Land Assessment Templates

Are you looking for information on land assessment, also known as land assessed? Our webpage provides valuable insights into the process of land assessment and its importance in various regions. Through this comprehensive resource, you can find guidance on navigating the complex procedures involved in land assessment.

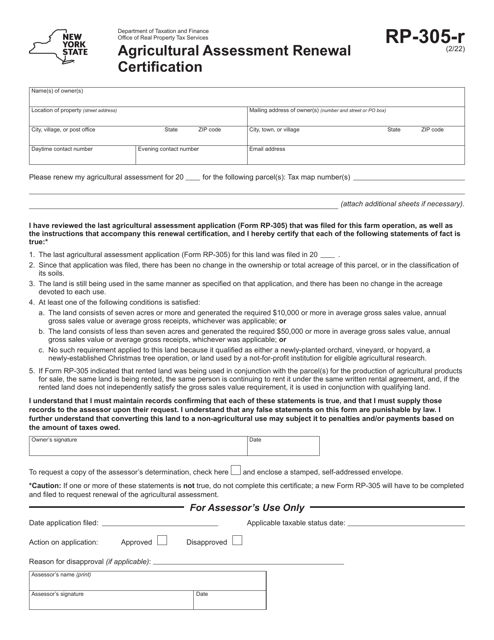

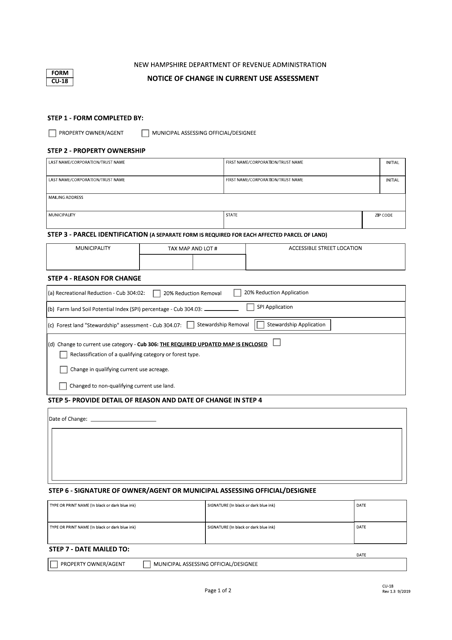

Discover the essentials of land assessment, including the different forms used in various states. For instance, you can explore the Form CU-18 Notice of Change in Current Use Assessment, specifically used in New Hampshire. Additionally, we highlight the Application for Greenbelt Assessment in Tennessee, which focuses on open space land and open space easements. Moreover, we shed light on similar applications specific to McNairy County and the state of Tennessee.

Understanding soil and site evaluation procedures is another crucial aspect of land assessment. Our webpage further delves into the Soil/Site Evaluation Procedures in Stanly County, North Carolina, offering valuable insights into this vital part of the assessment process.

Whether you are a property owner, real estate professional, or simply interested in learning more about land assessment practices, our webpage serves as an informative guide. Embrace the opportunity to gain a comprehensive understanding of land assessment, also known as land assessed, and how it affects property values and taxes.

Note: This is a sample text; you can modify it as per your requirements.

Documents:

25

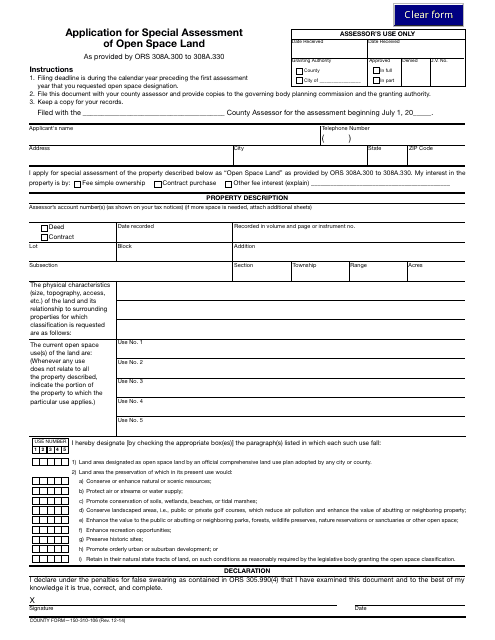

This Form is used for applying for special assessment of open space land in Oregon.

