Federal Taxable Income Templates

Federal Taxable Income

Federal taxable income refers to the amount of income that is subject to federal tax. It is an important concept for individuals and businesses when preparing their tax returns. Understanding how to calculate and report federal taxable income is crucial in order to comply with tax laws and regulations.

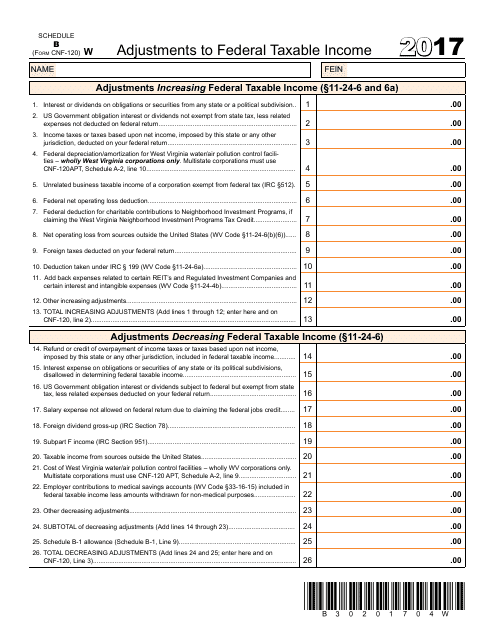

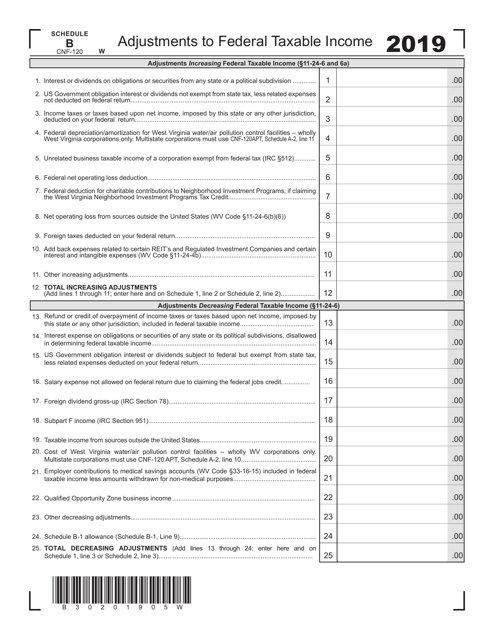

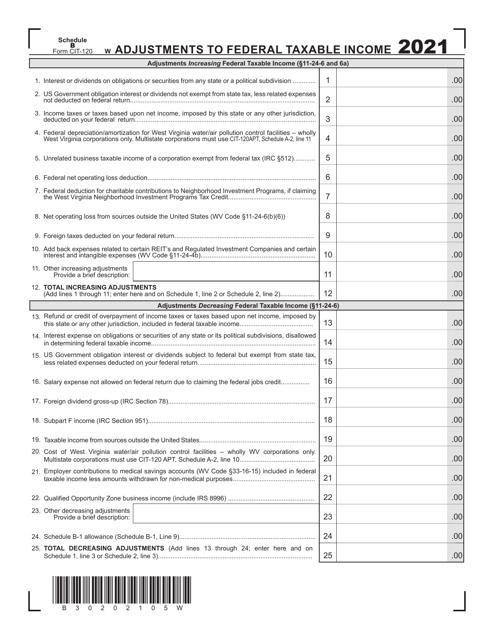

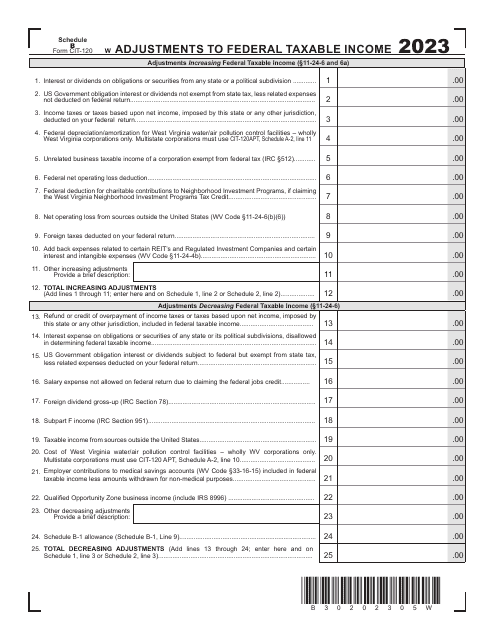

There are various documents and schedules that help individuals and businesses determine their federal taxable income. For example, in the state of West Virginia, individuals and businesses must fill out Form CNF-120 Schedule B, B-1, C - Adjustments to Federal Taxable Income

