Tax Tips Templates

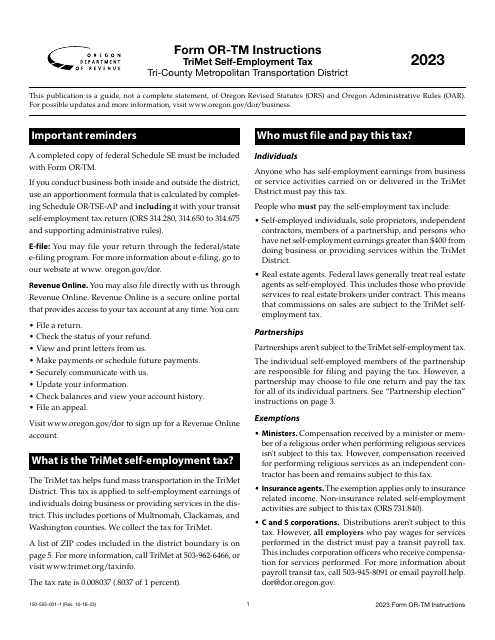

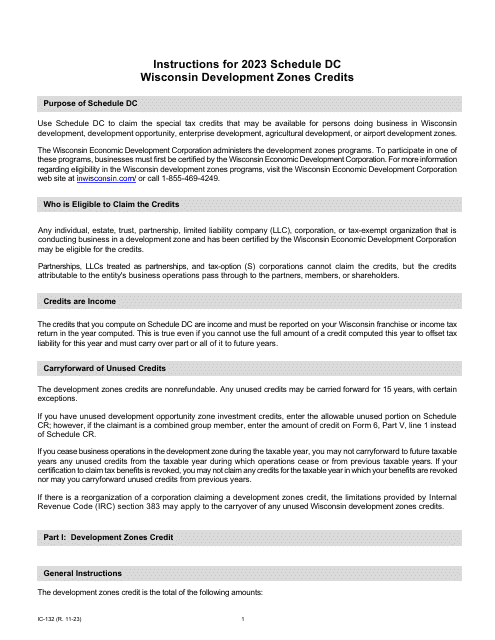

Looking for tax tips to maximize your deductions and minimize your tax liability? Our tax tips collection is here to help. Whether you're an individual or a business owner, our comprehensive selection of tax tips will provide you with valuable information and guidance on various tax forms and strategies.