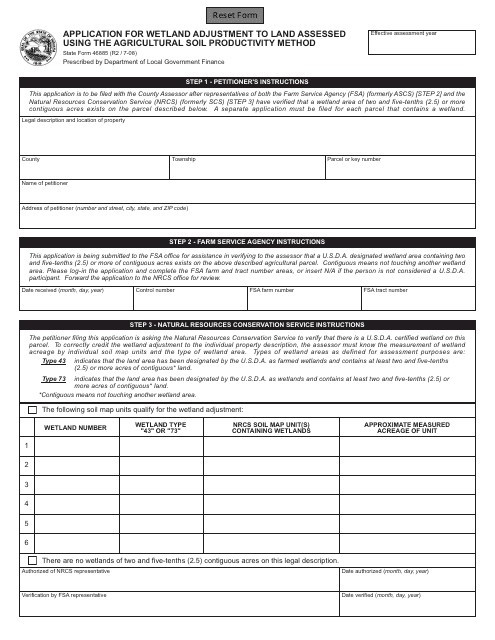

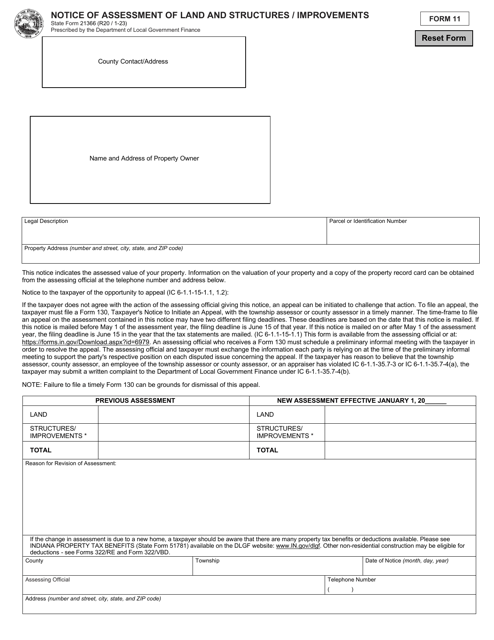

This form is used for applying for wetland adjustment to land assessed using the agricultural soil productivity method in the state of Indiana.

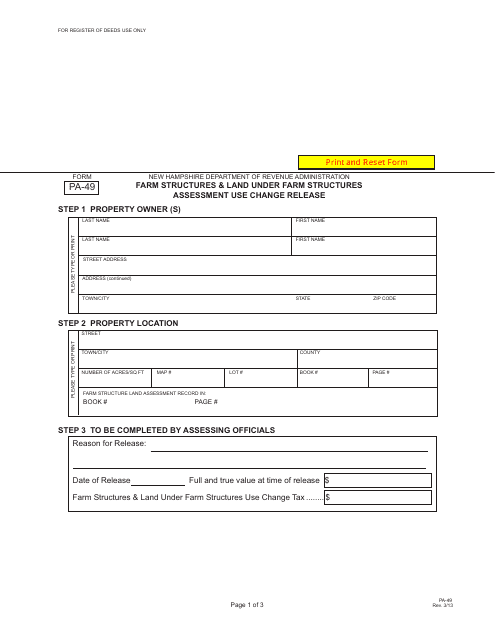

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.

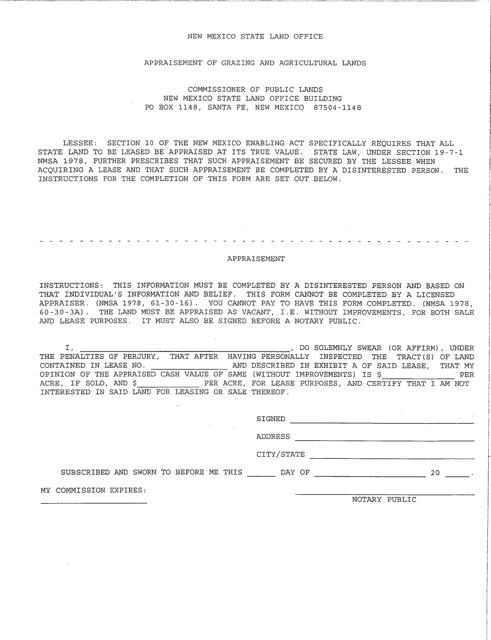

This document is used for appraising grazing and agricultural lands in the state of New Mexico. It provides a valuation of these types of properties for assessment and taxation purposes.

