Asset Schedule Templates

An asset schedule is a comprehensive listing of all the assets, both real and personal, that an individual or organization owns. It is a crucial document used for various purposes such as financial planning, taxation, and legal matters.

The asset schedule provides a detailed inventory of assets, including properties, vehicles, investments, and other valuable possessions. It helps individuals and businesses keep track of their assets and their current value. This document plays a vital role in determining net worth, asset allocation, and making informed financial decisions.

Also known by its alternate names such as asset register or asset inventory, the asset schedule serves as a valuable tool for estate planning, insurance purposes, divorce settlements, and business valuations. By maintaining an up-to-date asset schedule, individuals can ensure they have an accurate record of their assets, minimizing the risk of overlooking any valuable items.

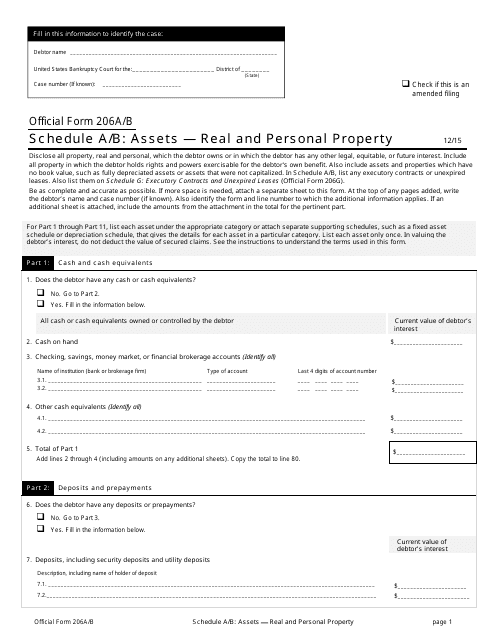

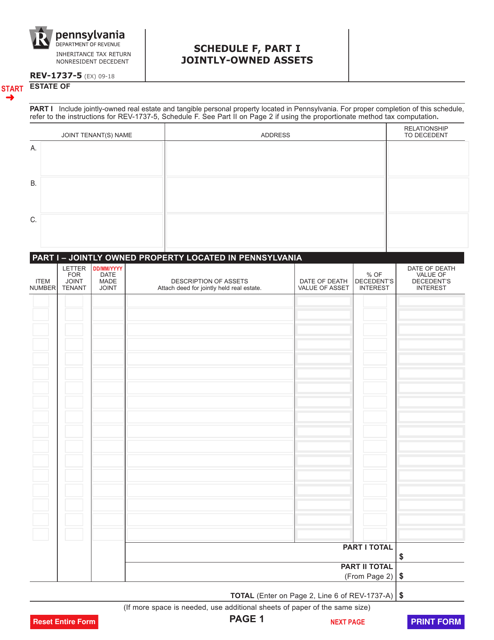

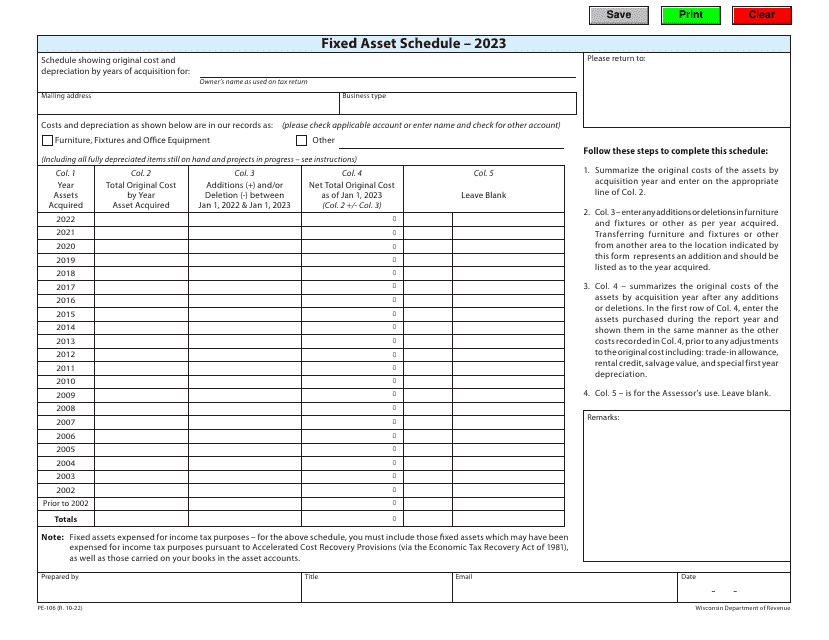

Whether it is an Official Form 206A/B Schedule A/B Assets, Form REV-1737-5 Schedule F Jointly-Owned Assets, or Form PE-106 Fixed Asset Schedule, this document collection serves as a comprehensive resource that allows individuals and businesses to effectively manage their assets. It provides a clear picture of the assets' value, which is crucial information for financial planning, tax reporting, and compliance.

In conclusion, an asset schedule is an essential document for individuals and businesses to keep track of their assets. Whether it's managing personal finances or complying with legal and tax requirements, maintaining an accurate and up-to-date asset schedule is essential. With its alternate names such as asset register or asset inventory, this document collection serves as a valuable resource for individuals and organizations alike.

Documents:

6

This Form is used for reporting real and personal property assets.

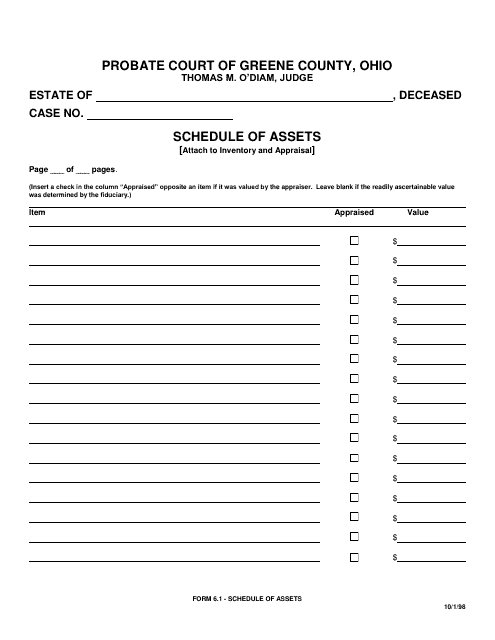

This Form is used for creating a schedule of assets in Greene County, Ohio. It helps document and categorize property and assets within the county.