Tax Liability Templates

Documents:

496

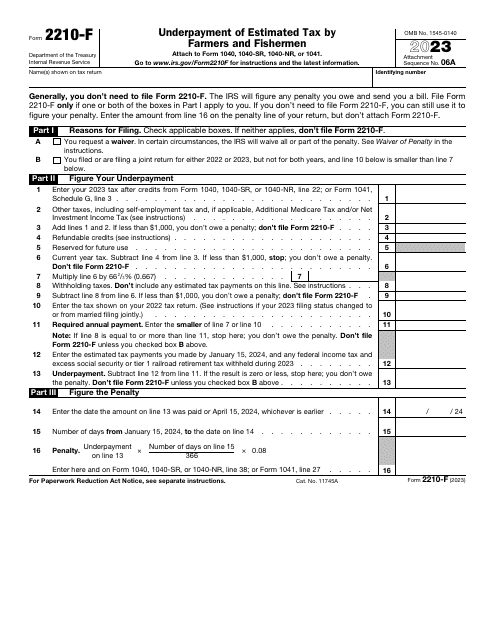

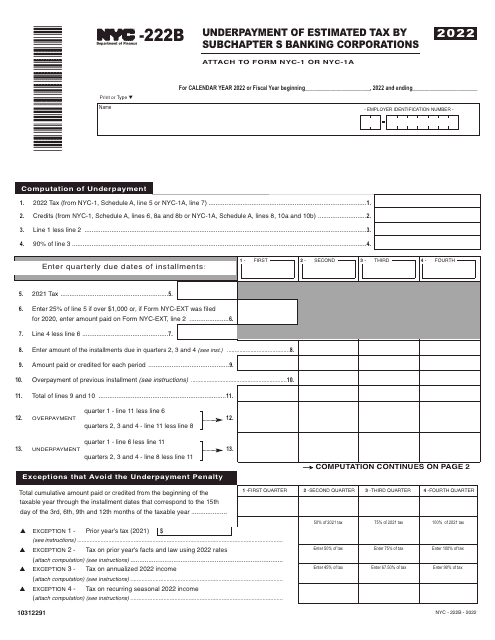

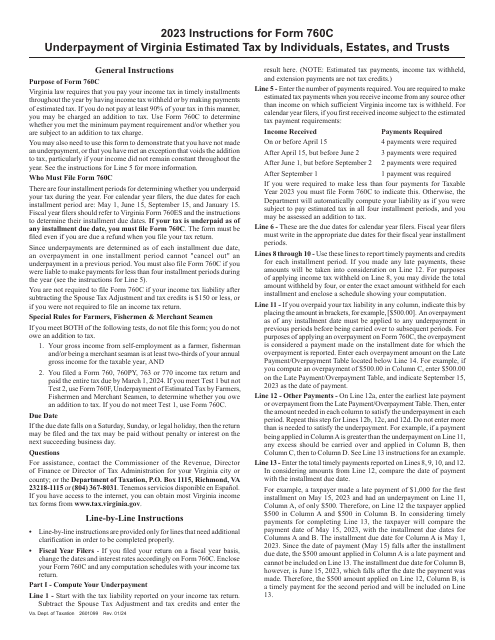

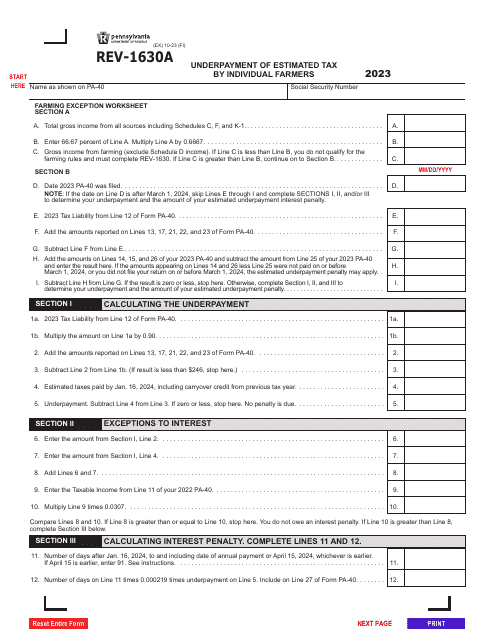

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

