Loan Terms and Conditions Templates

Looking for the most favorable loan terms and conditions? We've got you covered! Our extensive collection of loan terms and conditions documents offers a comprehensive guide to help you navigate the borrowing process with ease. Whether you're a first-time homebuyer in California or in need of a capital loan in Connecticut, our range of documents provides the necessary information and requirements specific to your location.

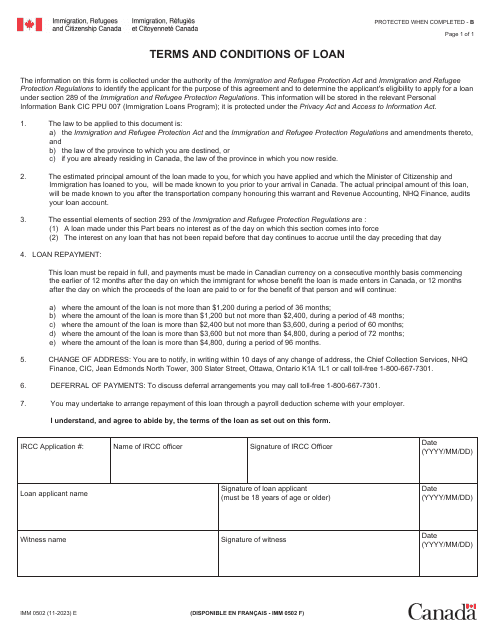

Our loan terms and conditions collection, also known as loan agreements or lending agreements, outlines the key terms, interest rates, repayment schedules, and other crucial details you need to consider when obtaining a loan. With our diverse range of documents, you can find everything from the initial maximum rate schedules for consumer credit sales in South Carolina to the terms and conditions of a loan under the Calhome Program in California.

Our loan terms and conditions documents are meticulously compiled and regularly updated to ensure that you have the most accurate and up-to-date information at your fingertips. Whether you're a borrower or a lender, our collection provides a comprehensive resource to help you understand the legal requirements and obligations associated with loans.

So, if you're ready to explore the world of loan terms and conditions, look no further. Our comprehensive collection of loan agreements is here to assist you every step of the way, ensuring that you make informed decisions and secure the best possible loan terms for your financial needs.

Documents:

17

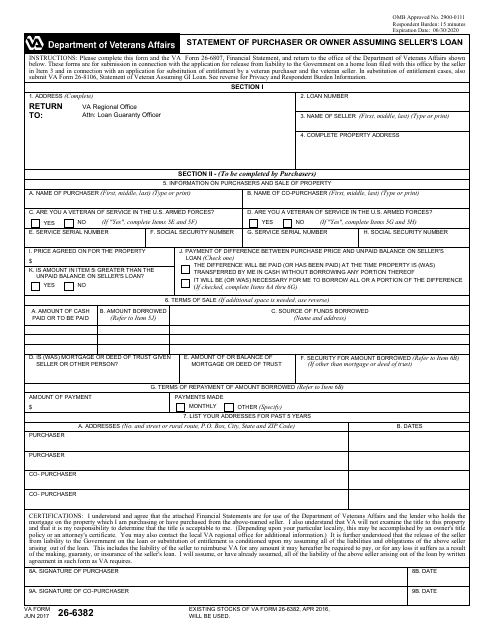

This Form is used for buyers or owners who are assuming the seller's loan.

