Extension of Time Templates

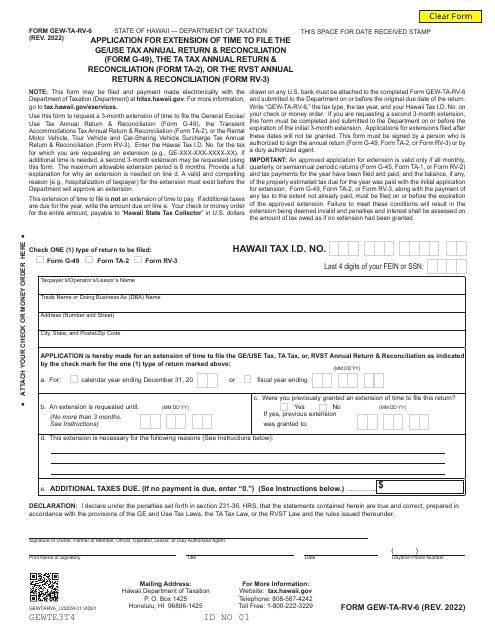

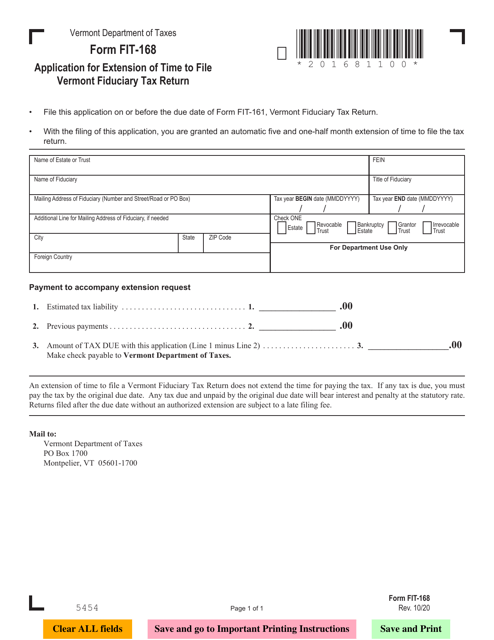

Are you in need of more time to file important documents? Our Extension of Time services can help! Whether you need an extension of time to file your corporate income tax returns, proof of beneficial use, water right permit application, corporate activity tax return, or unrelated business income tax return, we’ve got you covered.

At Extension of Time, we understand that life can get busy and sometimes it's difficult to meet deadlines. That's why we offer a variety of extension forms and services to help you request additional time. Our user-friendly forms make it easy for you to fill out and submit your extension request quickly and efficiently.

Our services are available for businesses and individuals alike, with specific forms tailored to meet the requirements of each state. We have a wide range of extension forms for different purposes, ensuring that you can find the right form for your needs.

Don't stress about meeting filing deadlines anymore. Let Extension of Time help you get the extra time you need to complete your documents accurately and efficiently. Trust our expertise in extensions and take advantage of our easy-to-use forms today.

Documents:

234

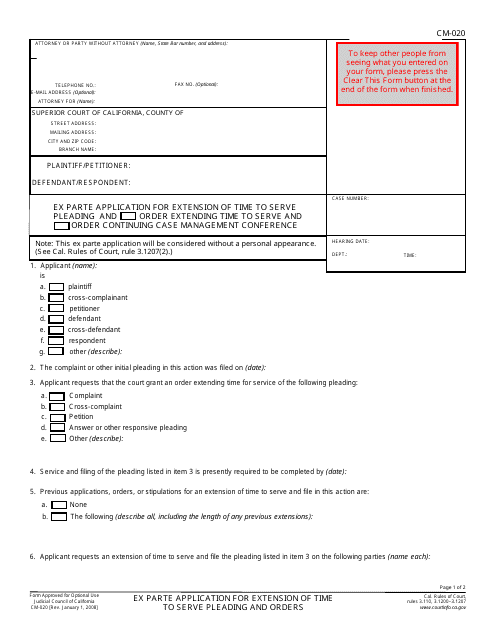

This form is used for requesting an extension of time to serve a pleading in a California court case.

