Historic Properties Templates

Historic Properties: Preserving the Past, Empowering the Future

Preserving our rich cultural heritage is crucial for understanding and appreciating our roots. Historic properties, also known as historic property or heritage buildings, play a vital role in safeguarding our history and promoting a sense of identity within communities. These properties provide a glimpse into the past and offer a unique opportunity to learn from our ancestors.

At USA, Canada, and other countries, we understand the importance of historic properties in maintaining our collective memory. That's why we have developed a comprehensive collection of documents that focus on the preservation, rehabilitation, and tax incentives related to historic properties. Our extensive range of resources provides valuable insights and guidance for individuals, organizations, and government entities involved in the conservation and restoration of historical buildings.

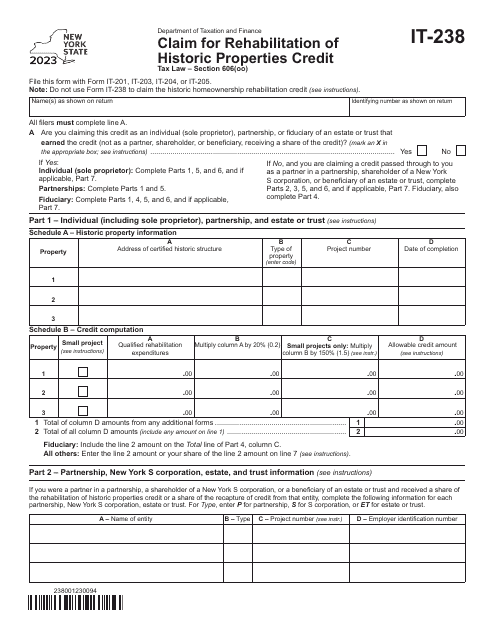

