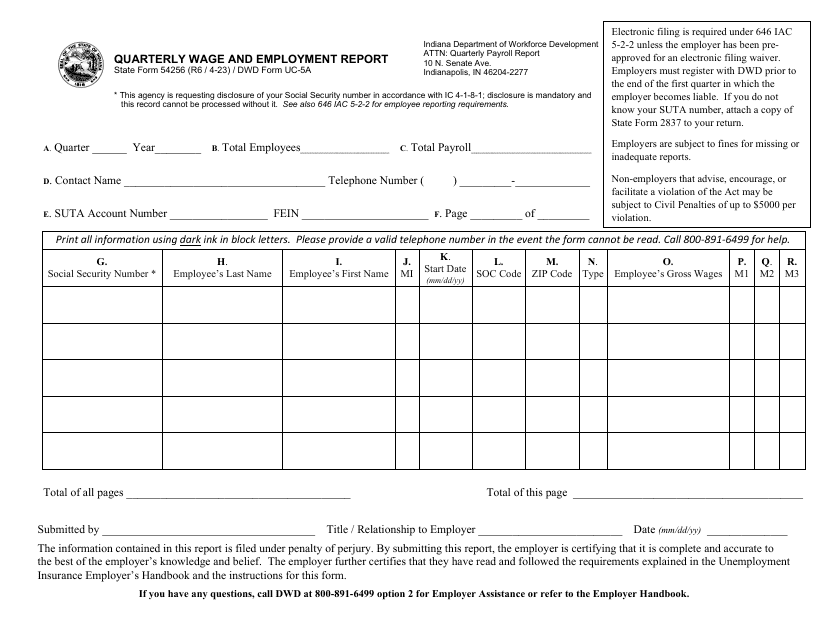

To ensure accurate distribution and tracking of unemployment compensation, states often require employers to submit regular reports, such as the Indiana State Form 54256 (DWD Form UC-5A) Quarterly Wage and Employment Report. These reports help maintain up-to-date records of wages and employment within the state.

In summary, unemployment compensation provides crucial financial support to individuals who are temporarily out of work. States have established specific procedures, forms, and guidelines to facilitate the process of applying for and receiving these benefits. Whether it's understanding tax returns, requesting exemptions, or reporting employment data, these documents play a crucial role in ensuring the efficient administration of unemployment compensation programs.

Documents:

40

This Form is used for requesting to amend your Unemployment Compensation Quarterly Tax Return in the state of Ohio. It provides instructions on how to properly fill out and submit the form to make changes to your tax return.

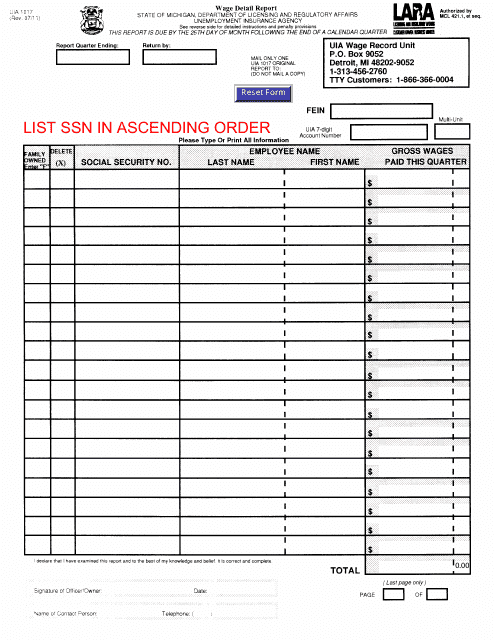

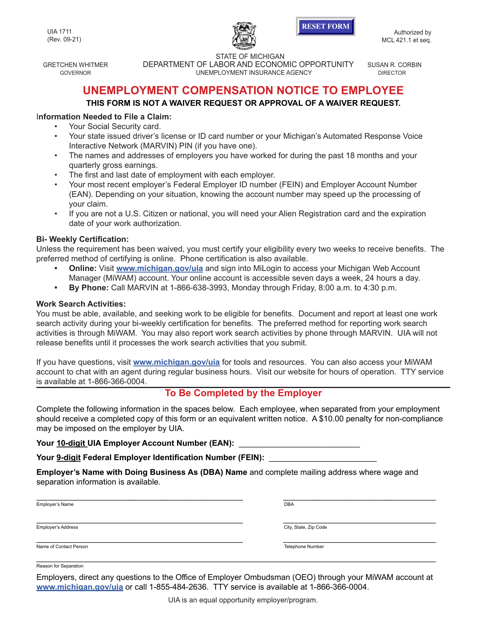

This form is used for reporting wage details in the state of Michigan.