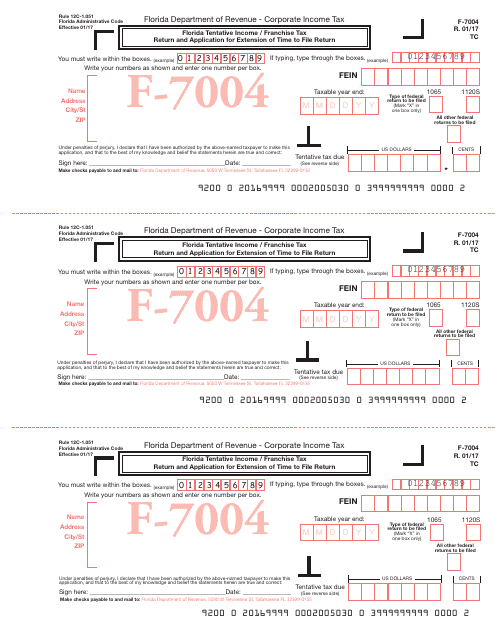

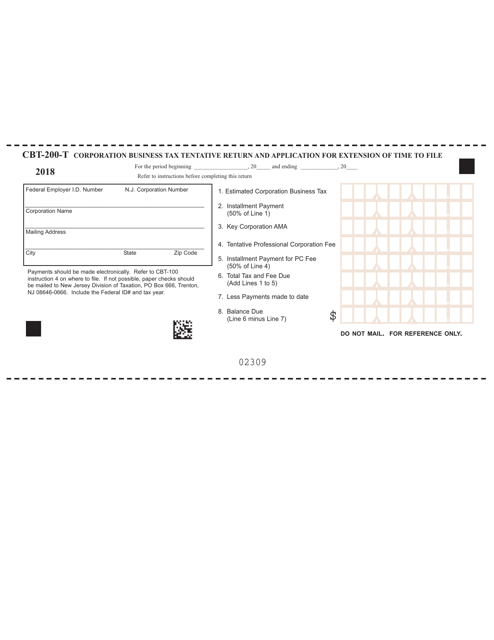

This Form is used for filing the Florida Tentative Income/Franchise Tax Return and applying for an extension of time to file the return in Florida.

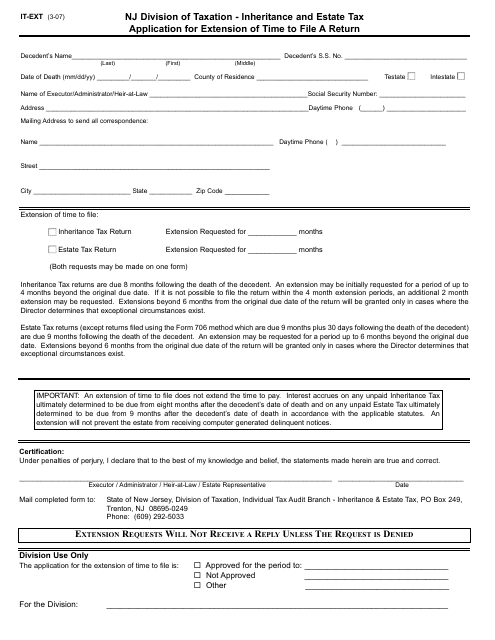

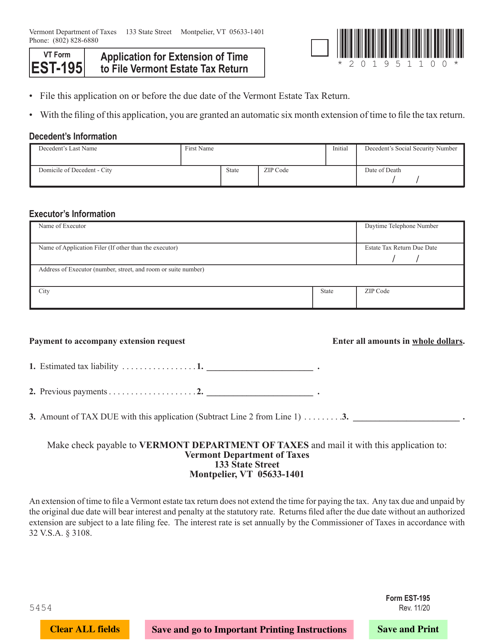

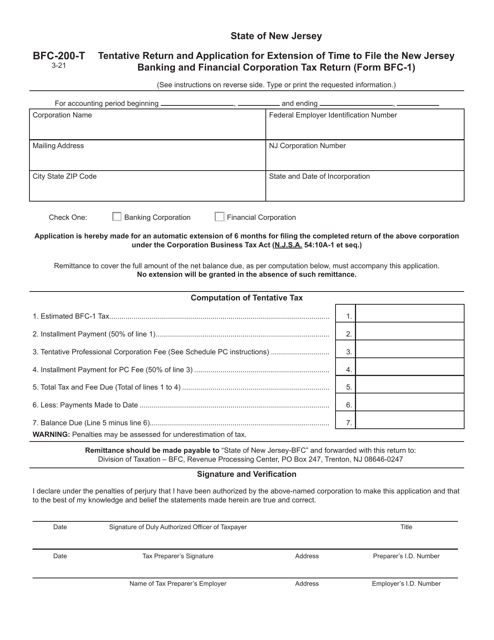

This form is used for applying for an extension of time to file an inheritance and estate tax return in the state of New Jersey.

