Employee Expenses Templates

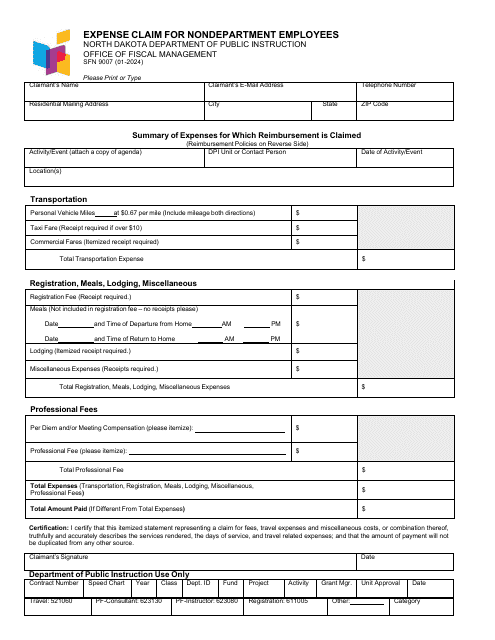

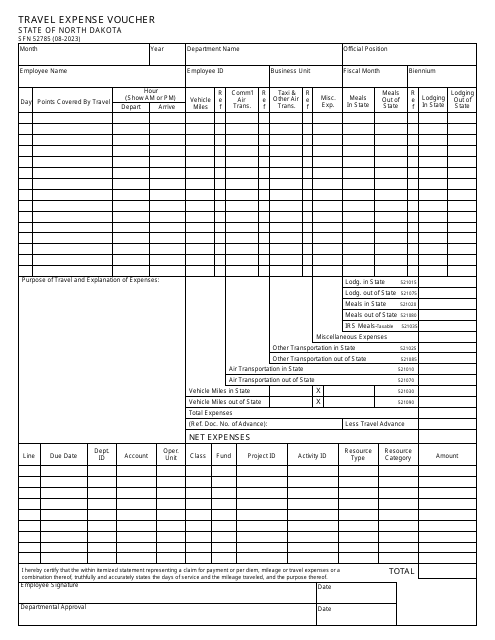

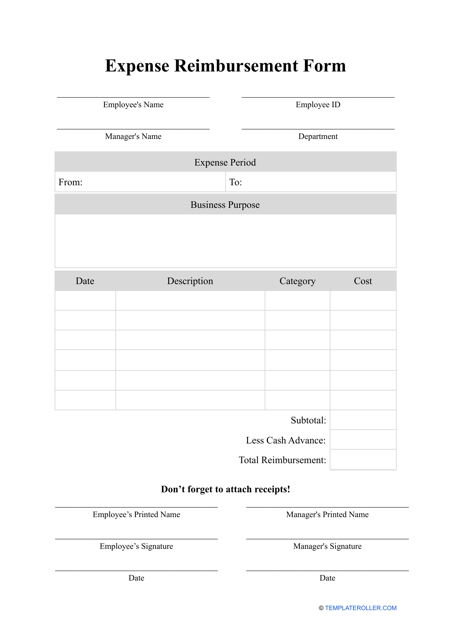

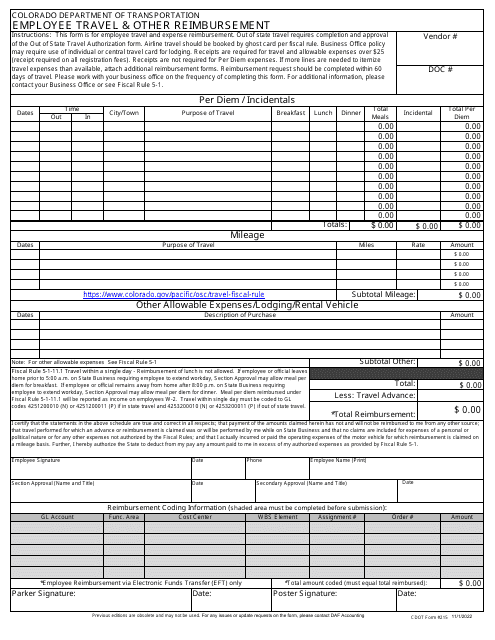

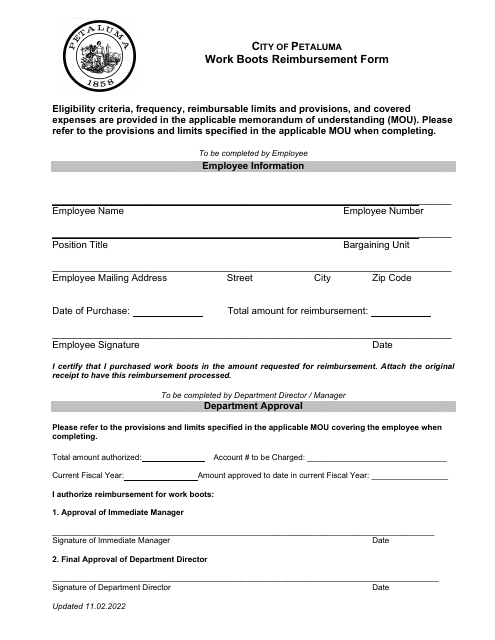

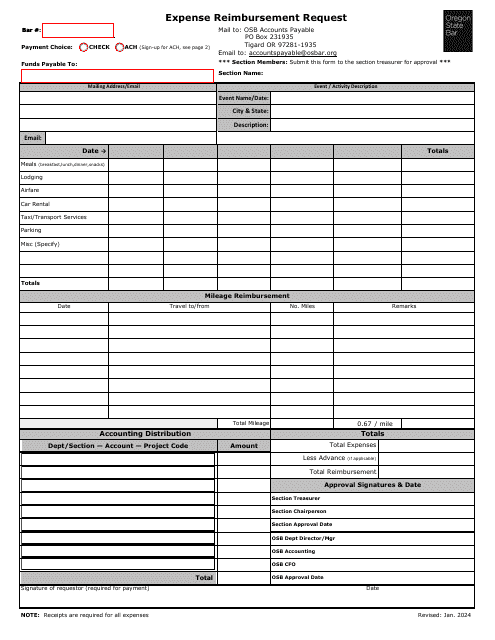

Are you an employee who often incurs expenses related to your job? If so, you may be familiar with the concept of employee expenses. Employee expenses, also known as employee expense forms, are a collection of documents that help track and reimburse any out-of-pocket expenses incurred by employees while performing their job duties.

These documents serve an important purpose, ensuring that employees are fairly compensated for expenses that are necessary for the completion of their work. By completing an employee expense form, employees can document their business-related expenses, such as travel costs, meals, and supplies. This documentation is then used by their employer or a third-party organization to review and approve the expenses for reimbursement.