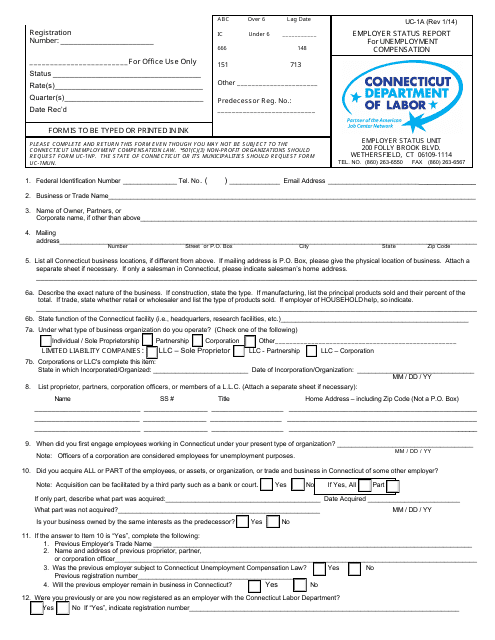

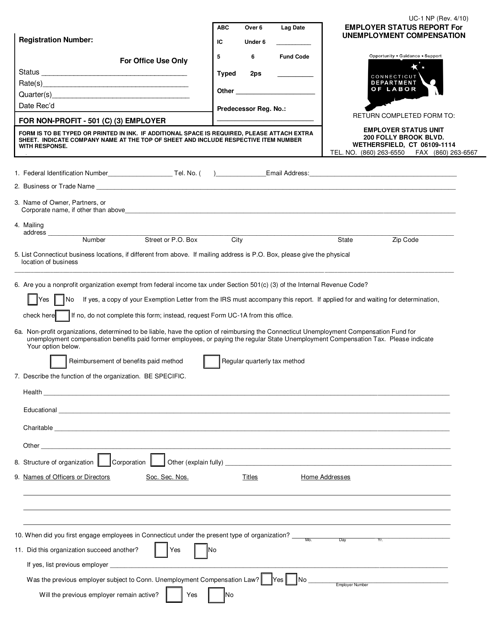

This form is used for employers in Connecticut to provide a status report for unemployment compensation.

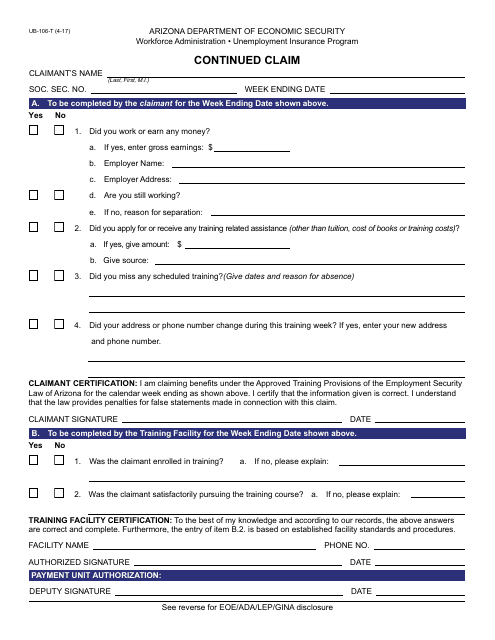

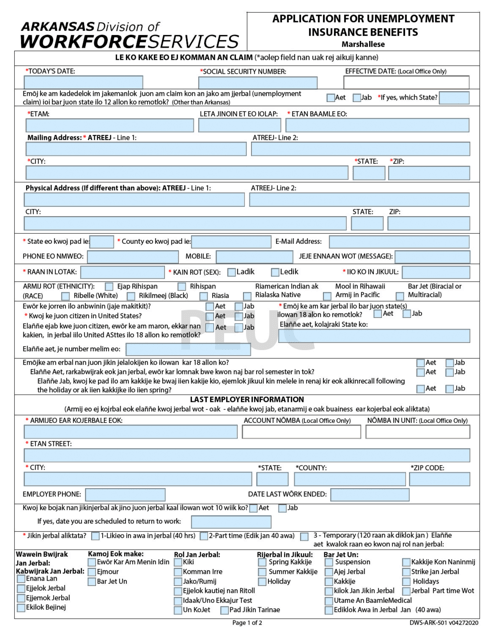

This form is used for filing a continued claim for unemployment benefits in Arizona.

