Assets and Liabilities Templates

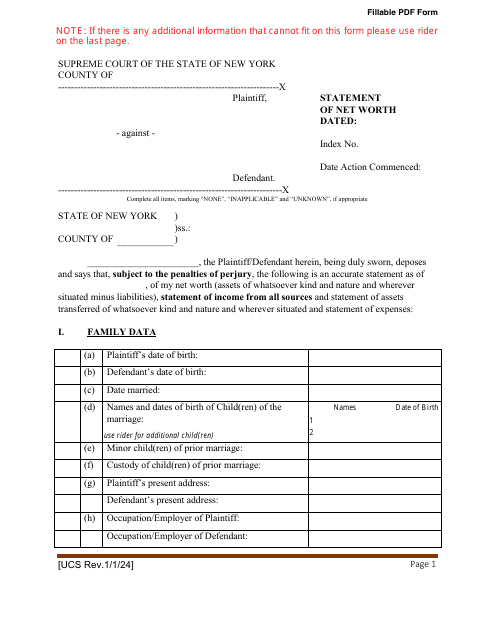

Are you unsure about your financial situation? Do you need to assess your assets and liabilities? Welcome to our Assets and Liabilities documentation system. This collection of documents is designed to help individuals and businesses understand their financial standing and make informed decisions.

