Title Insurance Templates

Title Insurance, also known as title insurance forms or title insurers, is a crucial component in the real estate industry. It provides protection to both the buyer and lender against any potential financial loss due to undiscovered defects in the title of the property.

Title insurers play a significant role in ensuring a smooth and secure transfer of real estate ownership. They thoroughly examine public records, including deeds, mortgages, and court records, to identify any potential issues that may affect the title. By doing so, they help mitigate risks and offer an added layer of security for property buyers.

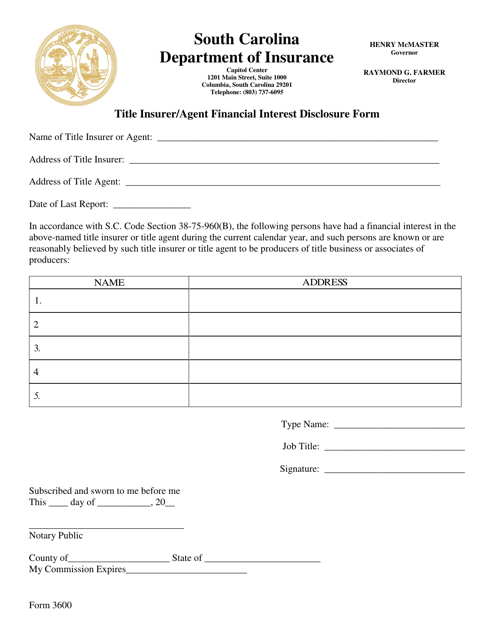

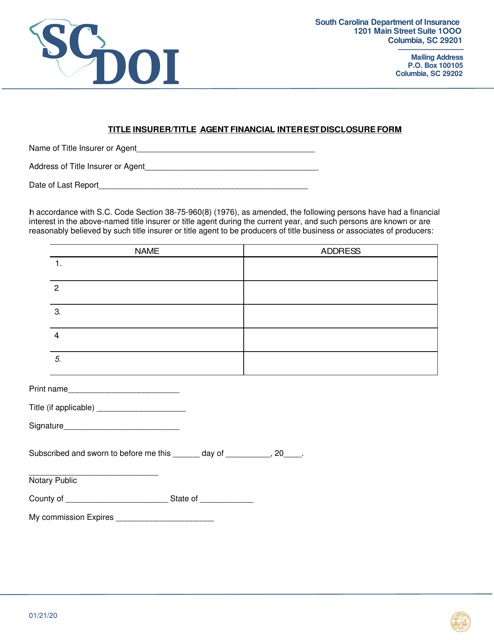

One of the essential documents related to title insurance is the SCID Form 3600 Title Insurer/Agent Financial Interest Disclosure Form, which is required in South Carolina. This document ensures transparency by disclosing any financial interests between the title insurer and the agent.

