Social Security Tax Templates

Are you looking for information on Social Security taxes? Look no further. Our website provides comprehensive resources on Social Security taxes, also known as Social Security contributions or FICA taxes.

Whether you're a nonresident alien on an F, J, or M type visa or a U.S. citizen, understanding your obligations regarding Social Security taxes is essential. The Internal Revenue Service (IRS) has specific forms and instructions to help you navigate the complexities of these taxes.

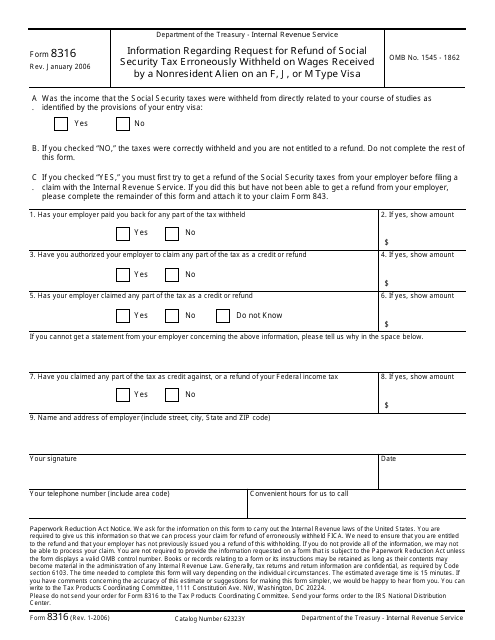

IRS Form 8316 "Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a Nonresident Alien on an F, J, or M Type Visa" is designed for nonresident aliens who believe that Social Security taxes have been withheld erroneously from their wages. This form provides information on how to request a refund.

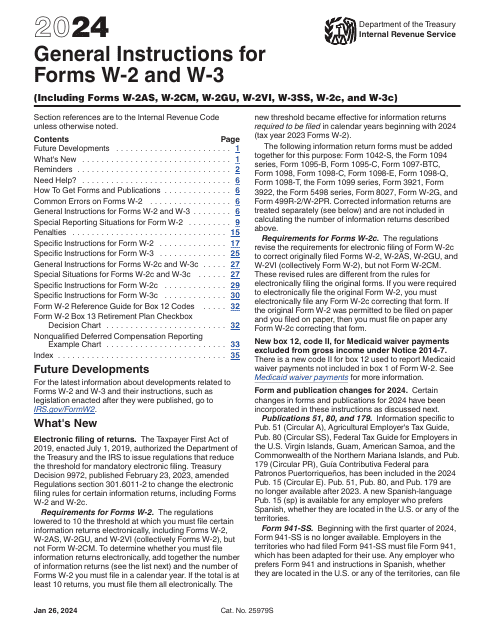

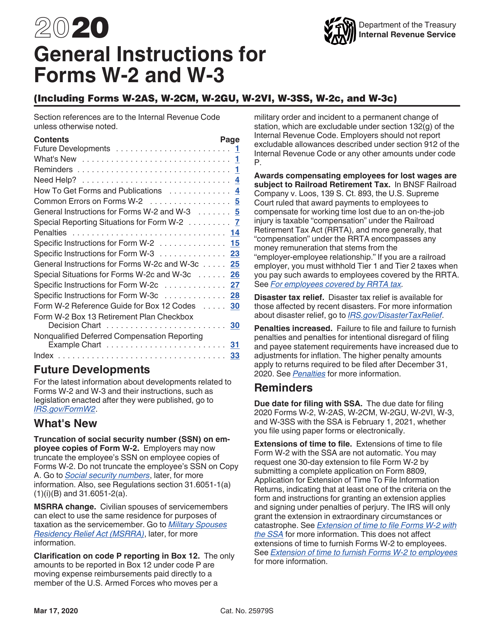

If you are an employer, the IRS provides detailed instructions on Form W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C for reporting wages and withholding Social Security taxes. These instructions ensure that employers accurately report employee wages and calculate the correct amount of Social Security tax to withhold.

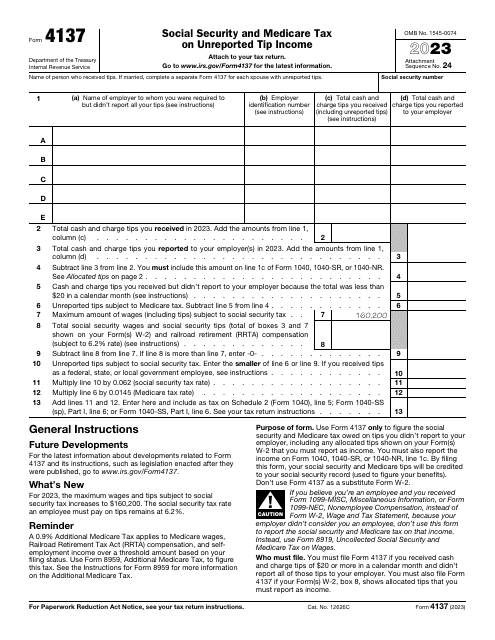

For individuals who receive tips as part of their income, IRS Form 4137 "Social Security and Medicare Tax on Unreported Tip Income" is essential. This form allows individuals to report and pay the Social Security and Medicare taxes on tips that were not included in their wages reported on Form W-2.