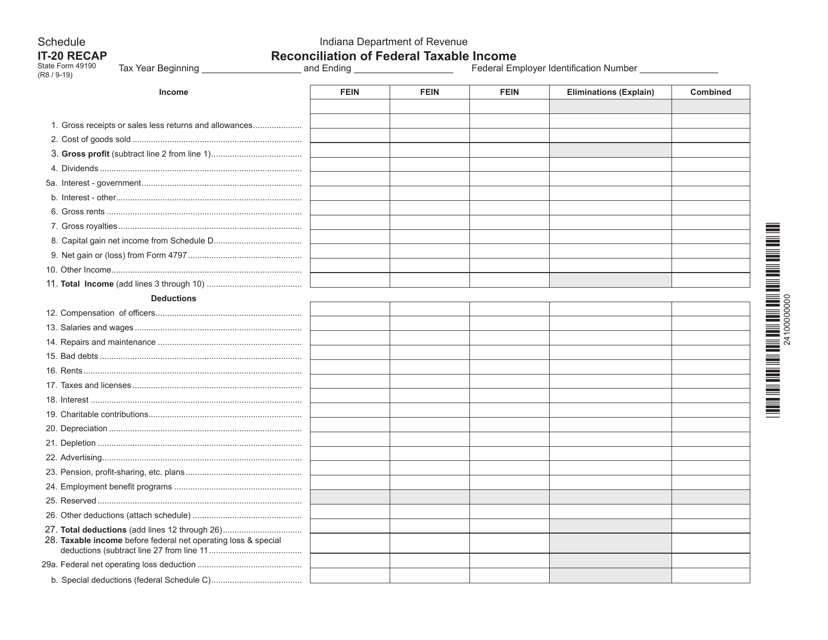

. This form allows taxpayers to make adjustments to their federal taxable income based on specific circumstances in the state.Similarly, in Indiana, taxpayers are required to complete State Form 49190 Schedule IT-20 RECAP - Reconciliation of Federal Taxable Income

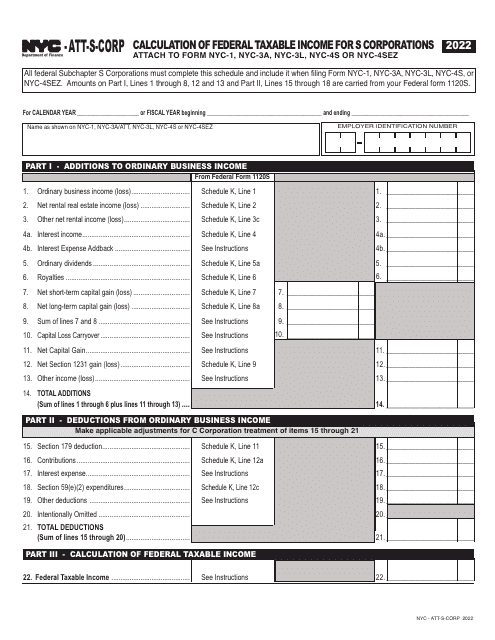

. This schedule helps taxpayers reconcile their federal taxable income with the state's tax regulations.Different jurisdictions may have their own unique forms and schedules for calculating federal taxable income. For instance, in New York City, S corporations must utilize Form NYC-ATT-S-CORP - Calculation of Federal Taxable Income

for S Corporations. This form ensures that S corporations accurately calculate and report their federal taxable income to the city.It's important to note that federal taxable income calculations can vary depending on the jurisdiction and specific circumstances. Therefore, taxpayers must carefully review the instructions and requirements of the applicable forms and schedules to accurately determine their federal taxable income.

In summary, federal taxable income is the income subject to federal tax, and it is crucial for individuals and businesses to accurately calculate and report this amount. The various forms and schedules provided by different jurisdictions allow taxpayers to make adjustments, reconcile their income, and calculate their federal taxable income accordingly.

Documents:

9

This form is used for reporting adjustments to federal taxable income for residents of West Virginia.

This Form is used for reconciling federal taxable income for individuals in the state of Indiana.

This form is used for reporting adjustments to federal taxable income for residents or businesses in West Virginia. It is required to calculate the correct state tax liability.

This form is used for making adjustments to your federal taxable income when filing taxes in West Virginia.