Small Business Compliance Templates

Ensuring compliance with regulations and requirements is crucial for small businesses to thrive and avoid penalties. Our small business compliance program provides the necessary guidance and resources to help businesses navigate the complex landscape of rules and regulations.

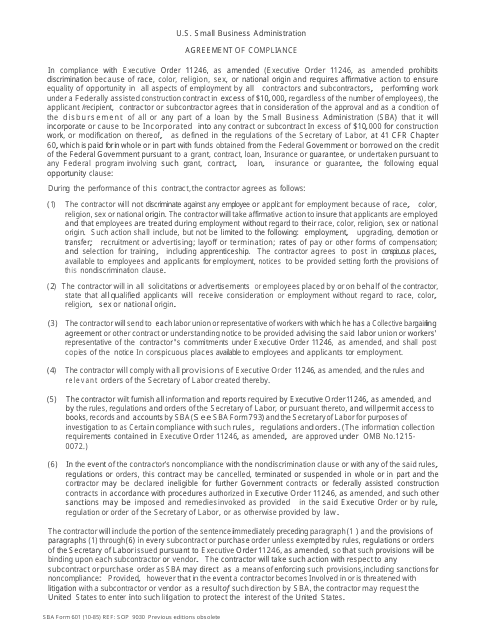

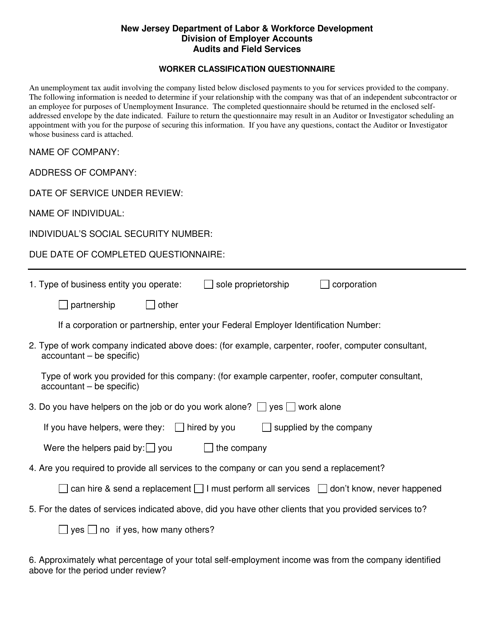

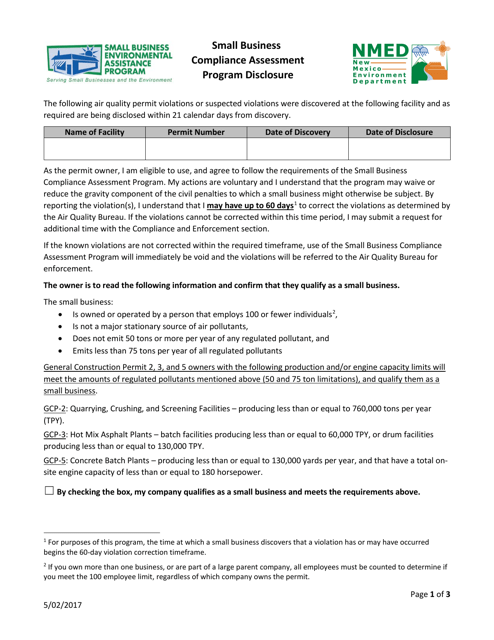

Our program includes a comprehensive collection of documents, including the SBA Form 601 Agreement of Compliance, Worker Classification Questionnaire, and Small Business Compliance Assessment Program Disclosure. These documents cover a wide range of topics, including size and affiliation guidelines, classification of workers, and annual reporting requirements.

At Small Business Compliance, we understand that compliance can be overwhelming, especially for small businesses with limited resources. That's why our Small Business Compliance Guide is designed to simplify the process and provide step-by-step instructions to ensure businesses meet their obligations.

Stay ahead of the compliance curve and protect your business with our collection of small business compliance documents. Gain peace of mind knowing that you are adhering to all necessary regulations, while avoiding costly fines and legal issues. Let us help you navigate the intricate world of compliance, so you can focus on what matters most – growing your business.

Documents:

5

This Form is used for businesses to agree to comply with certain regulations or requirements set by the Small Business Administration (SBA).

This document is used for determining the proper classification of workers in New Jersey. It helps employers determine if workers should be classified as employees or independent contractors.

This form is used for disclosing the Small Business Compliance Assessment Program in the state of New Mexico.

This document provides a guide for small businesses regarding compliance requirements related to their size and affiliation. It outlines the regulations and obligations that small businesses must adhere to based on their size and relationships with other entities.