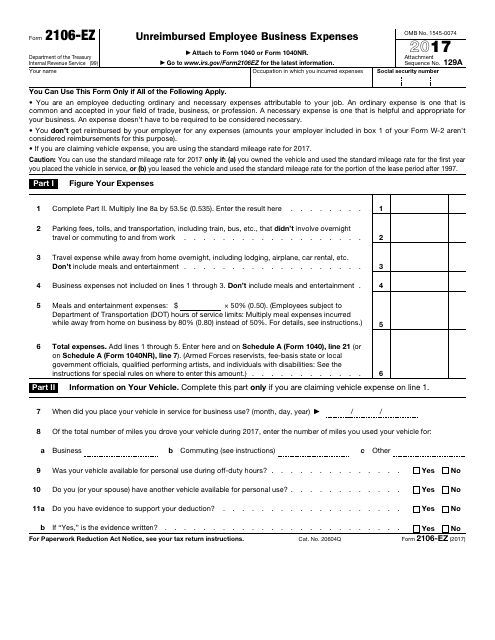

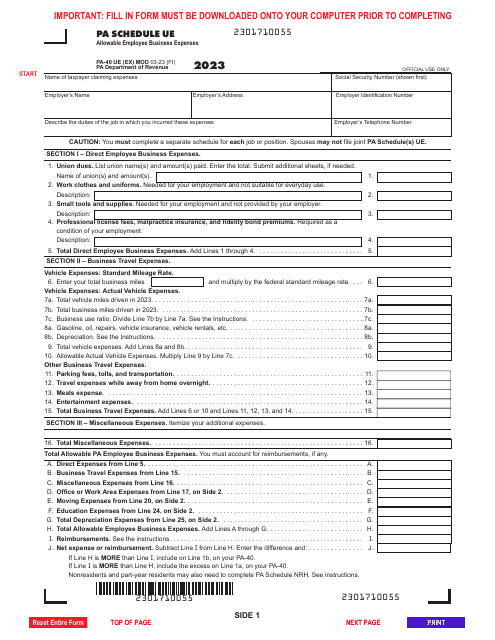

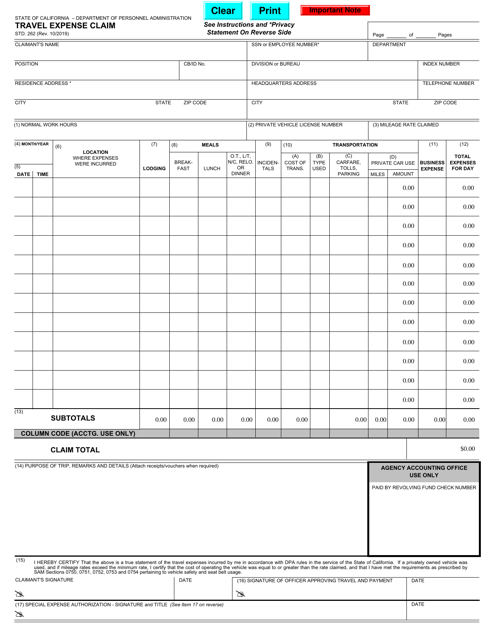

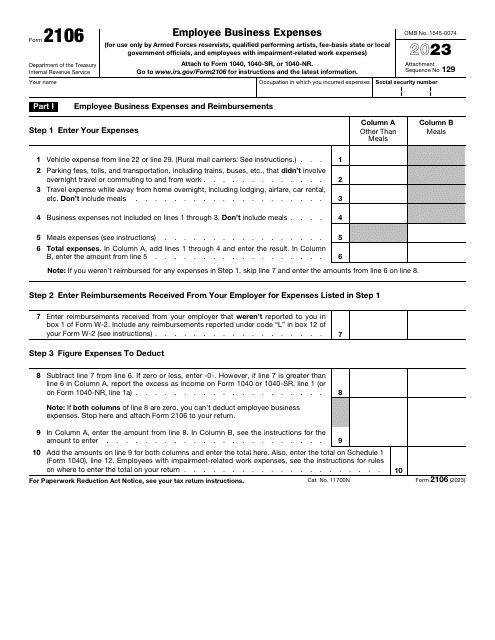

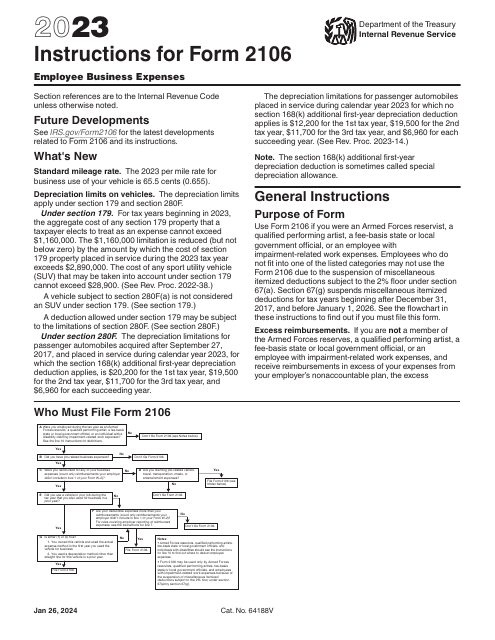

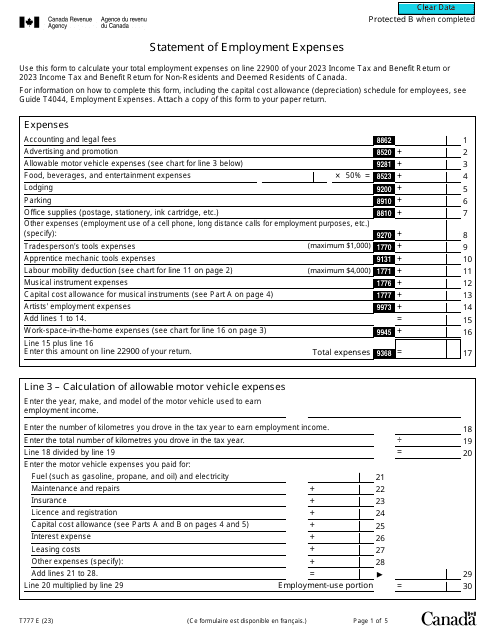

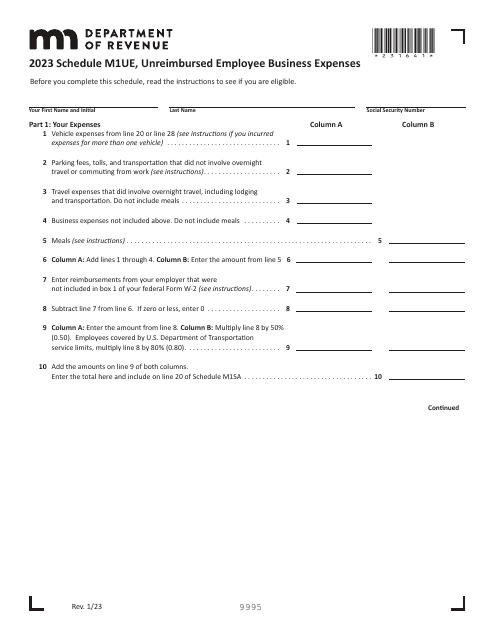

One example of an employee expense form is the IRS Form 2106-EZ for Unreimbursed Employee Business Expenses. This form is used by employees to report expenses that were not reimbursed by their employer and may be eligible for a tax deduction. Other examples include state-specific forms, such as the Authorization of Employee Expenses to Be Paid by a Third-Party Organization in Vermont or the Form PA-40 Schedule UE for Allowable Employee Business Expenses in Pennsylvania.

If you're unsure about how to properly complete these forms or what expenses are eligible for reimbursement, don't worry. Many of these documents come with detailed instructions to guide you through the process. For instance, the Instructions for IRS Form 2106 provide a step-by-step explanation of how to fill out the form and maximize your potential tax deduction.

Employee expense forms are a vital tool for both employees and employers alike. They help ensure that employees are fairly compensated for their work-related expenses, while also allowing employers to maintain accurate records and comply with tax regulations. So, whether you're an employee seeking reimbursement or an employer looking to streamline your expense tracking process, familiarize yourself with these important documents.

Documents:

24

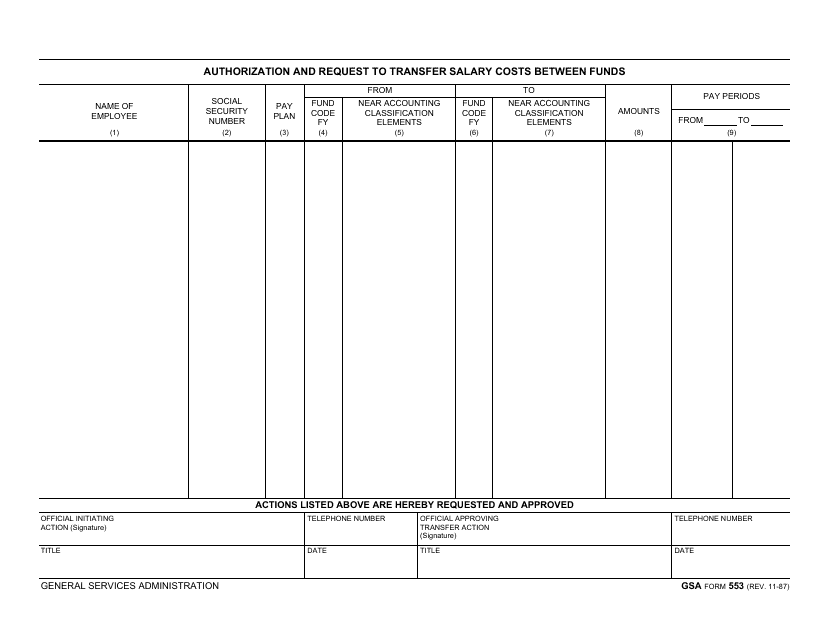

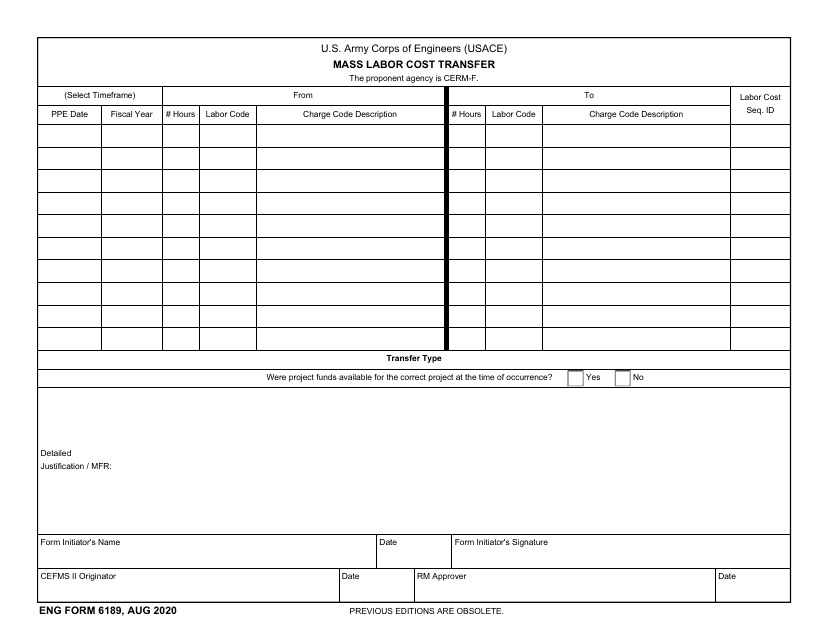

This Form is used for authorizing and requesting the transfer of salary costs between funds in the GSA (General Services Administration).

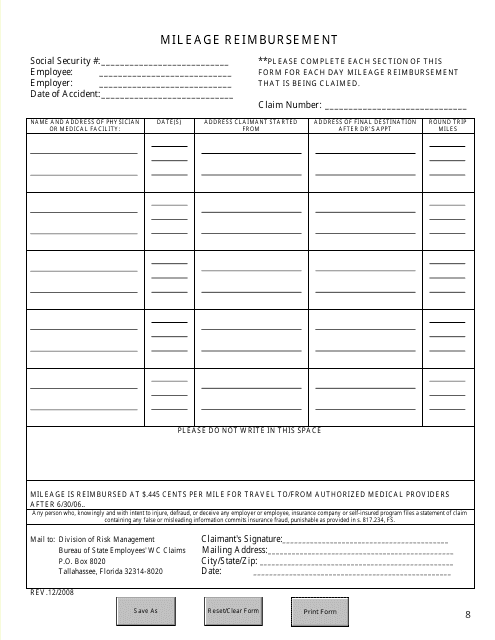

This form is used for employees in Florida to request reimbursement for mileage expenses incurred while traveling for work purposes.