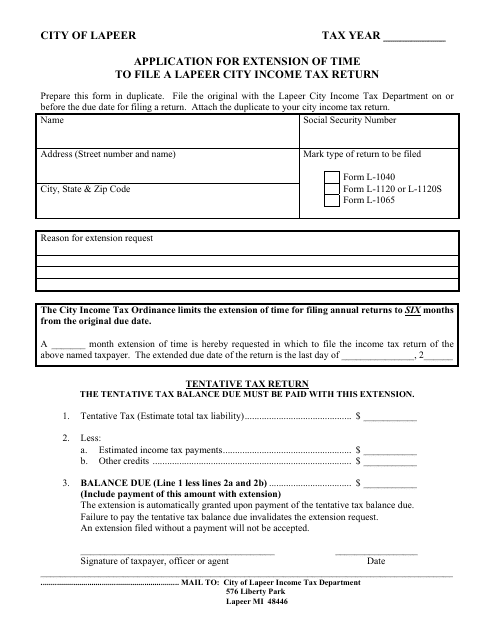

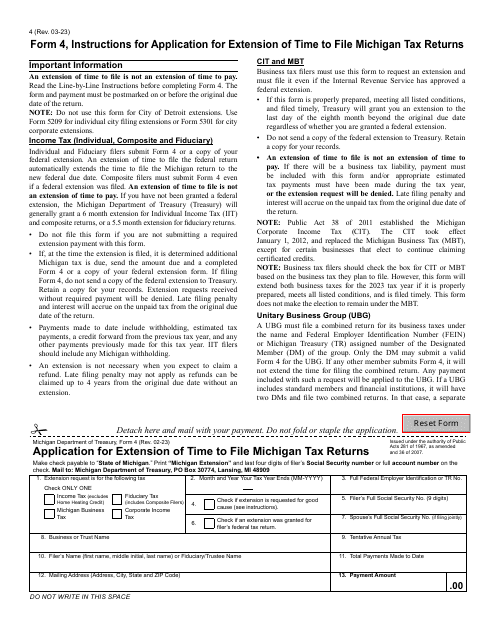

Application for Extension of Time to File a Lapeer City Income Tax Return - City of Lapeer, Michigan

This document is used for requesting an extension of time to file an income tax return for residents of Lapeer City, Michigan.

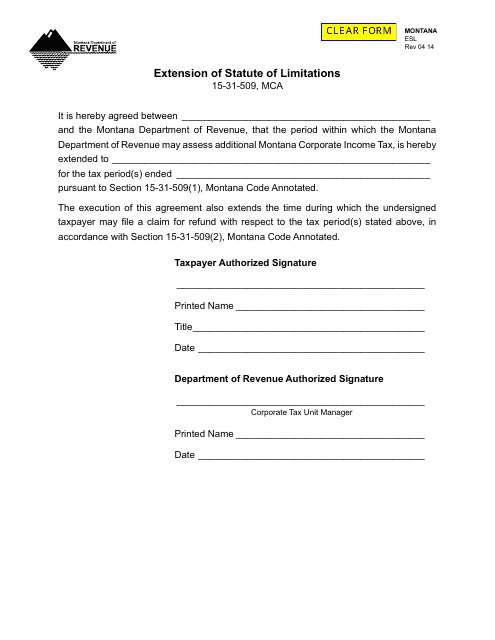

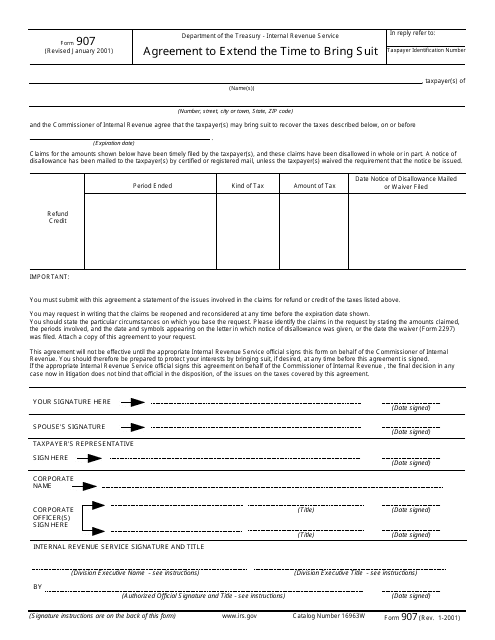

This Form is used for requesting an extension of the statute of limitations in the state of Montana for ESL-related matters.