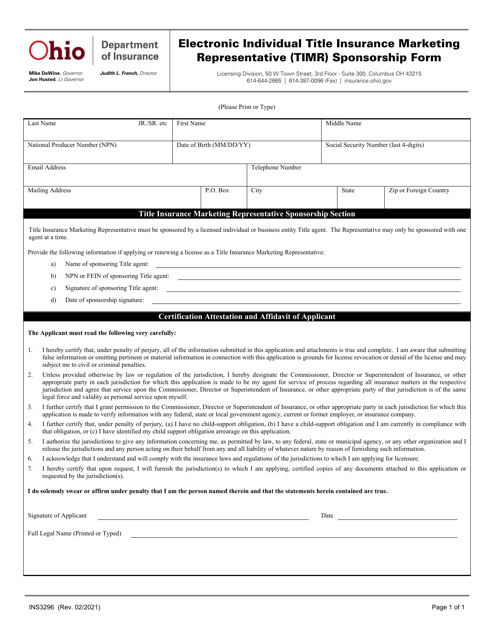

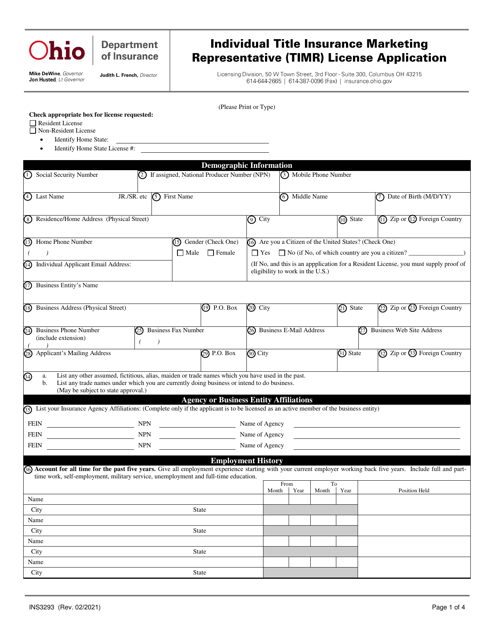

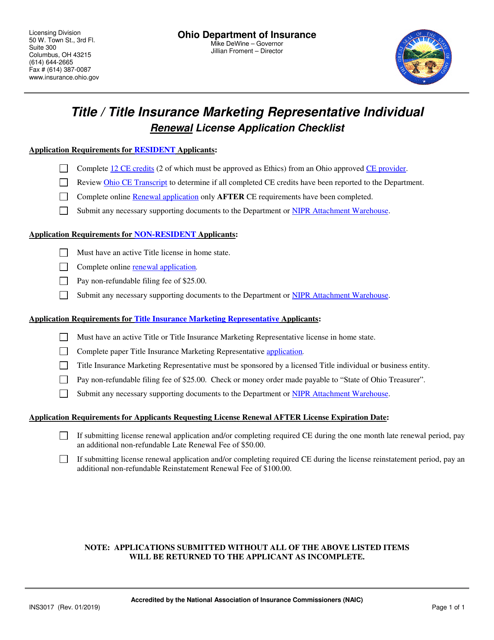

In Ohio, the Form INS3293 Individual Title Insurance Marketing Representative (Timr) License Application is crucial for individuals seeking to become licensed title insurance marketing representatives. This form serves as an application and helps regulate the industry by ensuring that individuals meet the necessary requirements.

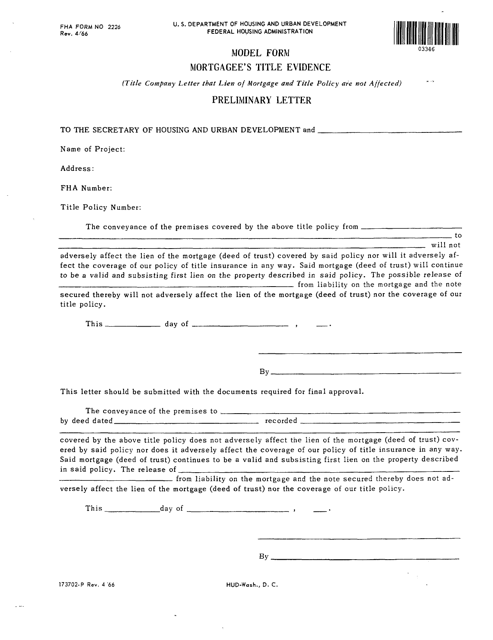

Another essential document is the Form FHA-2226 Model Form - Mortgagee's Title Evidence. This form is often required by mortgage lenders and serves as evidence that the title of the property is free from any liens or encumbrances. It helps protect lenders' interests in case of default on the mortgage.

Furthermore, Unity of Title is an important concept in Miami-Dade County, Florida, where the title of a property must be examined to ensure there are no multiple ownership claims or other disputes. This document helps establish a clear and unambiguous title, which is vital for a smooth real estate transaction.

In summary, title insurance, also known as title insurance forms or title insurers, provides essential protection for buyers and lenders alike. Through careful examination of public records and the use of various documents such as SCID Form 3600, Form INS3293, and Form FHA-2226, title insurers help ensure a secure and successful real estate transaction. Additionally, concepts like Unity of Title in Miami-Dade County further contribute to establishing clear and unambiguous titles for properties.

Documents:

48

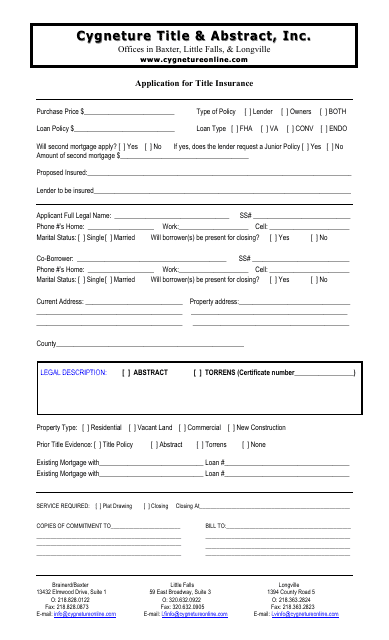

This Form is used for applying for title insurance through Cygneture Title & Abstract, Inc.