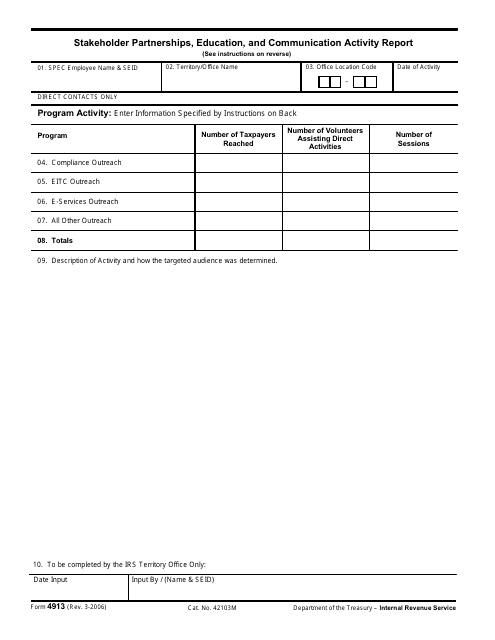

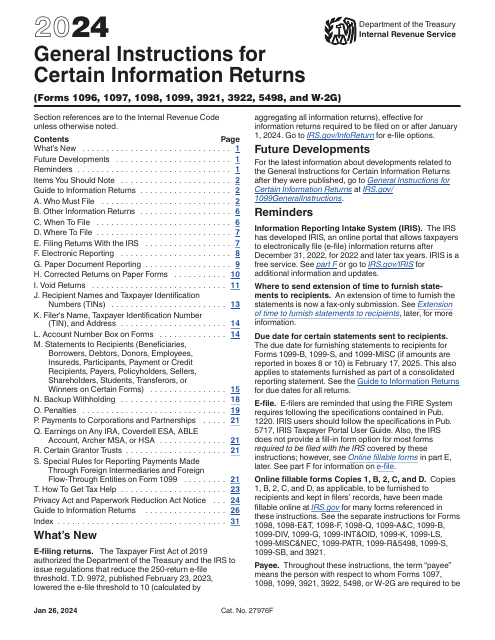

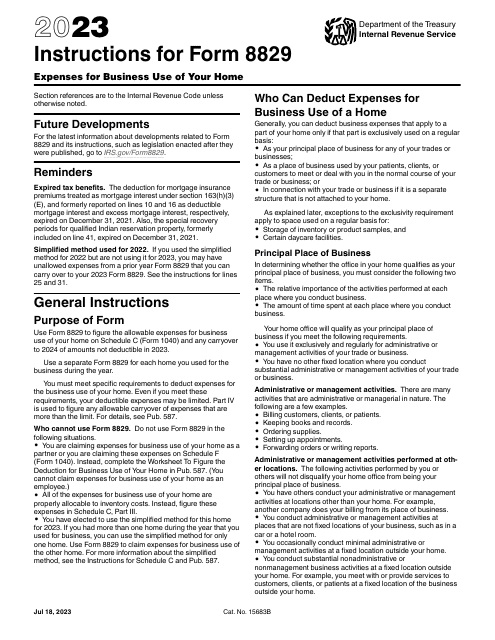

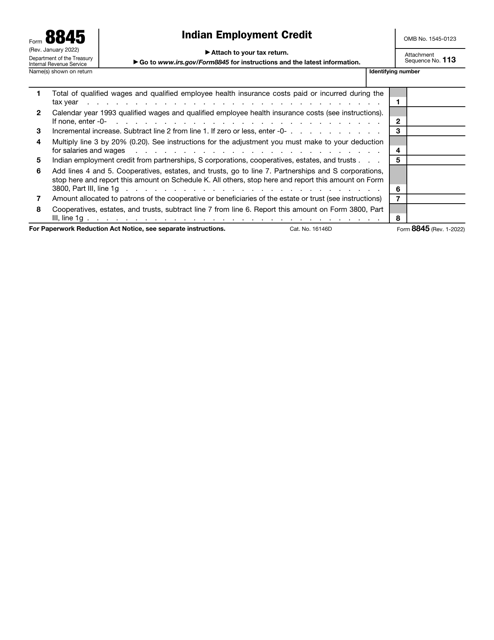

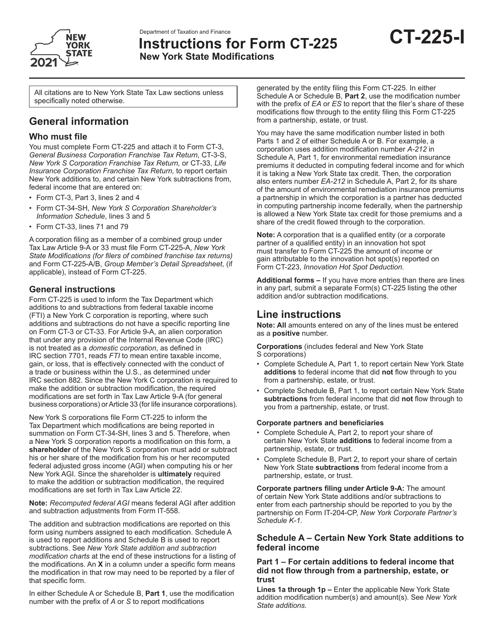

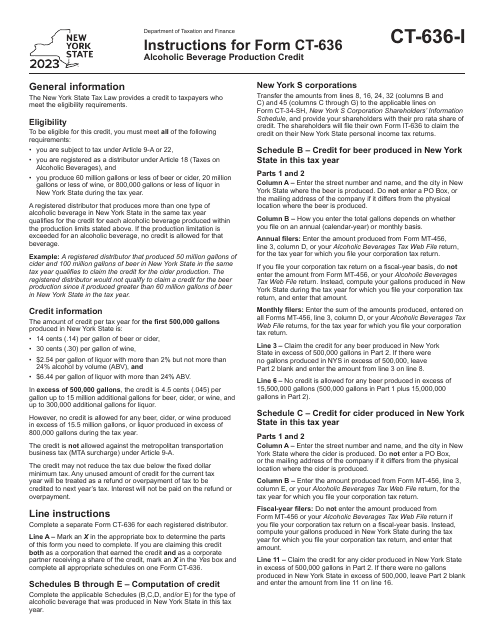

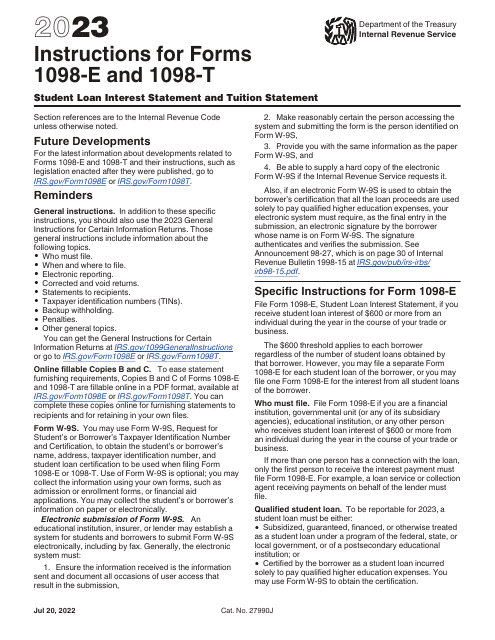

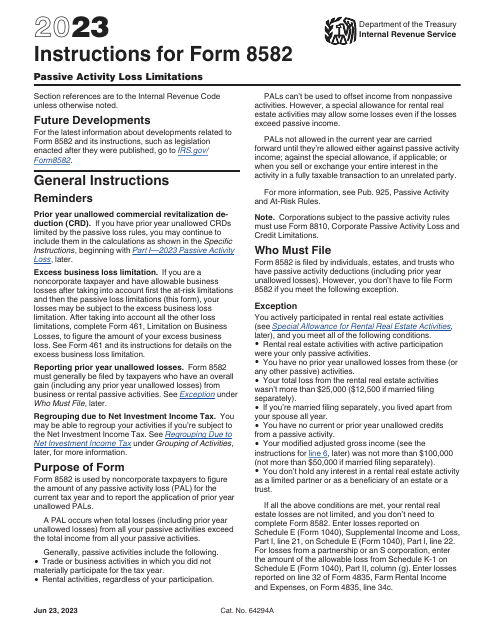

Explore our extensive range of tax tips, including tips for completing IRS Form 1096, 1097, 1098, 1099, 3921, 3922, 5498, W-2G Certain Information Returns. We also offer tips specifically tailored to different industries, such as Publication 68 - Tax Tips for Photographer, Photo Finishers, and Film Processing Laboratories in California. If you're a business owner looking to claim the Indian Employment Credit, we have detailed instructions for IRS Form 8845.