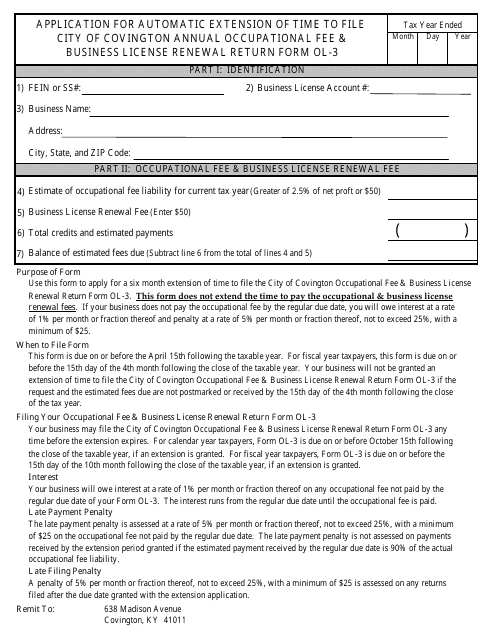

This form is used for requesting an automatic extension of time to file the City of Covington Annual Occupational Fee & Business License Renewal Return (Form Ol-3) in Covington, Kentucky.

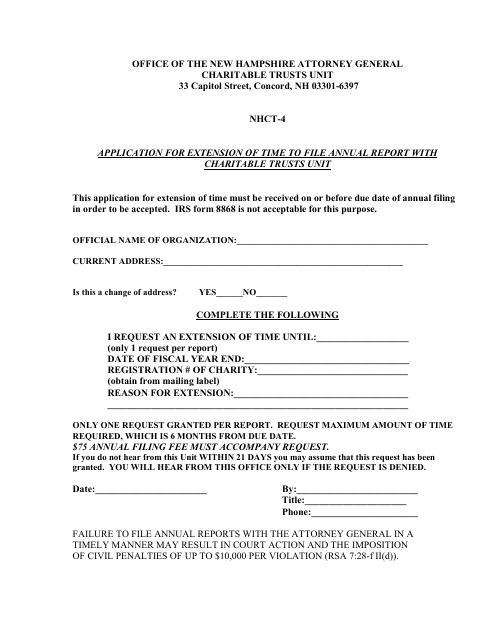

This form is used for requesting an extension of time to submit the annual report with the Charitable Trusts Unit in New Hampshire.

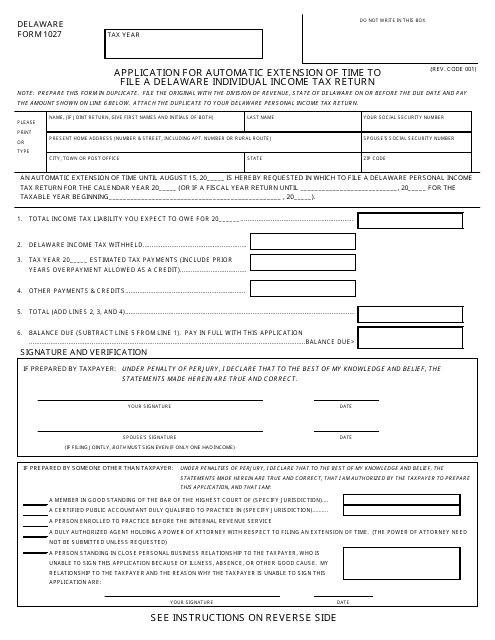

This Form is used for requesting an automatic extension of time to file a Delaware individual income tax return.

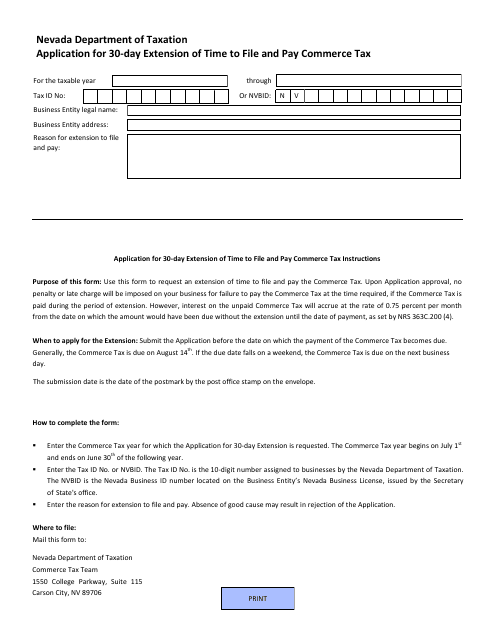

This form is used to request a 30-day extension of time to file and pay the Commerce Tax in Nevada.

