Working Capital Templates

Working Capital

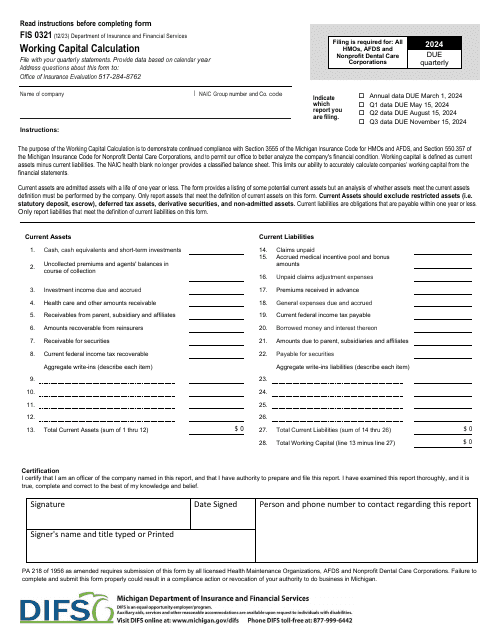

Looking to optimize your business's financial health? Look no further than working capital. This collection of documents and resources is designed to help businesses effectively manage their cash flow and liquidity, enabling them to meet their short-term financial obligations while also funding their day-to-day operations.

Also known as working capital management or working capital optimization, this collection provides businesses with the tools they need to effectively calculate, analyze, and improve their working capital position. Whether you're a small business owner looking to better understand your financial ratios or a company seeking funding through export working capital guarantees, these documents have got you covered.

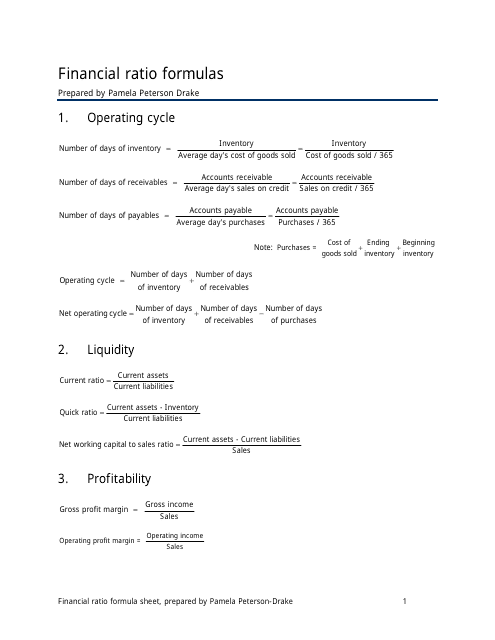

From financial ratio formulas templates, which offer a comprehensive guide to calculating and interpreting essential ratios, to application forms for export working capital guarantees, which can help businesses secure funding for international trade ventures, this collection covers all aspects of working capital management. Additionally, you'll find resources that walk you through the process of requesting funds reimbursement or working capital advance payments for specific purposes.

Streamline your financial operations, improve your cash flow, and enhance your business's overall financial performance with the help of these invaluable documents. Dive into the workings of working capital management and start optimizing your business's financial wellbeing today.

Explore our working capital documents and resources to gain the knowledge and tools you need to make informed financial decisions and propel your business towards success.

Documents:

11

This document provides a template for calculating financial ratios. It includes formulas for common ratios like profitability, liquidity, and solvency. Use this template to analyze and assess the financial health of a company.

This Form is used for joint applications for export working capital guarantee under the Small Business Administration's Export Express Program.

This Form is used for joint applications of U.S. exporters and lenders for the Export Working Capital Guarantee program of the Small Business Administration (SBA). It helps provide working capital to small businesses to support their exporting activities.

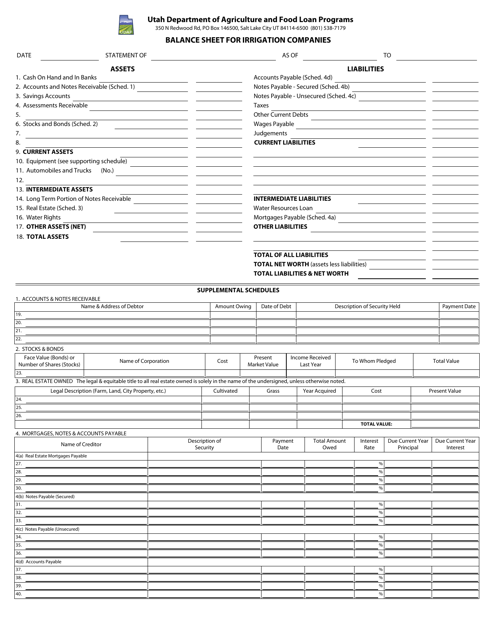

This document provides a detailed overview of the financial position and performance of irrigation companies in Utah. It showcases assets, liabilities, and shareholders' equity, giving valuable insights into the company's financial health.

