Federal Tax Credit Templates

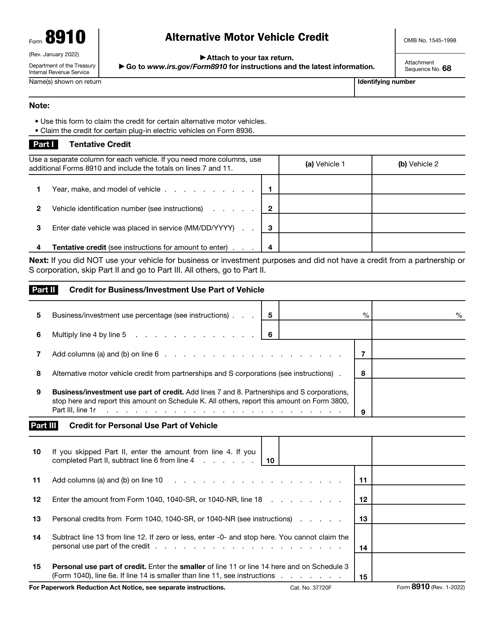

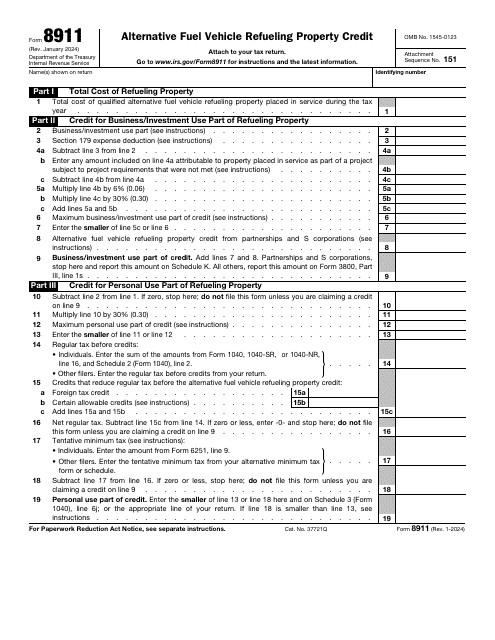

Are you looking for ways to save on your federal taxes? Look no further than the world of federal tax credits. These credits are available to individuals and businesses alike, offering substantial savings on your tax bill. From credits for federal tax paid on fuels to credits for electric vehicles and alternative motor vehicles, the federal tax credit system is designed to incentivize specific behaviors that contribute to a greener, more sustainable future.