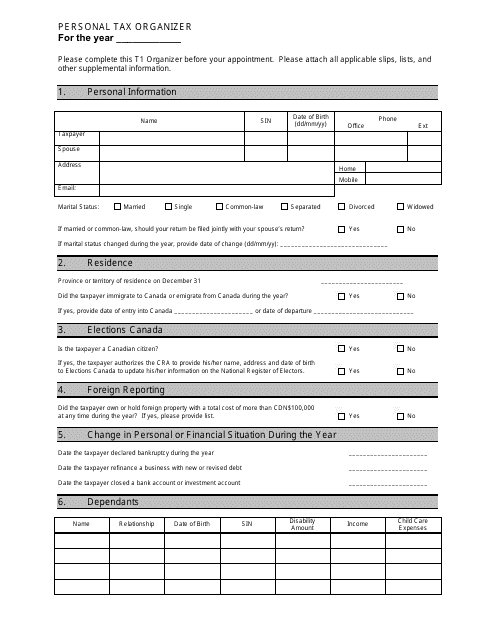

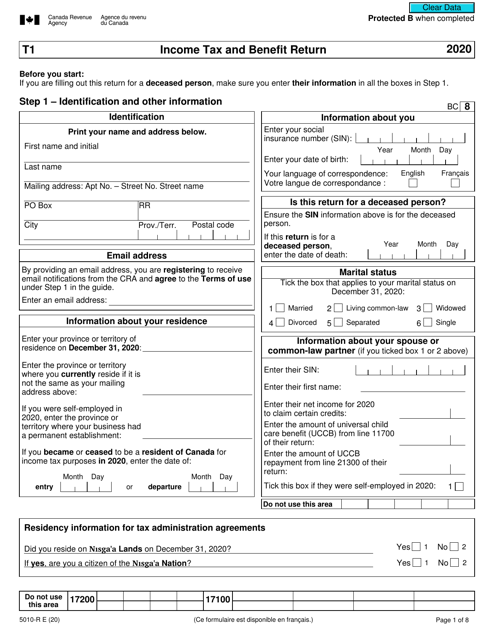

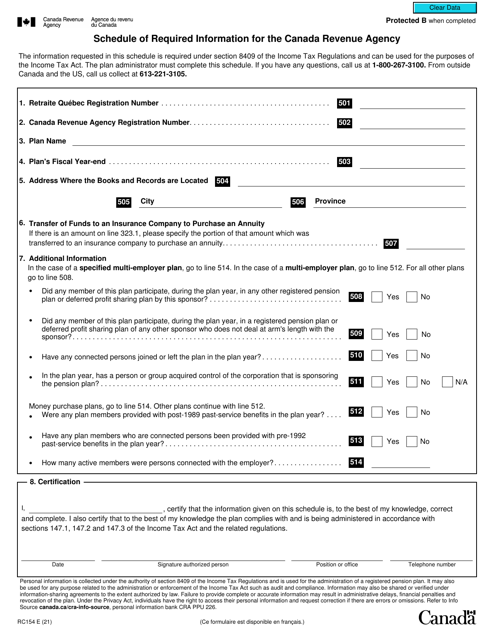

Not only do we cover tax tips for individuals and businesses in the United States, but we also provide resources for taxpayers in Canada. Our collection includes the Form RC154 Schedule of Required Information for the Canada Revenue Agency, ensuring that our Canadian users have access to relevant tax information and guidelines.

Whether you're new to filing taxes or have years of experience, our tax tips collection has something for everyone. Stay updated on the latest tax regulations, learn about common deductions and credits, and optimize your tax return with our expert advice.

Don't let tax time stress you out. Browse our tax tips collection today and take control of your financial future.

Documents:

46

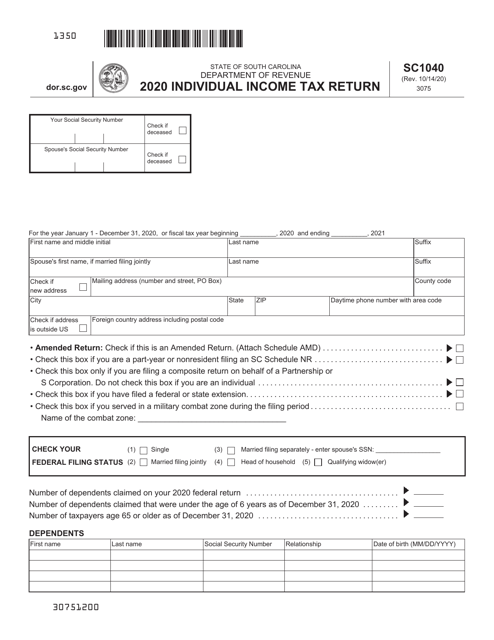

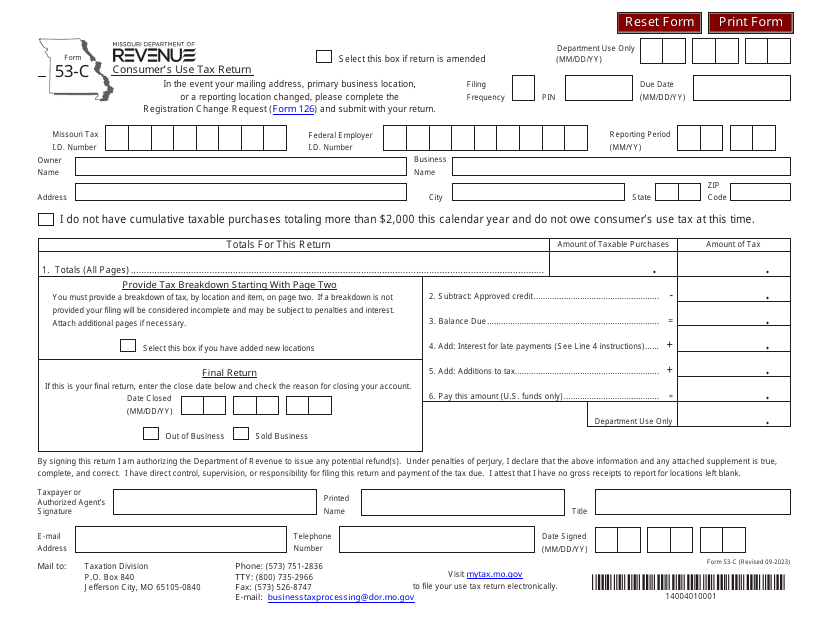

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

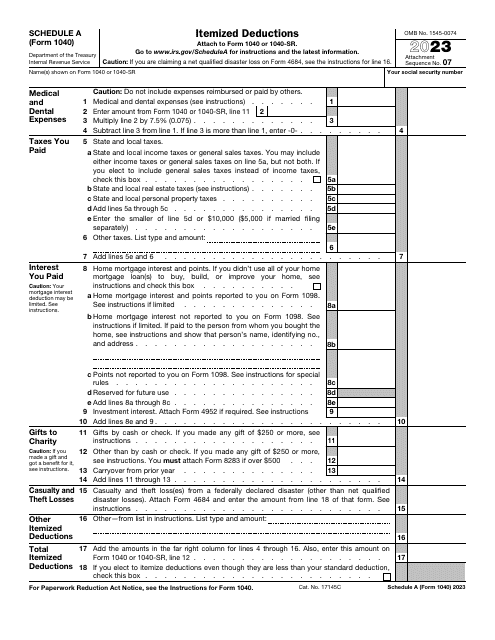

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

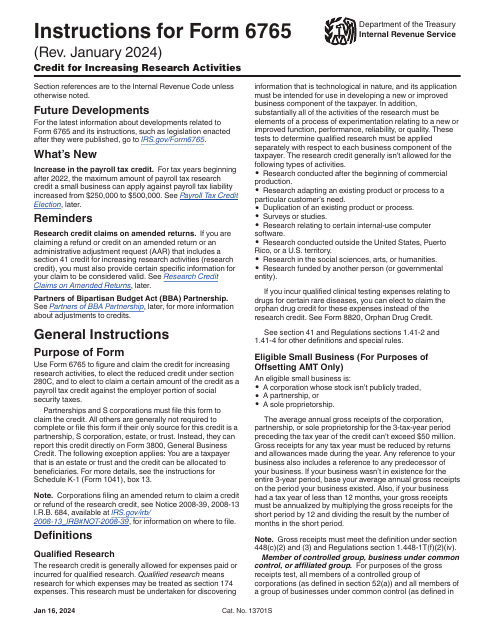

This is a document you may use to figure out how to properly complete IRS Form 6765