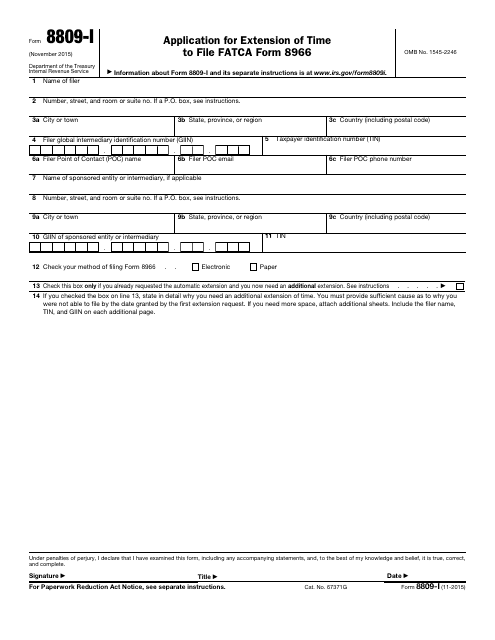

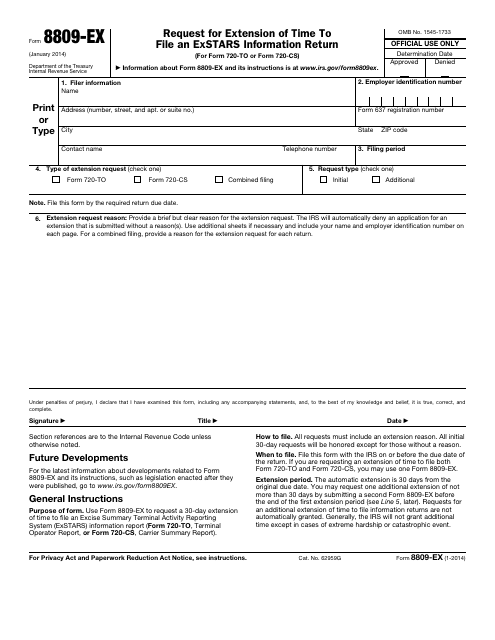

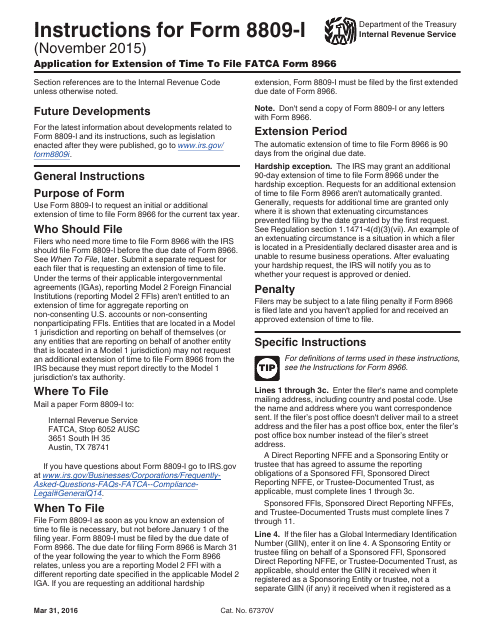

This Form is used for requesting an extension of time to file the Fatca Form 8966 to the IRS.

This Form is used for requesting an extension of time to file the Fatca Form 8966 with the IRS.

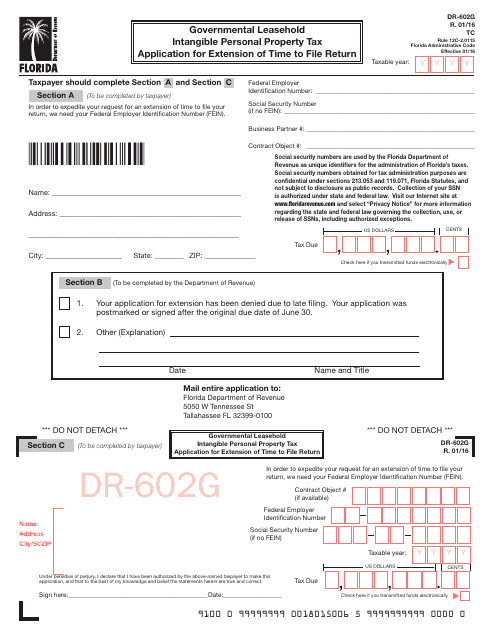

This form is used for requesting an extension of time to file a return for the Governmental Leasehold Intangible Personal Property Tax in Florida.

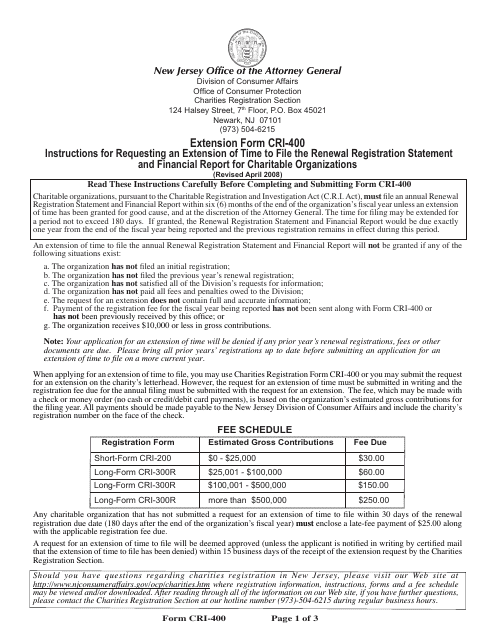

This Form is used for applying for an extension of time to file the annual renewal registration statement and financial report for a charitable organization in New Jersey.