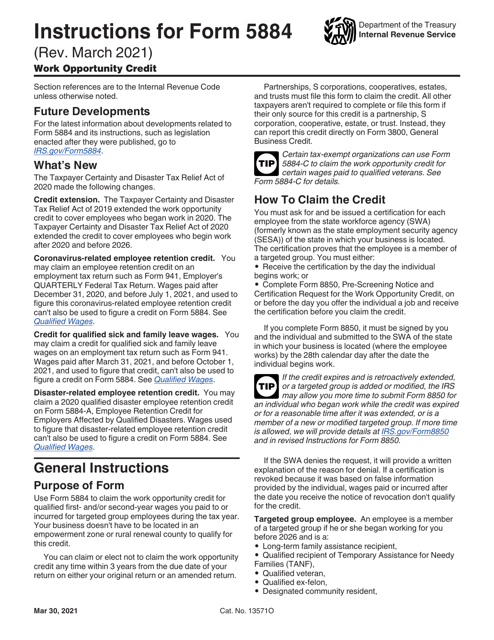

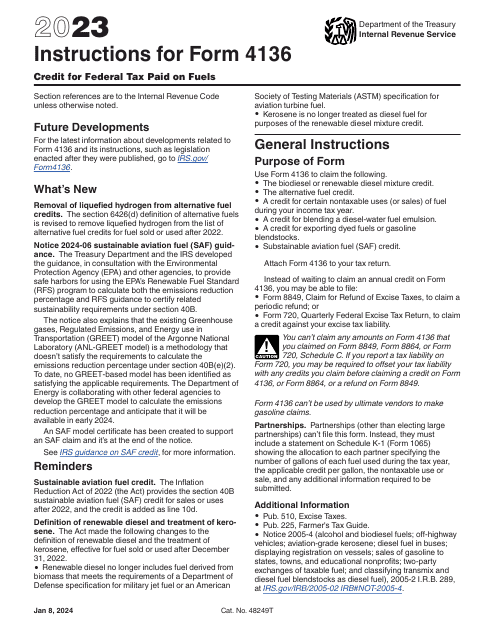

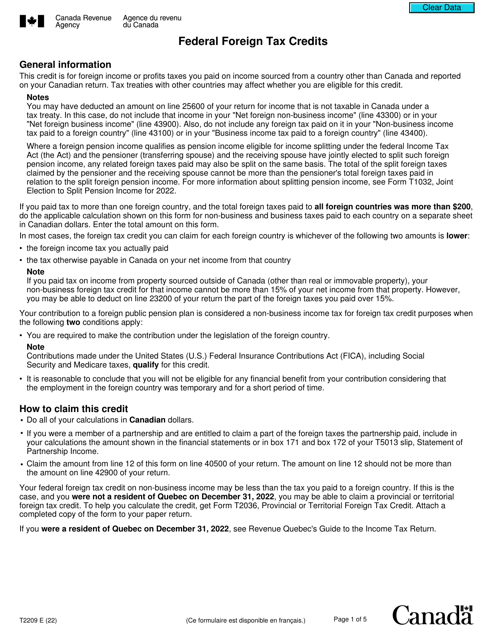

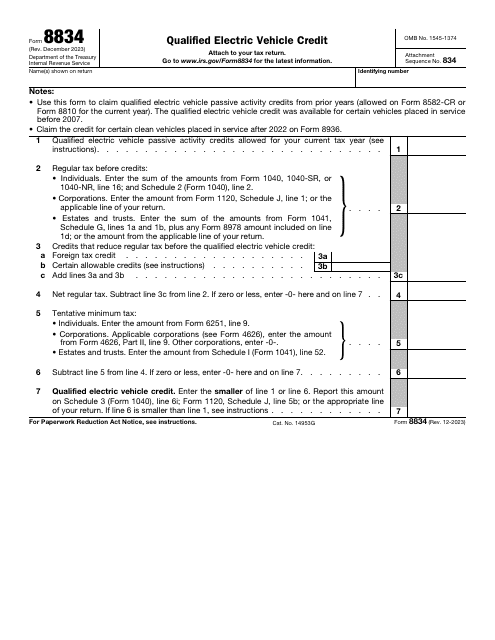

The federal tax credit program is administered by the IRS and includes a wide range of credits that you may be eligible for. For example, if you've paid federal taxes on fuels, there's a credit available to help offset those costs. Likewise, if you've purchased a qualified electric vehicle, there's a credit for that too. The same goes for alternative motor vehicles - if you've made the switch to a cleaner, more fuel-efficient option, you could be eligible for a credit.

Understanding the ins and outs of the federal tax credit program can be overwhelming, but we're here to help. Our comprehensive collection of resources includes forms, instructions, and checklists to help you navigate the process with ease. Whether you're an individual taxpayer or a business owner, we have the information you need to take advantage of these valuable credits.

With our extensive library of documents, you'll find everything you need to know about federal tax credits. Our resources cover the various types of credits available, the eligibility requirements, and step-by-step instructions on how to claim them. We understand that the tax code can be complex, but our resources are designed to simplify the process and ensure you don't miss out on any potential savings.

Don't let valuable tax credits slip through your fingers. Explore our comprehensive collection of federal tax credit resources today and start saving on your taxes. With our help, you can navigate the world of federal tax credits with confidence and maximize your savings.

Documents:

11

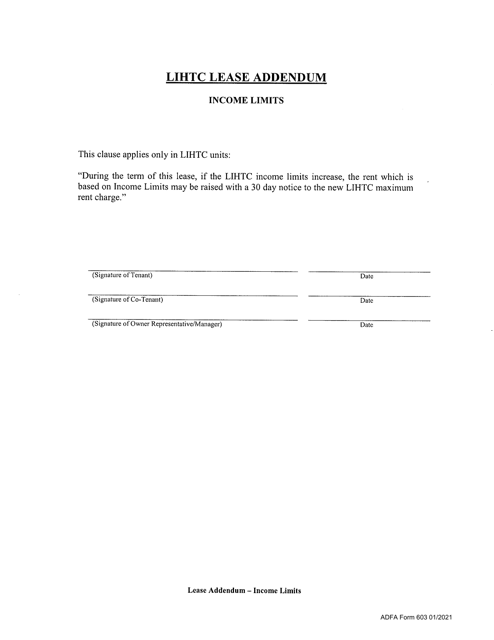

This document is a form used for adding an income limit provision to a Low-Income Housing Tax Credit (LIHTC) lease in Arkansas. It helps ensure that tenants meet the income requirements for affordable housing.

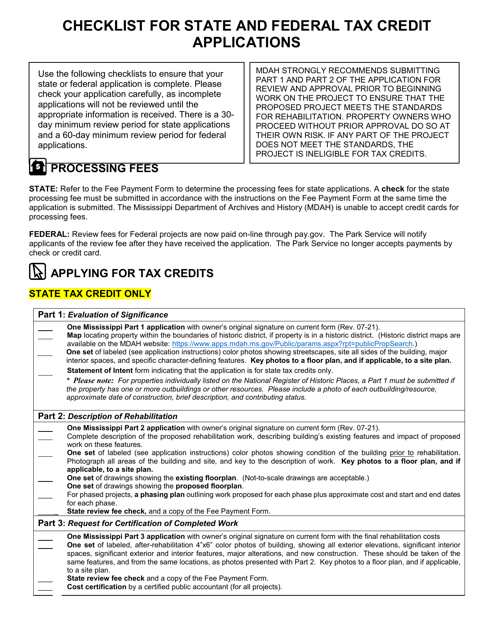

This document is a checklist for individuals in Mississippi who are applying for state and federal tax credits. It helps ensure that all necessary information and documentation are included in the application to receive tax credits.