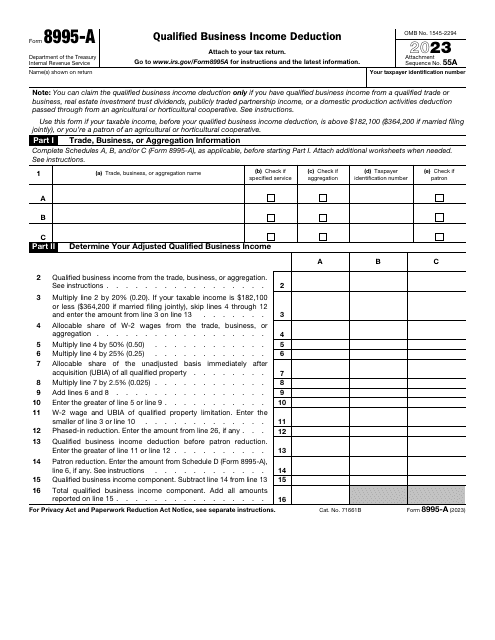

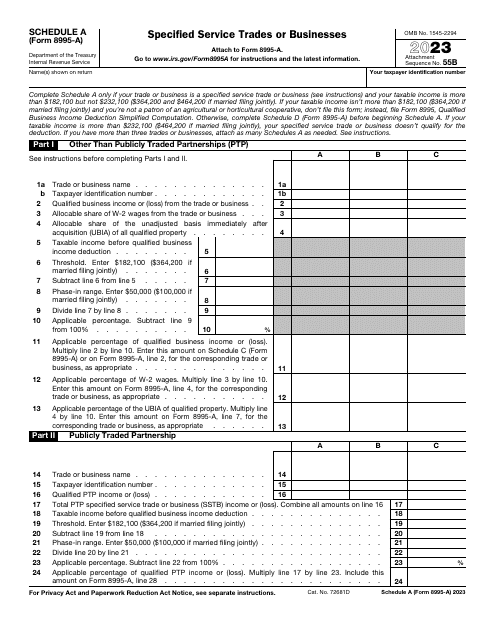

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

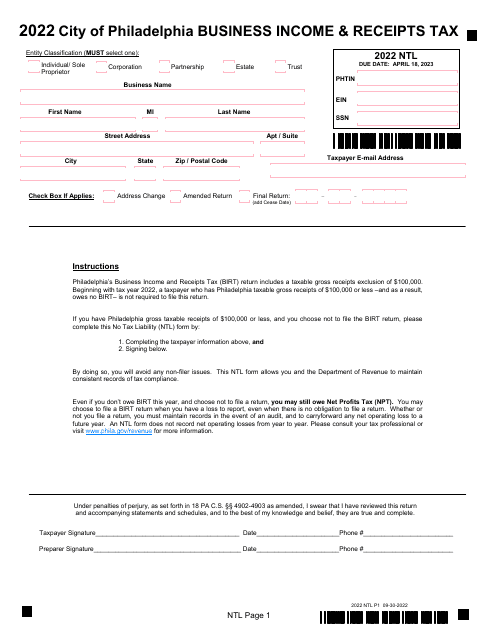

This form is used for reporting birth information and confirming no tax liability in the City of Philadelphia, Pennsylvania.