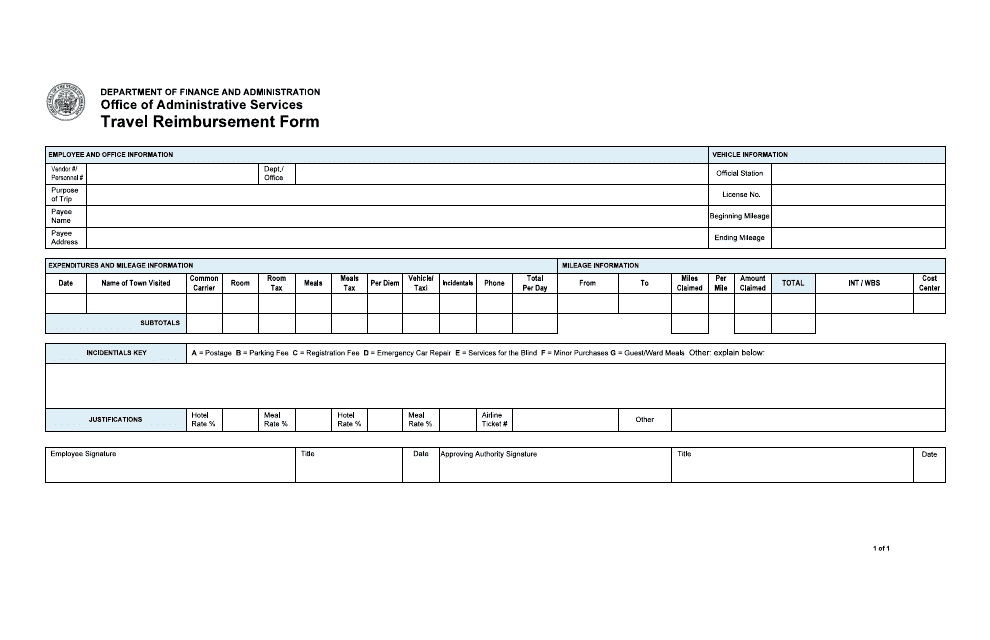

This Form is used for requesting reimbursement for travel expenses incurred during a trip to Arkansas.

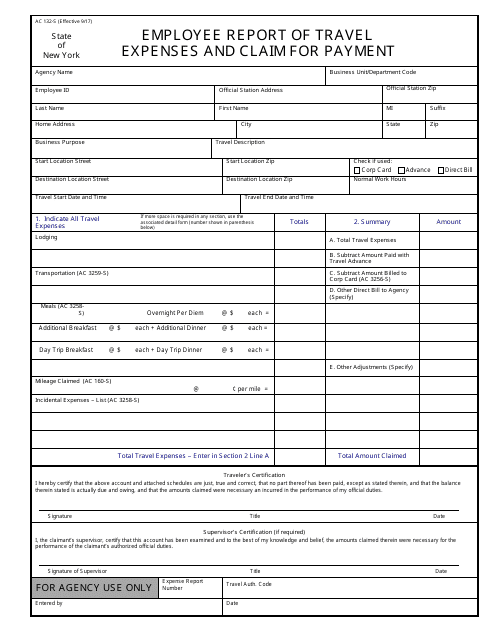

This form is used for employees to report their travel expenses and claim for payment in New York.

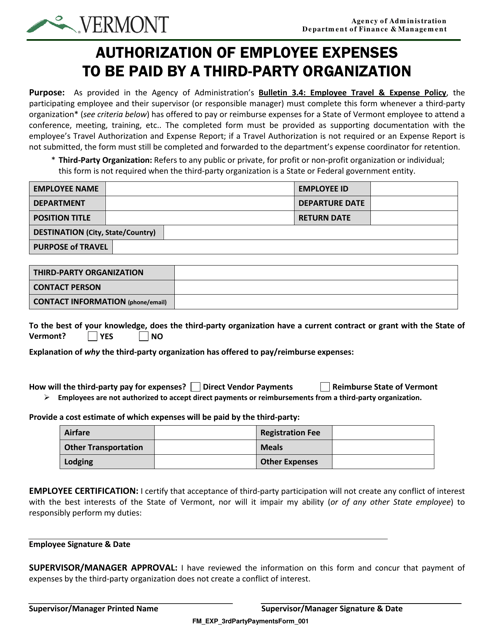

This document is used for authorizing employee expenses to be paid by a third-party organization in the state of Vermont.

