Agricultural Income Templates

Agricultural income, also known as agriculture income, is an essential aspect of the economic landscape in many countries. This type of income primarily focuses on the financial gains generated from farming and related activities. Farmers and agricultural businesses often need to report their agricultural income to the tax authorities or use specialized forms to benefit from specific exemptions and deductions.

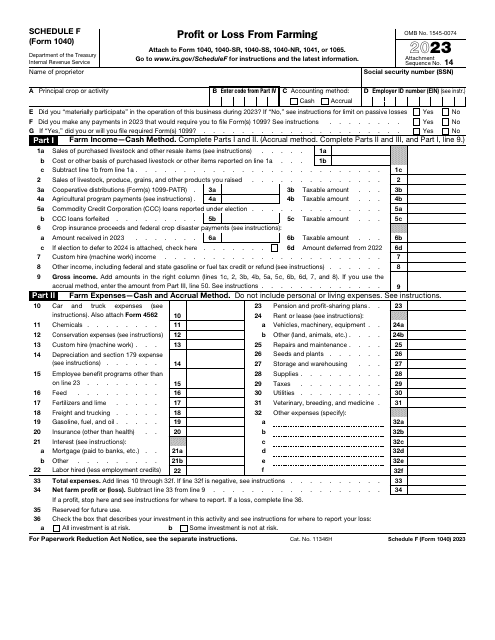

Within the United States and other countries, various documents are used to document and report agricultural income. One such document is IRS Form 1040 Schedule F Profit or Loss From Farming. This form allows farmers to report their farming-related income and expenses, enabling them to calculate their profit or loss accurately.

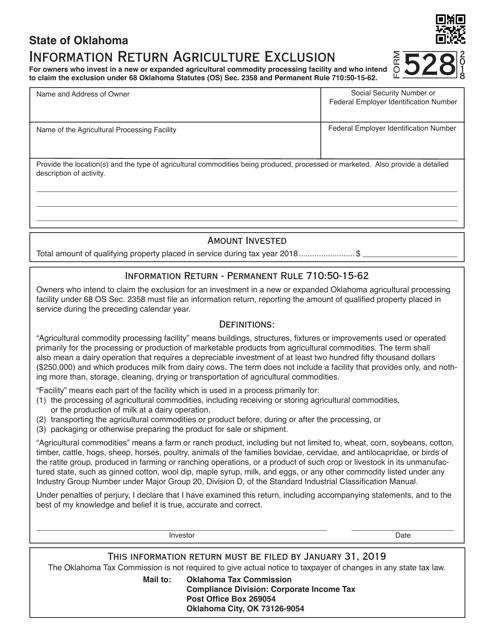

In the state of Oklahoma, farmers may have to utilize OTC Form 528 Information Return Agriculture Exclusion. This form provides information to the Oklahoma Tax Commission regarding agricultural income that might be eligible for certain tax exclusions.

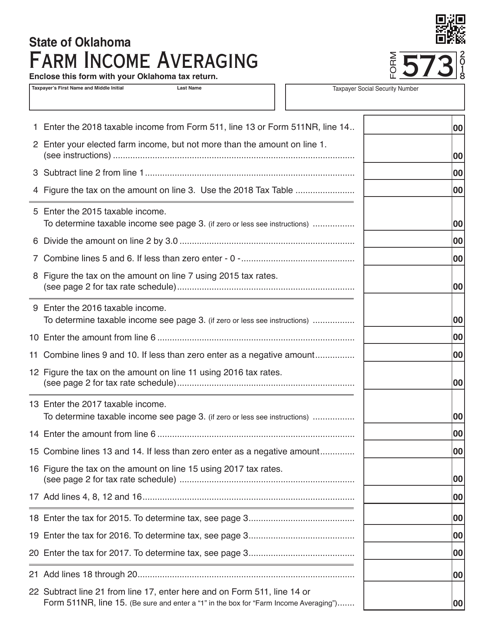

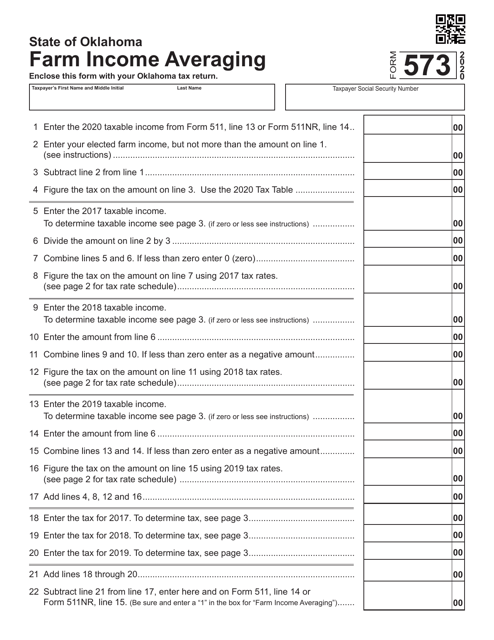

Similarly, Oklahoma farmers can make use of Form 573 Farm Income Averaging, which allows them to average their income over a specific period. This income averaging provision can help farmers mitigate the fluctuations in income caused by volatile market conditions or unforeseen events.

