Income Allocation Templates

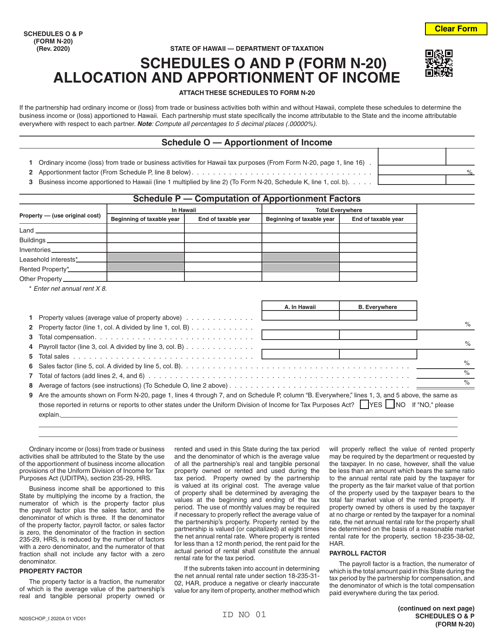

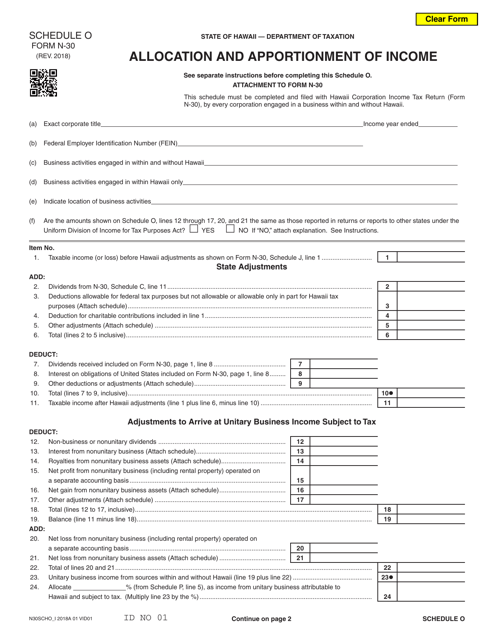

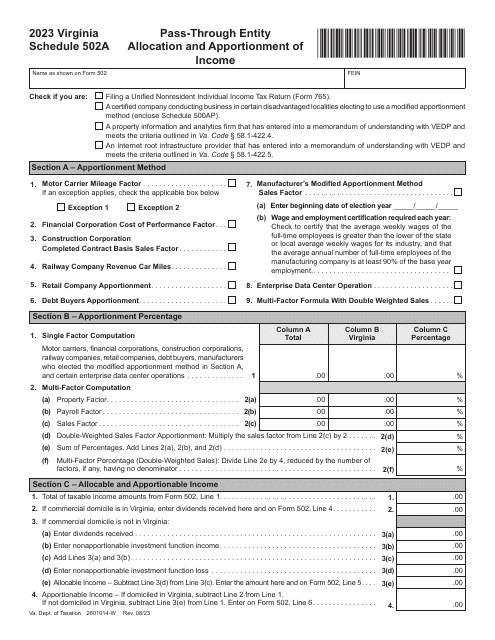

Are you looking for a way to accurately allocate your income? Our income allocation documents provide a comprehensive solution for individuals and businesses alike. With a range of forms and worksheets from various jurisdictions, our collection covers all your income allocation needs.

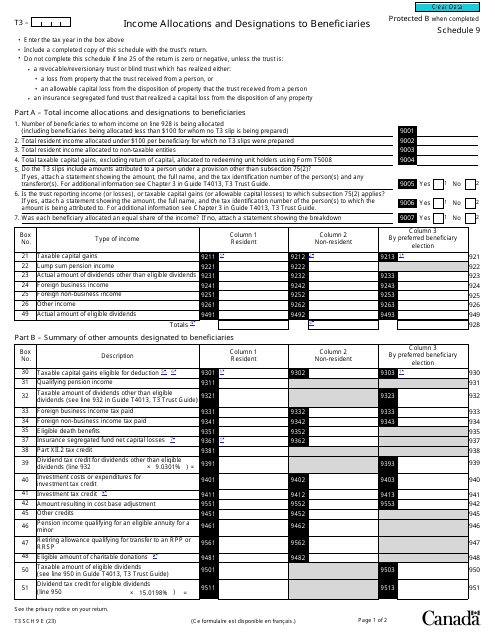

Also known as income allocations, our documents are designed to assist you in accurately calculating and distributing your income. From determining estate nonresident credits to summarizing trust income allocations, our forms cover a wide range of financial scenarios.