This Form is used for reporting and determining liability in the state of Ohio. It helps identify individuals or organizations that may be held responsible for certain actions or events.

This form is used for requesting changes to the quarterly tax return for unemployment compensation in Ohio.

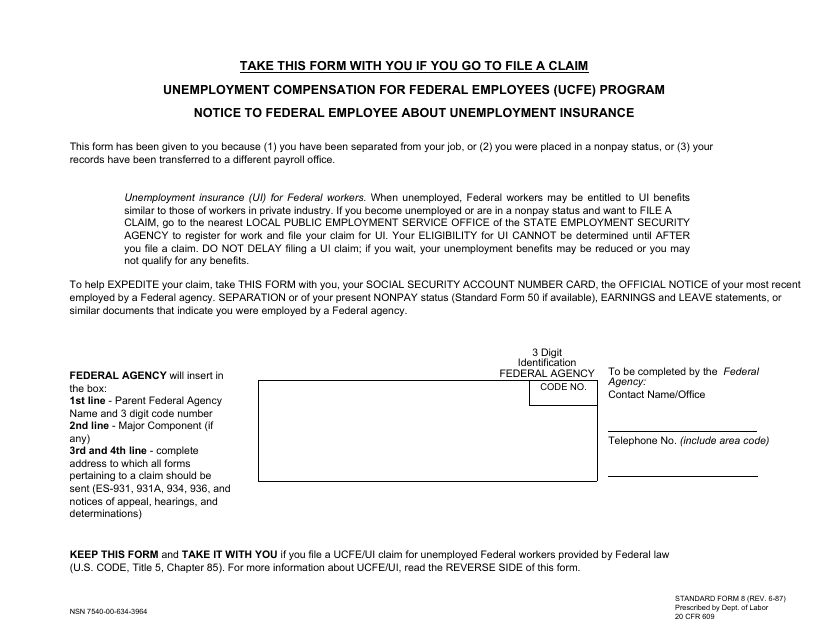

This form is used for notifying federal employees about their eligibility for unemployment insurance under the Unemployment Compensation for Federal Employees program.

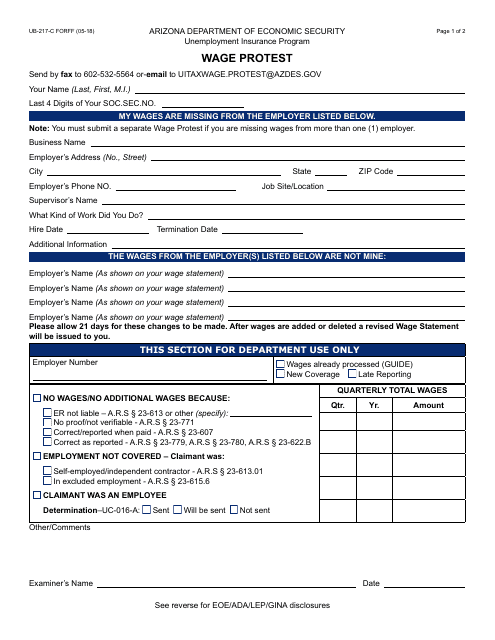

This form is used for filing a wage protest in the state of Arizona. It is used to challenge an employer's reported wages or to report discrepancies in the wages paid.