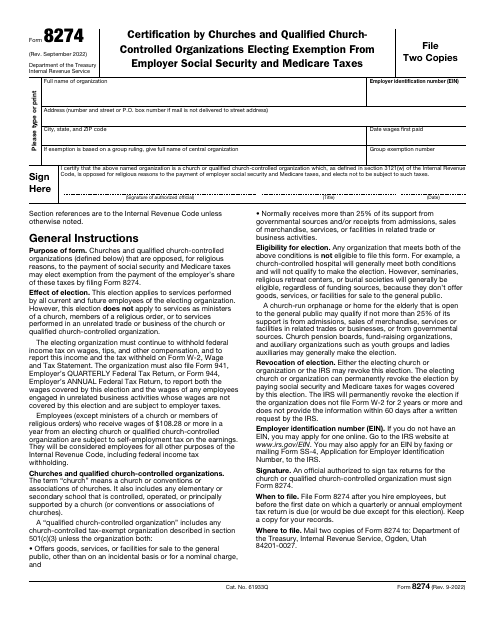

Certain churches and qualified church-controlled organizations have the option to elect exemption from employer Social Security and Medicare taxes. IRS Form 8274 "Certification by Churches and Qualified Church Controlled Organizations Electing Exemption From Employer Social Security and Medicare Taxes" provides a mechanism for these organizations to claim the exemption.

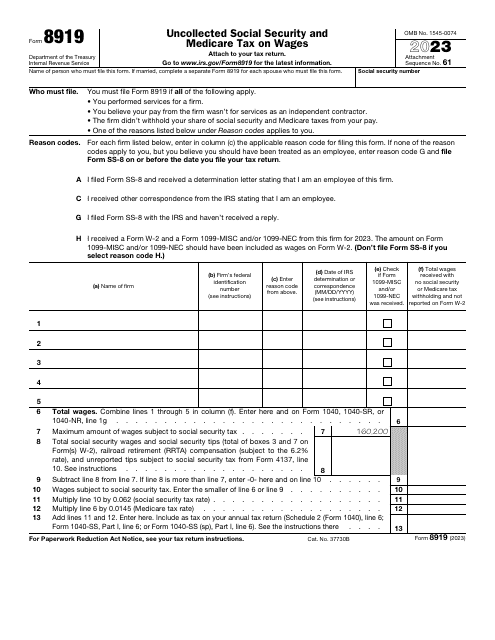

In some cases, individuals may have uncollected Social Security and Medicare tax due to various reasons. IRS Form 8919 "Uncollected Social Security and Medicare Tax on Wages" is used to calculate and pay the amount of uncollected tax.

Understanding and complying with Social Security tax requirements can be challenging. Our website is here to provide you with the information, forms, and instructions needed to navigate Social Security taxes effectively.

Documents:

10

This form is used for providing information regarding a request for refund of social security tax that was mistakenly withheld on wages received by a nonresident alien on an F, J, or M type visa.

This type of document is used for reporting wages and taxes withheld for employees. It is required by the Internal Revenue Service (IRS) for employers to file annually. The different variations of the form (W-2, W-3, W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2C, W-3C) correspond to specific circumstances and requirements.

This is a formal report filed by an individual who believes they have to receive compensation in the form of social security and Medicare taxes.

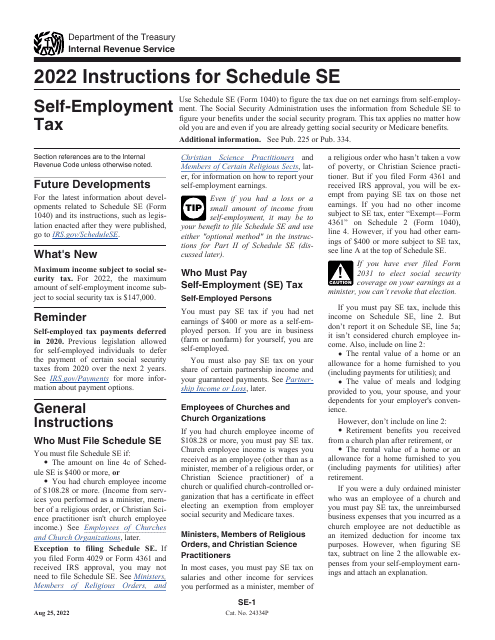

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.