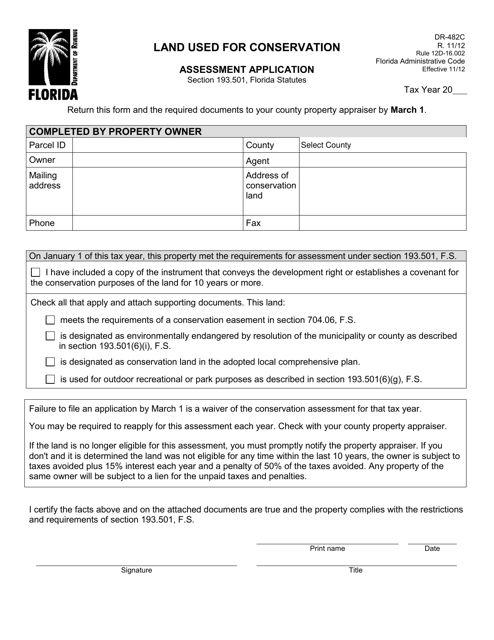

This form is used for applying for a conservation assessment on land in Florida. It is used to assess the property's eligibility for a reduced tax assessment based on conservation use.

This form is used for notifying a change in the current use assessment in New Hampshire. It is used by property owners to inform the authorities about any changes in the use of their land for tax assessment purposes.

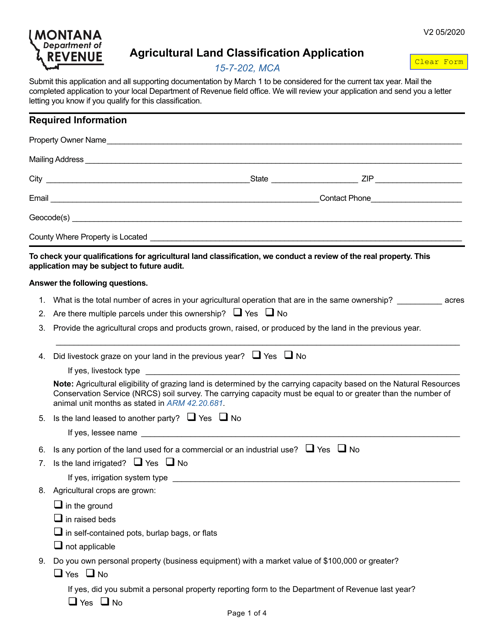

This Form is used for applying for agricultural land classification in Montana.

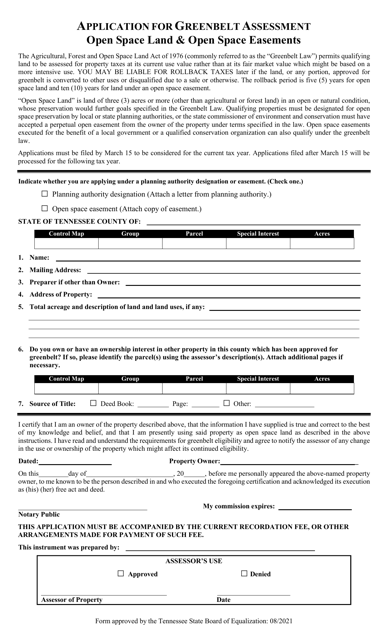

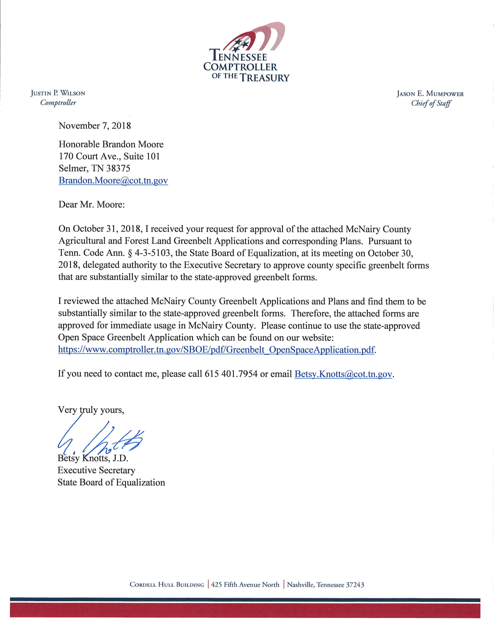

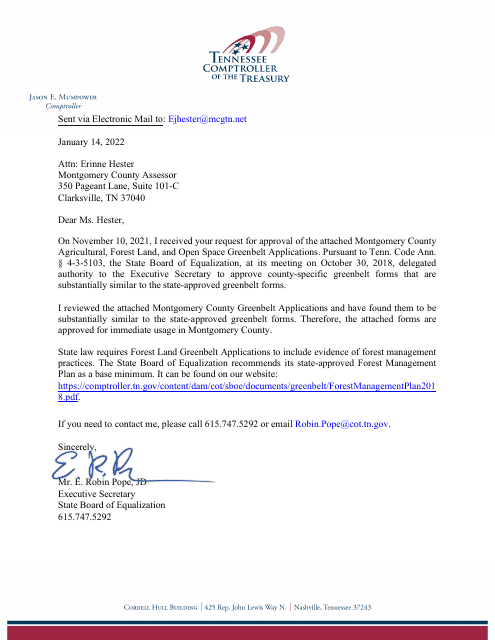

This form is used for applying for a greenbelt assessment in McNairy County, Tennessee. Greenbelt assessment is a program that provides property tax incentives for landowners who maintain agricultural or forested land. By applying for this assessment, landowners can potentially lower their property taxes.