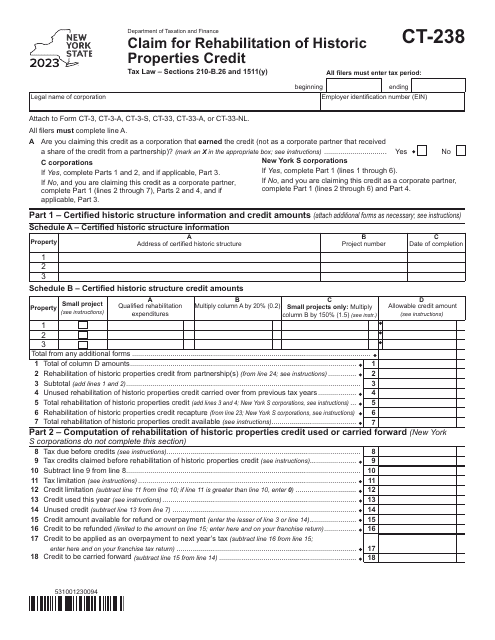

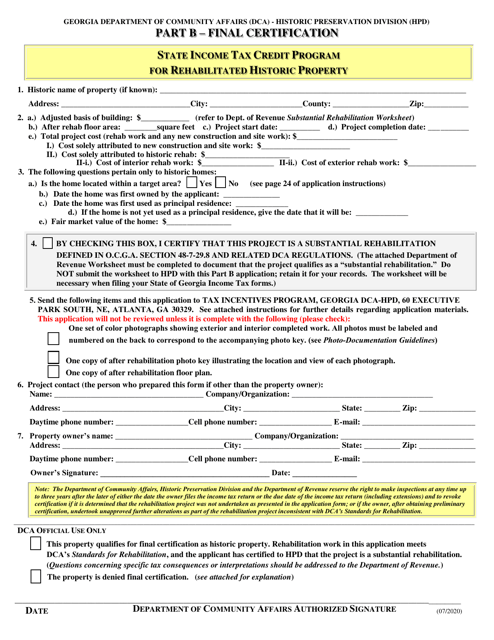

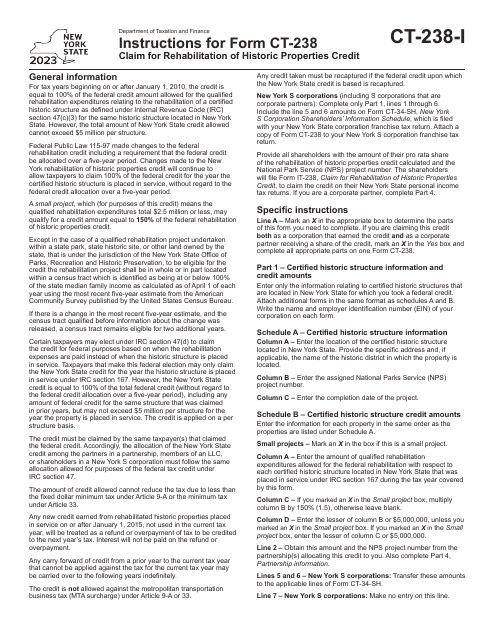

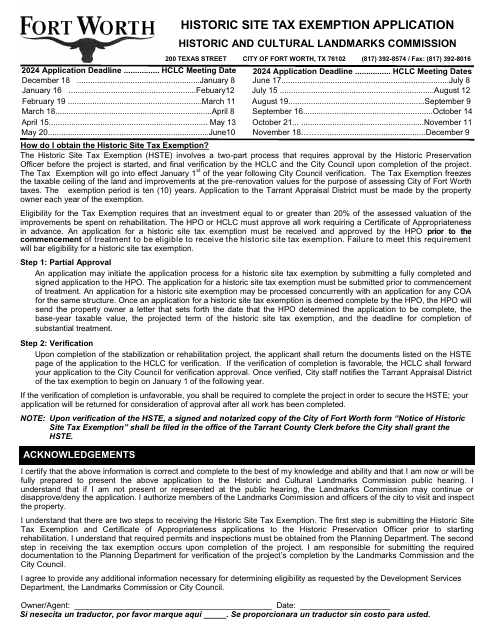

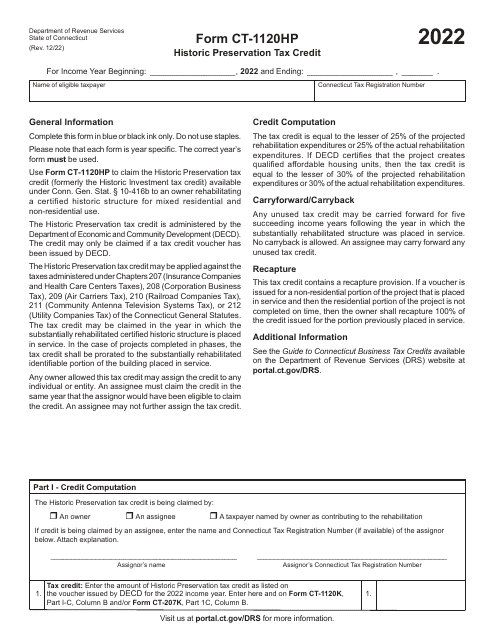

Among the documents in our historic properties collection are the "Part B Final Certification - State Income Tax Credit Program for Rehabilitated Historic Property" from the state of Georgia, as well as the "Instructions for Form CT-238 Claim for Rehabilitation of Historic Properties Credit" and "Form IT-238 Claim for Rehabilitation of Historic Properties Credit" from the state of New York. These documents outline the procedures and requirements for accessing tax credits and incentives for the restoration of historic properties.

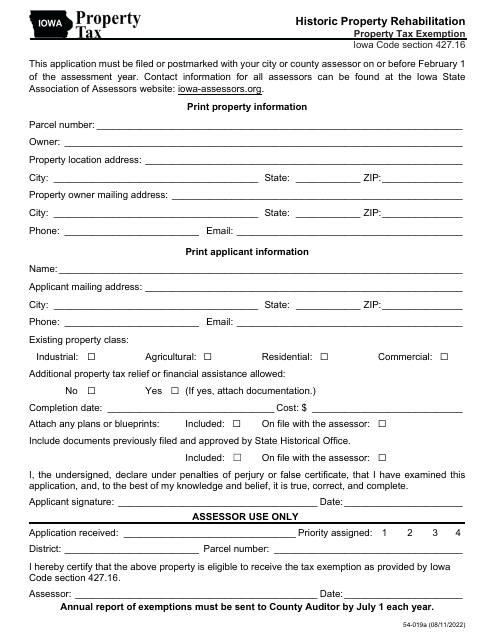

Additionally, our collection includes the "Form 54-019 Historic Property Rehabilitation Property Tax Exemption" from Iowa, which details the eligibility criteria and guidelines for obtaining property tax exemptions for qualified historic properties.

