Tax Guidance Templates

Are you struggling with understanding and completing your tax forms? Look no further! Our tax guidance documents are here to help you navigate the complex world of taxes and ensure that you stay compliant with the law. Whether you're a business owner, an employee, or an individual taxpayer, our comprehensive collection of tax guidance materials provides step-by-step instructions for various tax forms and returns.

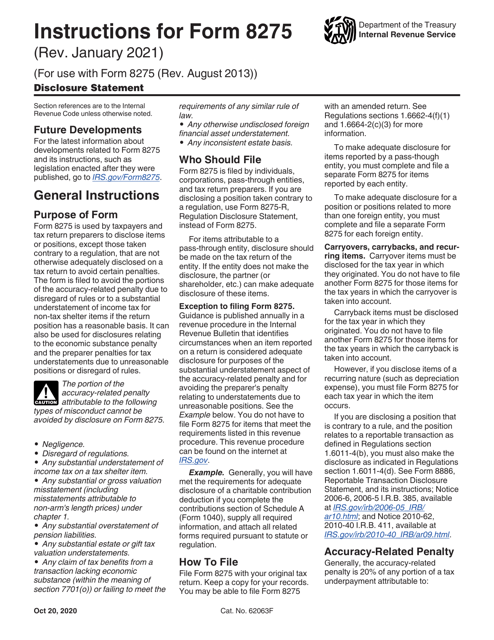

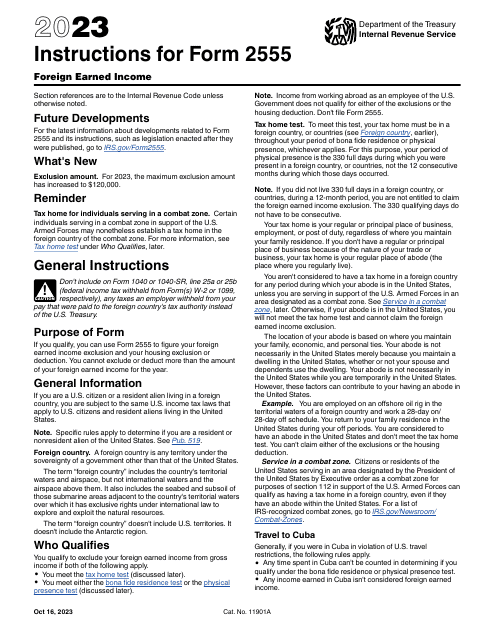

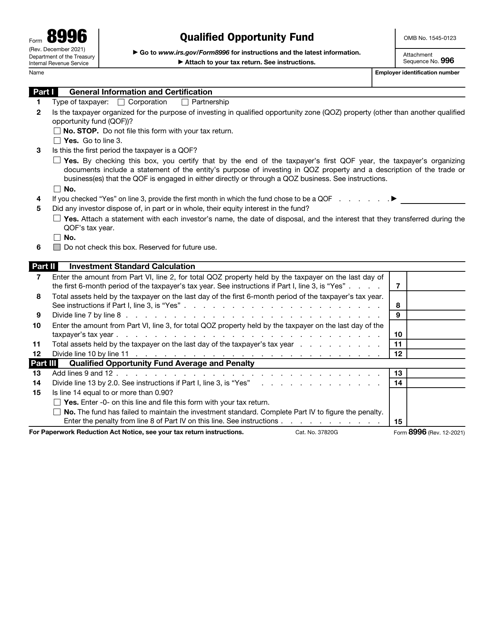

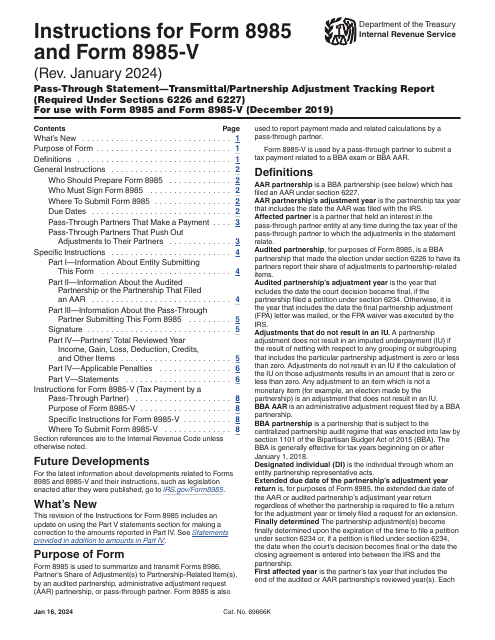

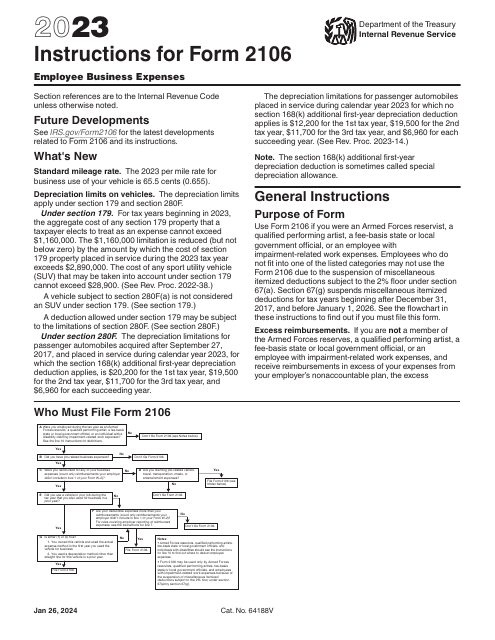

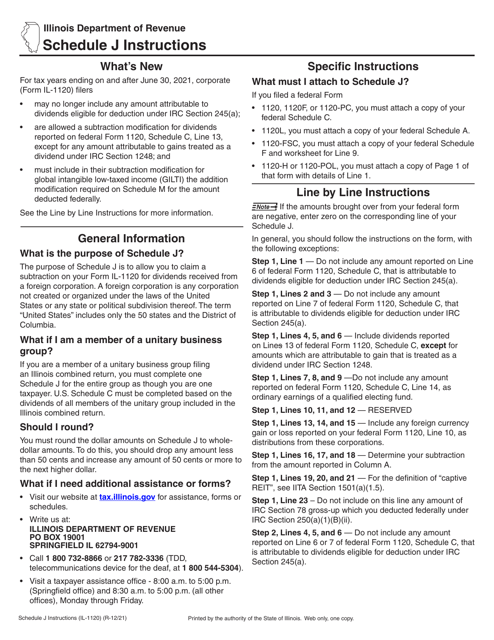

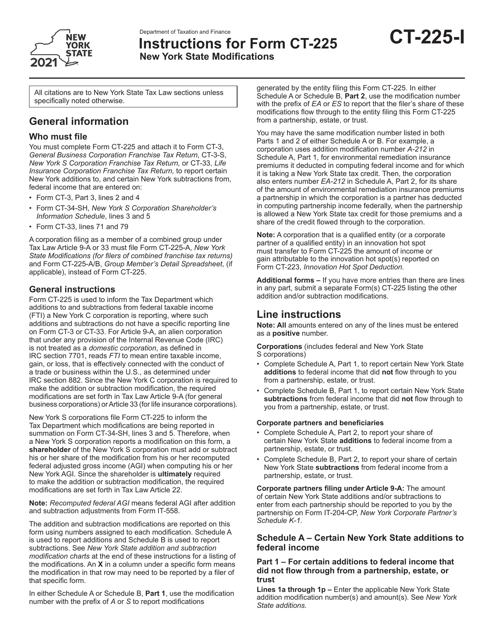

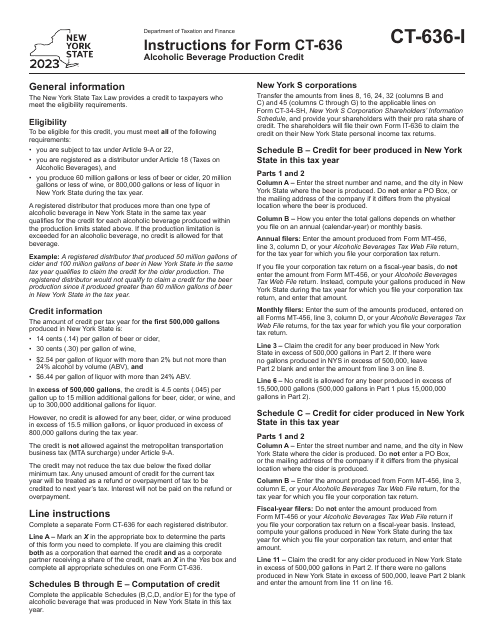

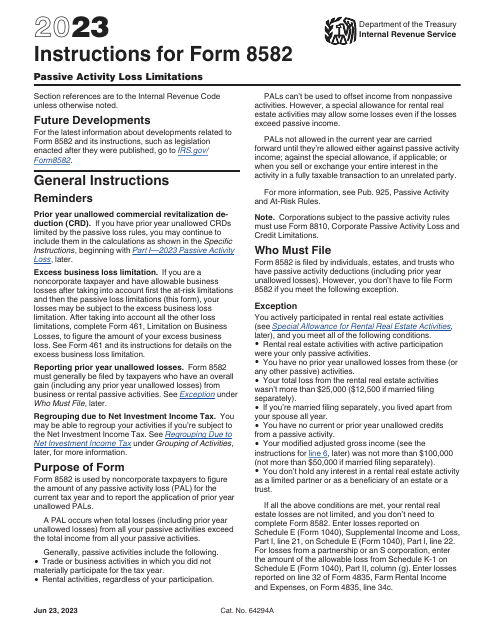

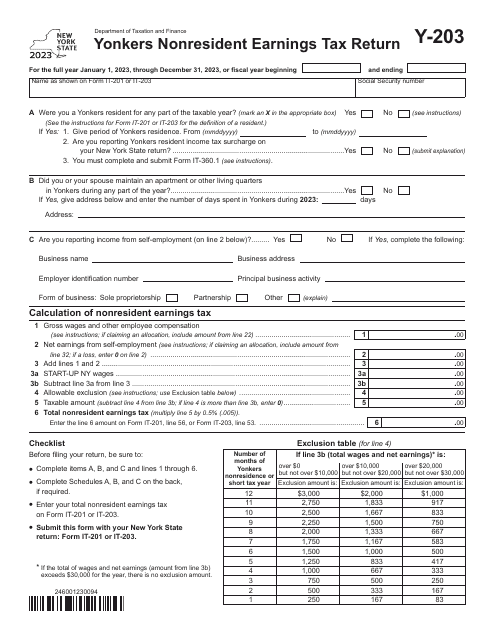

Our tax guidance documents cover a wide range of topics and jurisdictions. From provincial sales tax returns in Saskatchewan, Canada, to out-of-state cigarette and little cigar revenue returns in Illinois, we have the information you need to complete your forms accurately and efficiently. We also offer guidance on IRS forms, such as the Form 2106 for employee business expenses, and state-specific forms like the Form CT-225 for New York state modifications.

