Trabajadores Por Cuenta Propia Templates

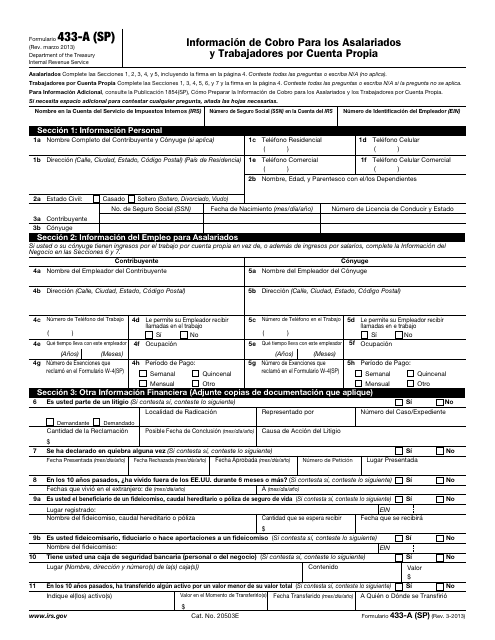

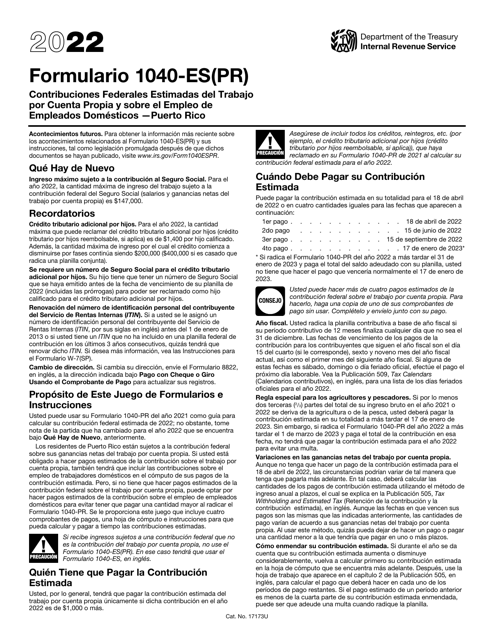

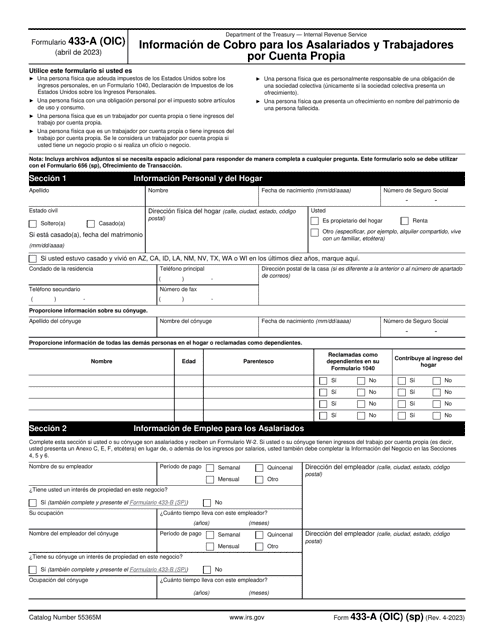

Are you a self-employed worker and need information about taxes and contributions? Look no further. Our collection of documents for self-employed workers has got you covered. Whether you need the IRS Formulario 433-A (SP) Informacion De Cobro Para Los Asalariados Y Trabajadores Por Cuenta Propia or the IRS Formulario 1040-ES(PR) Contribuciones Federales Estimadas Del Trabajo Por Cuenta Propia Y Sobre El Empleo De Empleados Domesticos - Puerto Rico, we have all the resources you need in both English and Spanish.

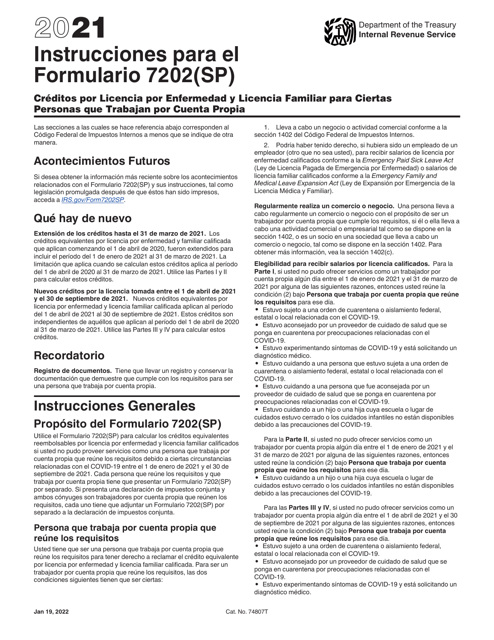

Our collection also includes instructional documents such as the Instrucciones para IRS Formulario 7202(SP) Creditos Por Licencia Por Enfermedad Y Licencia Familiar Para Ciertas Personas Que Trabajan Por Cuenta Propia. Whether you're looking for information on tax credits for self-employed individuals or guidance on handling collections, our documents have you covered.

Don't waste time searching for the right forms and information. Explore our collection of documents for self-employed workers and find everything you need in one place. Start simplifying your tax and contribution processes today!

Documents:

5

This document provides information for employees and self-employed individuals on payment collection.