Whether you are a homeowner seeking guidance on rehabilitating a historic property, a developer looking to take advantage of tax credits, or a preservationist interested in learning about best practices in historical conservation, our historic properties documents are a valuable resource for you. Explore our collection today and embark on a journey to preserve and honor our shared heritage.

Documents:

36

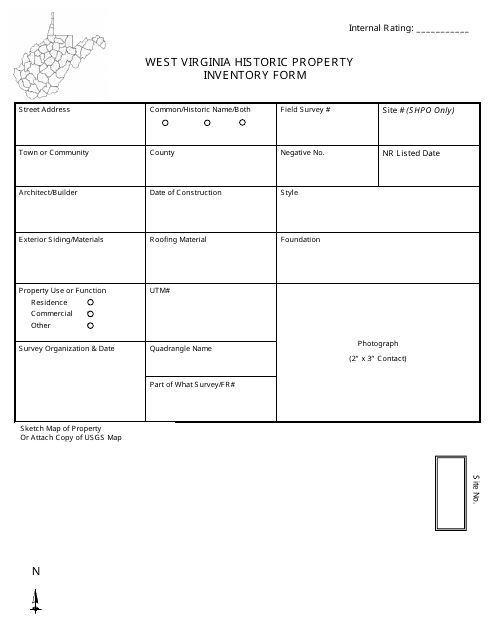

This document for recording and preserving information about historic properties in West Virginia. It is used by the West Virginia Division of Culture and History to maintain an inventory of historical sites in the state.

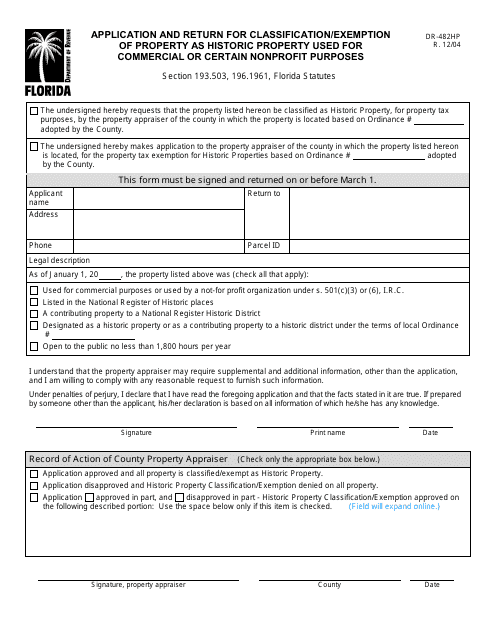

This form is used for applying and returning property for classification or exemption as historic property in Florida, specifically for commercial or certain nonprofit purposes.

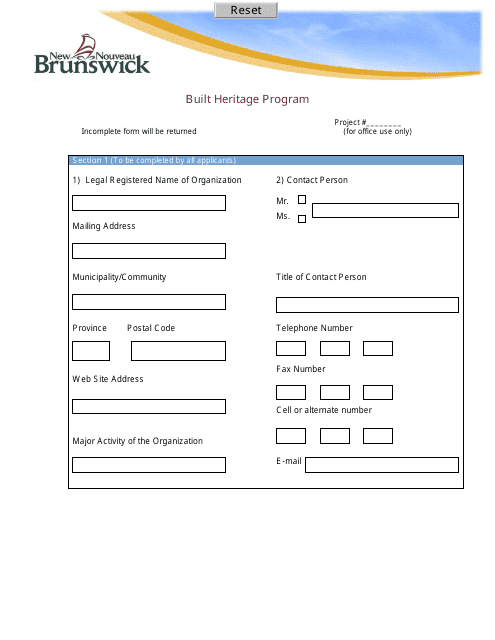

This document is an application for the Built Heritage Program in New Brunswick, Canada. It is used for applying for funding or assistance for the preservation and conservation of historic buildings and sites in the province.