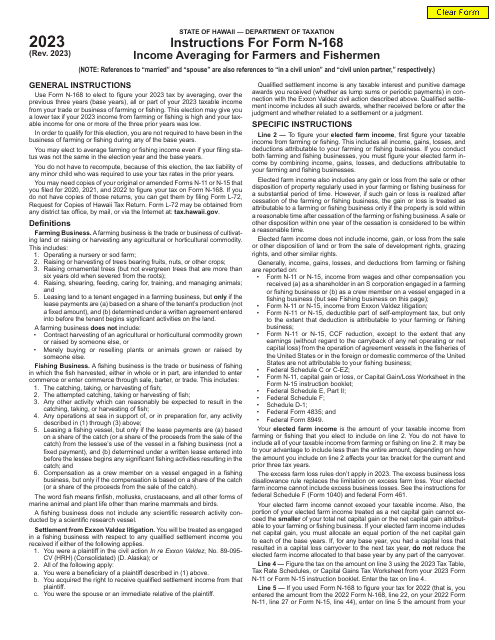

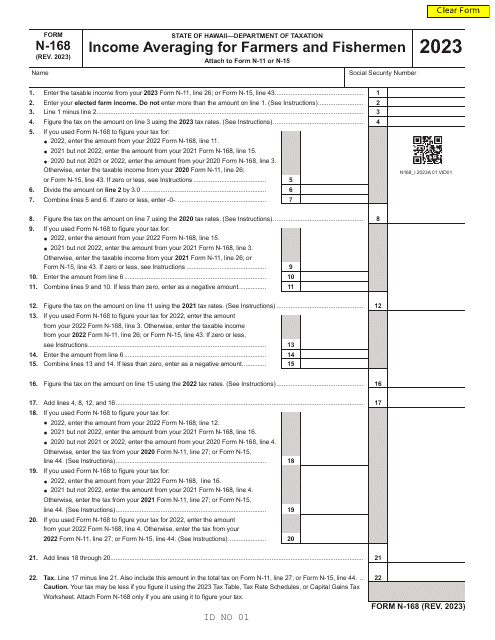

In Hawaii, farmers and fishermen can benefit from Form N-168 Income Averaging for Farmers and Fishermen. This form provides a similar income averaging mechanism specifically designed for individuals engaged in agricultural or fishing activities in the state.

Understanding and managing agricultural income is crucial for farmers and agricultural businesses to ensure compliance with tax regulations and avail themselves of available exemptions and deductions. This can be achieved by utilizing the appropriate documents such as IRS Form 1040 Schedule F, OTC Form 528, Form 573, or Form N-168. By accurately reporting agricultural income and taking advantage of relevant provisions, farmers can optimize their financial position and contribute to the sustainable growth of the agricultural sector.

Documents:

9

This form is used for reporting information related to the agriculture exclusion in the state of Oklahoma. It helps to determine which agriculture activities are exempt from certain taxes.

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

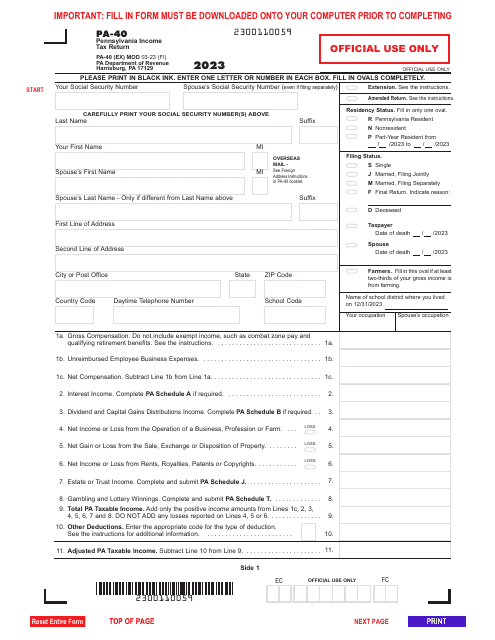

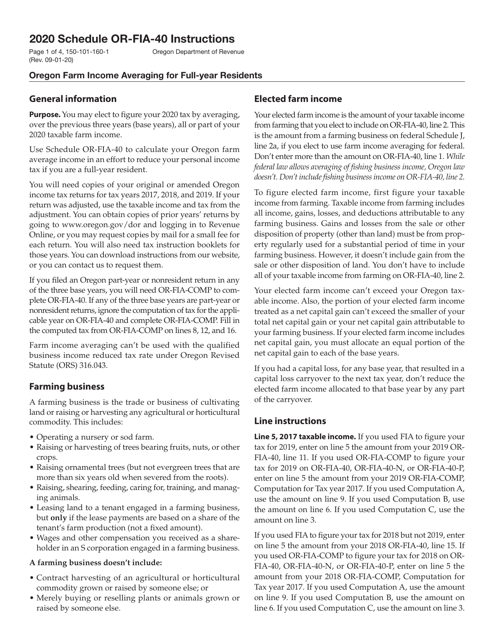

This Form is used for Oregon residents who are farmers to calculate their average income for tax purposes. It helps them determine if they qualify for income averaging and how to report their farm income.