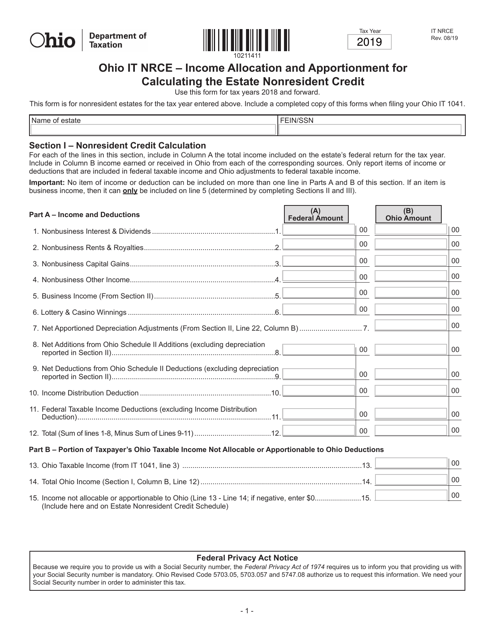

Take, for example, the "Form IT NRCE Income Allocation and Apportionment for Calculating the Estate Nonresident Credit" from Ohio. This document helps estate owners calculate the portion of their income that can be credited as nonresident income.

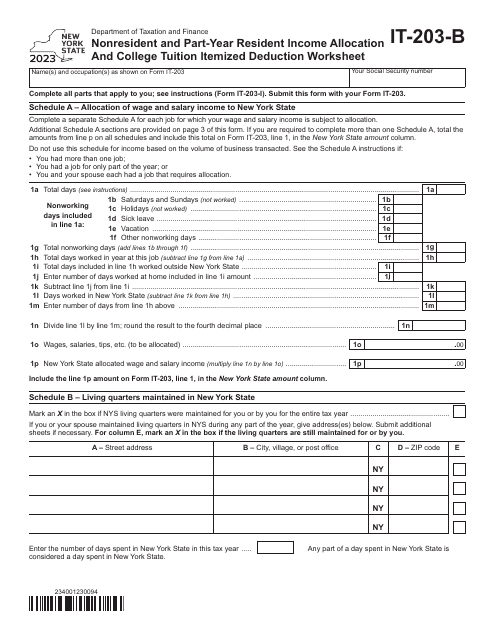

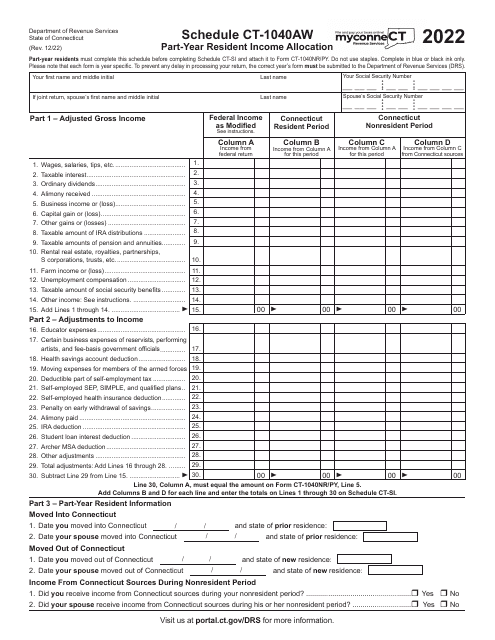

If you're a resident or part-year resident, our collection includes resources like the "Schedule CT-1040AW Part-Year Resident Income Allocation" from Connecticut and "Form IT-203-B Nonresident and Part-Year Resident Income Allocation and College TuitionItemized Deduction Worksheet" from New York. These forms assist individuals in accurately allocating their income based on their residency status.

