Accommodations Tax Templates

Welcome to our webpage dedicated to accommodations tax, also known as accommodation tax. Whether you are running a hotel, bed and breakfast, or any other type of lodging establishment, it is important to understand and comply with the requirements of the accommodations tax.

The accommodations tax is a tax imposed by various jurisdictions, including states, counties, and cities, on the rental of accommodations such as hotels, motels, inns, vacation rentals, and even campgrounds. This tax is typically collected from the guests and then remitted to the appropriate tax authority.

At our webpage, you will find comprehensive information and resources related to the accommodations tax. We provide guidance on how to properly calculate and collect the tax from your guests, as well as information on reporting and remitting the tax to the tax authorities.

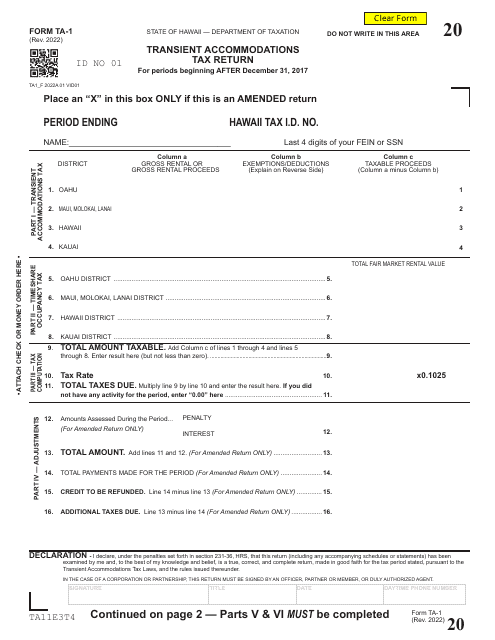

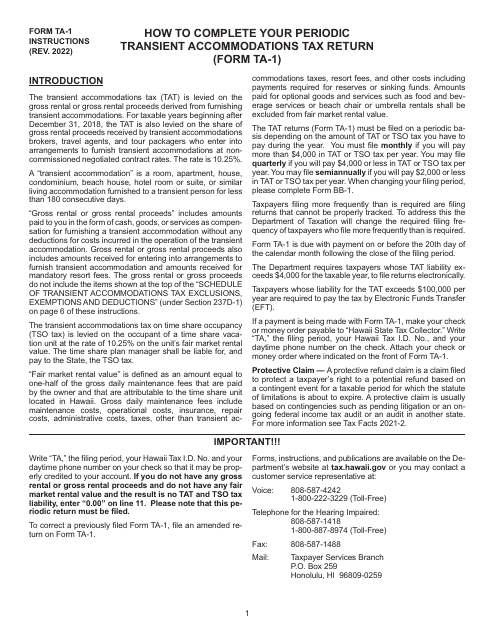

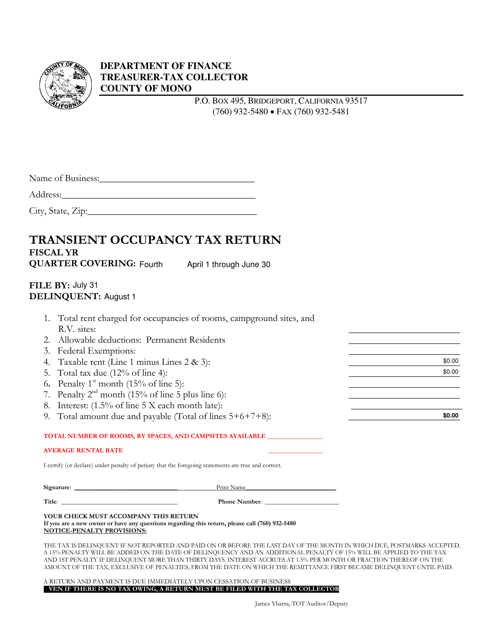

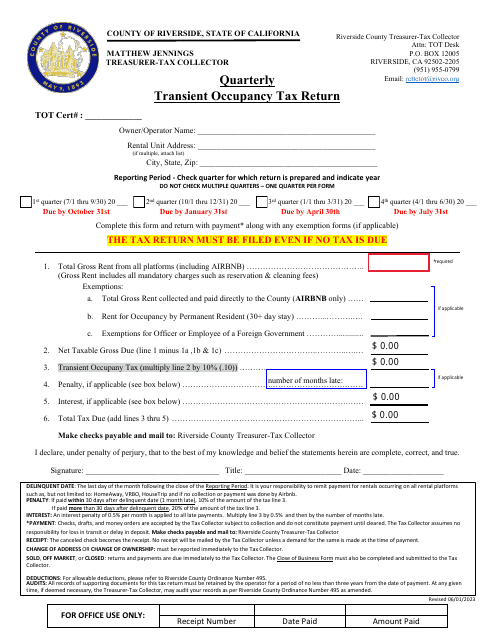

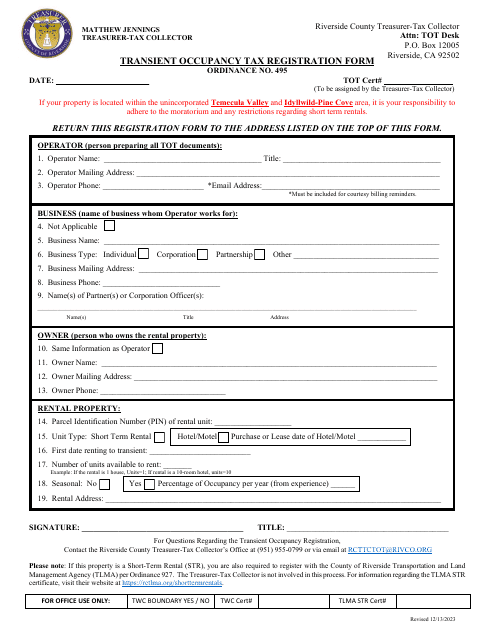

Our webpage also features a collection of various documents related to the accommodations tax. These documents include tax return forms specific to different jurisdictions, such as the Form TA-1 Transient Accommodations Tax Return for Hawaii, the Instructions for Form ST-388 State Sales, Use, and Accommodations Tax Return for South Carolina, and the Transient Occupancy Tax Return for Mono County, California, among others.

