Resident Credit Templates

Resident Credit Forms

Looking to claim your resident credit against separate tax on lump-sum distributions in New York State? Or perhaps you are eligible for the New York State Resident Credit but do not know where to start? Our resident credit forms and resources are here to help.

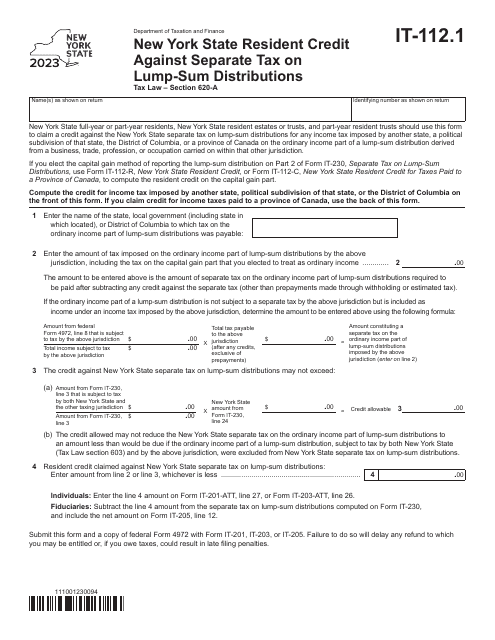

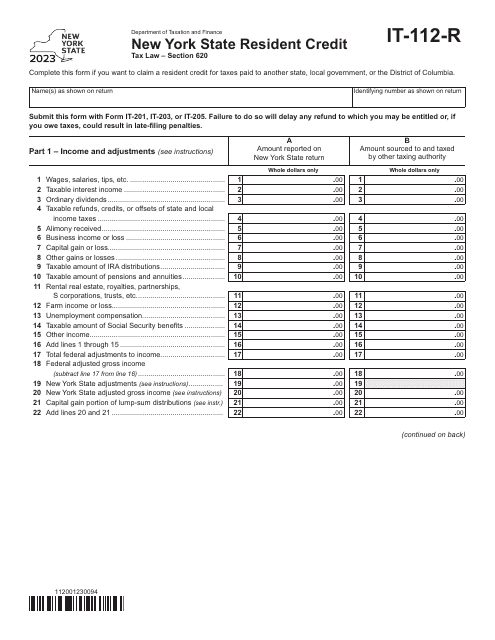

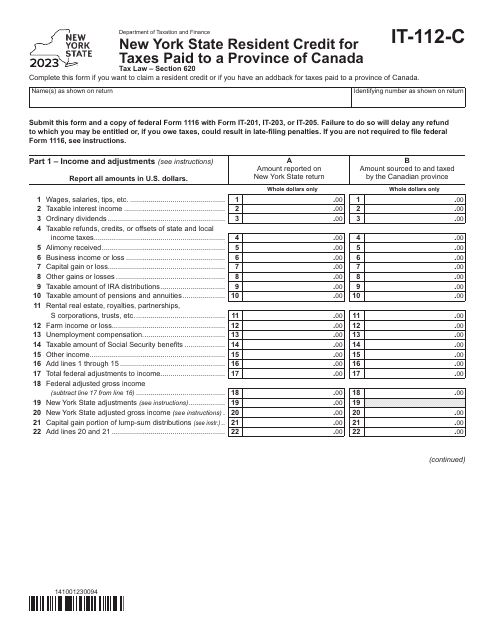

At Templateroller.com, we understand that navigating the complexities of resident credit can be overwhelming. That's why we offer a collection of resident credit forms, including Form IT-112.1 and Form IT-112-R for New York residents. These forms are designed to assist you in properly claiming your resident credit and ensuring compliance with state regulations.

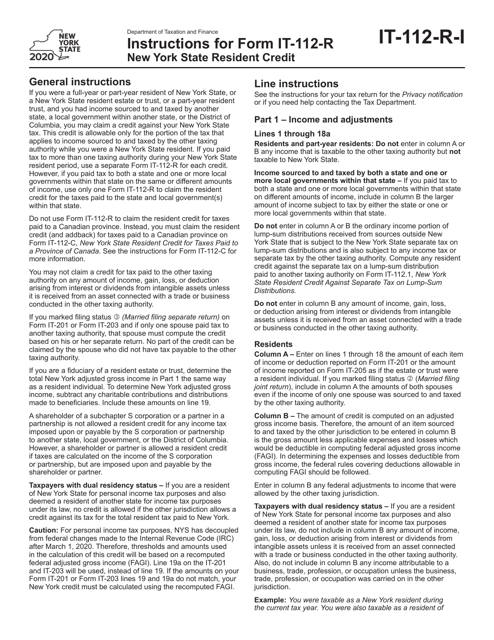

Our resident credit forms provide a streamlined approach to accurately calculate and report your entitled resident credit. With easy-to-follow instructions, you can confidently complete the forms and maximize your potential credit. We also offer additional resources such as detailed instruction guides for Form IT-112-R, providing further clarification and answering common questions.

Whether you are an individual taxpayer or a tax professional assisting clients with resident credit claims, our resident credit forms and resources are essential tools for ensuring accuracy and compliance. Don't let the complexities of resident credit deter you from claiming what you are entitled to. Explore our resident credit forms and resources today and simplify the process of claiming your resident credit against separate tax on lump-sum distributions in New York State.

--