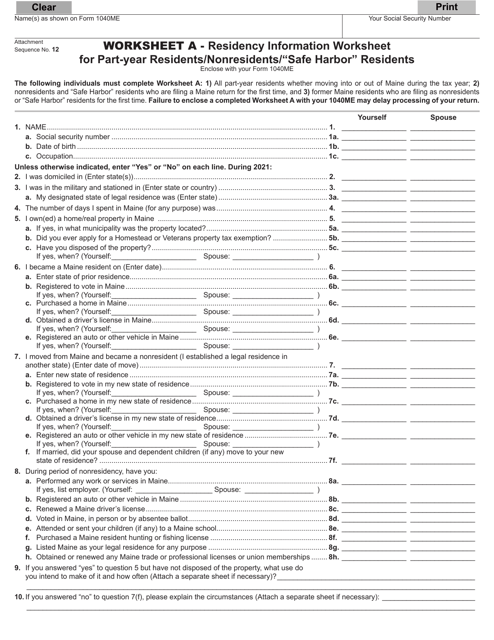

We understand that income allocation can be a complex process, especially for individuals with unique circumstances. That's why our collection also includes specialized worksheets like the "Form 1040ME Worksheet A, B Residency Information Worksheet and Income Allocation Worksheet" from Maine. Whether you're a part-year resident or a "safe harbor" resident, this worksheet helps you determine the appropriate allocation for your income.

In addition to these examples, we have a wide range of income allocation documents from various jurisdictions, available in both English and French. Our collection is constantly updated to ensure the most accurate and up-to-date resources for income allocation.

No matter your income allocation needs, our comprehensive collection of documents has you covered. Improve your financial accuracy and ensure compliance with our reliable income allocation forms and worksheets.

Documents:

31

This form is used for calculating the estate nonresident credit in Ohio by allocating and apportioning income.

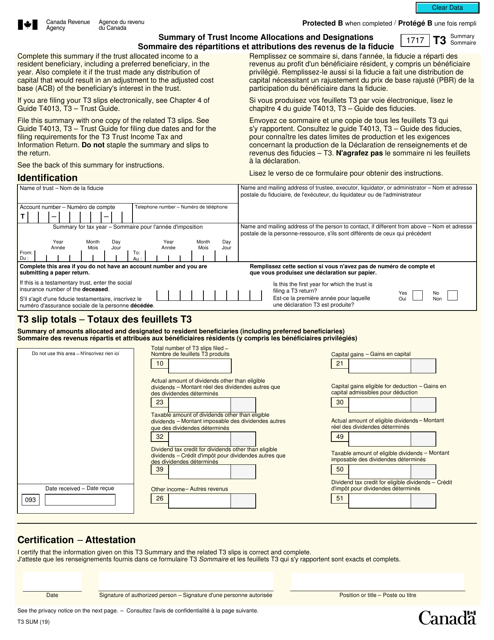

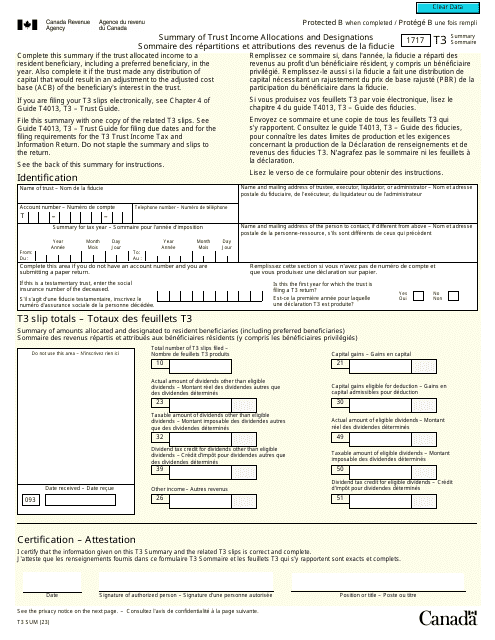

This form is used for summarizing trust income allocations and designations in Canada. It is available in both English and French.

