Registered Charities Templates

Registered Charities (also known as registered charity) play a vital role in society by providing support to those in need. These charitable organizations are officially recognized and registered with the government to ensure transparency and accountability in their operations.

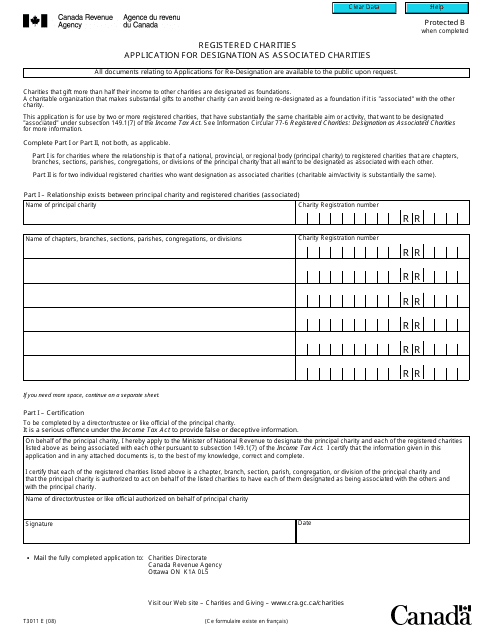

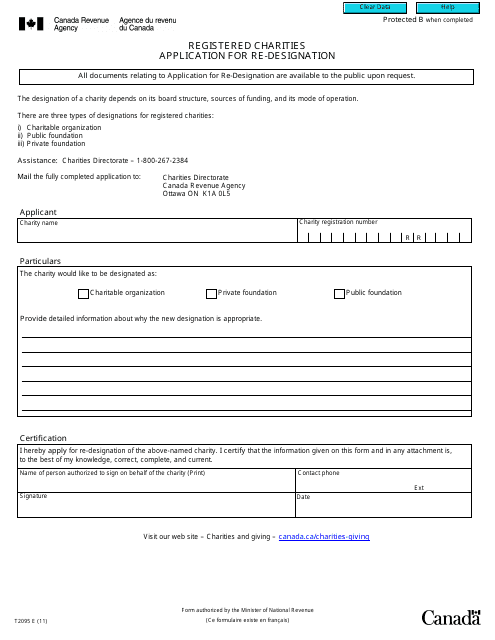

If you are seeking to establish your organization as a registered charity or make changes to an existing one, there are various documents and applications that you need to be familiar with. For instance, the Form T3011 Application for Designation as Associated Charities allows you to apply for associated charity status in Canada. Similarly, the Form T2095 Registered Charities: Application for Re-designation is the document you need to submit when seeking to re-designate your registered charity.