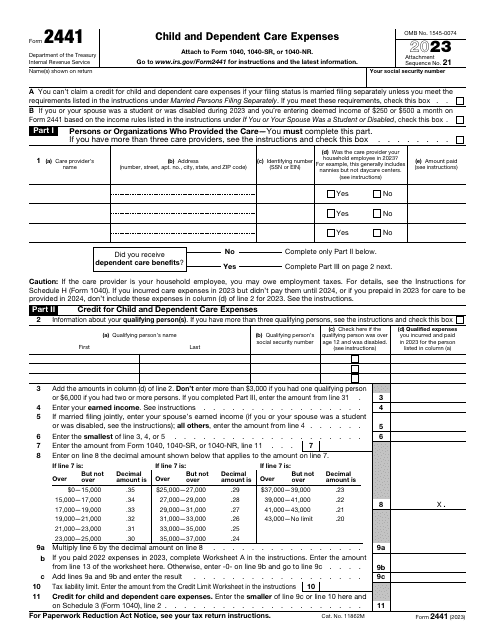

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

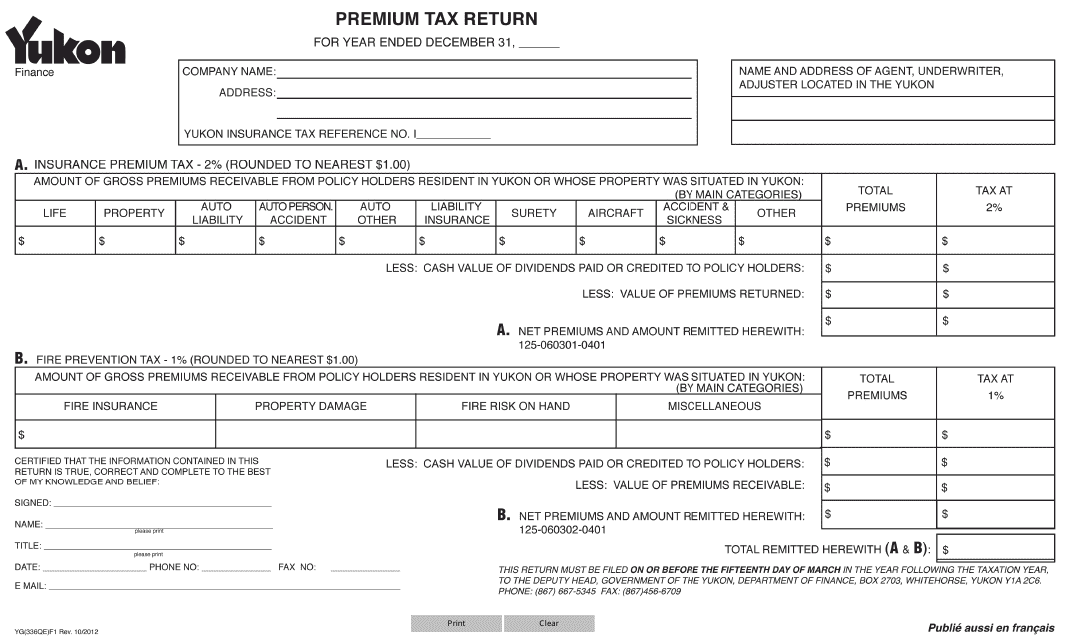

This form is used for filing premium tax returns in Yukon, Canada.

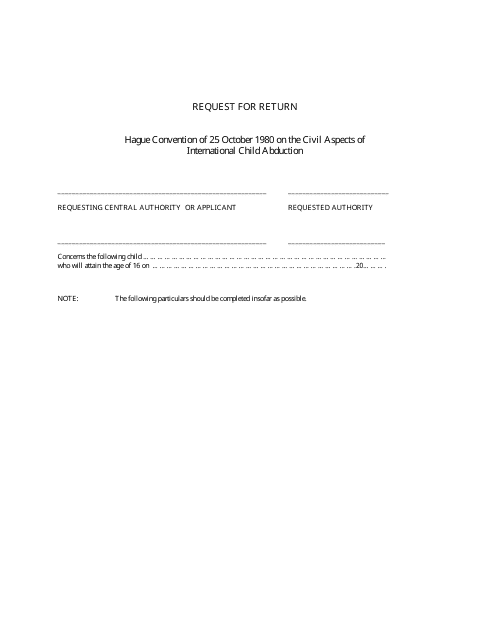

This document is used to request a return in the province of Saskatchewan, Canada.