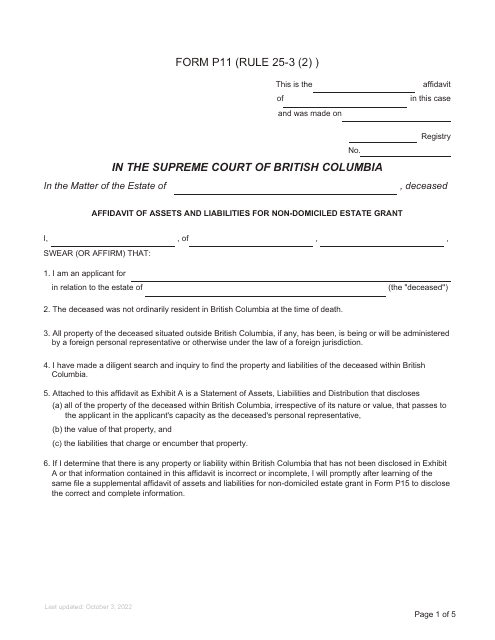

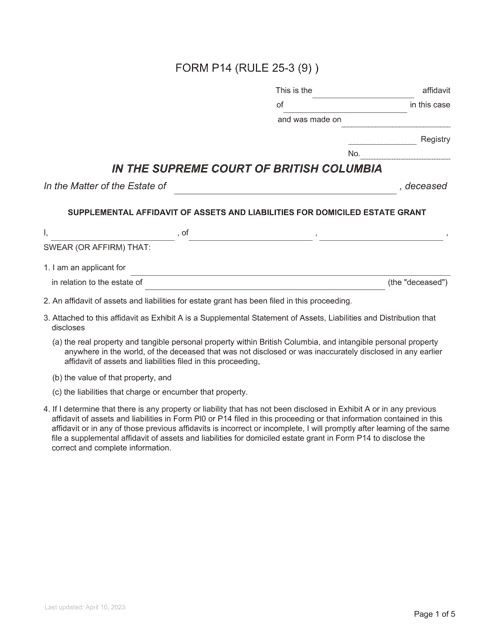

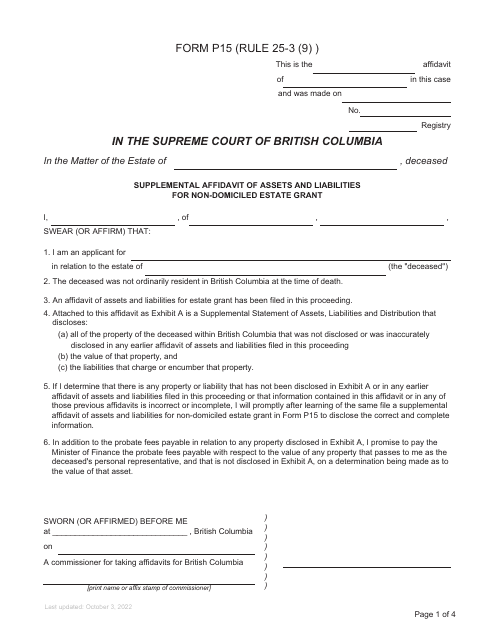

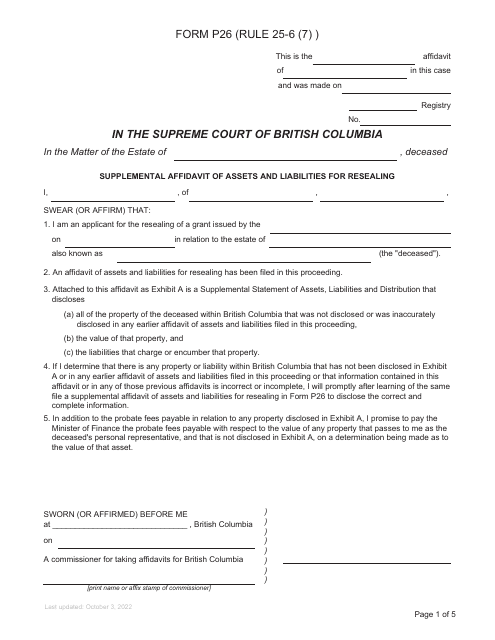

Whether you're applying for a non-domiciled estate grant in British Columbia or looking to reseal your assets and liabilities, we have the necessary forms to guide you through the process. Our comprehensive collection includes documents such as Form P11 Affidavit of Assets and Liabilities for Non-domiciled Estate Grant, Form P14 Supplemental Affidavit of Assets and Liabilities for Domiciled Estate Grant, and Form P26 Supplemental Affidavit of Assets and Liabilities for Resealing - all specific to British Columbia, Canada.

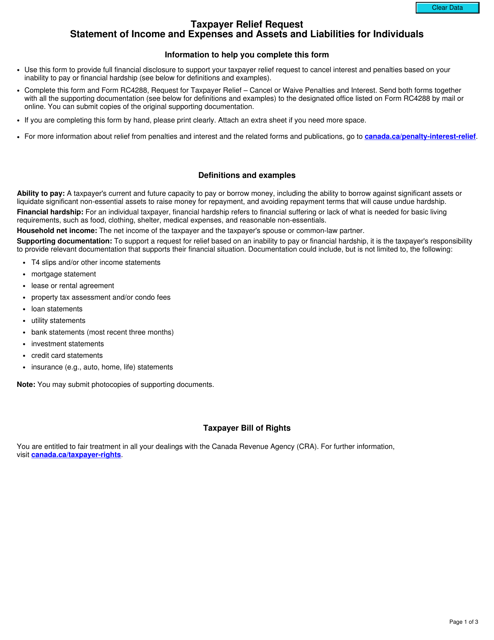

For individuals in Canada seeking taxpayer relief, we provide Form RC376 Taxpayer Relief Request Statement of Income and Expenses and Assets and Liabilities. This form allows you to present your financial situation and explain any exceptional circumstances that may affect your tax obligations.

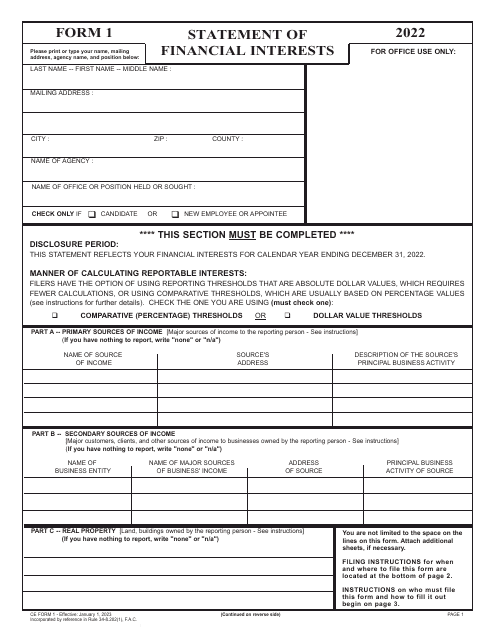

If you reside in Florida, our collection also includes CE Form 1 Statement of Financial Interests. This document is crucial for individuals looking to disclose their financial interests and comply with the state's regulations.

No matter where you are located or what your specific needs may be, our Assets and Liabilities documentation system has you covered. With our user-friendly forms and comprehensive resources, navigating your financial landscape has never been easier. Don't let uncertainties weigh you down - take control of your assets and liabilities with our trusted documentation.