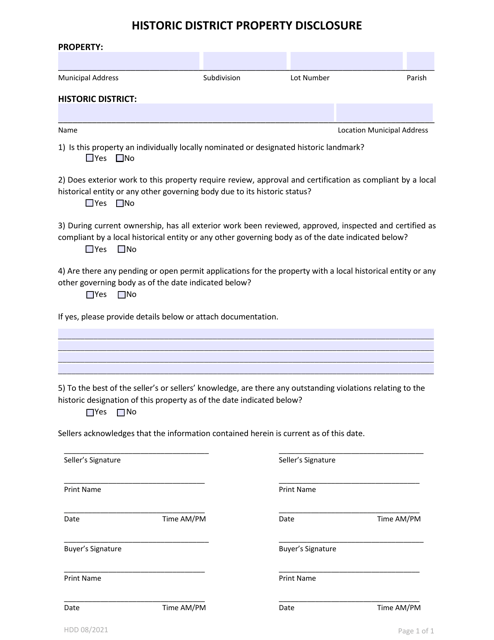

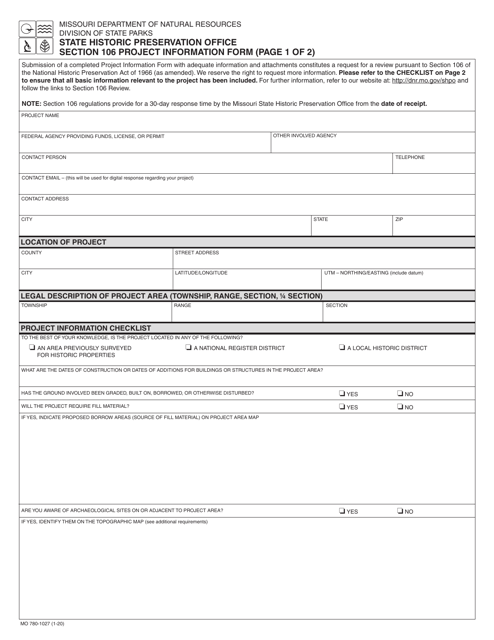

This Form is used for providing project information related to Section 106 in Missouri.

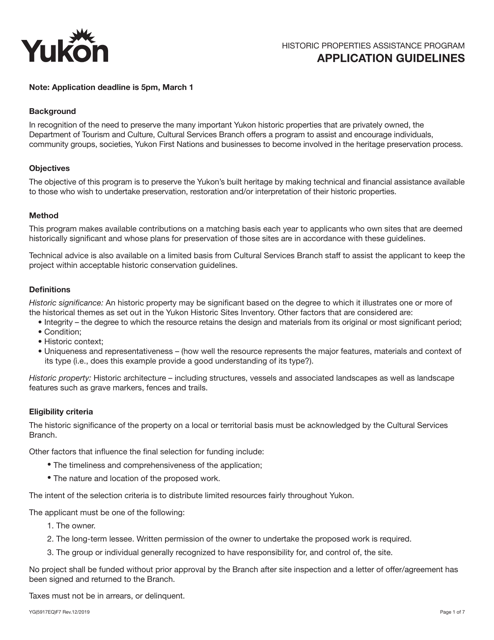

This form is used for applying to the Historic Properties Assistance Program in Yukon, Canada. The program provides financial assistance for the preservation and restoration of historic properties in the region.

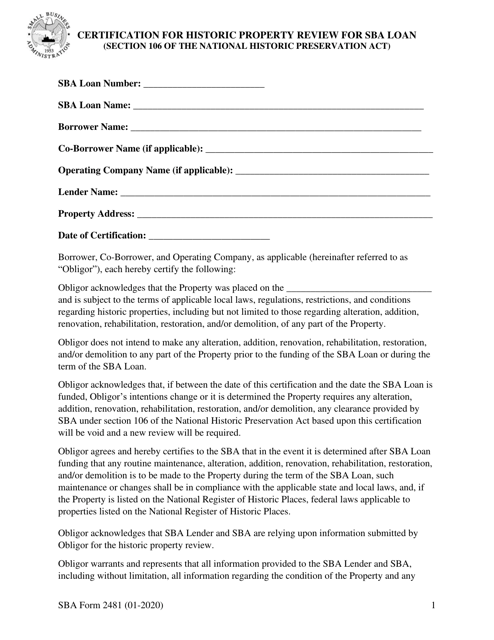

This form is used for confirming the review of historic properties for an SBA loan, specifically in accordance with Section 106 of the National Historic Preservation Act.

