Deductions and Credits Templates

Are you looking to maximize your deductions and credits? Look no further! Our comprehensive collection of documents on deductions and credits has got you covered. Whether you refer to them as deductions and credits or credits and deductions, we have the information and forms you need to navigate the complex world of tax regulations.

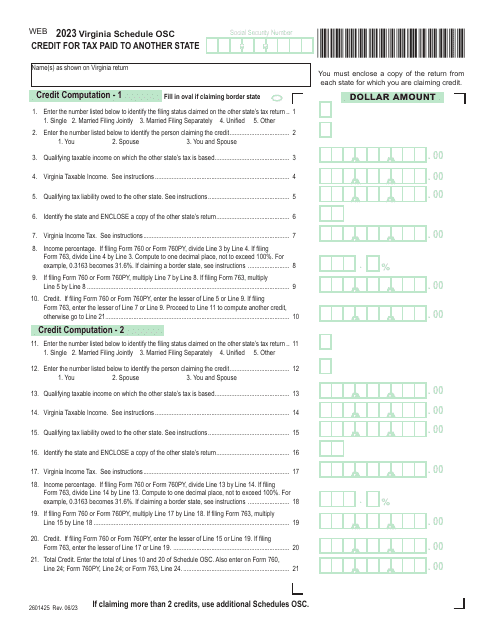

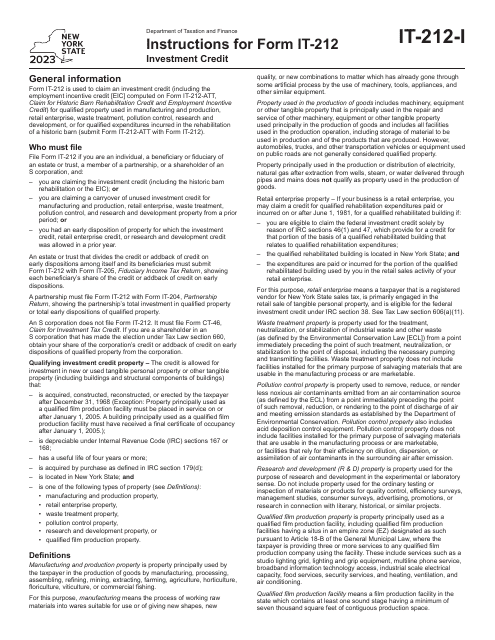

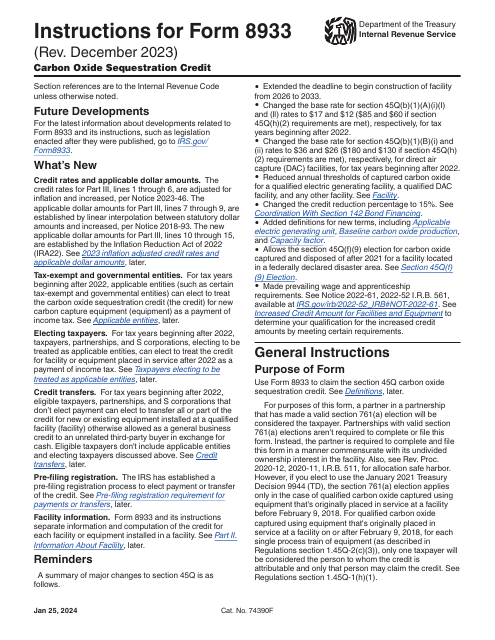

From the Schedule OSC Credit for Tax Paid to Another State in Virginia to the Instructions for Form IT-212 Investment Credit in New York, our documents cover a wide range of tax credits and deductions available to you. Whether you're a business owner looking to claim the Carbon Oxide Sequestration Credit or an individual aiming to estimate your tax payments using IRS Form 1040-ES, our collection has it all.

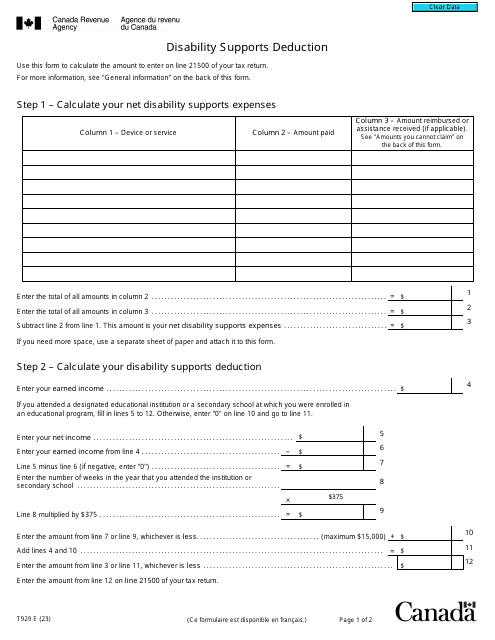

But it's not just limited to the United States. We also have relevant documents for our Canadian friends, such as Form T929 Disability Supports Deduction. So, no matter where you are, we can help you identify and understand the deductions and credits you may be eligible for.

With our user-friendly and comprehensive documents, you'll have all the information you need to make the most of deductions and credits available to you. Don't miss out on potential savings - explore our collection today!

Documents:

5

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.