Back Taxes Templates

Are you burdened by unpaid taxes from previous years? Don't let your back taxes weigh you down any longer. Our comprehensive collection of documents related to back taxes will provide you with the necessary tools to tackle this financial hurdle.

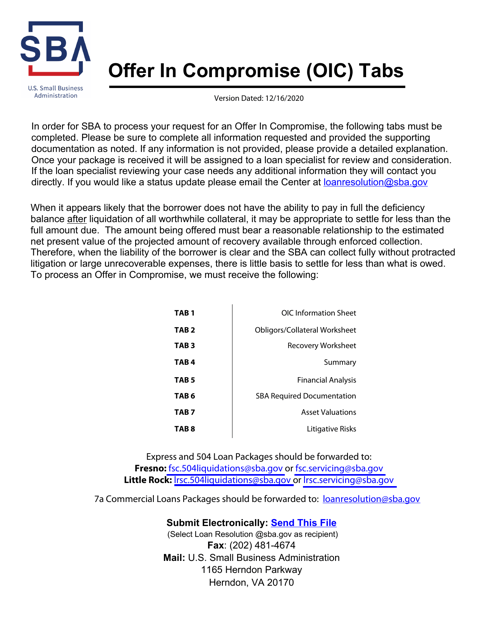

Also known as back taxes, these documents are designed to assist individuals and businesses in resolving their outstanding tax liabilities. Whether you're looking to negotiate an offer in compromise, disclose a failure to file a return, or seek voluntary disclosure agreements, our extensive selection of resources has got you covered.

These documents are specifically tailored to meet the requirements of various jurisdictions, including California, Nevada, Arkansas, and the IRS. We understand that navigating the complexities of tax laws can be overwhelming, which is why our collection provides detailed forms and instructions to simplify the process.

Don't let back taxes hinder your financial well-being. Take control of your tax obligations with our comprehensive collection of documents. Say goodbye to the stress and uncertainty of unpaid taxes and start paving the way to financial freedom today.

Documents:

7

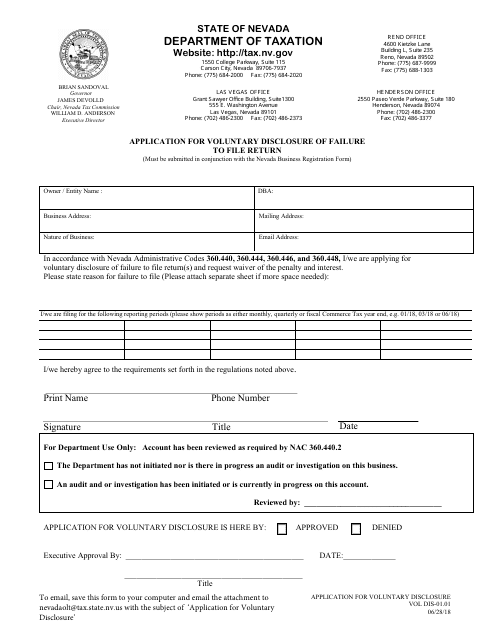

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

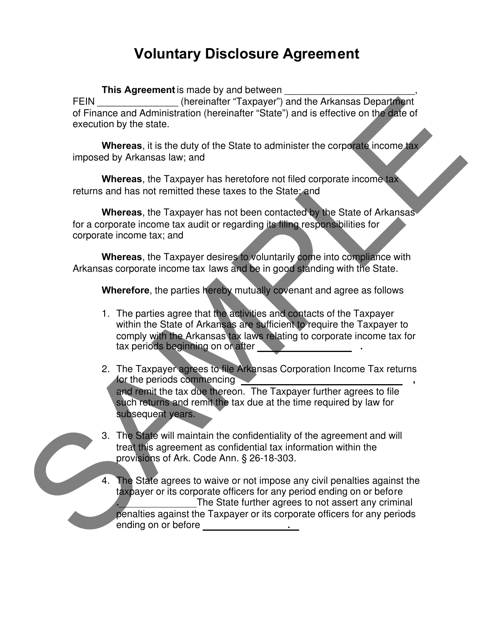

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.