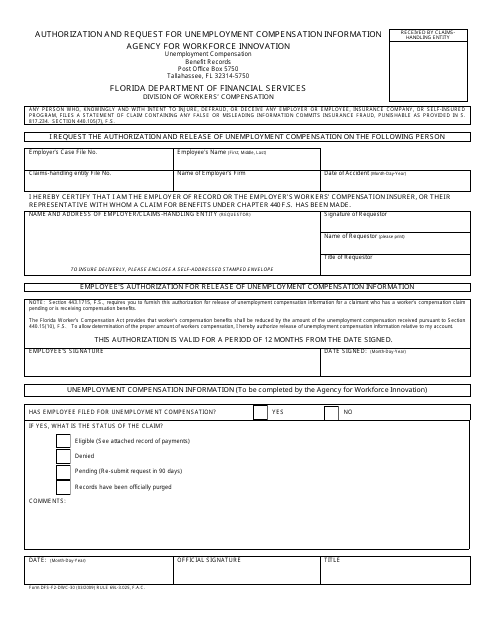

This document is used for authorizing and requesting information related to unemployment compensation in the state of Florida.

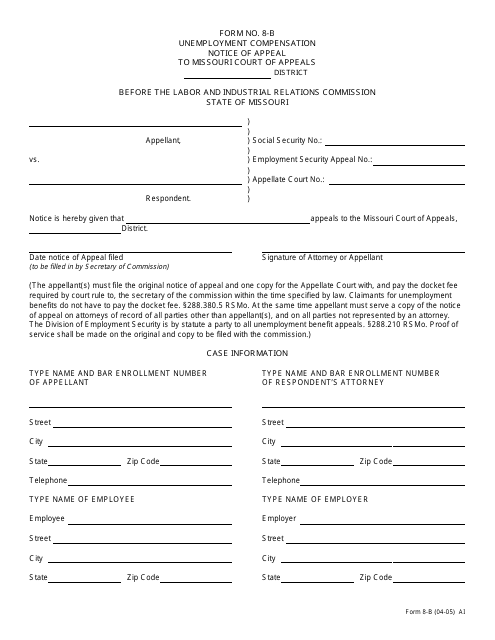

This form is used for filing an appeal to the Missouri Court of Appeals regarding an unemployment compensation case in Missouri.

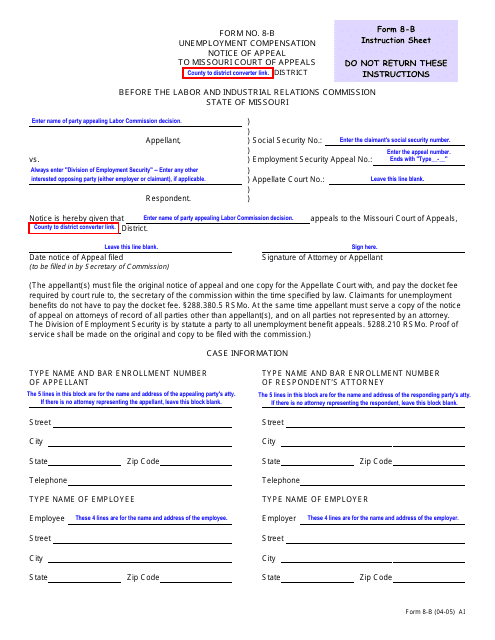

This form is used for filing an appeal regarding unemployment compensation in the state of Missouri. It provides instructions on how to complete and submit the Form 8-B.

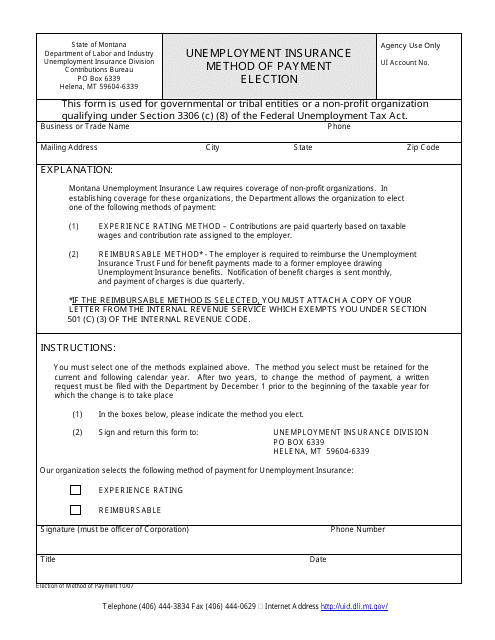

This document is used for selecting the method of payment for unemployment insurance in Montana.