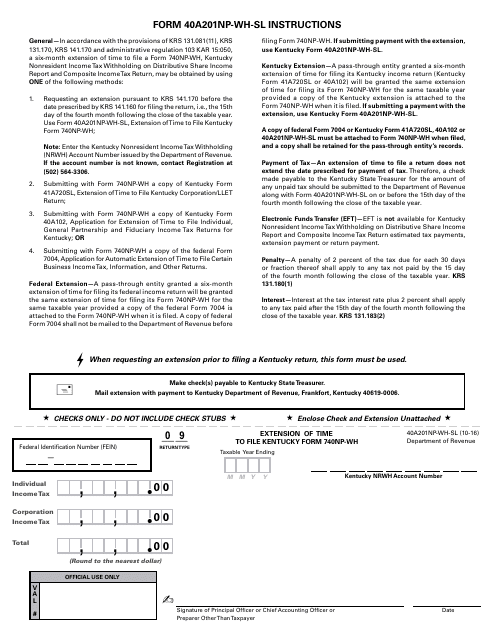

This form is used for requesting an extension of time to file the Kentucky Form 740np-Wh, which is a tax return form specific to Kentucky residents.

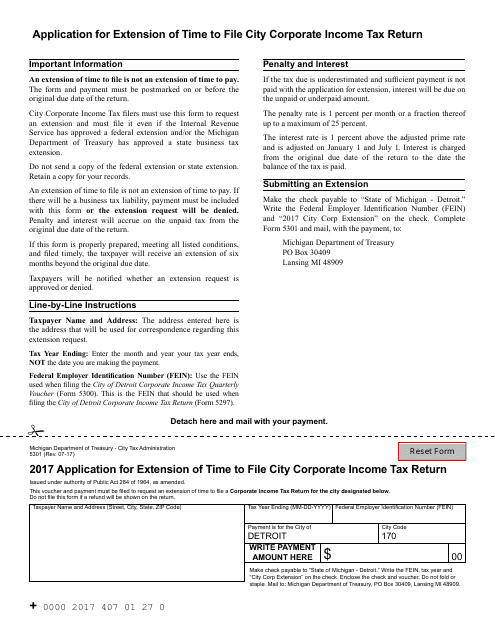

This document is for businesses in the City of Detroit, Michigan who need more time to file their city corporate income tax return.

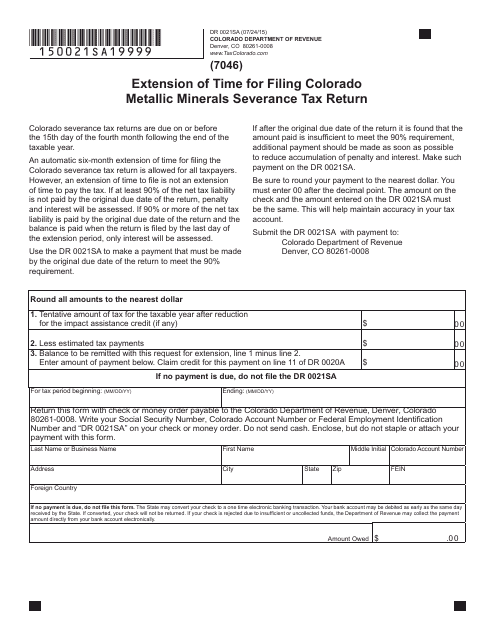

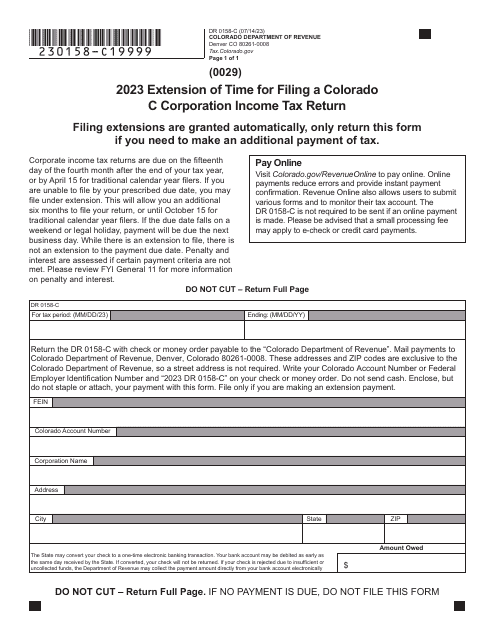

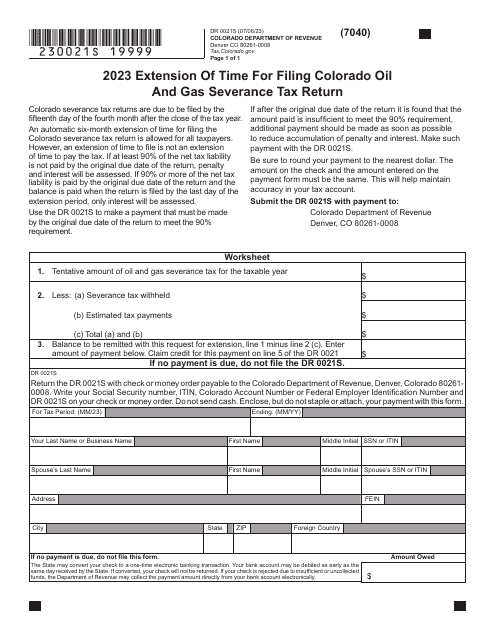

This Form is used for requesting an extension of time for filing the Colorado Metallic Minerals Severance Tax Return in the state of Colorado.

