Tentative Refund Templates

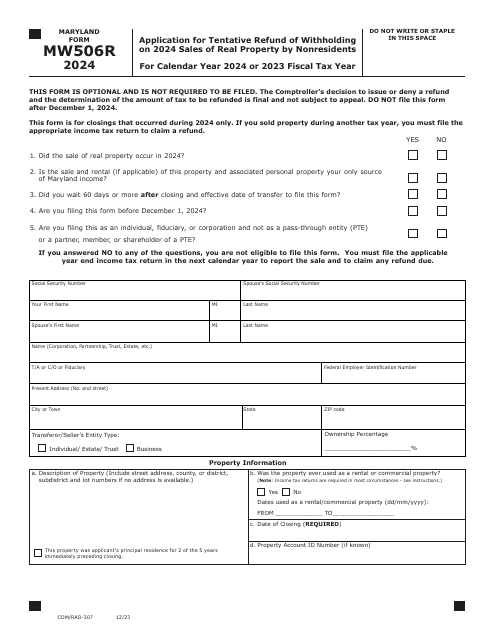

Are you looking for a way to claim a refund for a specific situation? Our tentative refund documents can help you with that. Also known as applications for tentative refund or requests for tentative refund, these documents provide a way for individuals and corporations to seek a partial refund based on specific circumstances.

Whether you're a nonresident person selling a Hawaii real property interest or a corporation carrying back a net operating loss, our collection of tentative refund documents has you covered. Our forms and instructions make it easy to navigate the process and maximize your chances of receiving a refund.

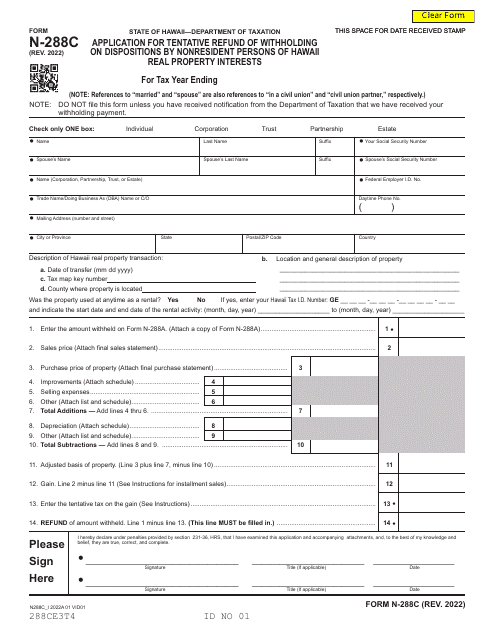

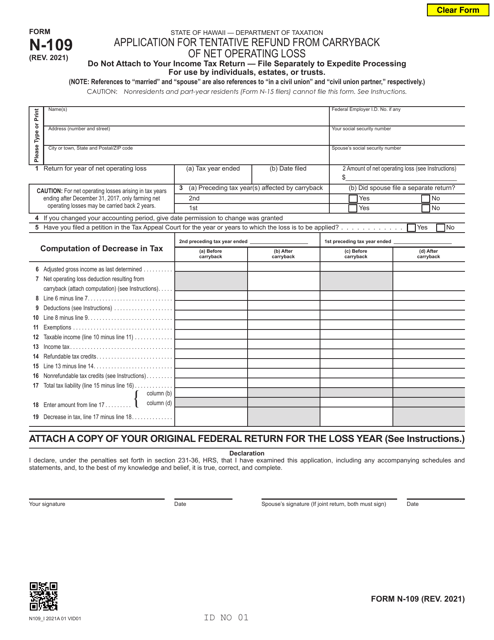

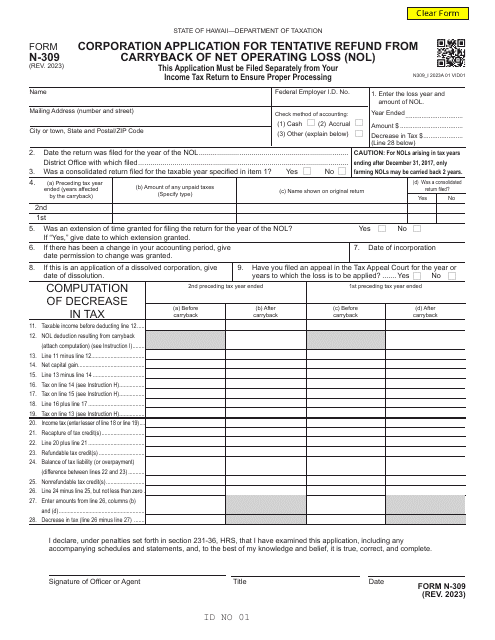

For nonresident individuals selling Hawaii real property interests, our Form N-288C guides you through the application for a refund of withholding taxes. On the other hand, corporations can use Form N-109 or Form N-309 for seeking a tentative refund from carrying back a net operating loss.