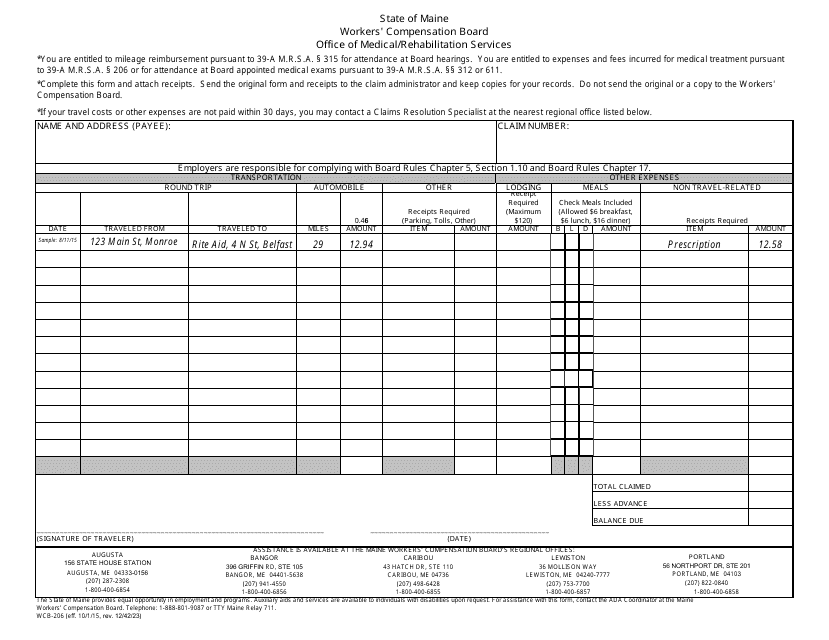

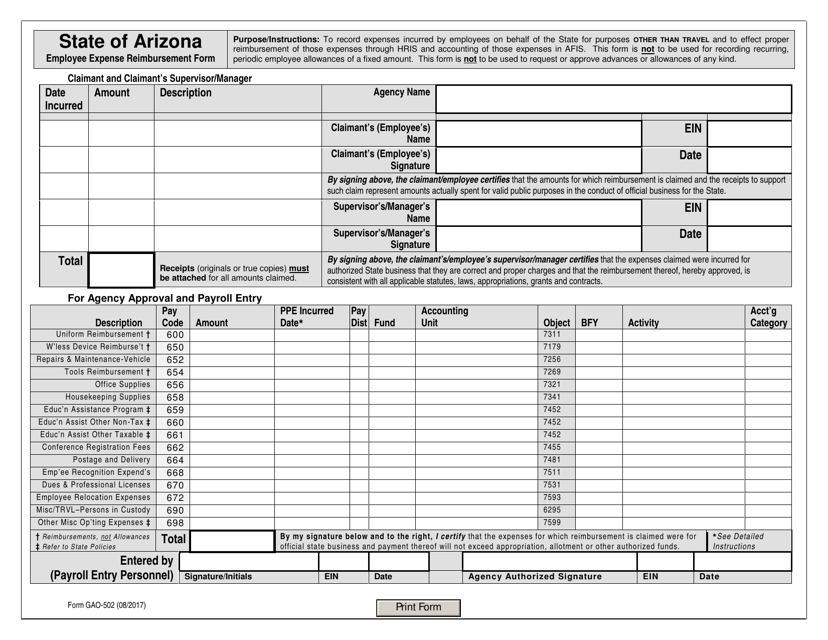

This form is used for employees in Arizona to request reimbursement for expenses incurred during work-related travel or other business expenses.

Use this form to recover back costs incurred while performing work on behalf of your employer.

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.