Exemption From Withholding Templates

Are you a nonresident alien individual working in the United States or Canada? If so, you may be eligible for an exemption from withholding taxes on your compensation. This means that you can potentially keep more of your hard-earned money in your pocket.

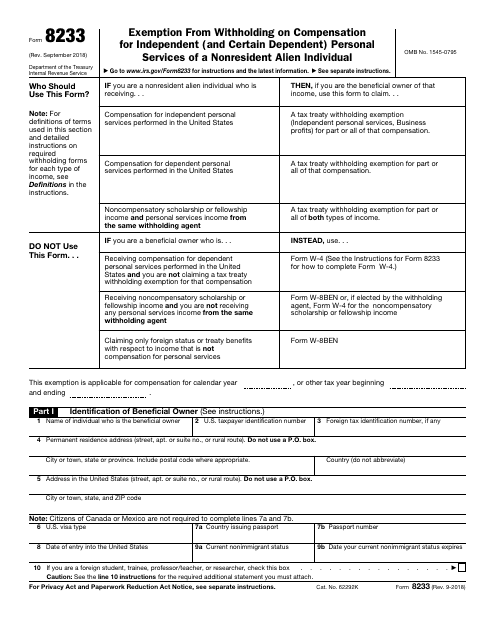

There are various documents and forms that you may need to submit to claim this exemption. One such document is the IRS Form 8233, which is specifically designed for nonresident alien individuals. This form allows you to declare your eligibility for exemption from withholding on compensation for independent or certain dependent personal services.

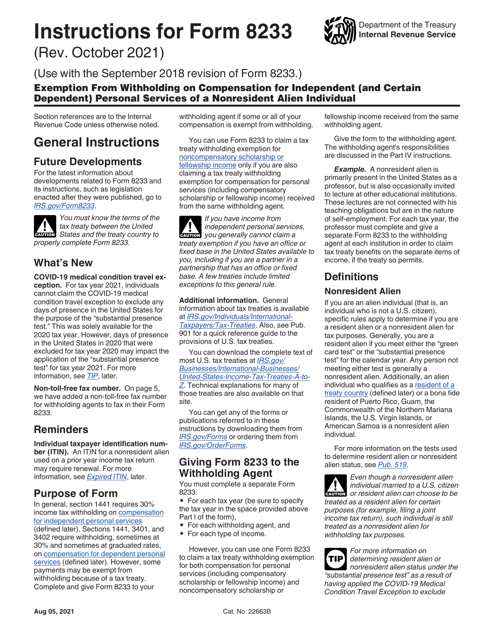

To help you complete the IRS Form 8233 correctly, there are detailed instructions provided by the IRS. These instructions explain the requirements and procedures for claiming the exemption. It is important to follow these instructions carefully to ensure that your application is processed successfully.

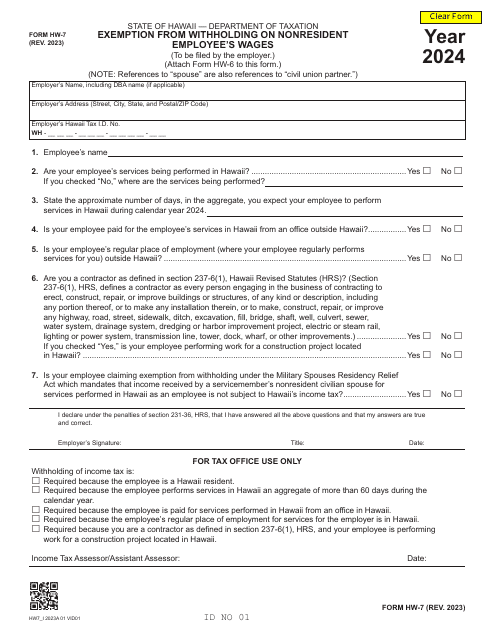

In addition to the IRS Form 8233, some states, such as Hawaii, also have their own form for claiming exemption from withholding. For example, the Form HW-7 is used in Hawaii to exempt nonresident employees from having taxes withheld from their wages.

If you are unsure about whether you qualify for an exemption from withholding or how to properly complete the necessary documentation, it is recommended to seek professional advice. Tax professionals can provide guidance and ensure that you take advantage of any available exemptions and minimize your tax liability.

Don't miss out on potential savings. Take advantage of the exemption from withholding for nonresident alien individuals and keep more of your earnings.

Documents:

8

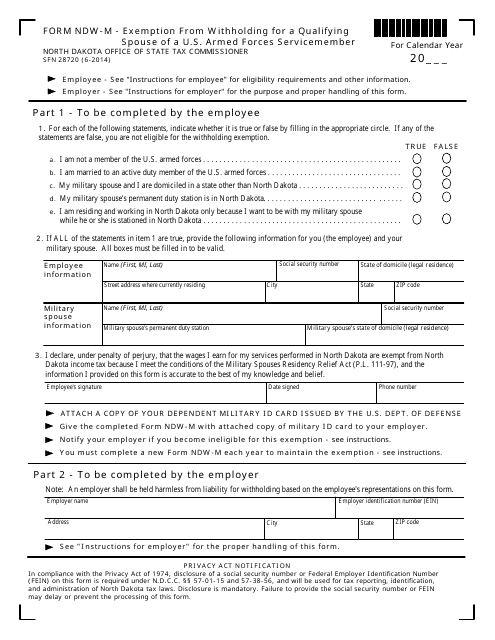

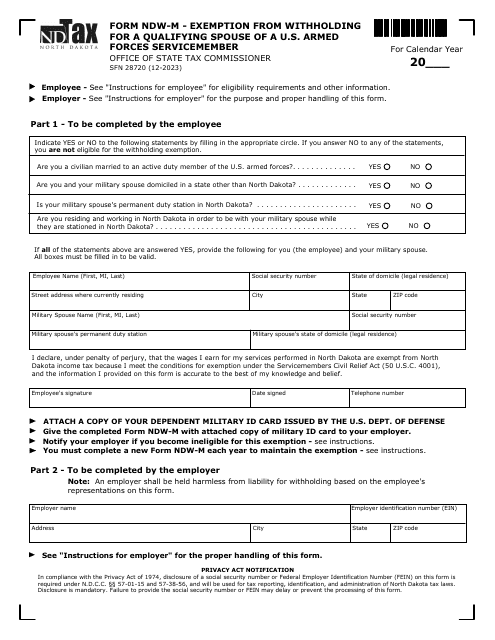

This form is used for claiming exemption from withholding for a qualifying spouse of a U.S. Armed Forces servicemember in North Dakota.