Education Organizations Templates

Are you looking for information on education organizations or educational organizations? Perhaps you are interested in organic education or learning about nonprofit educational organizations. Regardless of what you call them, these organizations play a crucial role in the world of education.

Education organizations are dedicated to providing educational opportunities and resources to individuals of all ages and backgrounds. They can range from formal institutions, such as schools and colleges, to nonprofit organizations that focus on educational initiatives. These organizations often work towards improving the accessibility and quality of education, promoting innovation in teaching and learning, and advocating for educational equity.

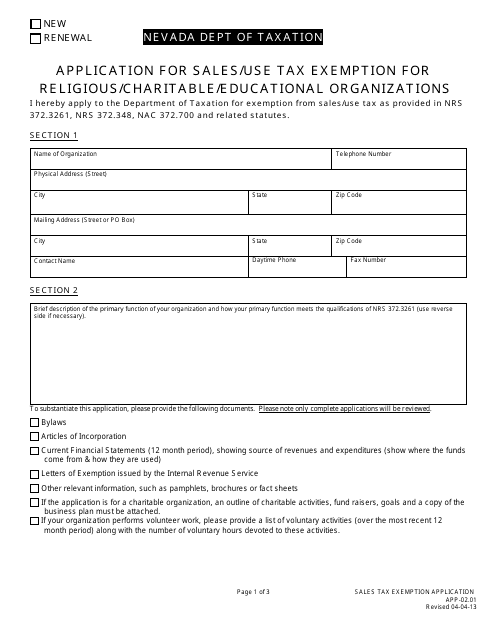

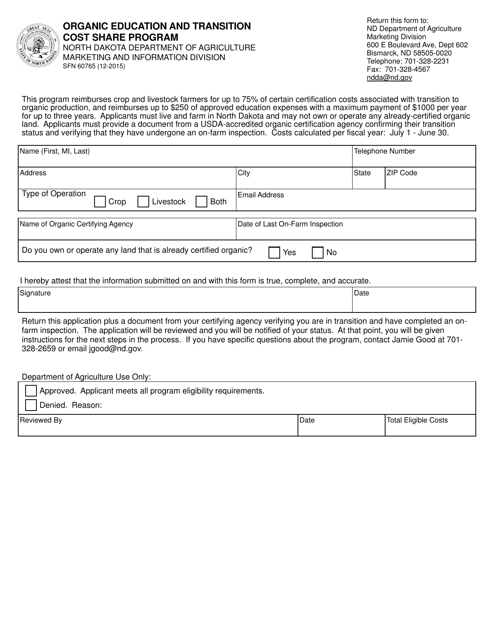

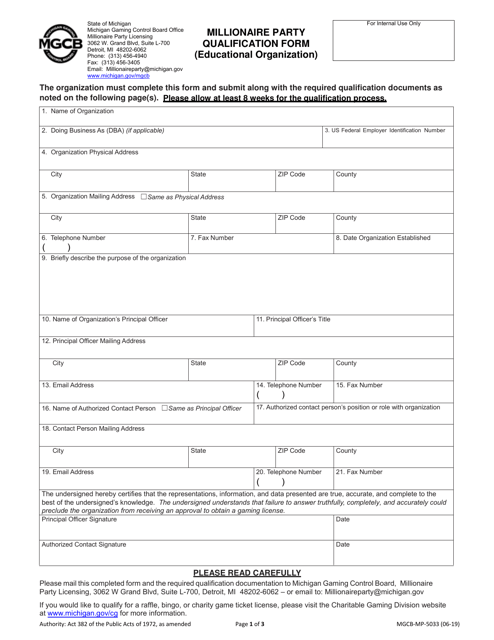

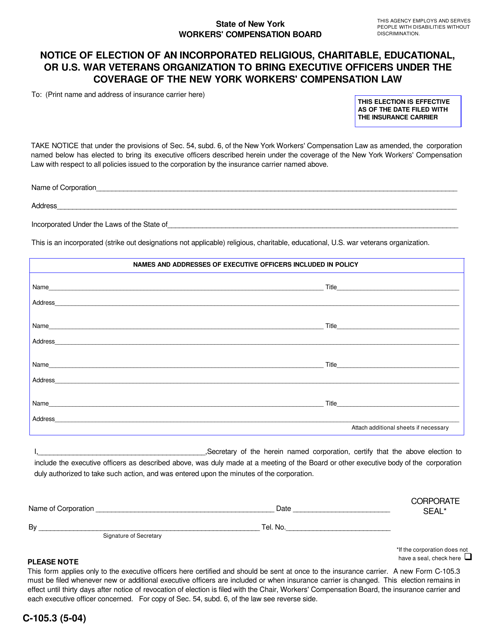

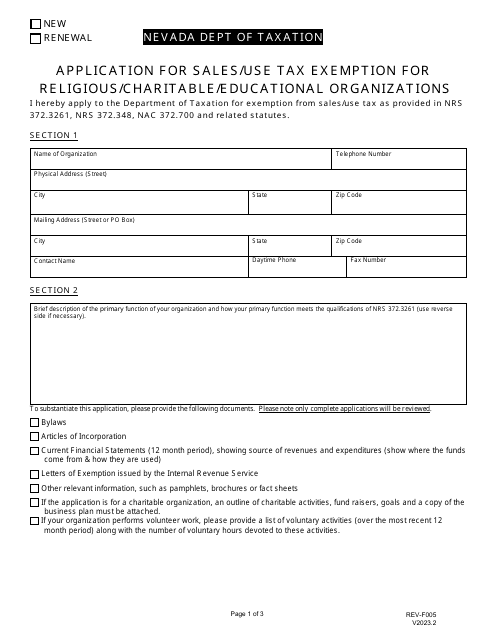

Education organizations often undergo various legal processes and documentation. Some examples of the documents you may come across include application forms for tax exemptions, such as the Form APP-02.01 Application for Sales/Use Tax Exemption for Religious/Charitable/Educational Organizations in Nevada. Other documents, like the Form SFN60765 Organic Education and Transition Cost Share Program in North Dakota, may pertain to specific educational initiatives or programs.