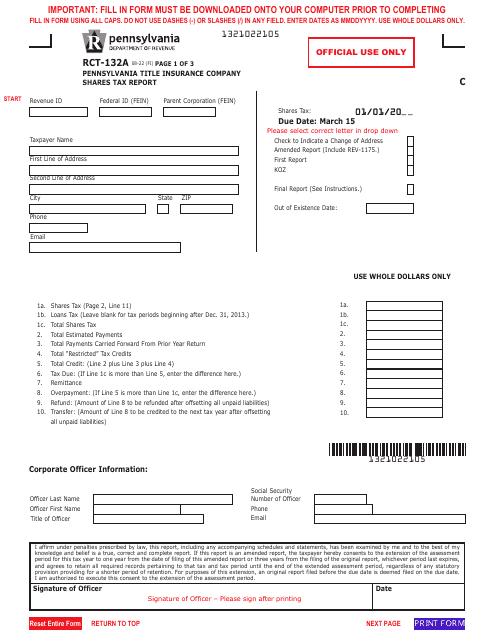

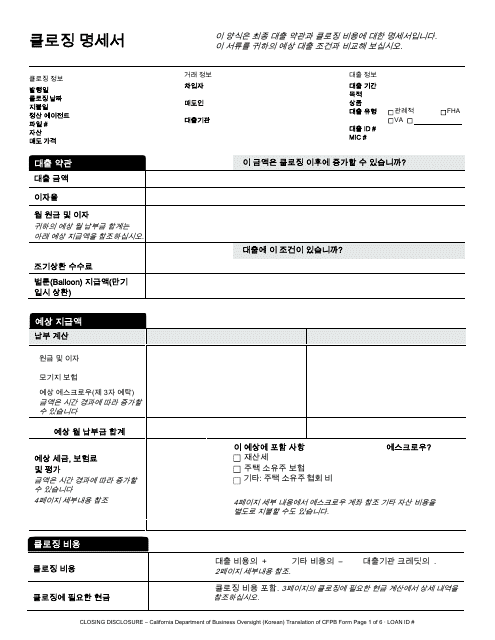

This Form is used for reporting shares tax by Pennsylvania title insurance companies. It provides instructions for completing Form RCT-132A.

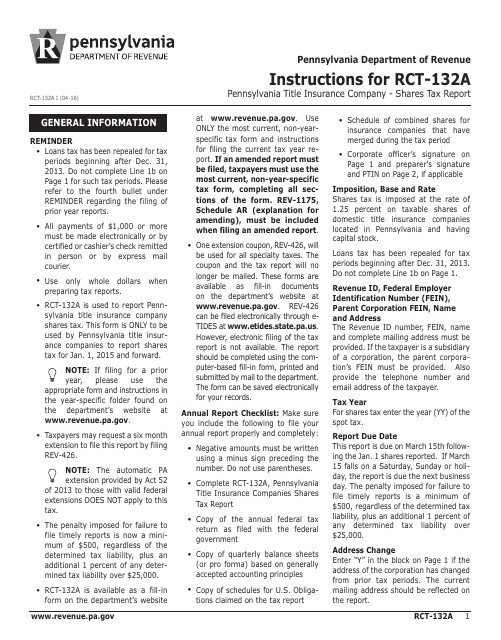

This document is used for providing the final details of a mortgage loan to a borrower in California who speaks Korean. It is required by law and outlines the terms and costs associated with the loan.