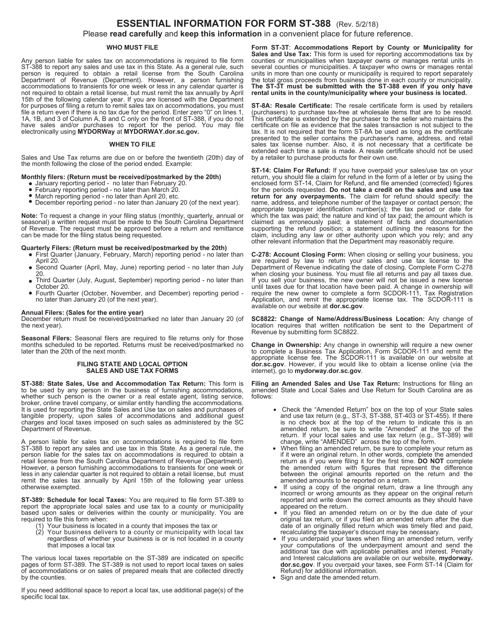

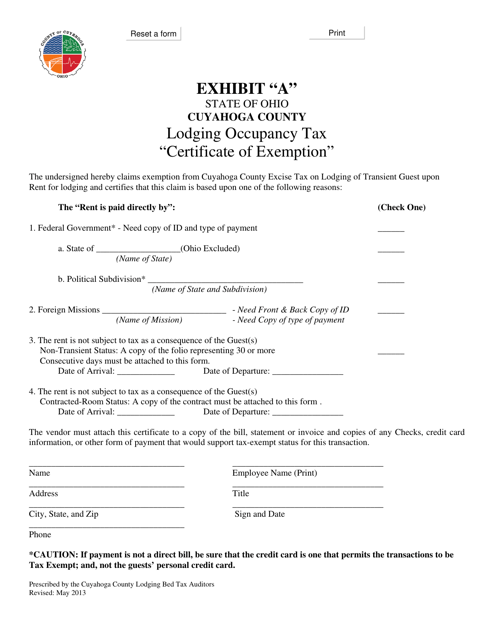

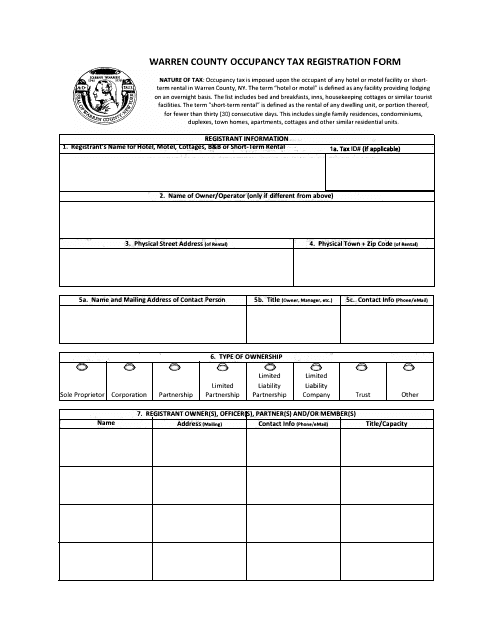

In addition to tax return forms, our webpage also offers resources such as exemption certificates, registration forms, and other supporting documents that may be required in specific jurisdictions. For example, you will find the Exhibit A Lodging Occupancy Tax Certificate of Exemption for Cuyahoga County, Ohio, and the Occupancy Tax Registration Form for Warren County, New York.

Whether you are a lodging establishment owner, a tax professional, or simply looking for information on the accommodations tax, our webpage is your go-to resource. Stay compliant with the accommodations tax regulations and ensure that you are fulfilling your tax obligations by accessing our comprehensive collection of documents and resources.

Note: We do not provide legal or tax advice. Please consult with a professional tax advisor or the relevant tax authority for specific guidance and requirements pertaining to the accommodations tax in your jurisdiction.

Documents:

10

Form TA-1 Transient Accommodations Tax Return for Periods Beginning After December 31, 2017 - Hawaii

This Form is used for filing the State Sales, Use, and Accommodations Tax Return in South Carolina. It provides instructions on how to report and pay sales, use, and accommodations taxes to the state.

This document is used for reporting and paying occupancy taxes in Warren County, New York. It is required for businesses that provide lodging accommodations to guests.

This document is used for filing the Transient Occupancy Tax Return in Mono County, California.

This document is a Lodging Occupancy Tax Certificate of Exemption specific to Cuyahoga County, Ohio. It is used for exempting certain types of lodging establishments from paying occupancy taxes in the county.

This form is used for registering for the occupancy tax in Warren County, New York.

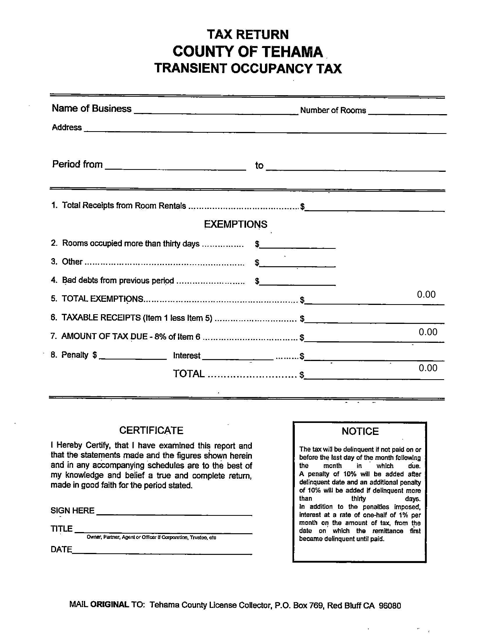

This document pertains to the Transient Occupancy Tax in Tehama County, California. It provides information about the tax and its regulations for individuals or businesses who provide temporary lodging services in the county.