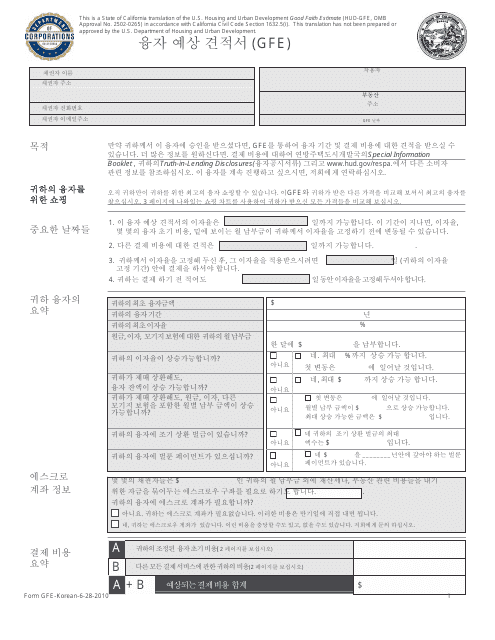

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

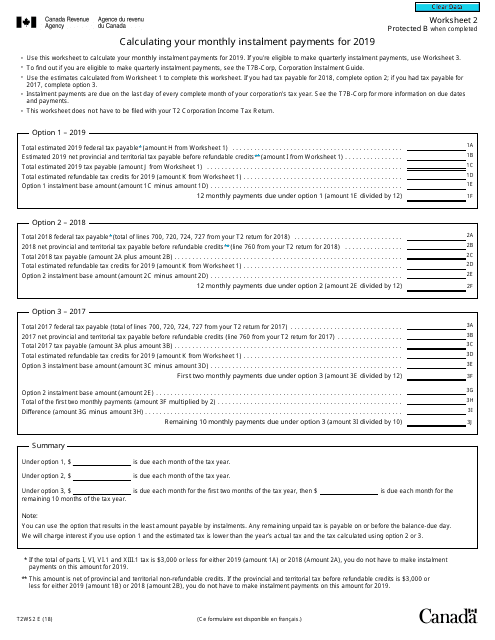

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

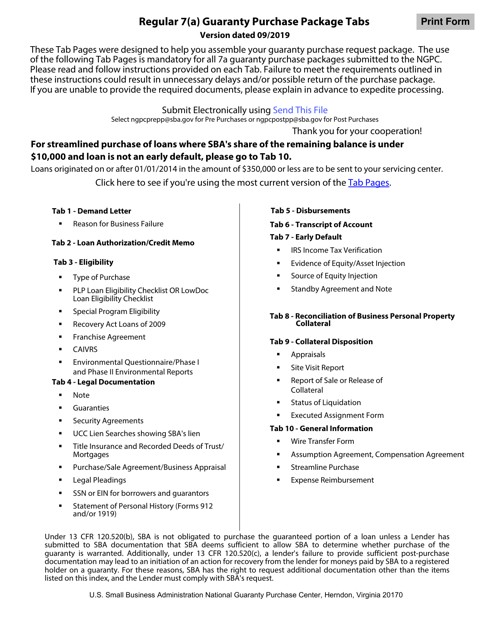

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

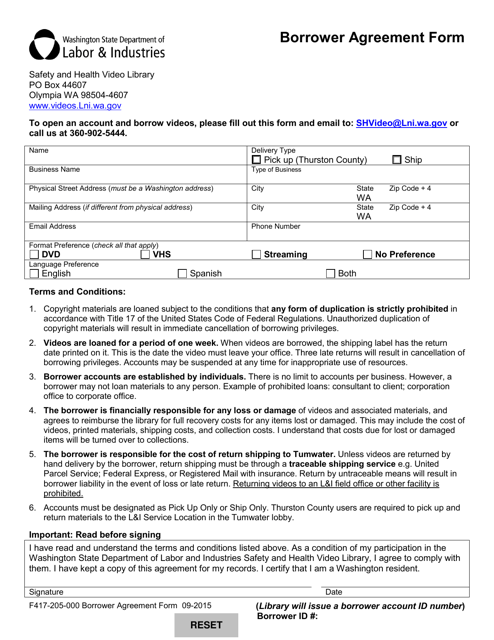

This form is used for borrowers in the state of Washington to enter into an agreement.

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

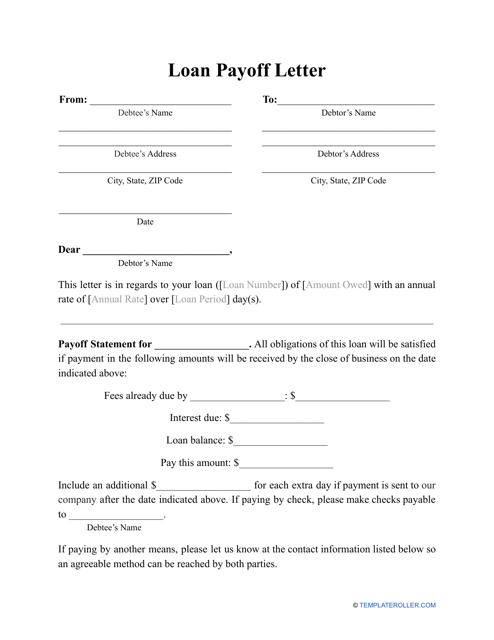

This letter provides detailed instructions on how to pay off a loan.