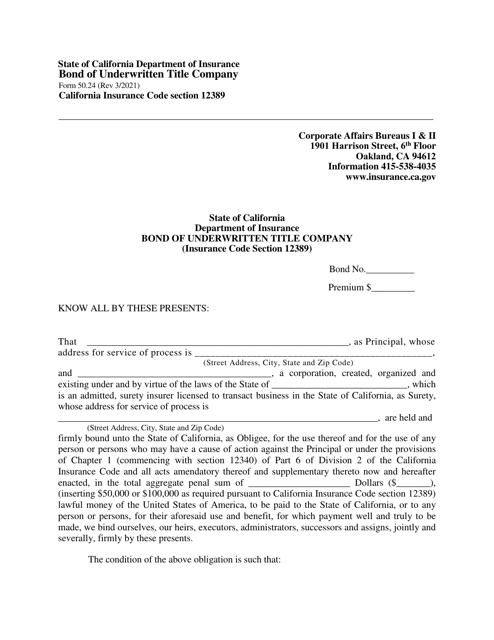

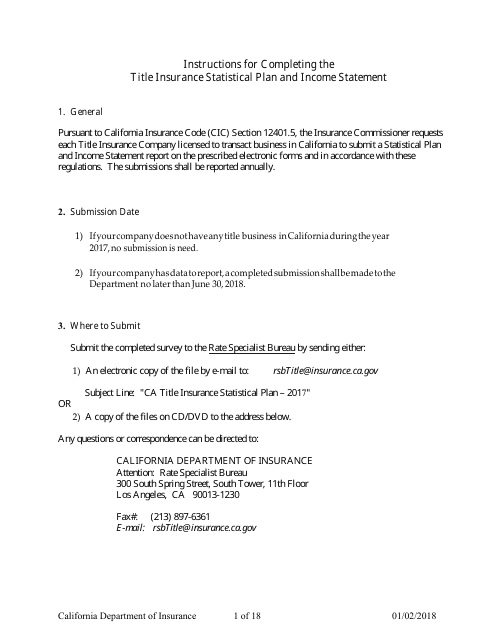

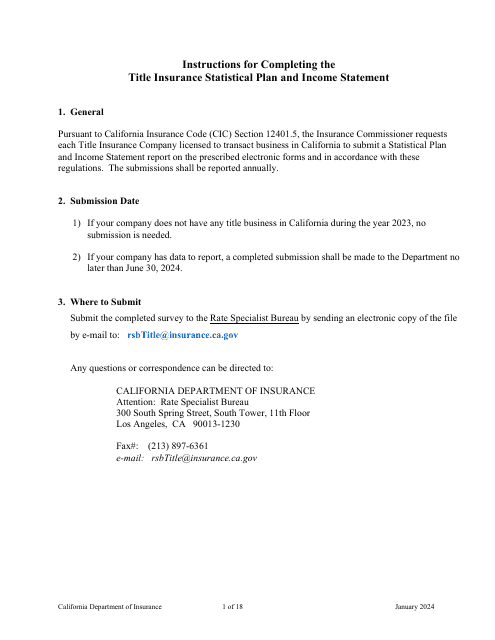

This document is used for reporting statistical information and income statement for title insurance companies in California. It provides instructions on how to fill out the required form.

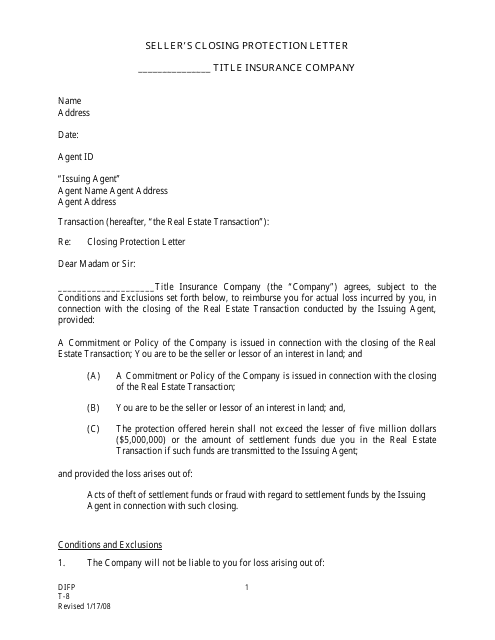

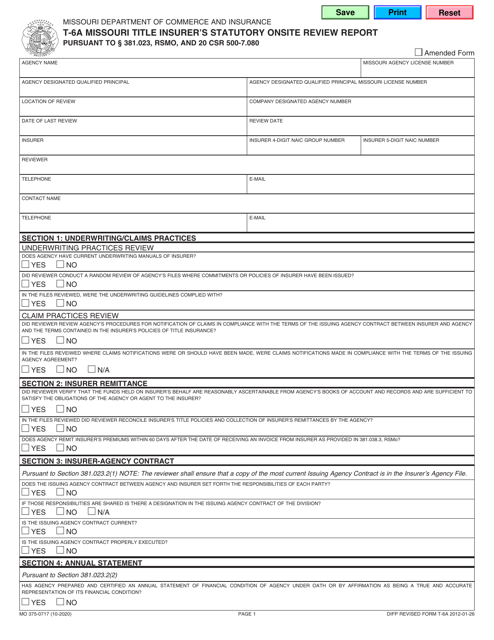

This form is used for providing the seller with closing protection in Missouri.

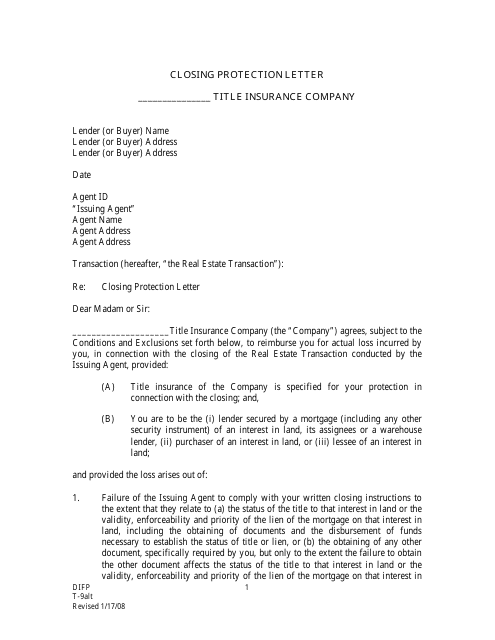

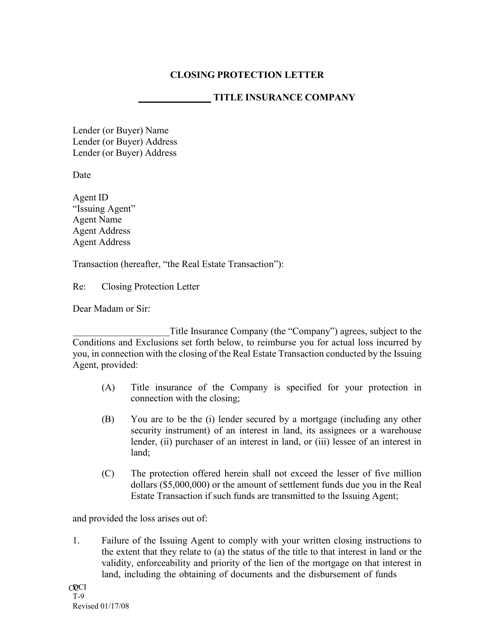

This Form is used for issuing a Closing Protection Letter in Missouri to protect the lender and buyer during a real estate transaction.