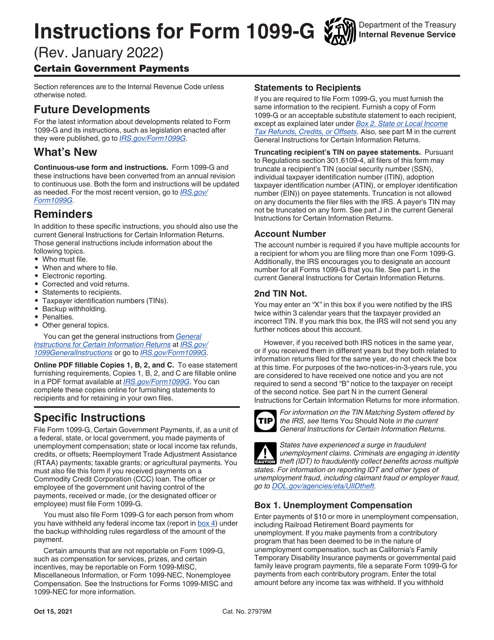

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

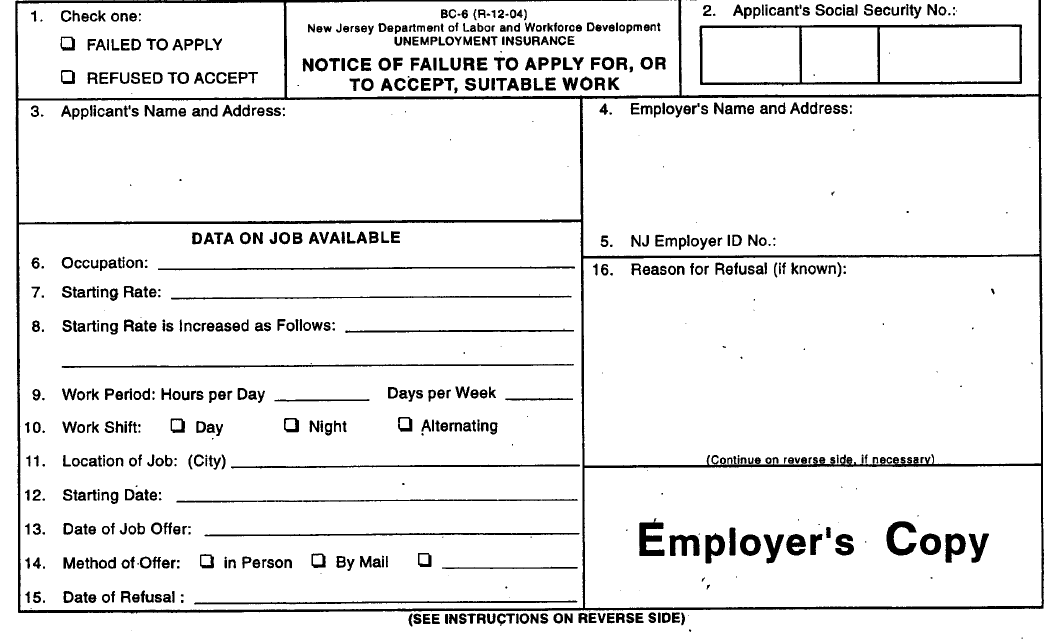

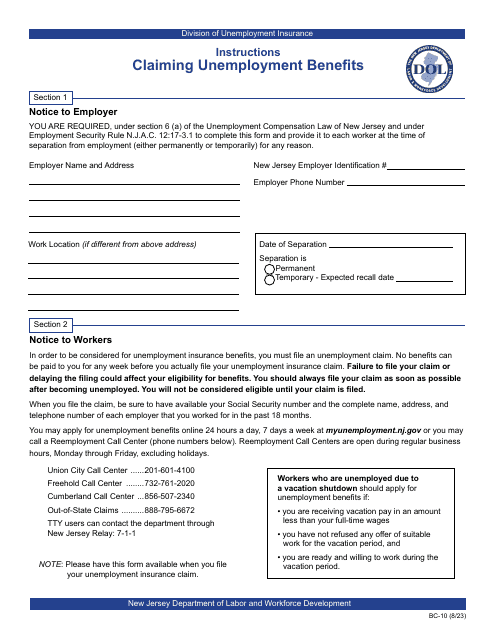

This form is used for notifying the New Jersey Department of Labor and Workforce Development about an individual's failure to apply for or accept suitable work. It is necessary for maintaining eligibility for unemployment benefits.