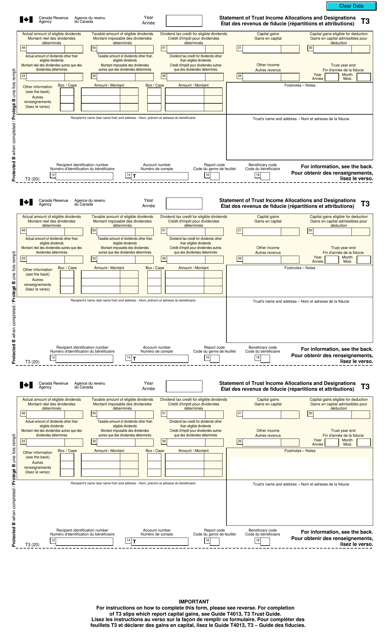

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

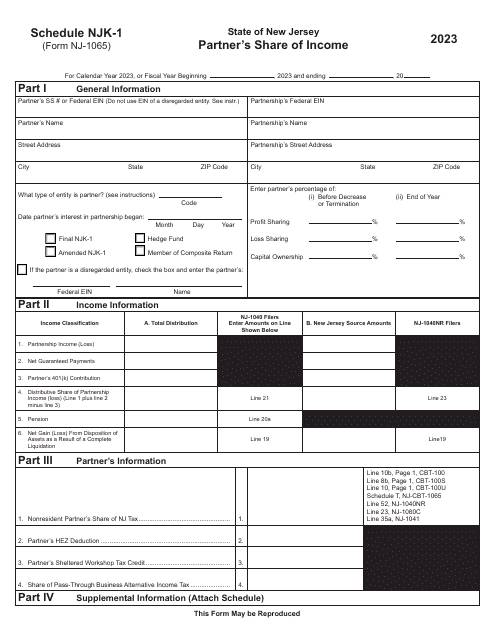

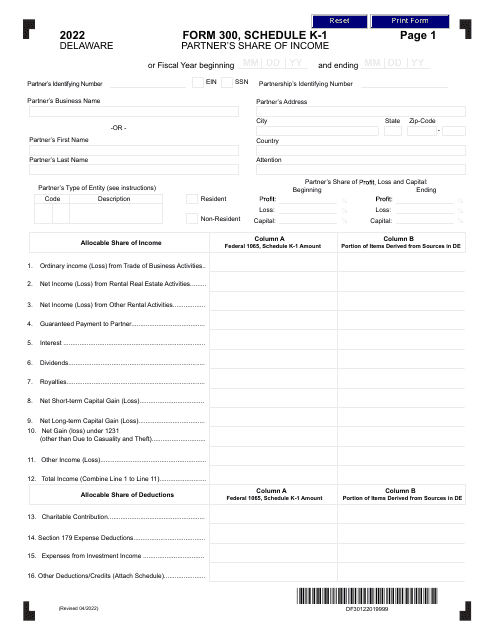

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

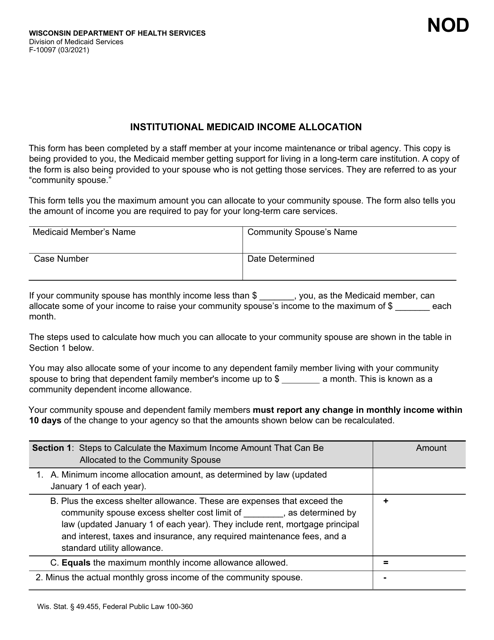

This form is used for allocating institutional Medicaid income in the state of Wisconsin.