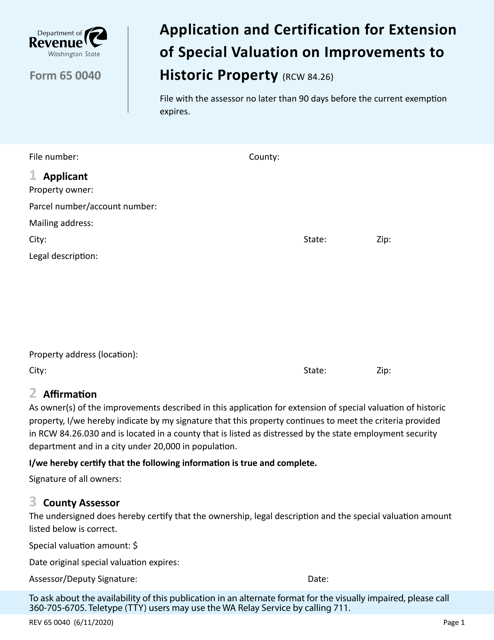

This form is used for applying for an extension of special valuation on improvements made to historic property in Washington state. It requires certification of eligibility for the special valuation.

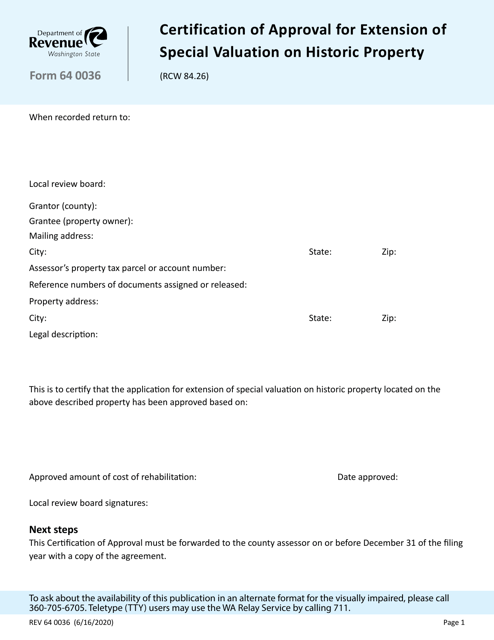

This form is used for certifying the approval for an extension of special valuation on historic property in Washington state.

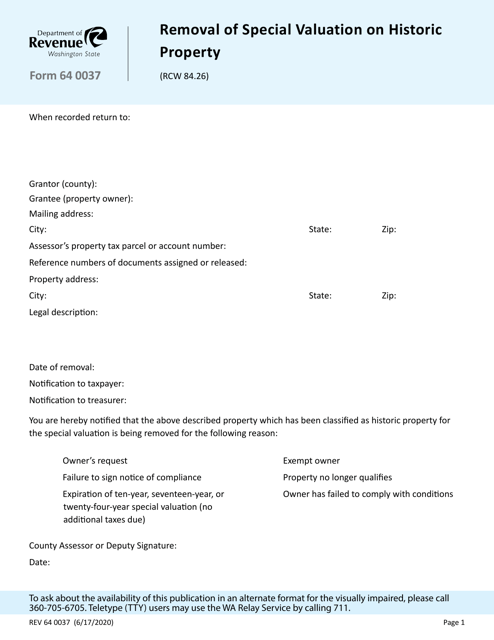

This Form is used for requesting the removal of special valuation on a historic property in Washington state.

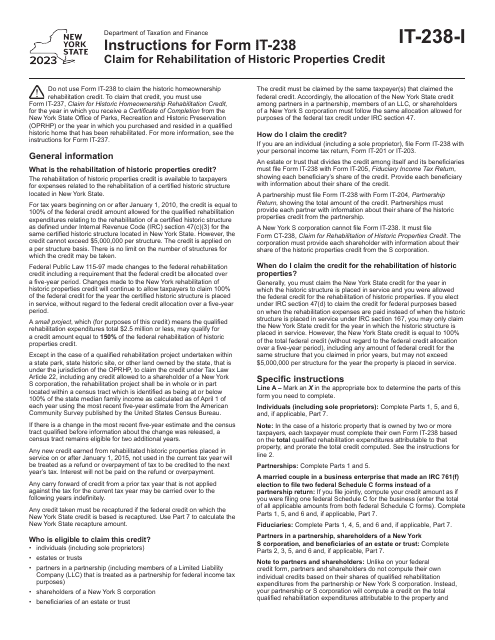

Instructions for Form IT-238 Claim for Rehabilitation of Historic Properties Credit - New York, 2023