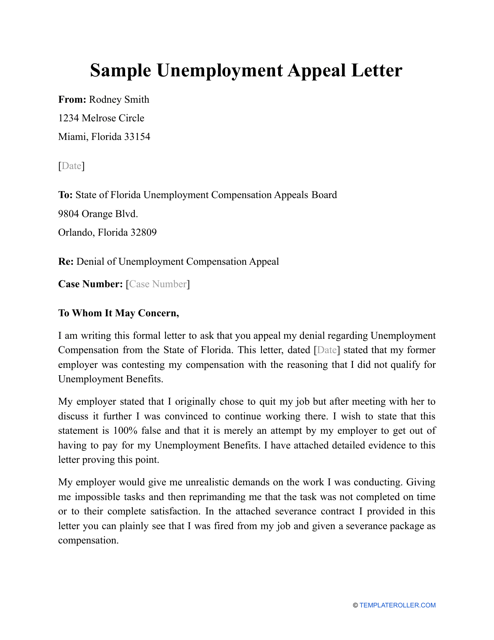

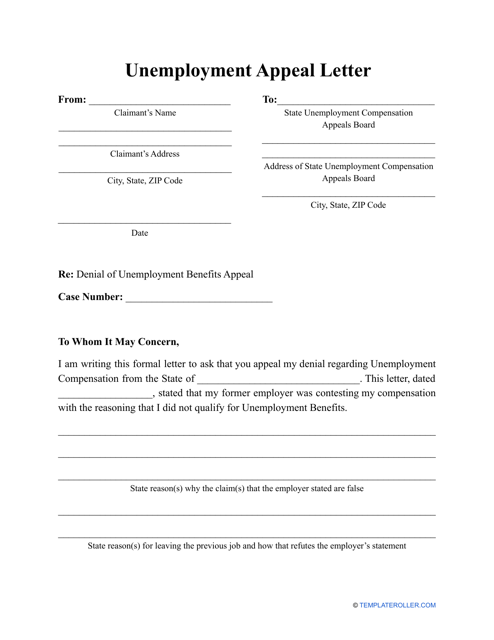

A former employee may prepare this letter when they would like to dispute an unemployment agency's decision not to provide them with unemployment benefits.

Use this letter to request a review of the decision of the Employment Security Department (ESD) that denied your unemployment benefits.

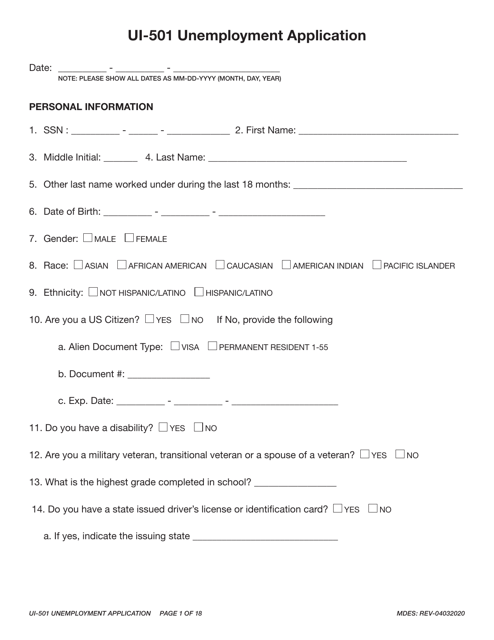

This form is used for applying for unemployment benefits in Mississippi.

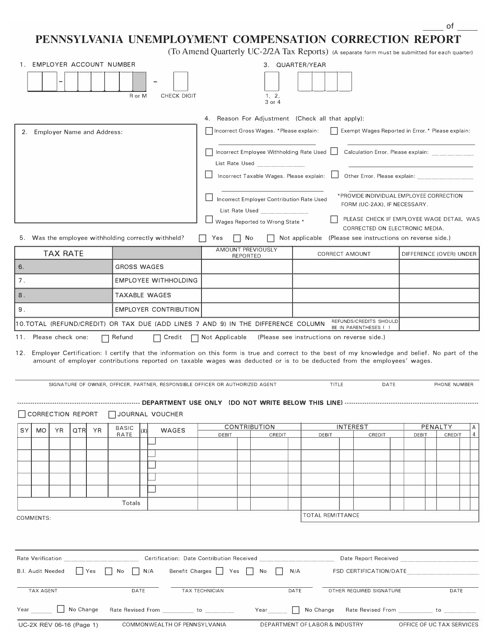

This Form UC-2X is used for reporting corrections to Pennsylvania Unemployment Compensation claims. If you need to correct any information related to your unemployment compensation, you can use this form to make the necessary changes.