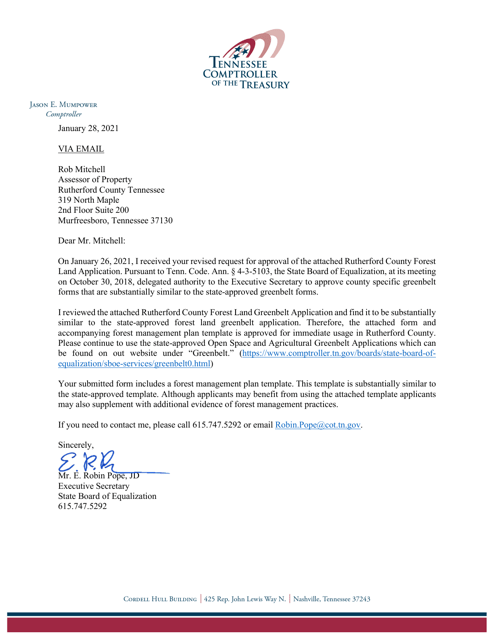

This form is used for applying for a greenbelt assessment in Rutherford County, Tennessee. It allows property owners to seek a reduced property tax rate for land used for agriculture, forestry, or open space.

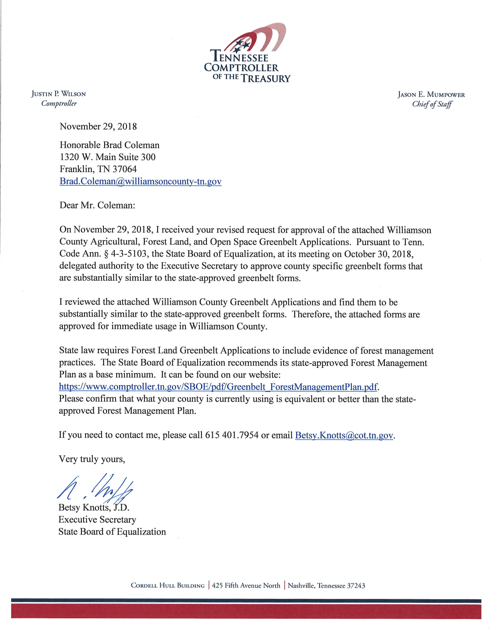

This document is used for applying for a Greenbelt Assessment in Williamson County, Tennessee.

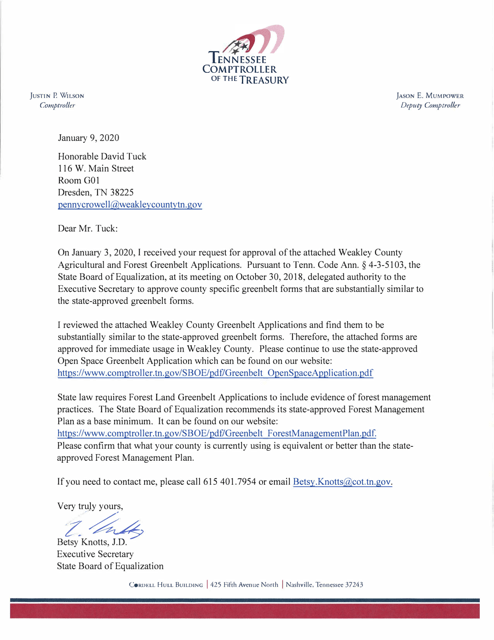

This document is for applying for a Greenbelt assessment in Weakley County, Tennessee. Greenbelt assessment is a program that aims to provide property tax relief for landowners who maintain their land in agricultural or forestry use. This application allows landowners to be considered for reduced property taxes based on the greenbelt assessment criteria.

This form is used for applying for Farm Use Assessment in Prince Edward Island, Canada. It is necessary for farmers to receive tax assessment benefits for agricultural use of their land.