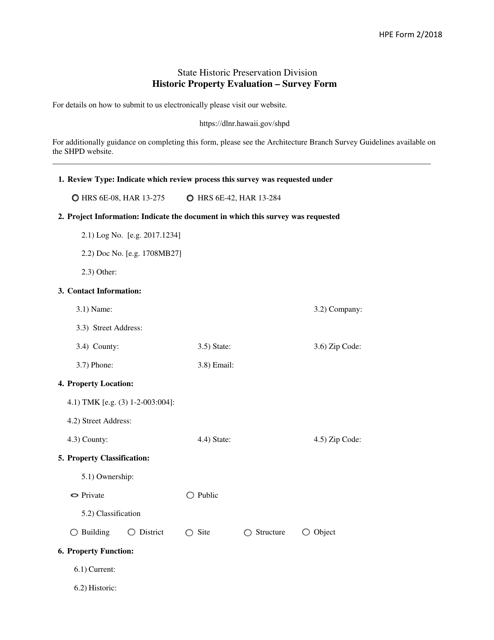

This form is used for evaluating the historical significance of a property in Hawaii. It is a survey form that helps determine the historical value and importance of a property.

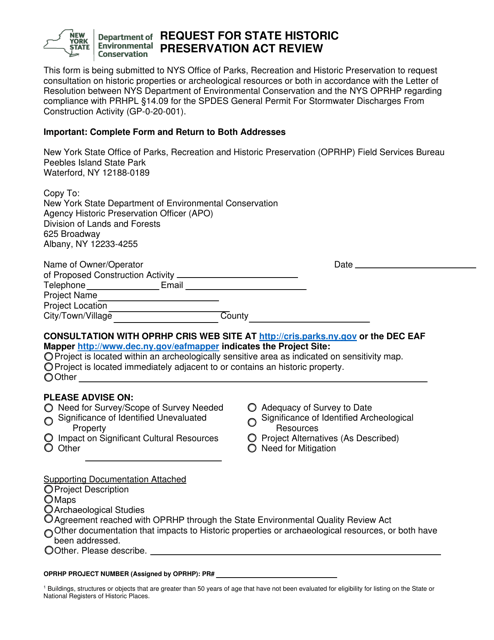

This Form is used for requesting a review under the State Historic Preservation Act in New York. It is used to assess the potential impacts of proposed projects on historic resources within the state.

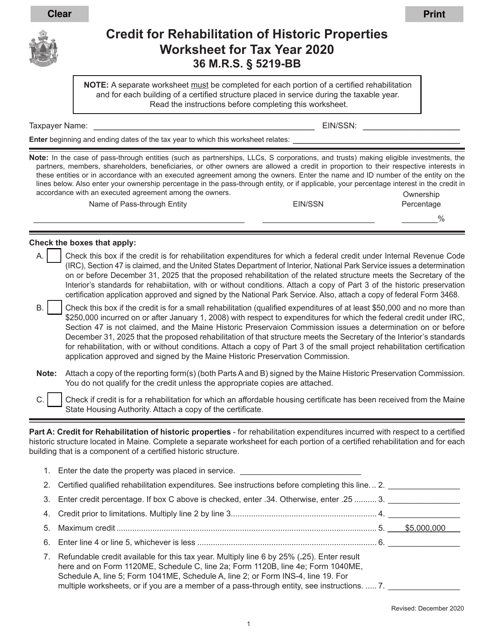

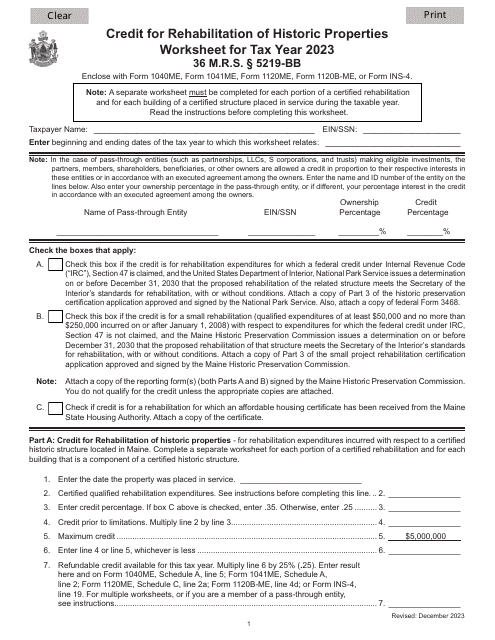

This Form is used for calculating and claiming tax credits for rehabilitating historic properties in the state of Maine.