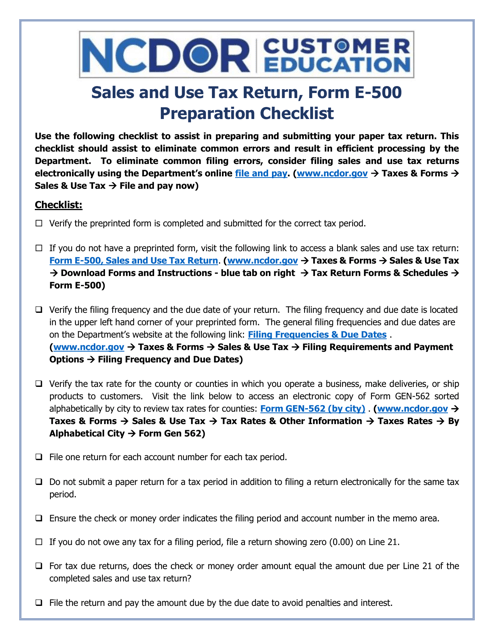

This form is used for preparing and ensuring accuracy of the E-500 tax form in North Carolina.

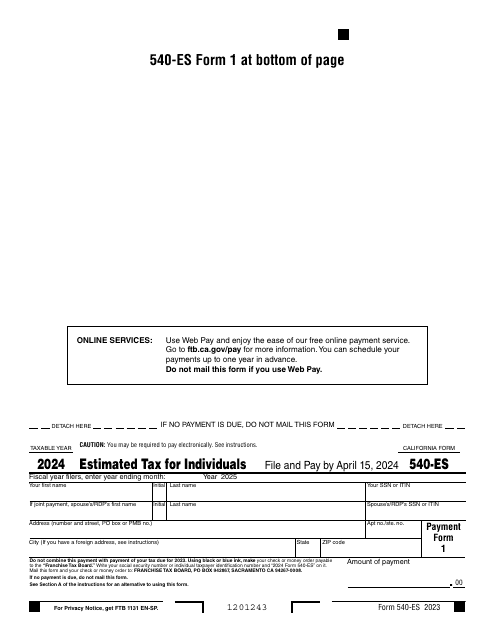

Fill out this form over the course of a year to pay your taxes in the state of California.

This document provides information about the Taxpayer Advocate Service, a resource available to help individuals with their tax-related issues.

This document provides instructions for filling out IRS Form 1040 and 1040-SR. It guides you through the process of reporting your income, deductions, and credits to calculate your tax liability.

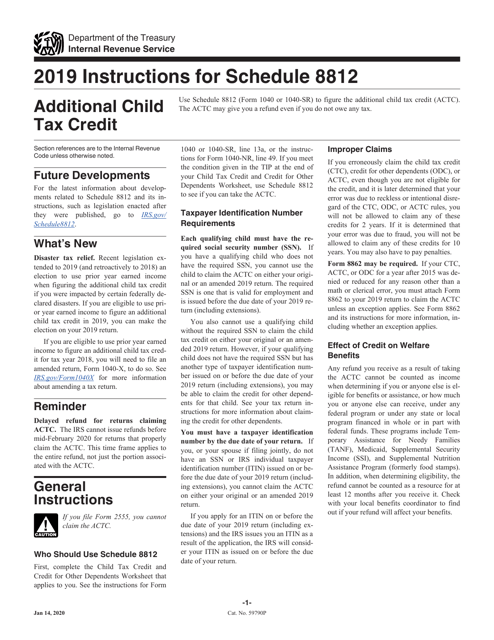

This form is used for claiming the Additional Child Tax Credit on your federal tax return. It provides instructions on how to fill out Form 1040 or Form 1040-SR if you qualify for this tax credit.

This document provides tax tips specifically for photographers, photo finishers, and film processing laboratories in California. It offers valuable information to help individuals in these professions navigate their tax obligations effectively.

This document provides tax tips and guidance specifically tailored for photographers, photo finishers, and film processing laboratories in California. It covers various aspects of tax planning and compliance unique to this industry to help businesses stay organized and maximize their tax benefits.

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.