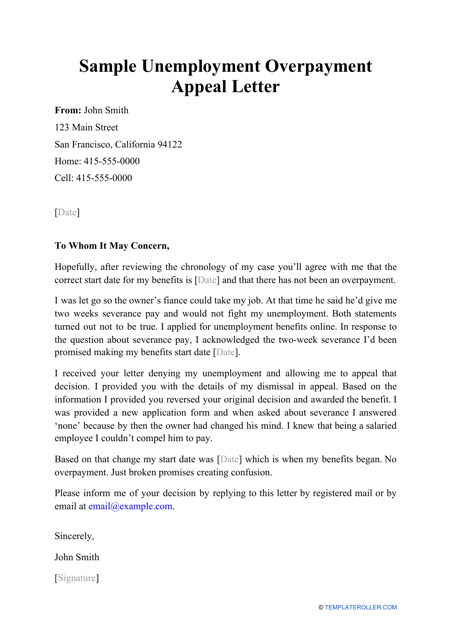

A former employee who was informed about an excessive amount of unemployment benefits they were granted may use this form to help remedy the situation.

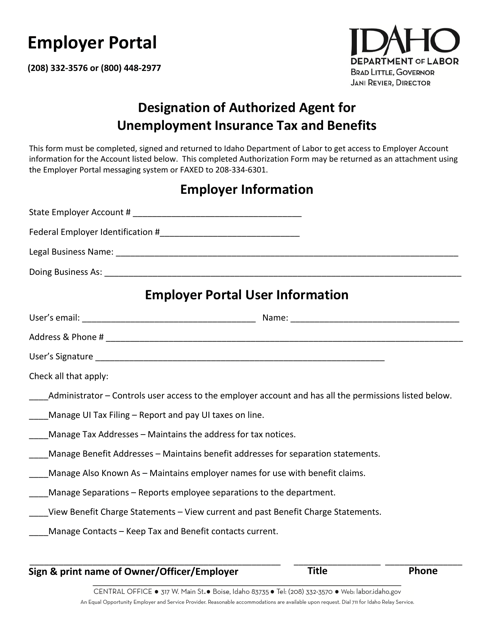

This document is used for designating an authorized agent to handle unemployment insurance tax and benefits in the state of Idaho.

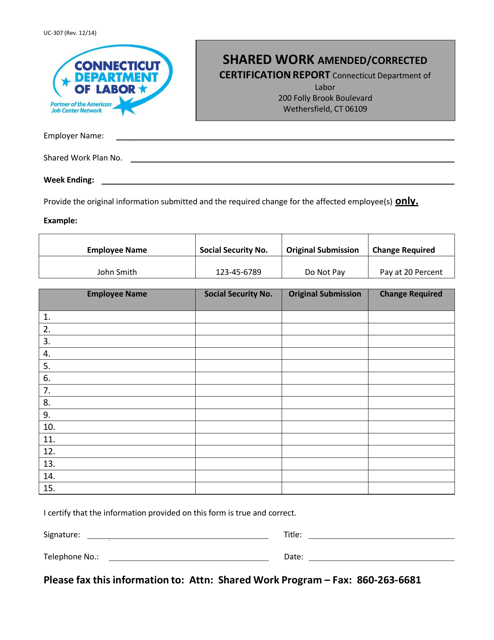

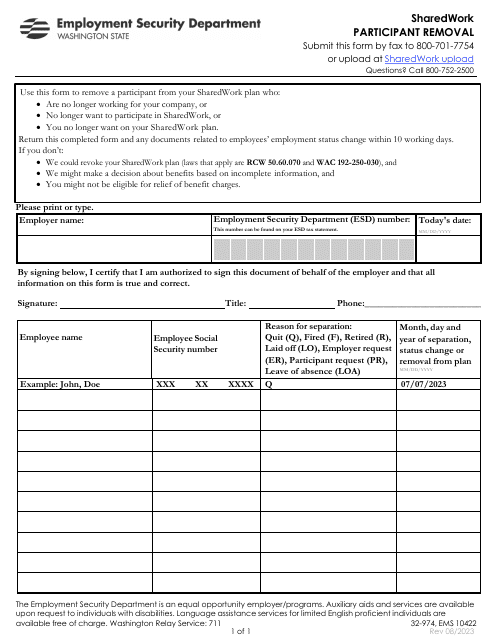

This form is used for submitting an amended or corrected certification report for the Shared Work program in Connecticut.