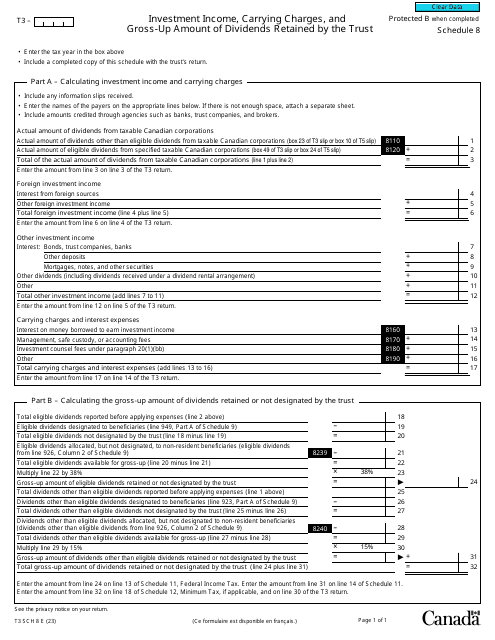

No matter where you are or what tax forms you're dealing with, our tax guidance documents give you the information you need to stay on top of your tax obligations. Whether you're looking for guidance on investment income, carrying charges, or the gross-up amount of dividends, our tax guidance documents provide clear instructions and explanations to help you make sense of even the most complicated tax concepts.

Don't let tax season stress you out. With our tax guidance documents, you can have peace of mind knowing that you have access to accurate and reliable information to help you navigate the world of taxes. Say goodbye to confusion and hello to simplicity with our tax guidance resources. Start exploring our tax guidance documents today and take control of your tax responsibilities.

Documents:

16

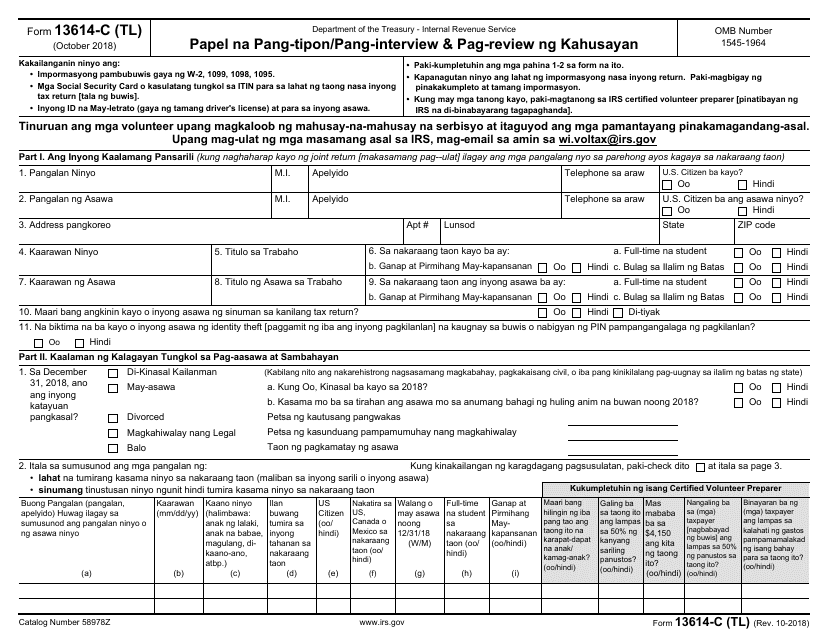

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

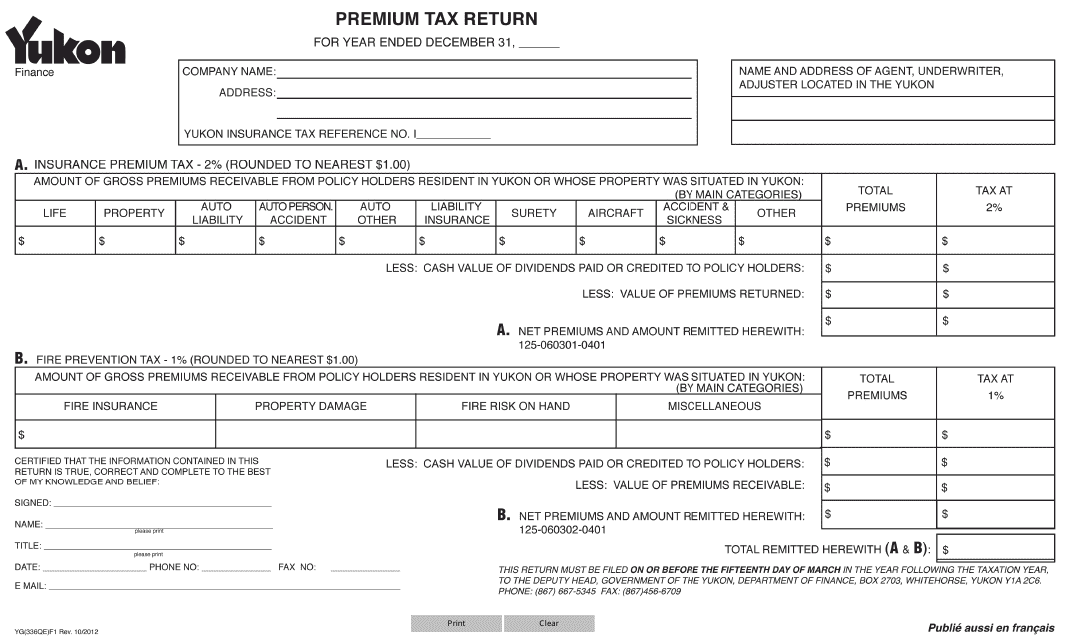

This form is used for filing premium tax returns in Yukon, Canada.

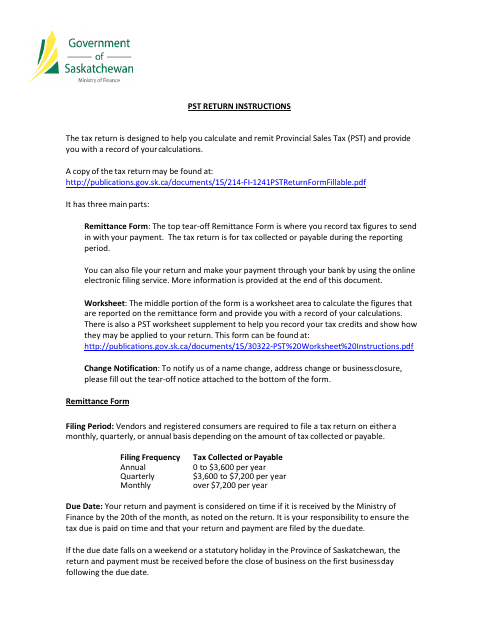

This document provides instructions for completing and filing the Provincial Sales Tax Return in Saskatchewan, Canada. It guides taxpayers on how to report and pay their sales tax obligations to the provincial government.

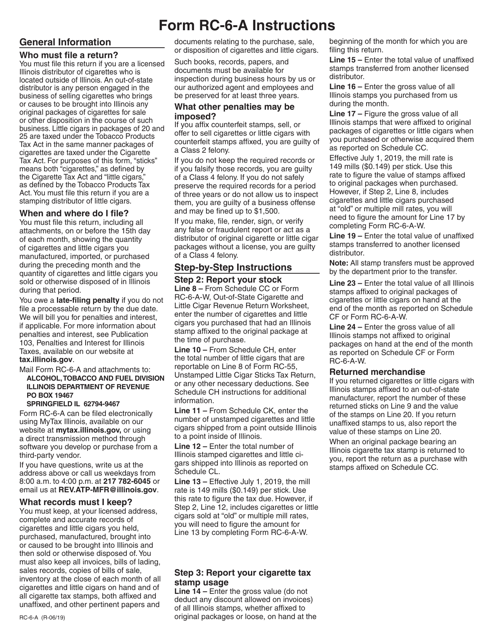

This Form is used for reporting cigarette and little cigar revenue generated out-of-state. It is specific to the state of Illinois.