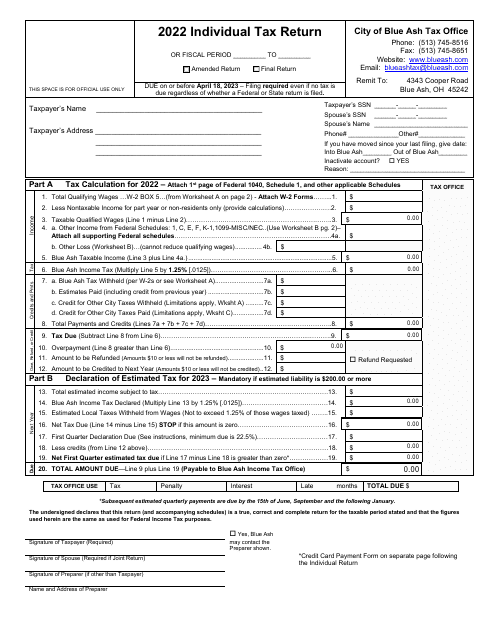

This Form is used for calculating the individual tax return for residents of the City of Blue Ash, Ohio.

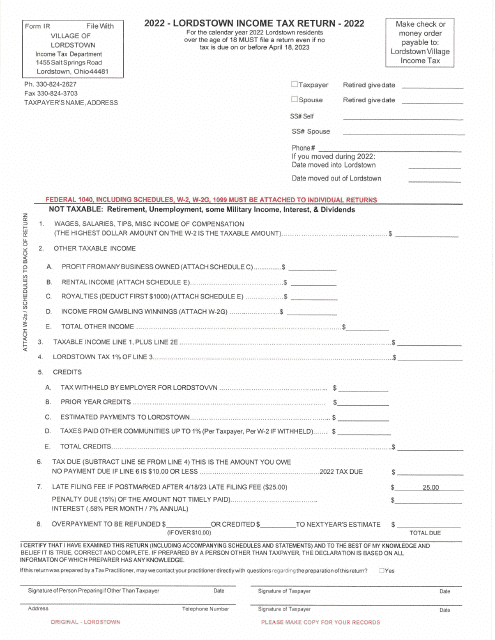

This Form is used for filing your income tax return in the Village of Lordstown, Ohio.

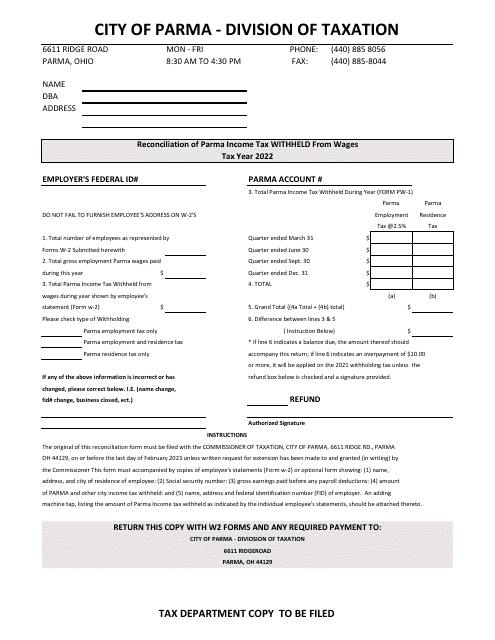

This form is used for reconciling the income tax withheld from wages in the City of Parma, Ohio.

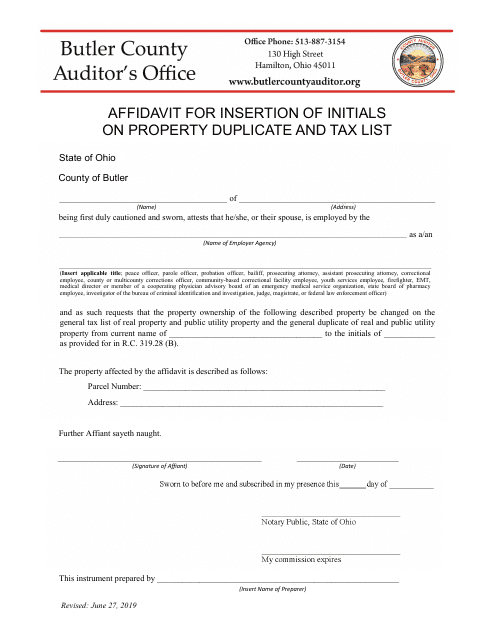

This document is used for requesting the insertion of initials on a property duplicate and tax list in Butler County, Ohio.