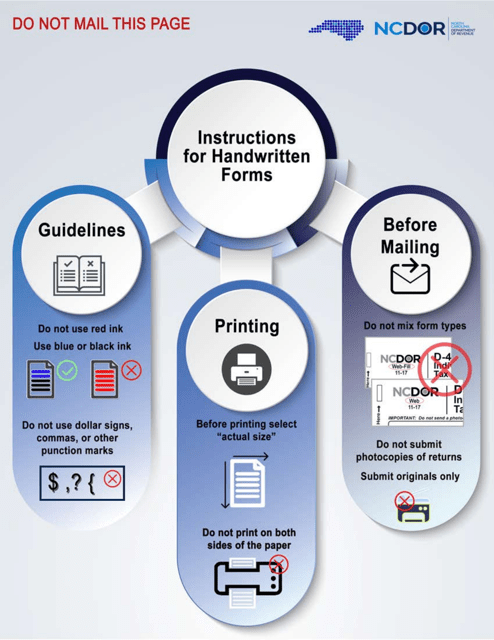

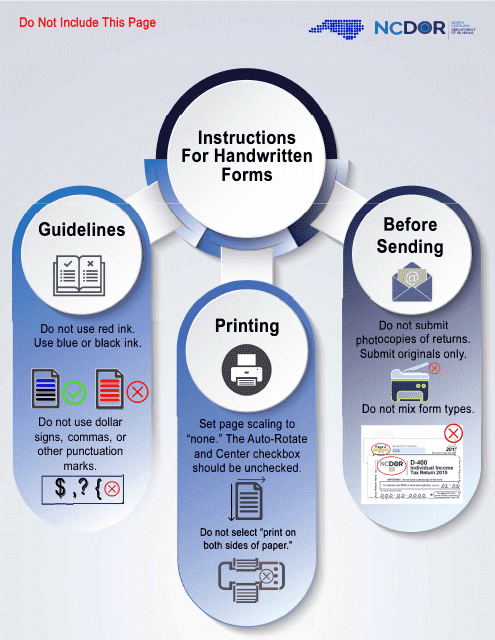

This form is used for installment payment for life, accident, health, and title insurance companies in North Carolina.

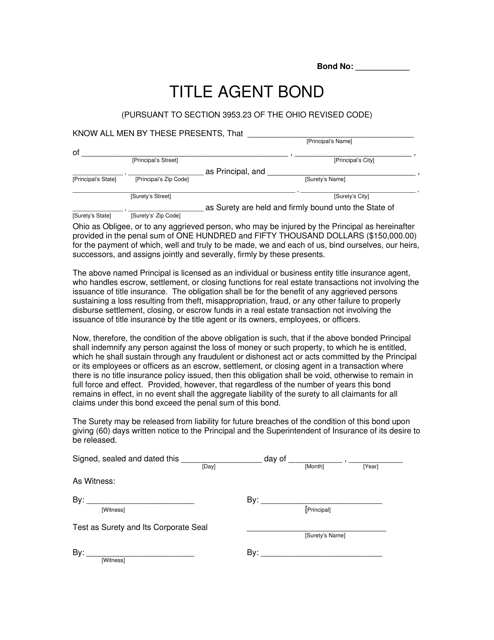

This document is used for obtaining an agent bond in the state of Ohio.

