Composite Income Tax Templates

Composite income tax, sometimes referred to as composite income tax return, is a type of tax system that allows pass-through entities, such as partnerships or S-corporations, to file a single tax return on behalf of their nonresident owners or shareholders. This streamlines the tax filing process by consolidating the tax liability for these nonresident individuals into a single return.

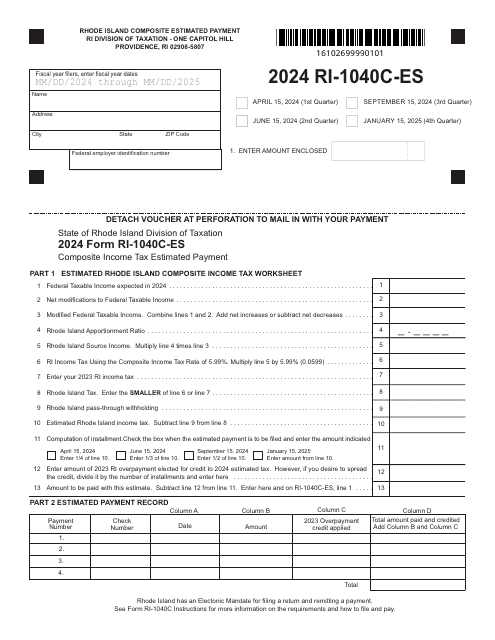

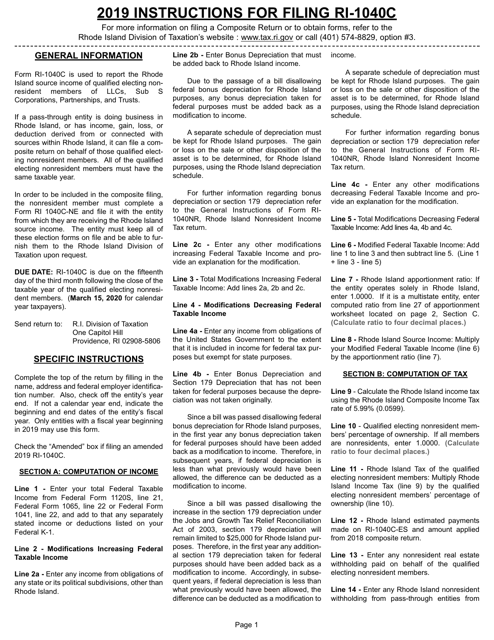

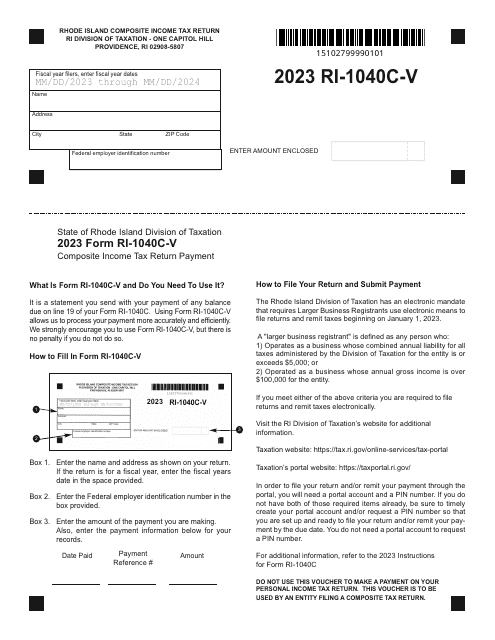

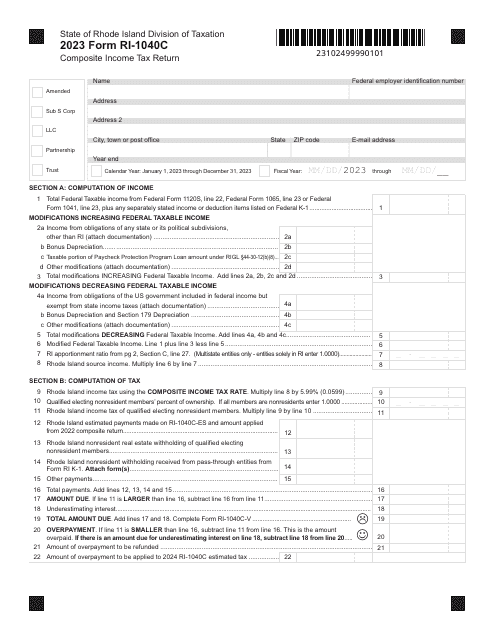

The composite income tax process can be complex and may vary from state to state. It typically involves the completion of specific forms and the payment of estimated taxes. For instance, in Rhode Island, nonresident individuals may need to use Form RI-1040C to report and pay their composite income tax liability. They can also use Form RI-1040C-V to make their composite income tax payment. Additionally, nonresident owners in Rhode Island may need to file Form RI-1040C-ES to submit estimated tax payments throughout the year. This ensures that the taxes are paid in a timely manner and avoids any penalties.