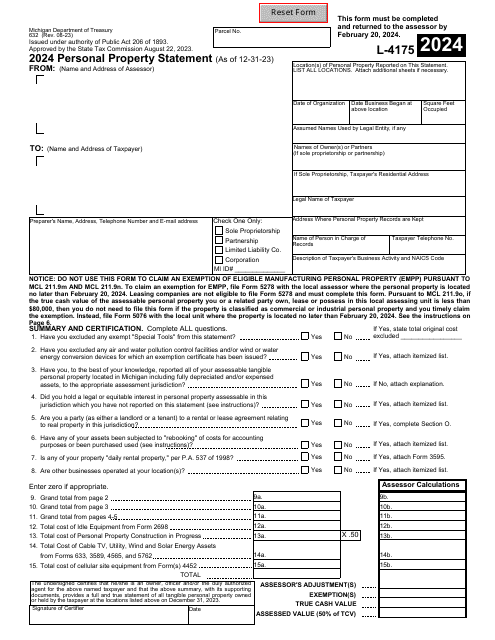

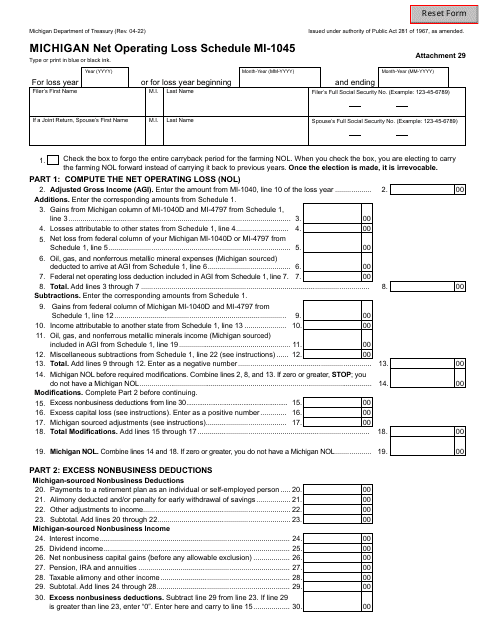

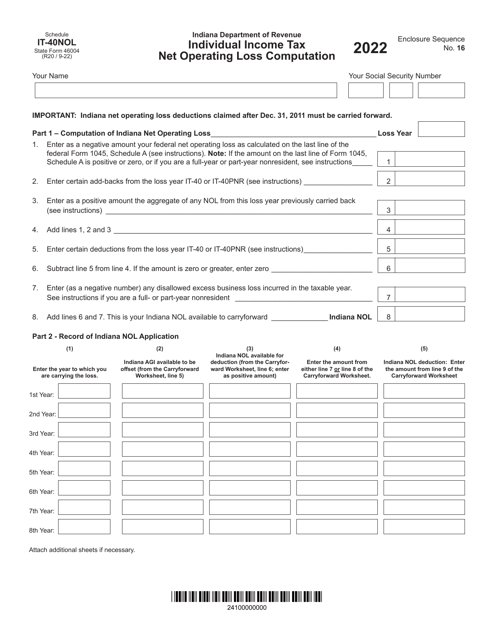

This Form is used for reporting net operating losses in the state of Michigan. It helps individuals and businesses calculate and claim any losses incurred in their operations for tax purposes.