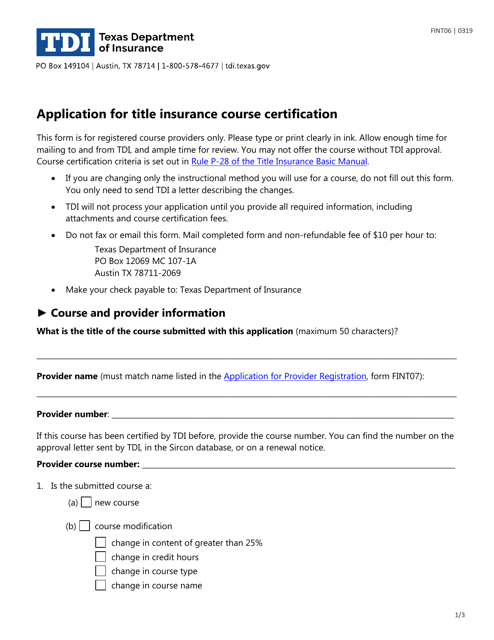

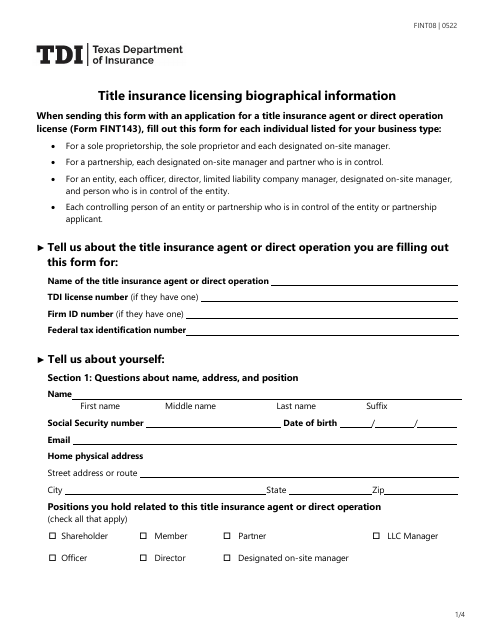

This form is used for applying for certification in a title insurance course in the state of Texas.

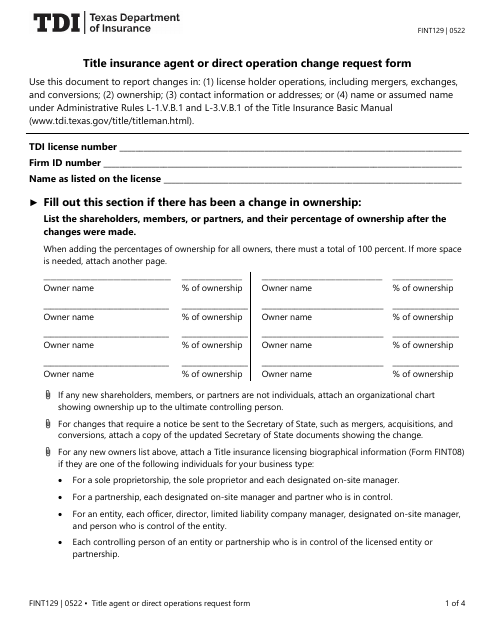

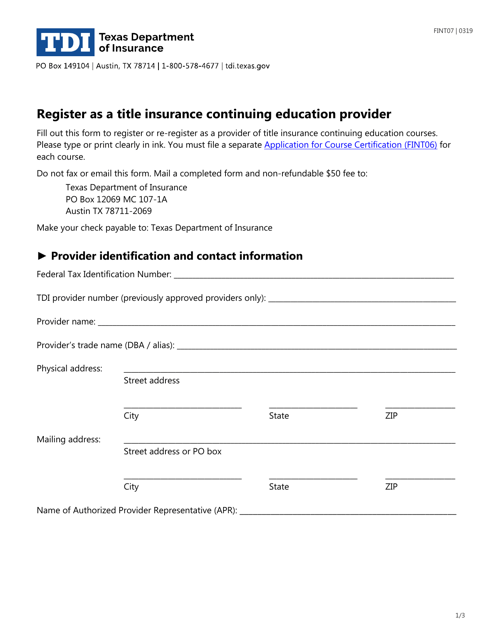

This form is used to register as a Title Insurance Continuing Education Provider in the state of Texas.

This form is used for disclosing the financial interests of title insurers or agents in South Carolina. It is a disclosure form required by the South Carolina Department of Insurance.

This Form is used for renewing the individual license of a Title Insurance Marketing Representative in Ohio. It provides a checklist of the necessary requirements for the renewal application.

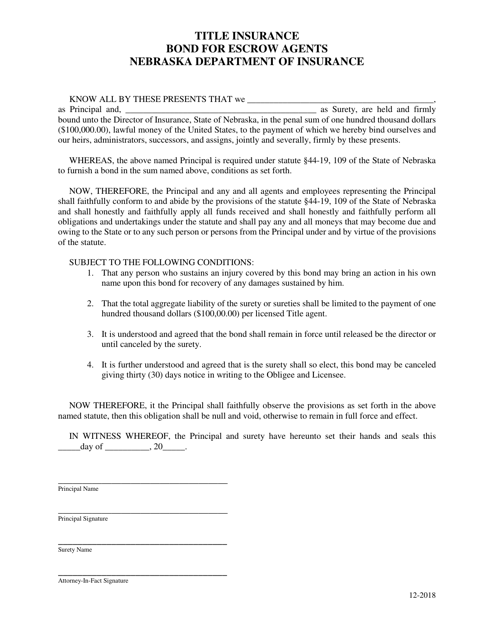

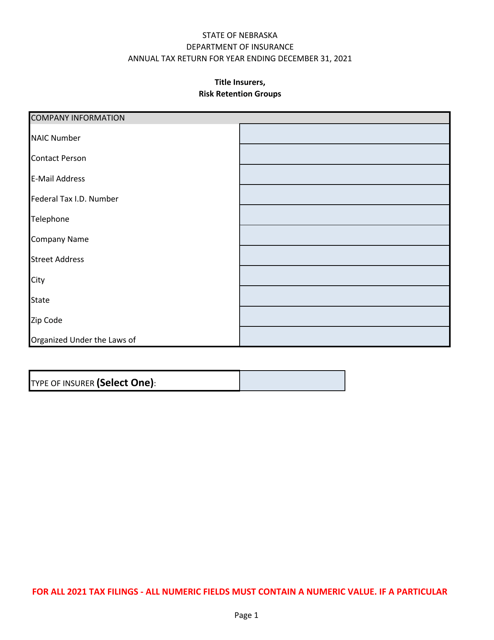

This form is used for securing title insurance by escrow agents in Nebraska. It serves as a bond to protect the interests of parties involved in real estate transactions.