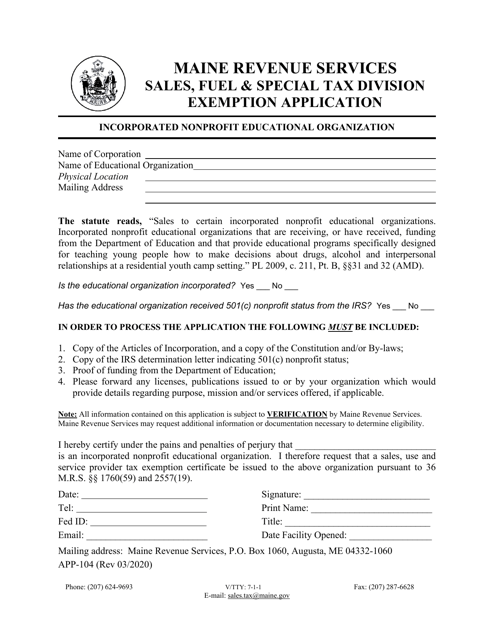

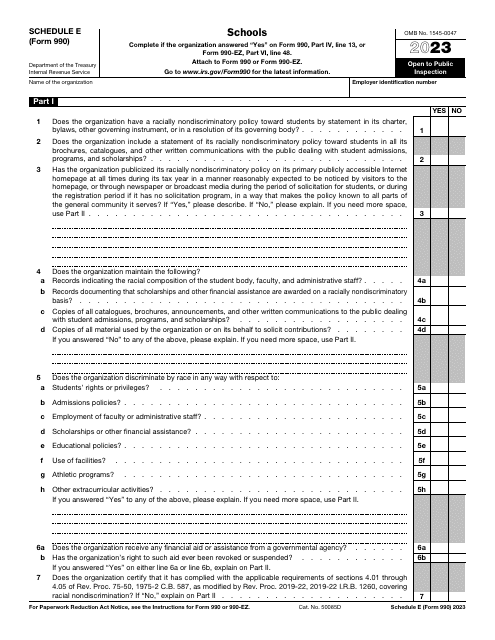

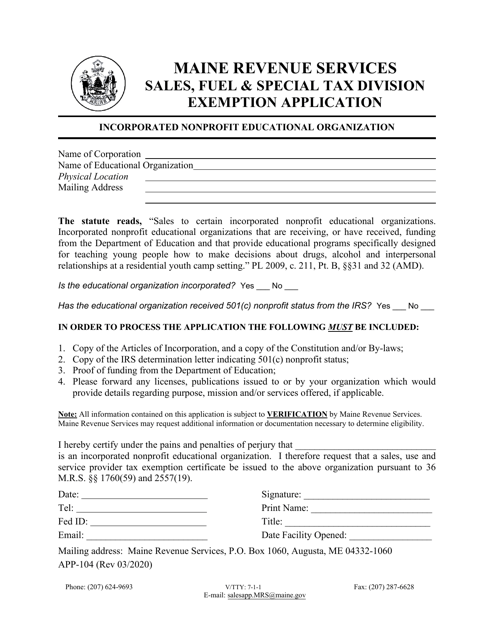

Additionally, there are documents such as the IRS Form 990 Schedule E Schools, which provide information about financial activities and compliance for nonprofit educational organizations. If you are operating a nonprofit educational organization, you may need to fill out forms like the Form APP-104 Incorporated Nonprofit Educational Organization Exemption Application in Maine.

Education organizations are essential for ensuring that educational opportunities are accessible to all. By supporting these organizations, you are contributing to the improvement of education in your community and beyond. Whether you are interested in organic education, nonprofit educational organizations, or simply want to learn more about educational initiatives, exploring these documents will provide valuable insights and resources.

Documents:

9

This form is used for religious, charitable, and educational organizations in Nevada to apply for sales and use tax exemption.

This Form is used for applying to the Organic Education and Transition Cost Share Program in North Dakota.

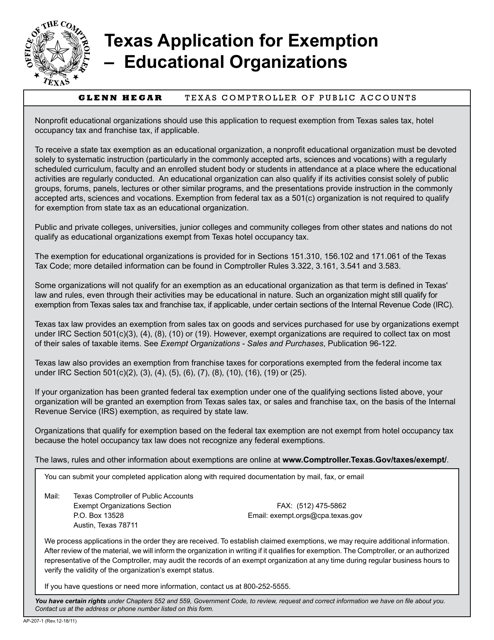

This form is used for filing an application for exemption for education organizations in Texas.

This form is used for nonprofit educational organizations in Maine that want to apply for exemption from certain taxes.

This form is used for qualifying educational organizations to host millionaire parties in the state of Michigan.

This form is used for notifying an incorporated religious, charitable, educational, or U.S. war veterans organization in New York about their election to bring executive officers under the coverage of the New York Workers' Compensation Law.

This Form is used for applying for an exemption as an incorporated nonprofit educational organization in the state of Maine.