Solid Minerals Templates

Solid Minerals is a comprehensive collection of documents that provide guidelines, instructions, and reporting forms related to the production, sales, and taxation of solid minerals. This essential resource covers all aspects of the solid minerals industry, ensuring compliance and facilitating efficient operations. Whether you are involved in the extraction, sale, or taxation of solid minerals, this collection offers invaluable guidance and tools to help you navigate the complex regulations and reporting requirements. From Form ONRR-4430 Solid Minerals Production and Royalty Report to Form DR-142 Solid Mineral Severance Tax Return, these documents cover a wide range of topics and provide step-by-step instructions to ensure accuracy and thoroughness in reporting. With the alternate names, solid minerals and solid mineral, this collection is easily recognizable and an indispensable resource for individuals and businesses operating in the solid minerals industry.

Documents:

6

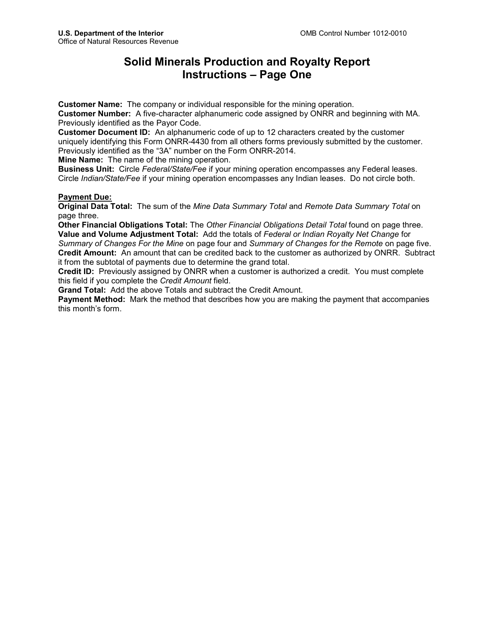

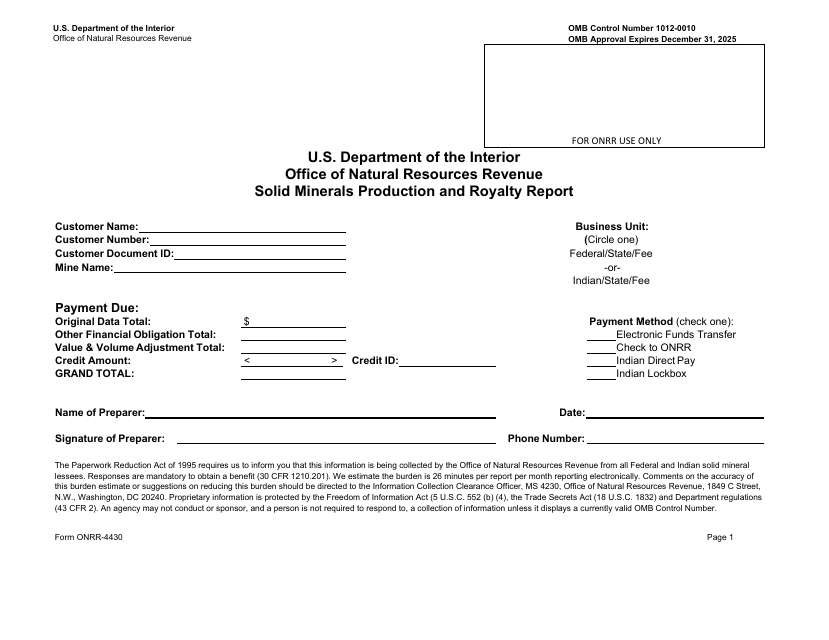

This Form is used for reporting solid minerals production and royalty information to the Office of Natural Resources Revenue (ONRR). It provides instructions on how to complete and submit the Form ONRR-4430.