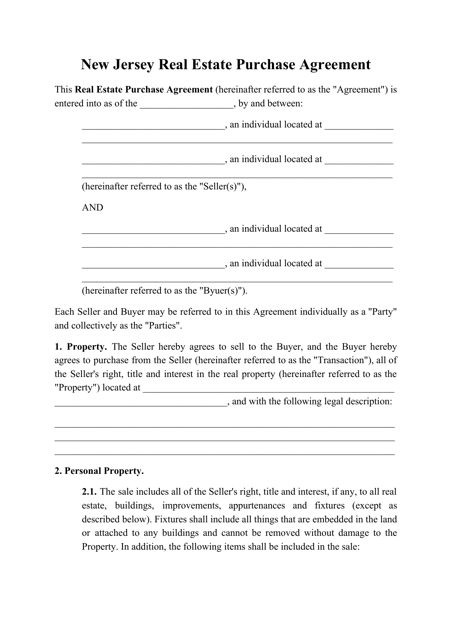

A New Jersey Real Estate Purchase Agreement is a formal document prepared and signed by New Jersey residents who sell and buy real estate for commercial or residential purposes.

This document is used for disclosing the financial interest of a title insurer or title agent in South Carolina.

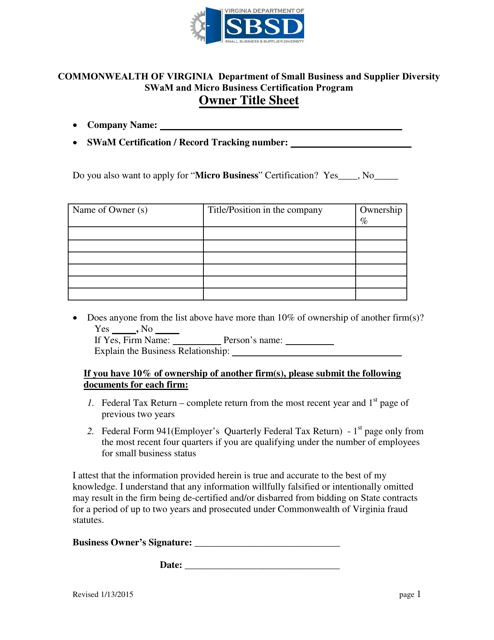

This document provides information and details about the ownership of a property in the state of Virginia. It includes the owner's name, contact information, and other relevant details.

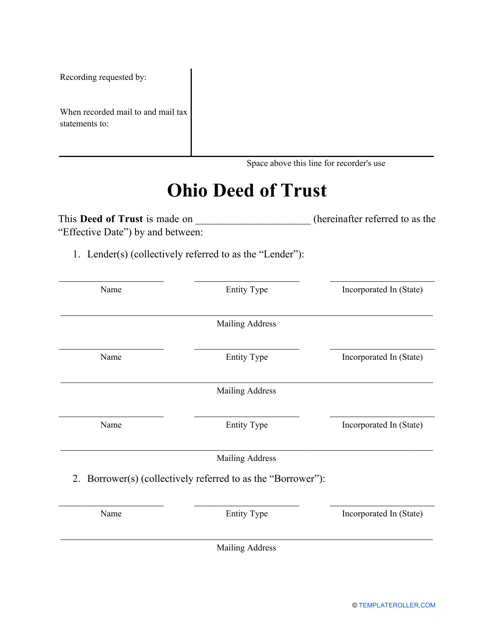

Complete this printable Deed of Trust template when making your own Deed in the state of Ohio.

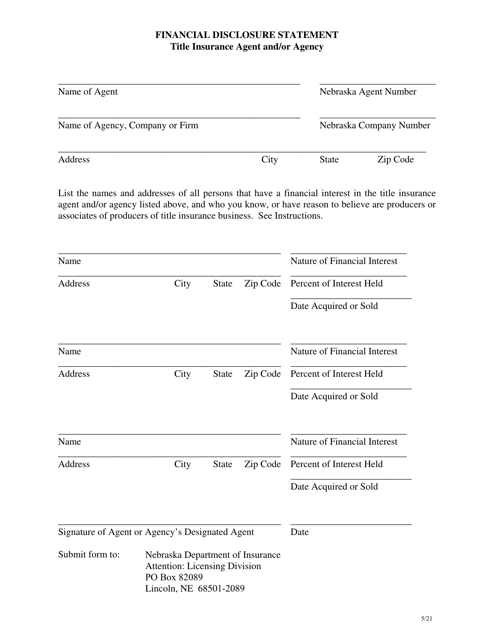

This document is used for disclosing financial information by title insurance agents and/or agencies in Nebraska. It provides transparency regarding their financial interests and potential conflicts of interest.