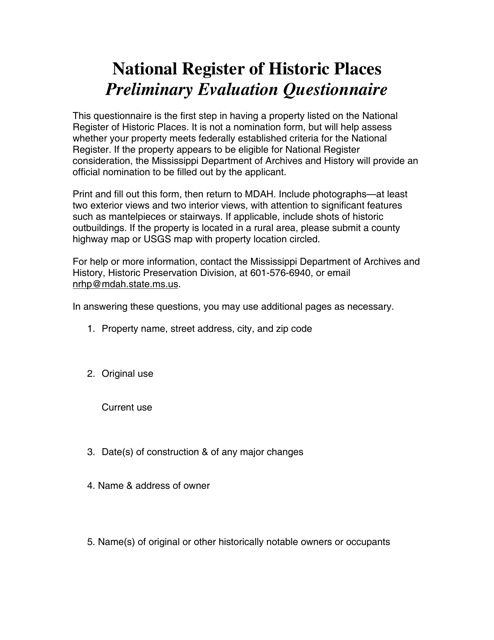

This form is used for conducting a preliminary evaluation of potential historic places in Mississippi to determine eligibility for inclusion in the National Register of Historic Places.

This document certifies the final eligibility for a state income tax credit program in Georgia for rehabilitating historic properties.

Instructions for Form CT-238 Claim for Rehabilitation of Historic Properties Credit - New York, 2023

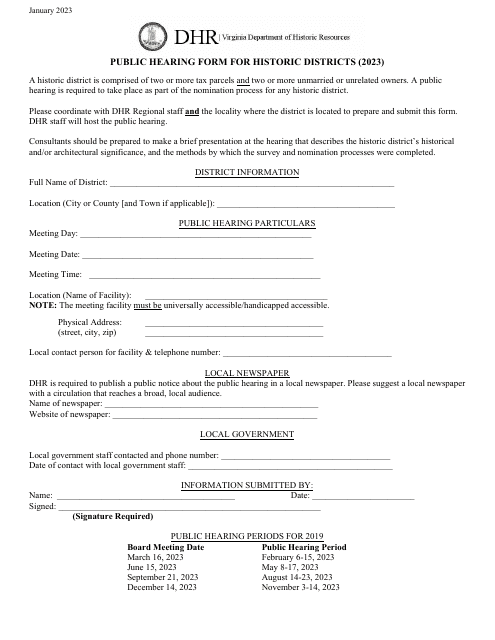

This form is used for conducting public hearings in historic districts in Virginia. It allows for input and feedback from the public regarding any proposed changes or developments that may impact the historical integrity of the district.

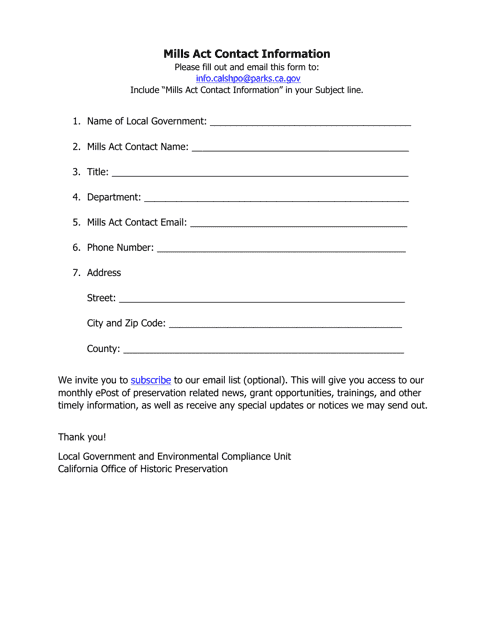

This document provides the contact information for the Mills Act program in California. It is a valuable resource for homeowners who are interested in learning more about this program and its benefits.