Documents:

14

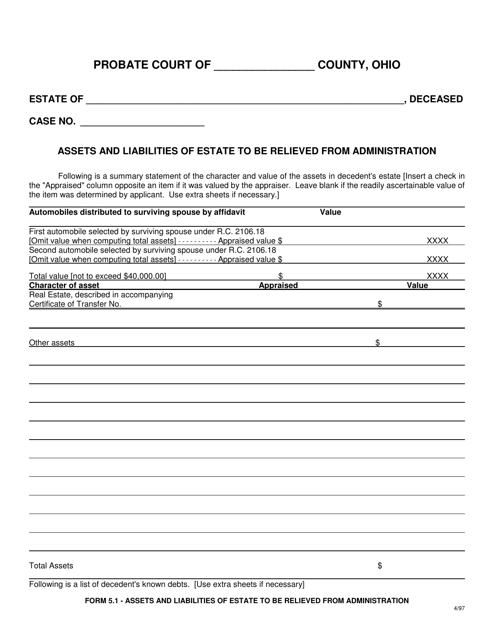

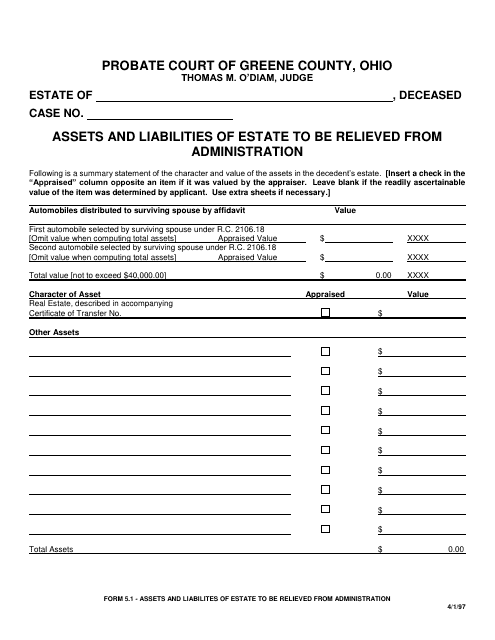

This type of document, Form 5.1 Assets and Liabilities of Estate to Be Relieved From Administration, is used in Ohio to provide a list of assets and liabilities of an estate that is being relieved from administration.

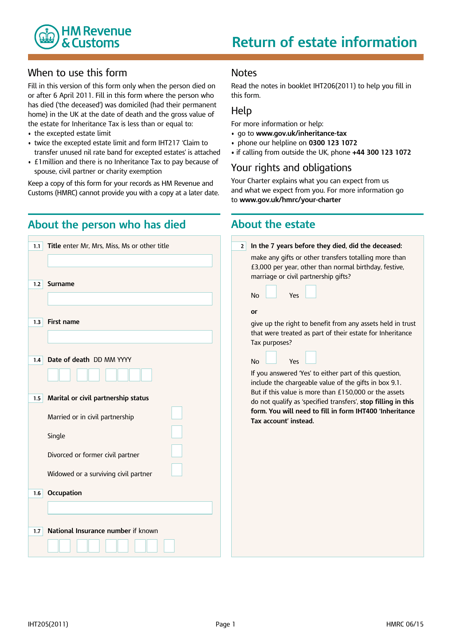

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

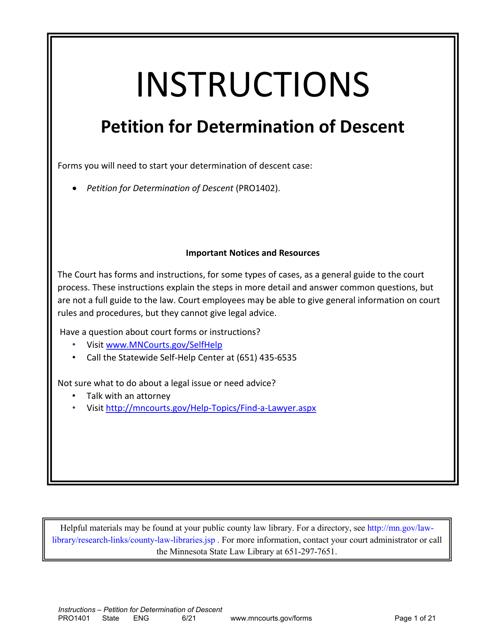

This form is used for filing a petition with the state of Minnesota to determine the descent of a person.

This document is used for listing the assets and liabilities of an estate in Greene County, Ohio that are to be relieved from administration.