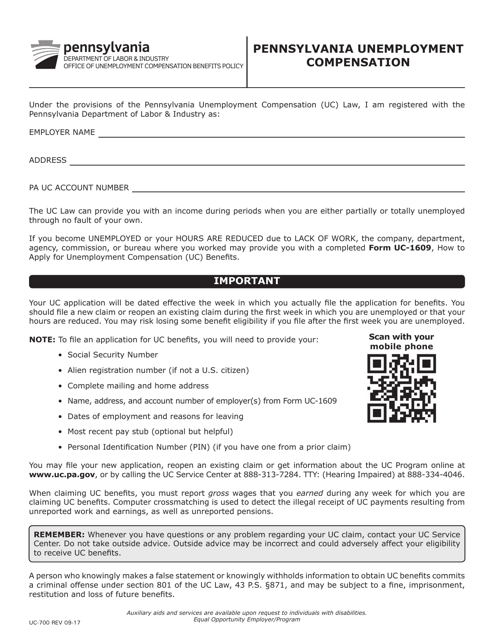

This form is used for filing for unemployment compensation in the state of Pennsylvania. It is required for residents who have lost their jobs and are seeking financial assistance.

This form is used for employers in Connecticut to report their status for unemployment compensation.

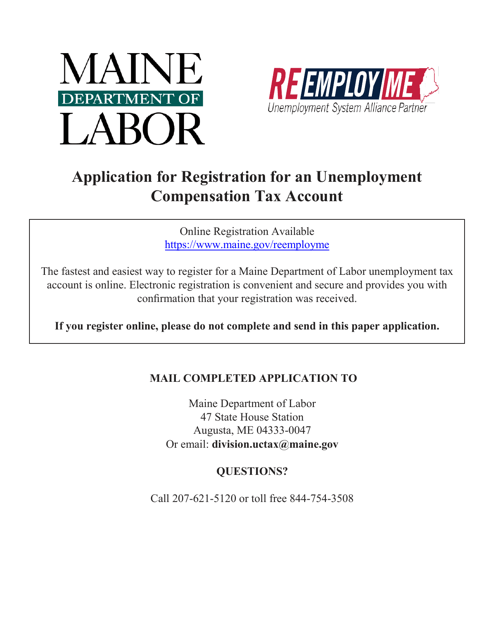

This form is used for registering a tax account for unemployment compensation in the state of Maine.

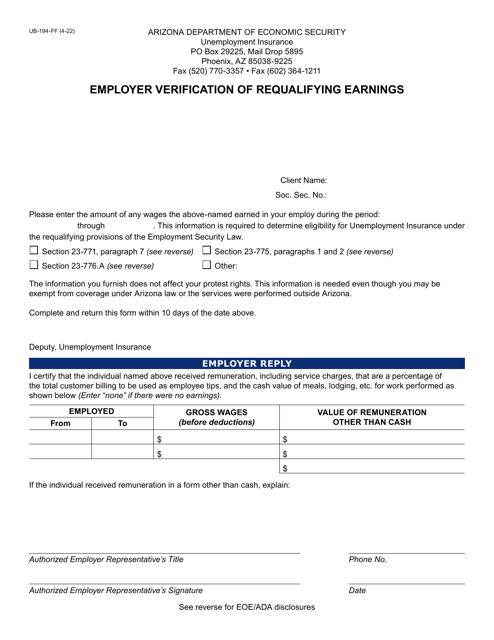

This form is used for employer verification of requalifying earnings in the state of Arizona. It is used to certify an employee's eligibility for certain benefits based on their earnings.

This notice informs individuals in Colorado about the possibility of receiving unemployment insurance benefits. It provides important information and instructions on how to apply for and receive these benefits.