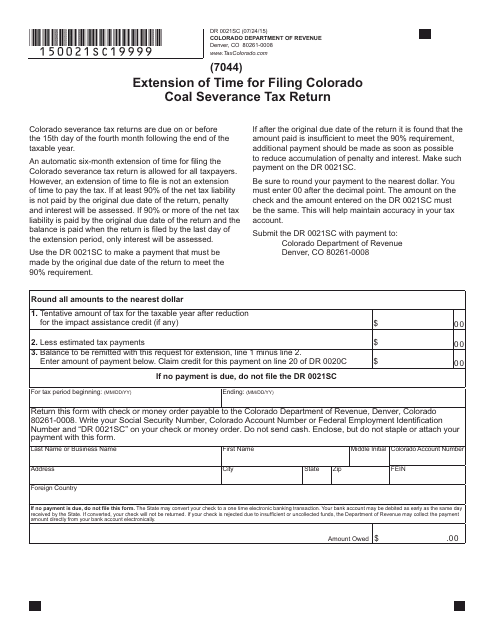

This form is used for requesting an extension of time to file the Colorado Coal Severance Tax Return in Colorado.

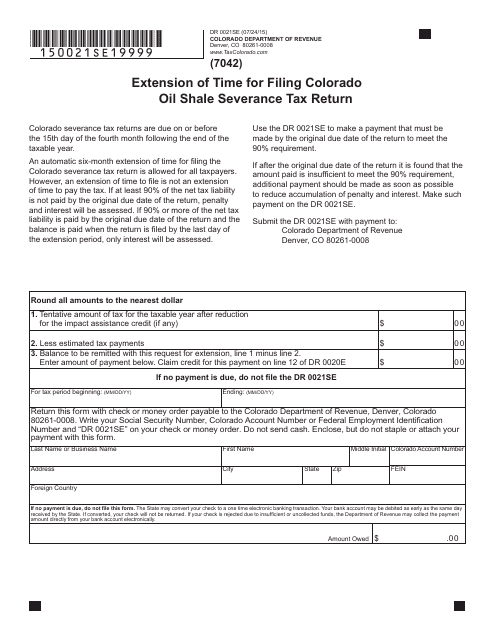

This form is used for requesting an extension of time to file the Colorado Oil Shale Severance Tax Return.

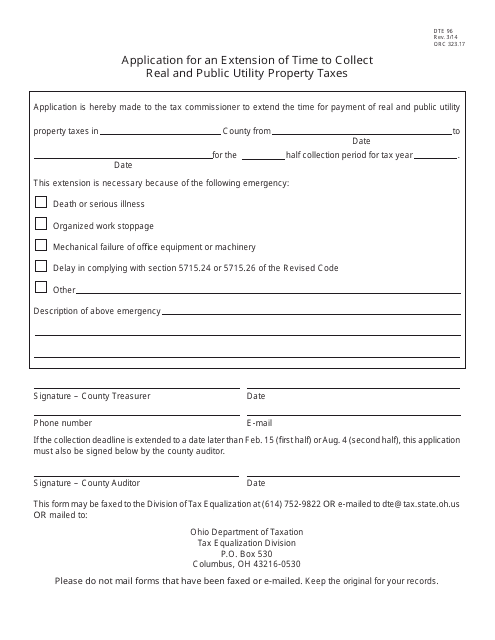

This form is used for applying for an extension of time to collect real and public utility property taxes in Ohio.

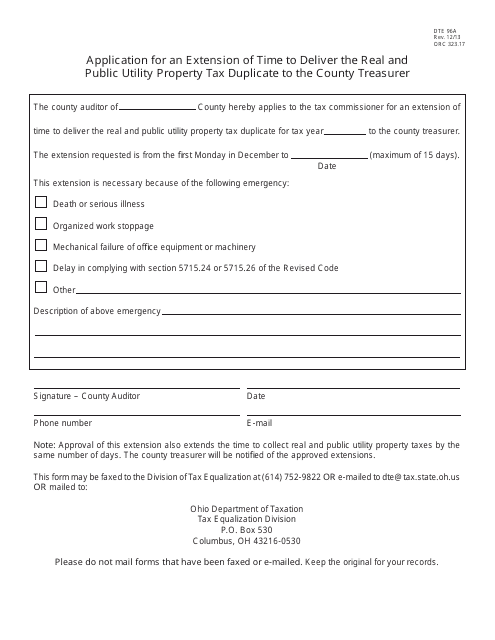

This form is used for applying for an extension of time to deliver the real and public utility property tax duplicate to the County Treasurer in Ohio.