This Form is used for applying for an Export Working Capital Guarantee, which provides financial assistance to businesses for exporting goods and services. It helps businesses obtain the necessary working capital needed for international trade.

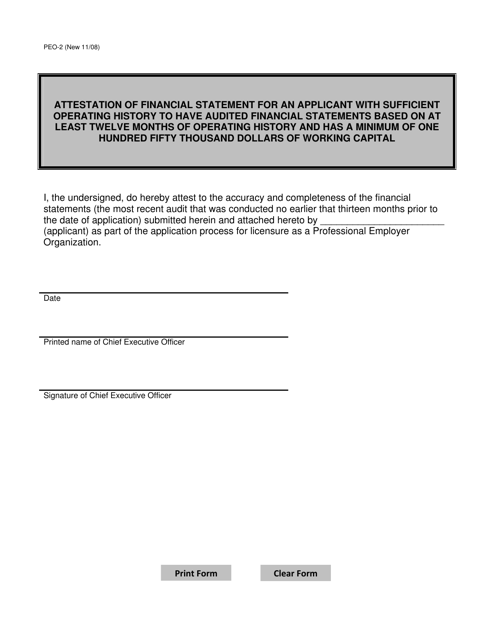

This form is used for attesting the financial statement of an applicant in Connecticut who has a sufficient operating history with audited financial statements based on at least twelve months of operating history and a minimum of one hundred fifty thousand dollars of working capital.

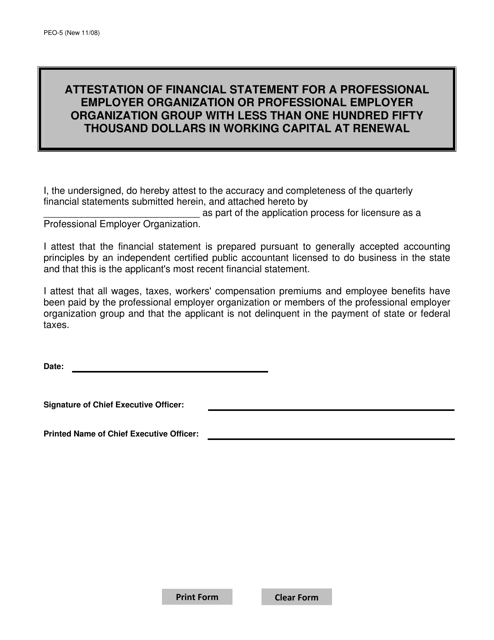

This form is used for professional employer organizations or professional employer organization groups in Connecticut with less than $150,000 in working capital to attest their financial statements at renewal.

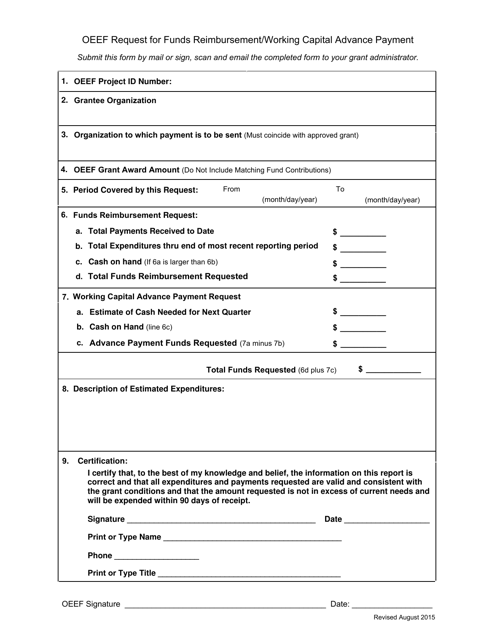

This Form is used for requesting reimbursement or an advance payment for funds related to working capital in the state of Ohio.

This Form is used for applying for an Export Working Capital Guarantee from the Export-Import Bank of the United States.