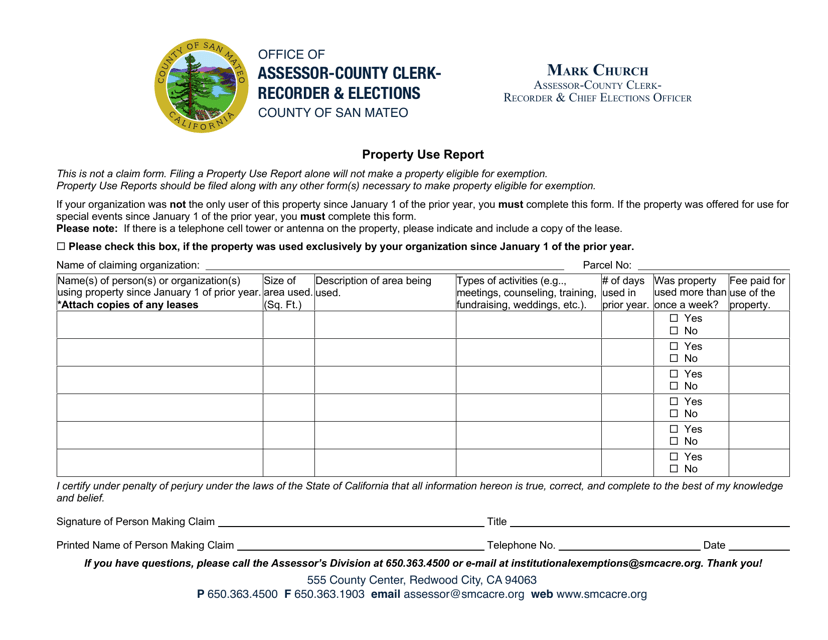

This document provides a report on the use of properties in San Mateo County, California. It gives information about how the properties are being used and can be useful for research or planning purposes.

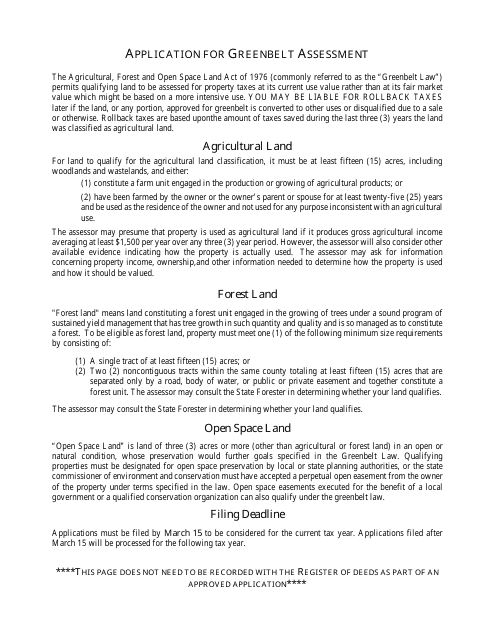

This Form is used for applying for a Greenbelt Assessment in the state of Tennessee. Greenbelt Assessment allows eligible agricultural, forest, or open land to be appraised at its current use value rather than its market value for property tax purposes.

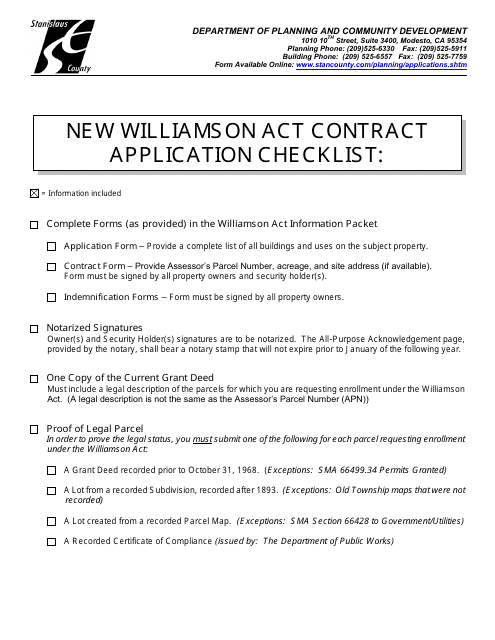

This form is used for applying for a new Williamson Act contract in Stanislaus County, California. The Williamson Act is a state law that provides property tax reductions for agricultural land in exchange for longer-term commitments to maintain the land for agricultural purposes.

This Form is used for applying for a boundary amendment of an existing Florida Forever project in Florida. It allows individuals or organizations to request changes to the designated boundaries of a project under the Florida Forever program, which aims to conserve and protect environmentally significant lands in the state.