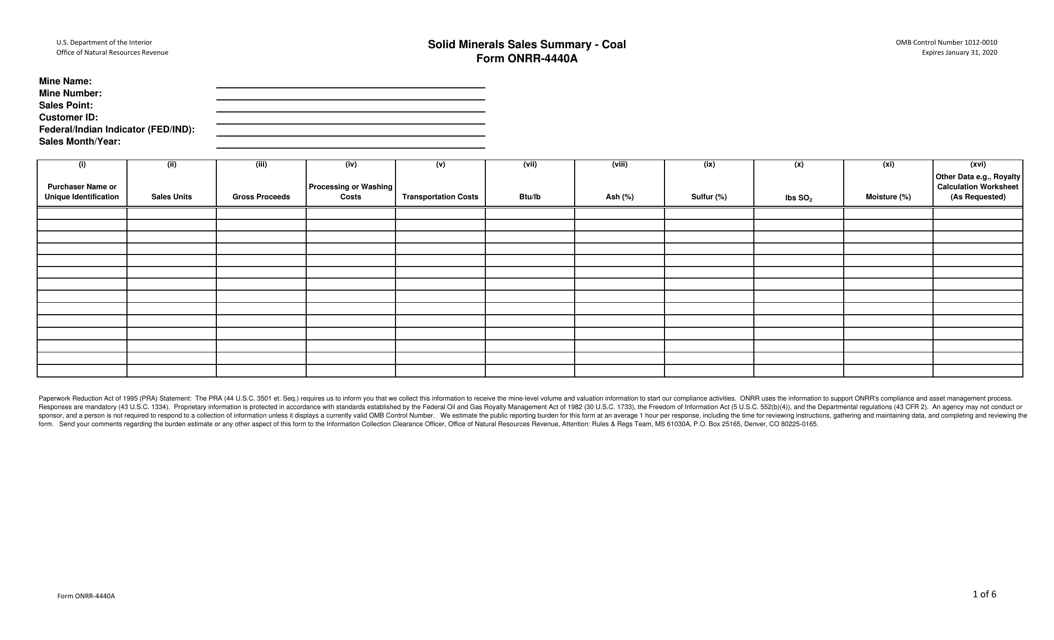

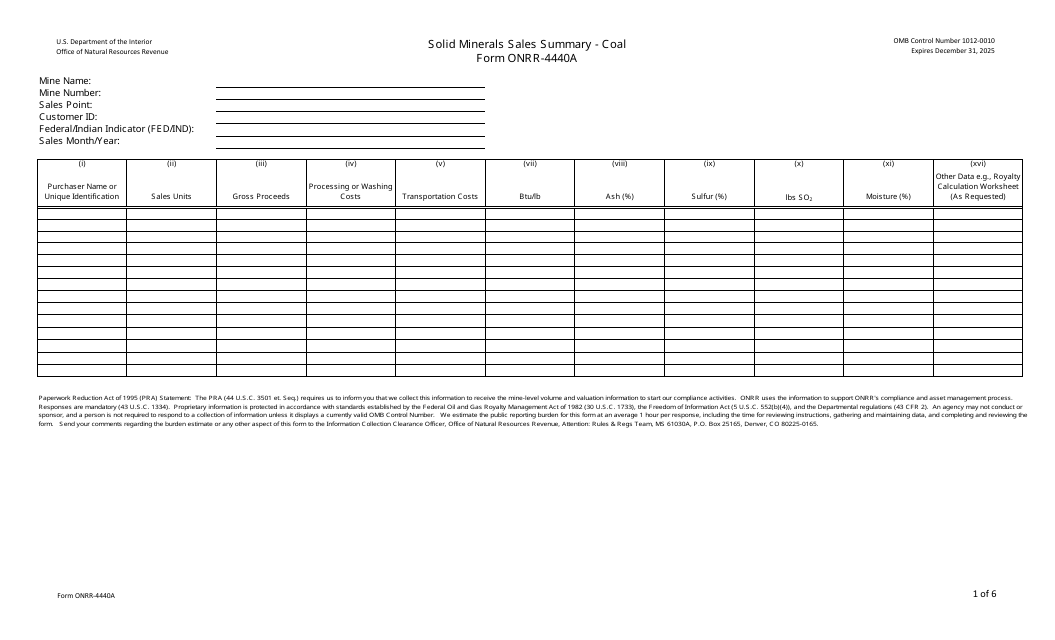

This Form is used for reporting and summarizing the sales of solid minerals.

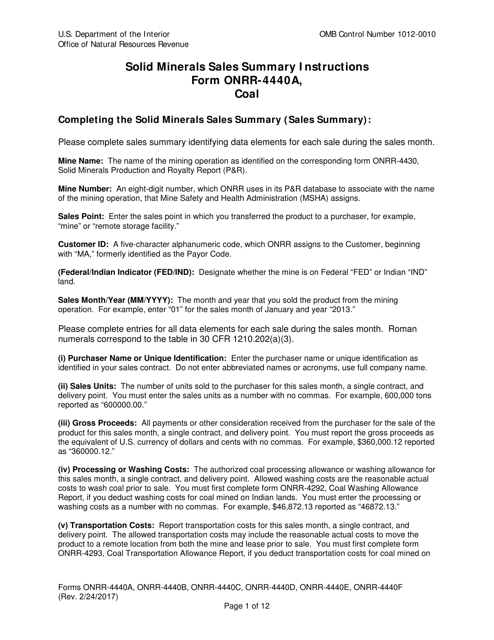

This form is used for reporting sales summary of solid minerals. It provides instructions on how to fill out Form ONRR-4440 and submit accurate information regarding the sales of minerals.

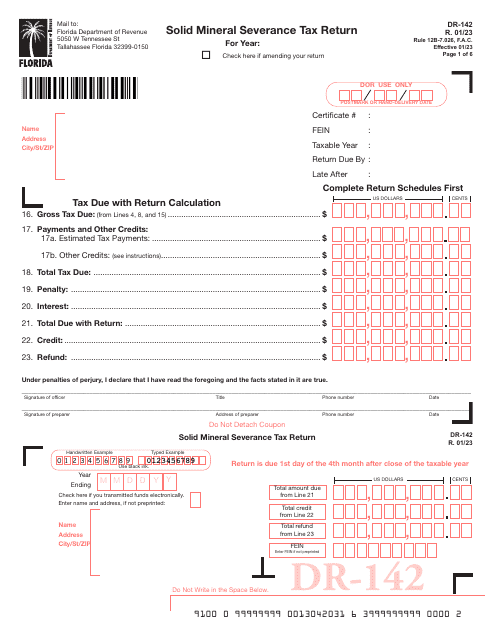

This Form is used for reporting and paying the solid mineral severance tax in the state of Florida.

This form is used for reporting and summarizing sales of solid minerals. It is specifically designed for the Office of Natural Resources Revenue (ONRR).

This Form is used for reporting and calculating production and royalty payments for solid minerals in the United States.