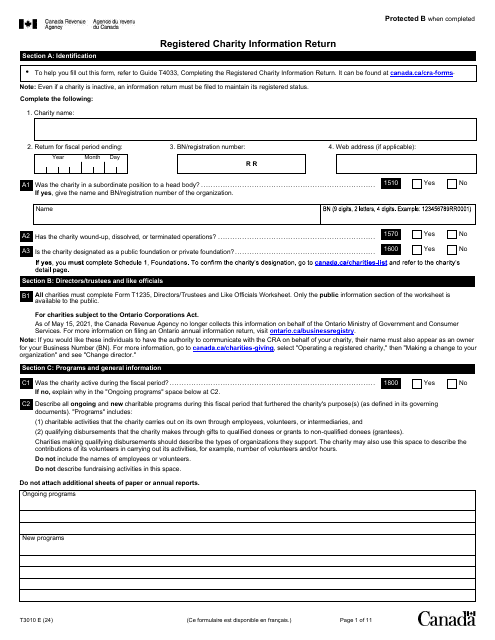

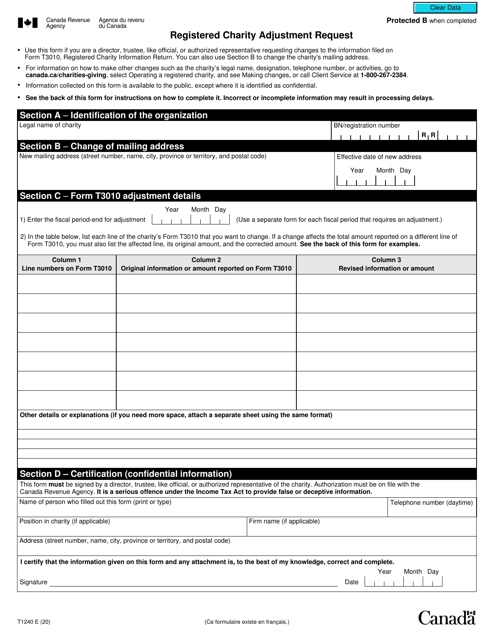

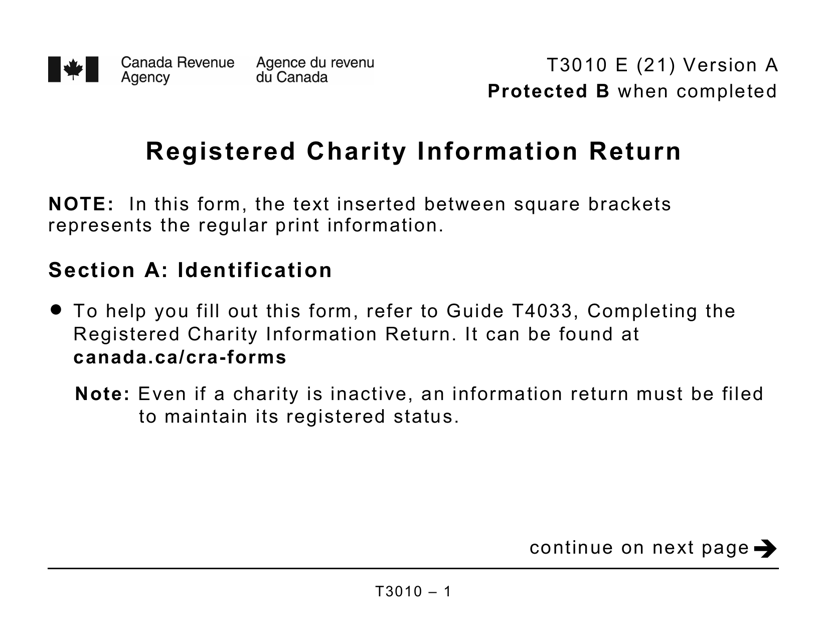

In addition, the Form T1240 Registered Charity Adjustment Request is used to request adjustments to your registered charity's records, ensuring that accurate information is maintained. On the other hand, the Form T3010 Registered Charity Information Return is a yearly requirement for registered charities to report their activities and finances to the Canadian government.

Whether you are a new applicant or an existing registered charity, it is essential to understand and comply with these important documents. They serve as an avenue for monitoring and evaluating the activities of registered charities, helping to foster trust and credibility among donors and the general public.

To navigate the requirements and obligations associated with registered charities, it is advisable to seek professional guidance or consult resources provided by government bodies such as the Canada Revenue Agency (CRA). These resources can assist in understanding the intricacies of the forms and ensure that your organization remains in good standing as a registered charity.

Documents:

13

This form is used for applying for designation as associated charities in Canada.

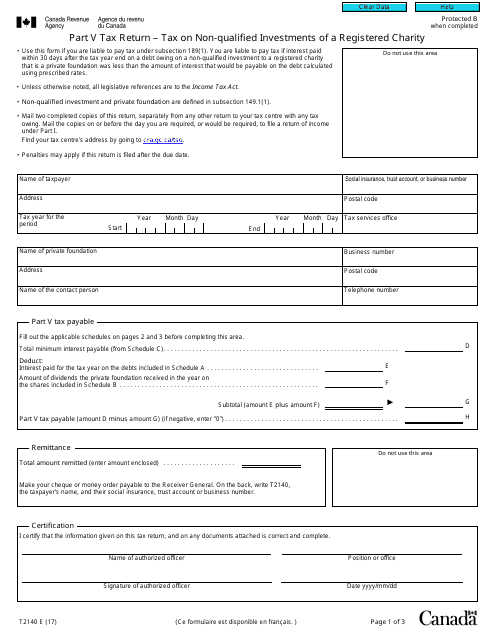

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

This Form is used for registered charities in Canada to apply for re-designation.

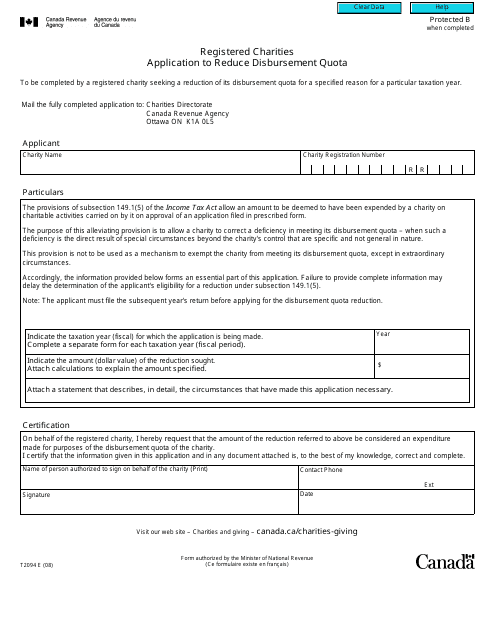

This form is used for registered charities in Canada to apply for a reduction in their disbursement quota.

This form is used for registered charities in Canada to request adjustments to their information on record.

This form is used for filing the Registered Charity Information Return in Canada. It is available in large print format for visually impaired individuals.