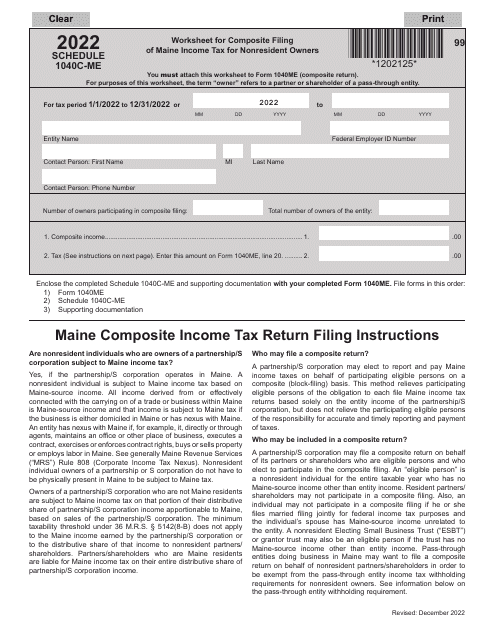

Maine, on the other hand, utilizes Schedule 1040C-ME, a worksheet specifically designed to assist nonresident owners in the filing of their composite income tax return. This worksheet helps determine the correct amount of tax due based on the individual's share of income derived from Maine sources.

Filing composite income tax returns not only simplifies the tax process for nonresident owners or shareholders but also helps in avoiding the need for these individuals to file individual tax returns in multiple states. This can save time, effort, and potentially reduce the overall tax burden.

If you are a pass-through entity with nonresident owners or shareholders, understanding and complying with the rules and regulations surrounding composite income tax is crucial. Consulting with a tax professional or utilizing online resources can help ensure accurate and efficient filing, while minimizing the risk of errors or penalties.

Documents:

17

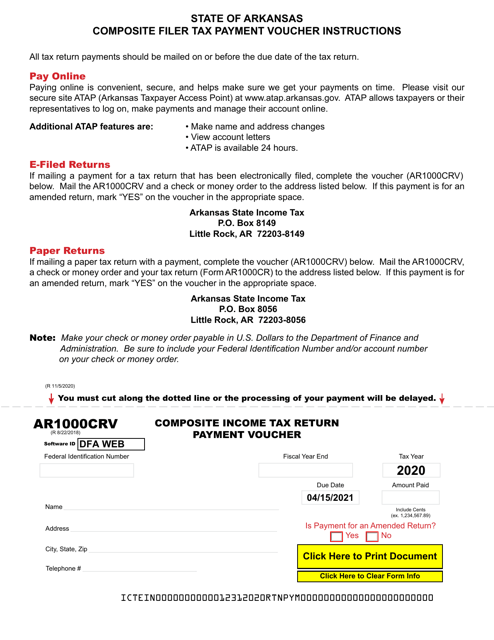

This Form is used for making payment for the Arkansas Composite Income Tax Return.