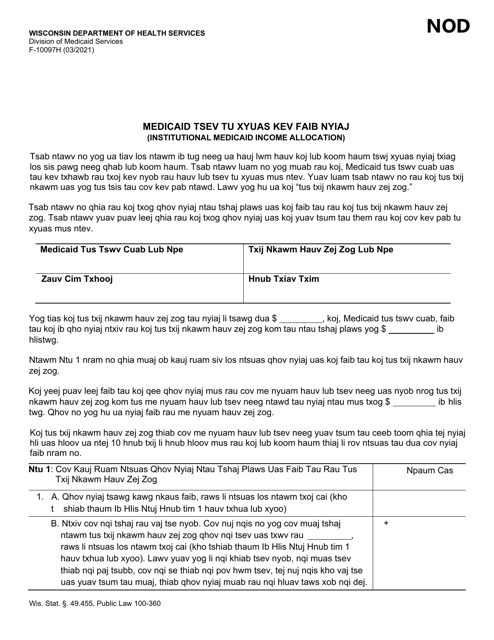

This Form is used for allocating income for institutional Medicaid in Wisconsin for individuals who speak Hmong.

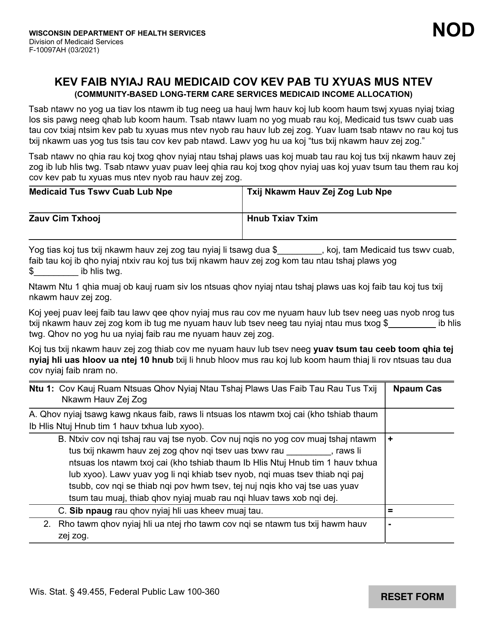

Form F-10097A Community-Based Long-Term Care Services Medicaid Income Allocation - Wisconsin (Hmong)

This Form is used to allocate Medicaid income for community-based long-term care services in Wisconsin for individuals of Hmong background.

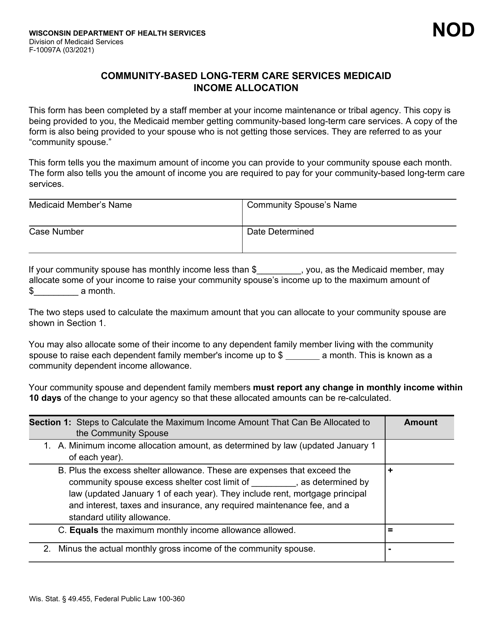

This document is used for allocating income for individuals receiving community-based long-term care services under the Wisconsin Medicaid program.

This form is used for determining residency information and income allocation for individuals who are part-year residents, nonresidents, or "safe harbor" residents in the state of Maine.