Homestead Credit Templates

Are you a homeowner seeking financial relief? Look no further than the Homestead Credit. This program provides assistance to homeowners, helping to ease the burden of property taxes. Whether you're a senior citizen, disabled person, or simply in need of financial support, the Homestead Credit can be a valuable resource.

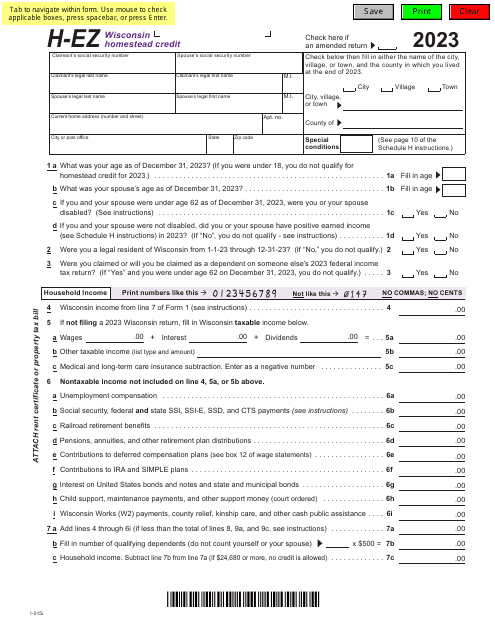

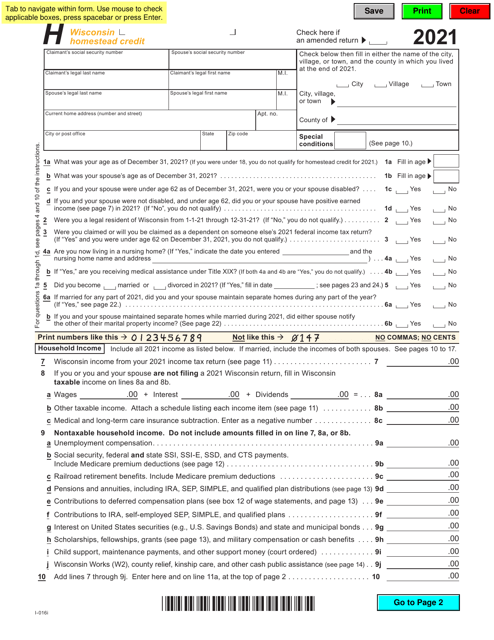

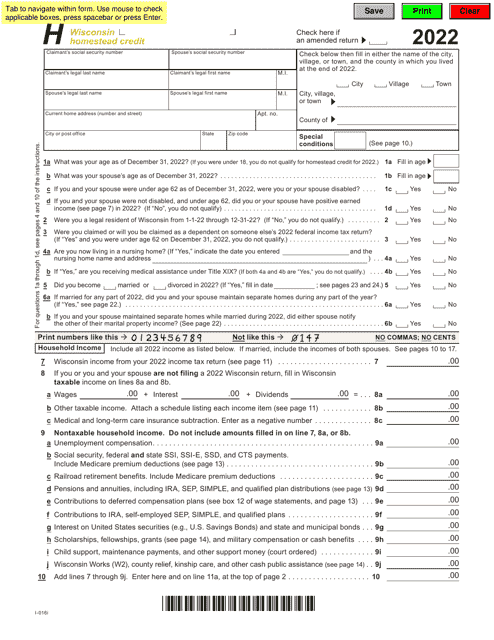

Also known as the Homestead Credit Application, this program offers a variety of benefits to eligible individuals. By filling out Form I-015I Schedule H-EZ or Form I-016 Schedule H, residents of Wisconsin can access the Wisconsin Homestead Credit. These forms are designed to simplify the application process, making it easier for homeowners to receive the financial relief they deserve.

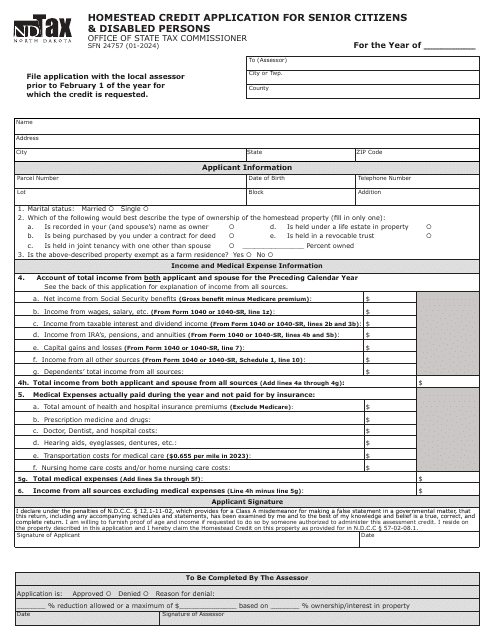

If you're a senior citizen or disabled person residing in North Dakota, Form SFN24757 Homestead Credit Application for Senior Citizens & Disabled Persons is the document you need. This form ensures that older adults and individuals with disabilities receive the support they need to maintain their homes.

Don't let property taxes overwhelm you. Apply for the Homestead Credit today and experience the financial relief you deserve. Whether you're in Wisconsin or North Dakota, our user-friendly forms make the application process simple and efficient.

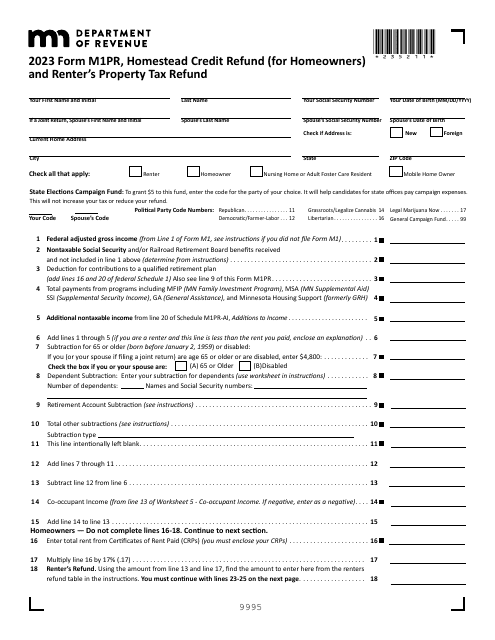

Documents:

11

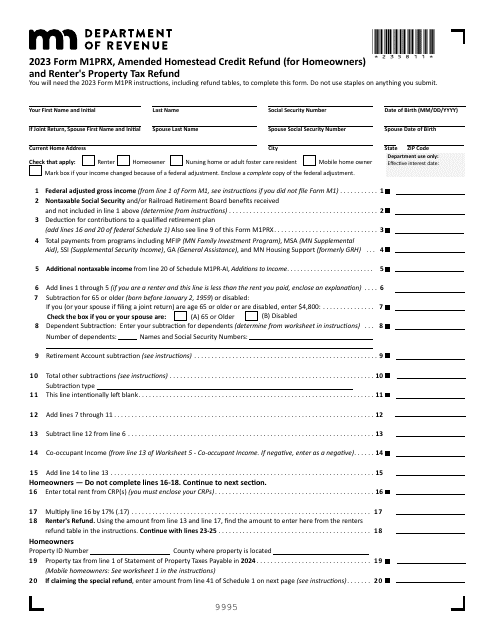

The purpose of this document is to let Minnesota taxpayers get a refund based on their household income and the property taxes or rent paid on their primary residence if they qualify.