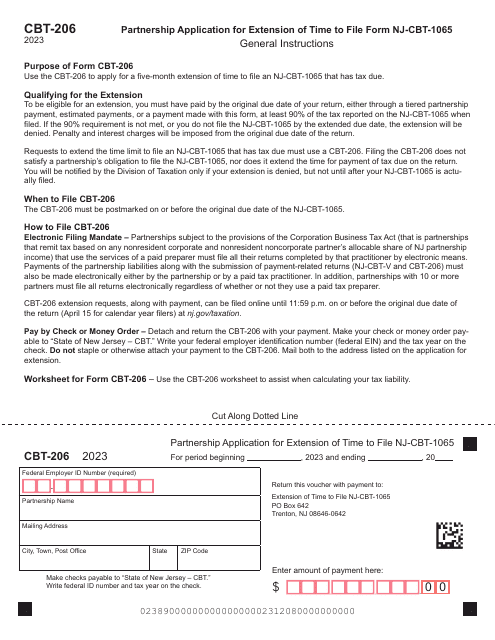

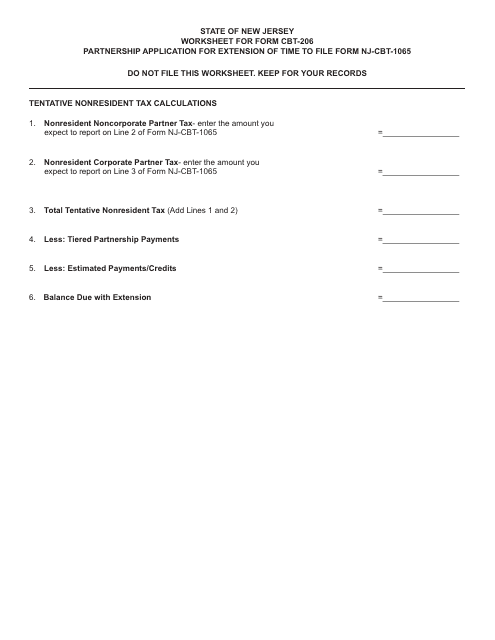

This document is a worksheet for Form CBT-206, which is used for partnership applications for an extension of time to file Form NJ-CBT-1065 in the state of New Jersey.

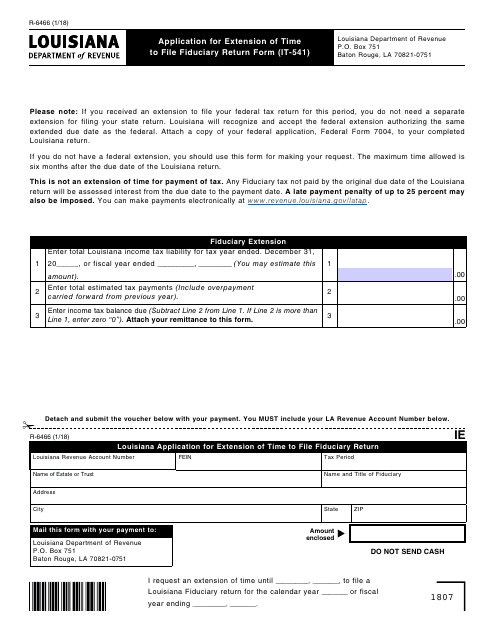

This form is used for applying for an extension of time to file the fiduciary return form (IT-541) in Louisiana.

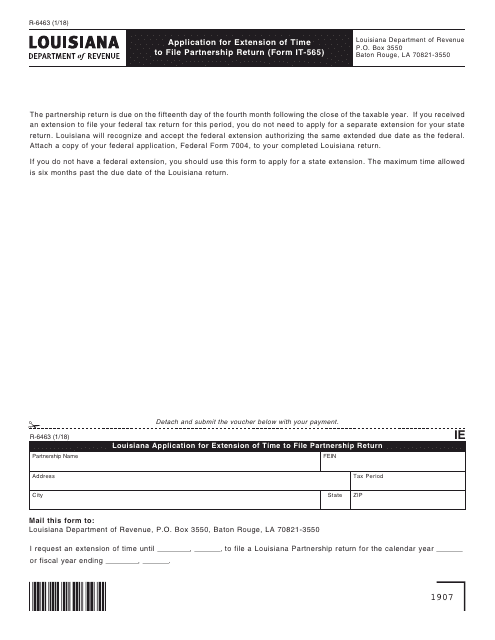

This Form is used for Louisiana partnerships to apply for an extension of time to file their partnership return (Form IT-565).