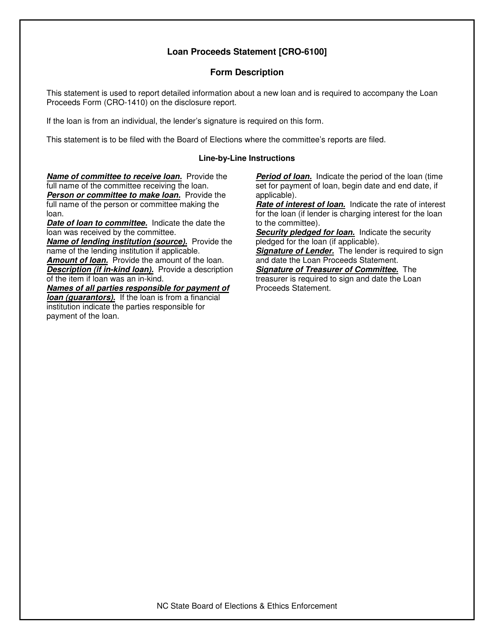

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

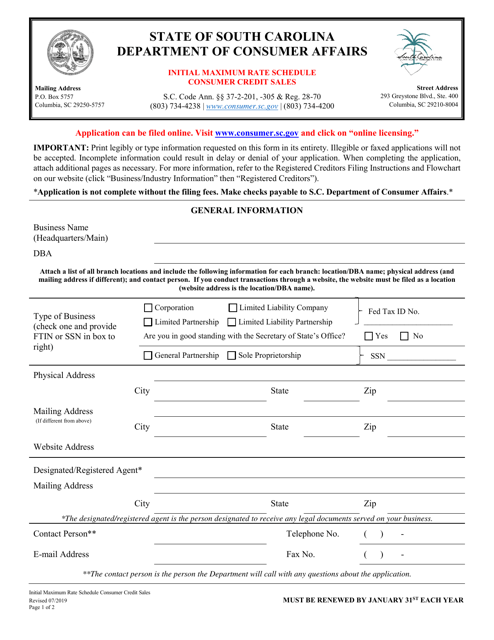

This document provides the maximum interest rates for consumer credit sales in South Carolina.

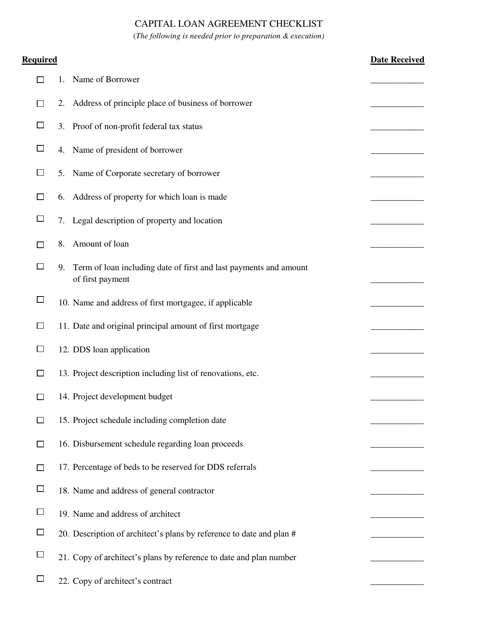

This document provides a checklist for a capital loan agreement in Connecticut. It outlines the necessary steps and requirements for obtaining a capital loan in the state.

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

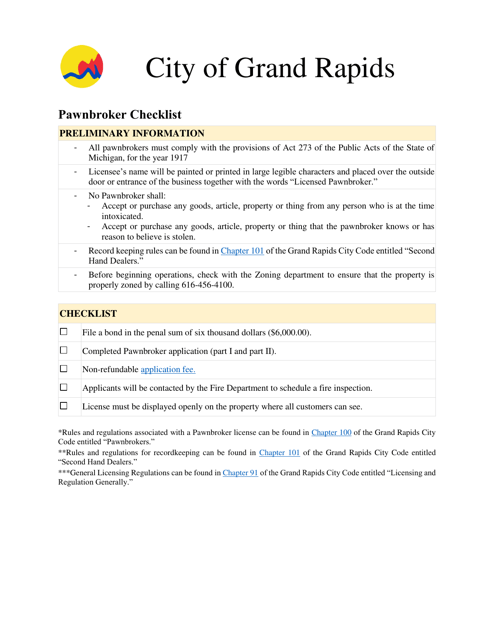

This document is a checklist for pawnbrokers operating in Grand Rapids, Michigan. It outlines the requirements and regulations that pawnbrokers must adhere to in the city.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.