Metropolitan Commuter Transportation Mobility Tax Templates

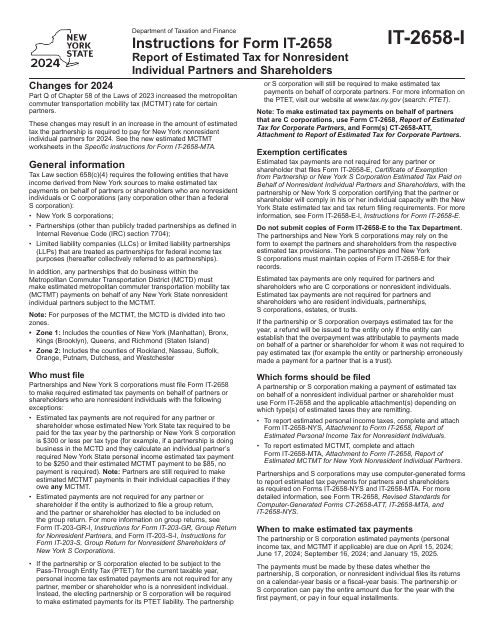

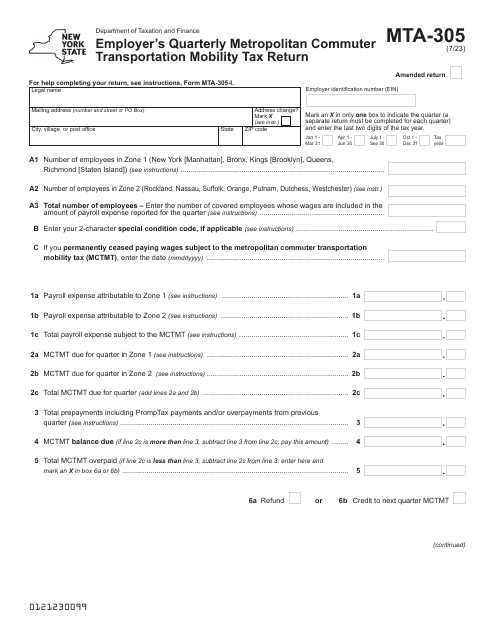

The Metropolitan Commuter Transportation Mobility Tax (MCTMT) is an important tax required for individuals and businesses in certain areas. This tax is specifically designed to support transportation infrastructure and services that benefit commuters in metropolitan areas.

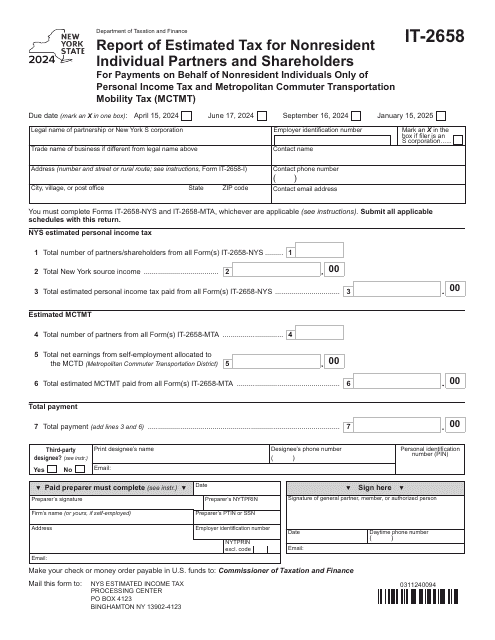

If you are a nonresident individual partner or shareholder in New York, you will need to report your estimated MCTMT payment using Form IT-2658. This form allows you to calculate and submit the estimated tax on behalf of nonresident individuals for both Personal Income Tax and the MCTMT. Additionally, there are specific instructions available for completing this form accurately.

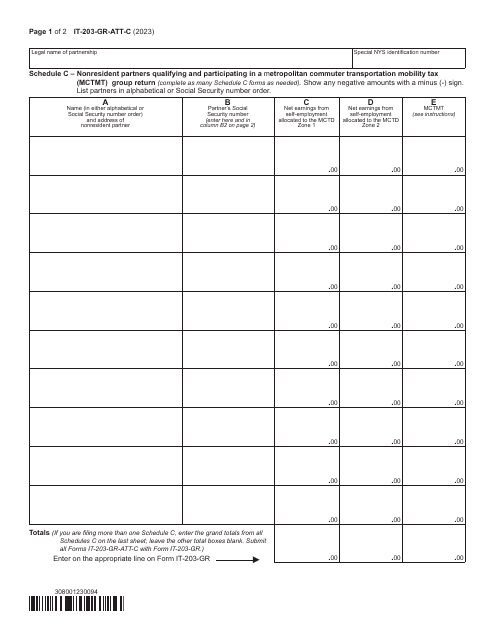

For nonresident partners qualifying and participating in a Metropolitan Commuter Transportation Mobility Tax group return, Schedule C is utilized. By completing this schedule, nonresident partners can contribute to the overall MCTMT payment for the group.

The MCTMT can be complex to navigate, but with the right information and resources, you can ensure compliance and avoid any potential penalties. Remember to consult with a tax professional or refer to the official documentation provided by the relevant tax authority for detailed guidance on fulfilling your MCTMT obligations.

(No text available)

Documents:

10

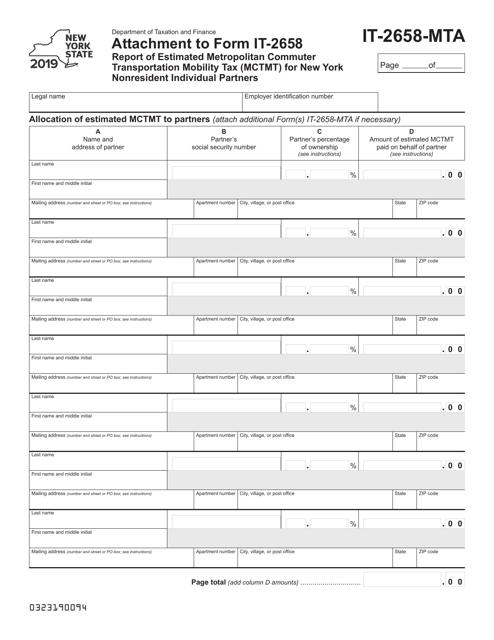

This document is used for reporting the estimated Metropolitan Commuter Transportation Mobility Tax (MCTMT) for nonresident individual partners in New York who are not residents of the state. It is an attachment to Form IT-2658.