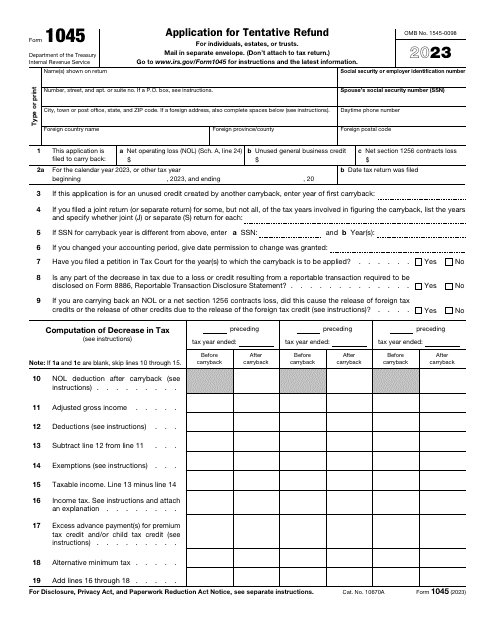

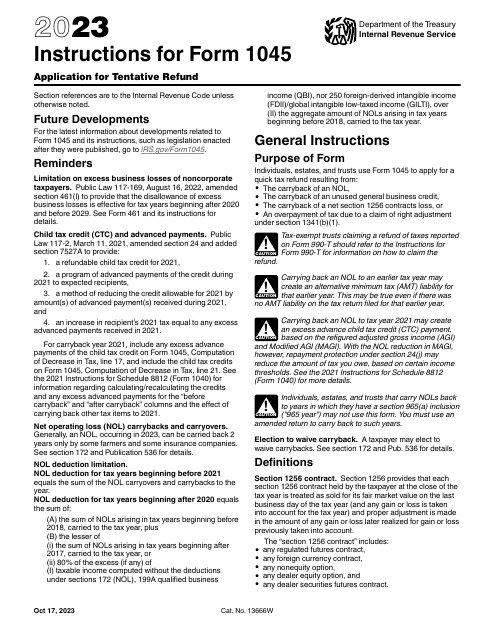

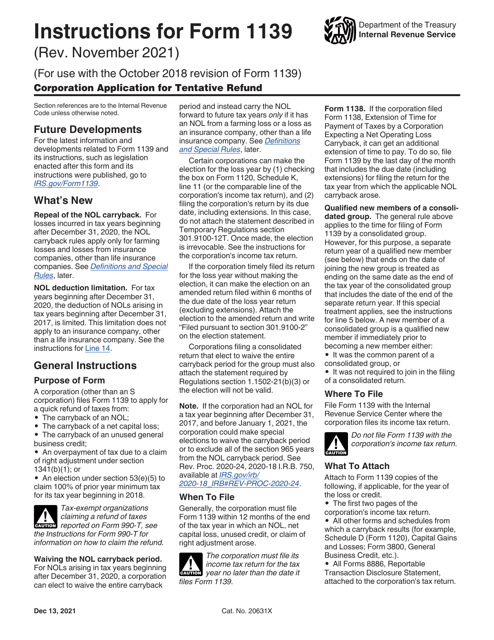

Our collection also includes instructions for IRS Form 1045, which is widely used to apply for a tentative refund on various tax matters. These instructions provide valuable guidance on completing the form accurately and ensuring that you meet all the requirements to qualify for a refund.

Take advantage of our tentative refund documents to explore the possibilities of getting a partial refund for your specific situation. Save time and effort by using our forms and following our instructions to ensure a smooth refund application process.

Documents:

20

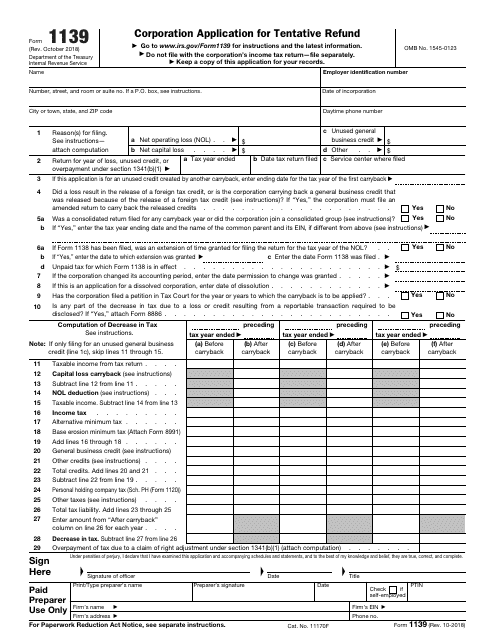

This form is used for corporations to seek a tentative refund of overpaid taxes from the Internal Revenue Service (IRS).