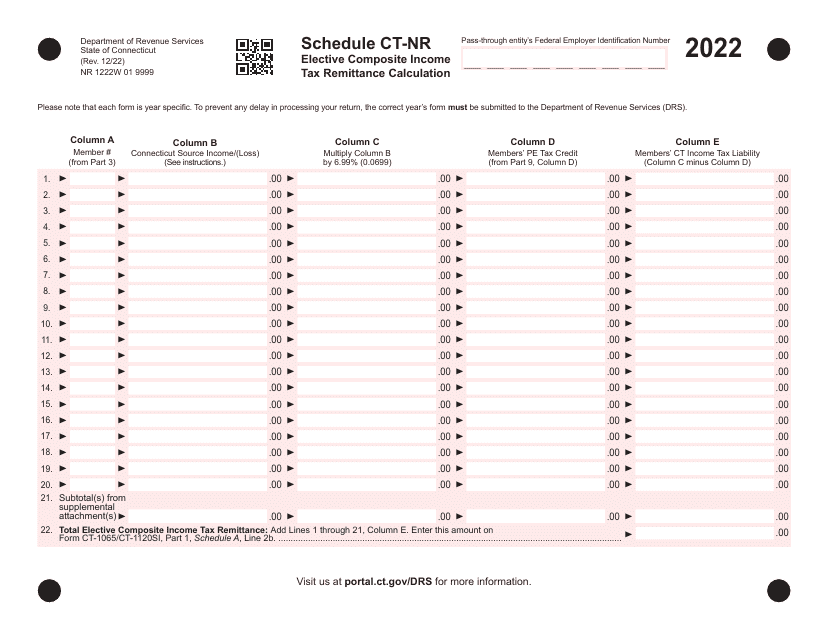

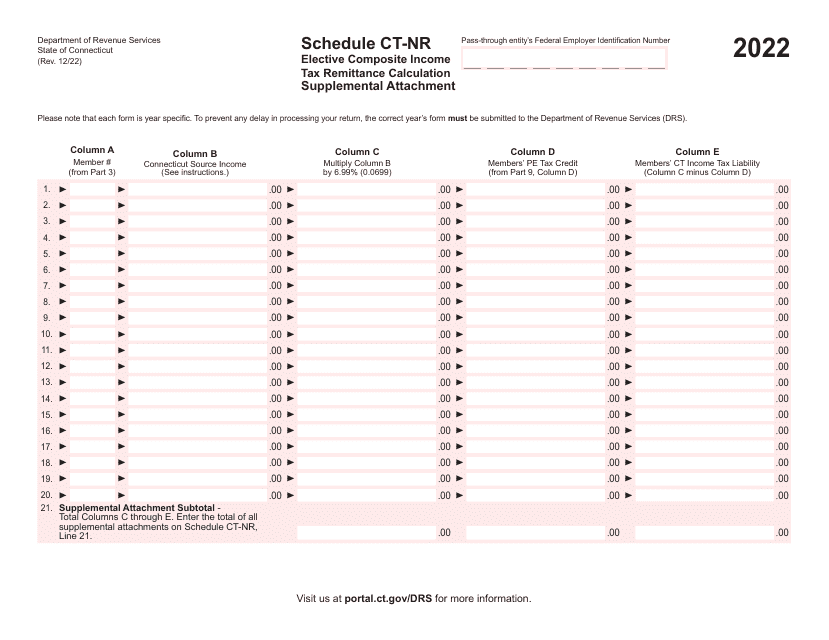

This document is a supplemental attachment used for the calculation of elective composite income tax remittance in Connecticut. It is used in conjunction with Schedule CT-NR.

This type of document is used for completing the Schedule 1040C-ME worksheet in Maine for nonresident owners who need to file composite income tax.