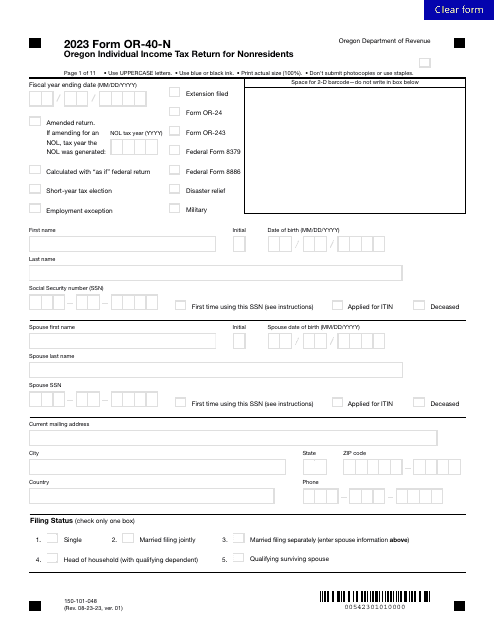

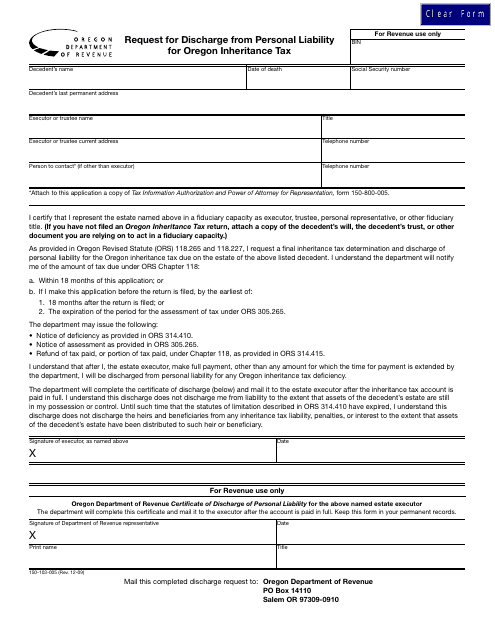

This form is used for requesting discharge from personal liability for Oregon inheritance tax in the state of Oregon.

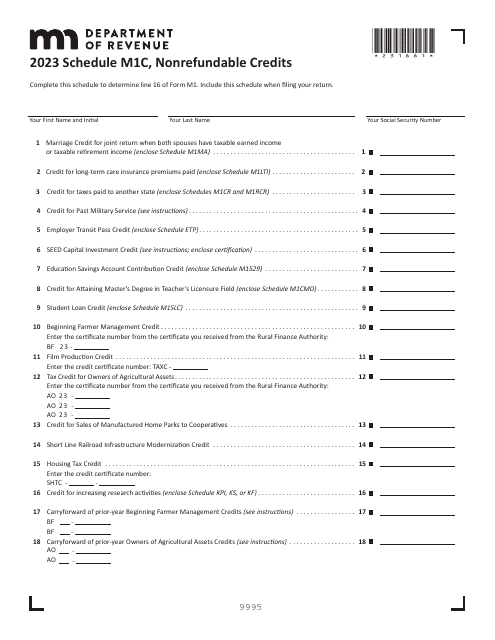

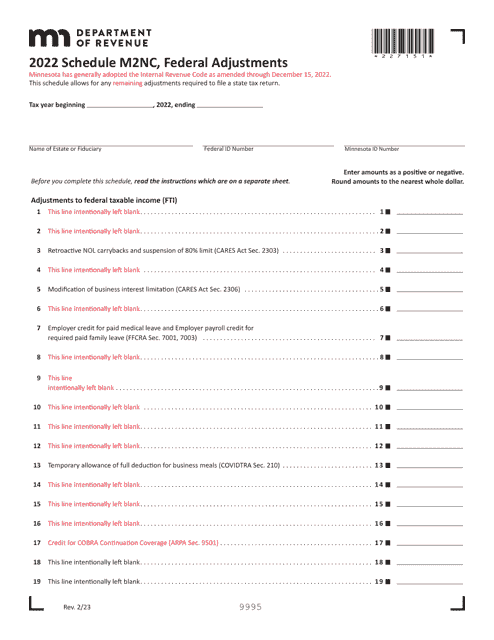

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.