This document is used for providing evidence of title ownership from the mortgagee's perspective in an FHA loan transaction.

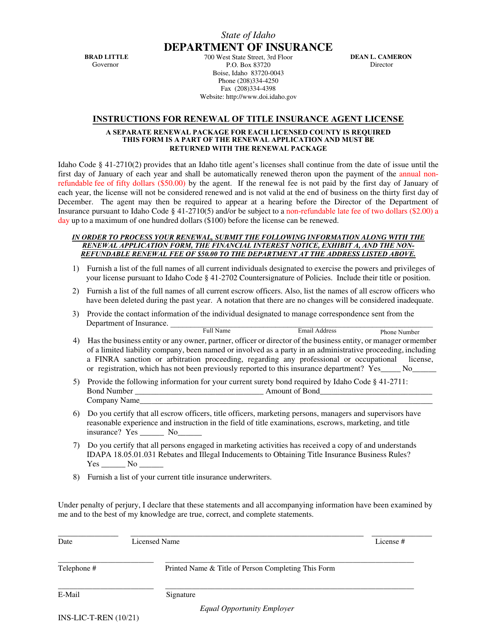

This document is for renewing a license for a title insurance agent in the state of Idaho.

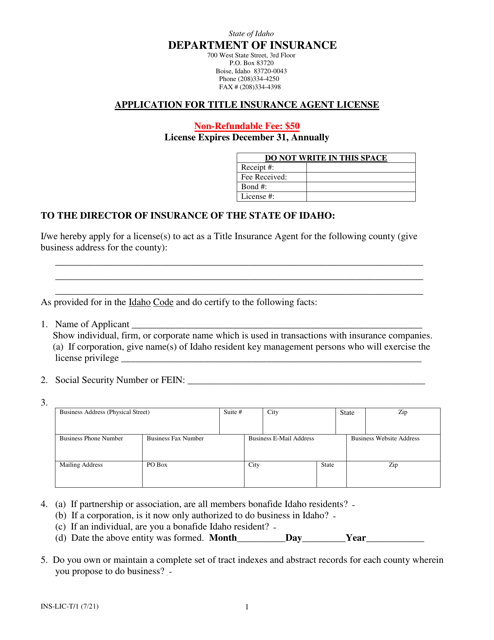

This form is used for applying for a title insurance agent license in Idaho.

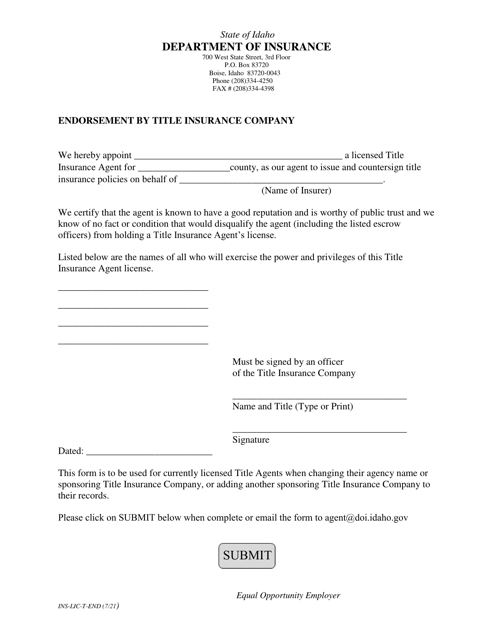

This document is an endorsement issued by a title insurance company in Idaho. It is used to provide additional coverage or protect against specific risks related to a property's title.

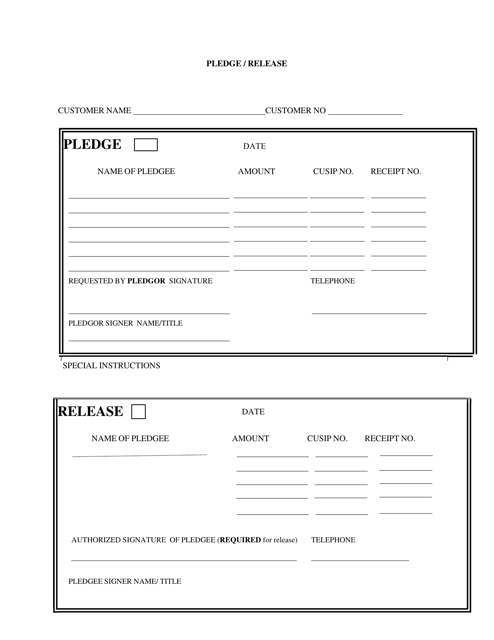

This document is used for pledging or releasing title insurance in the state of Illinois. It helps to establish or remove a mortgage or lien on a property and ensures the ownership rights are protected.

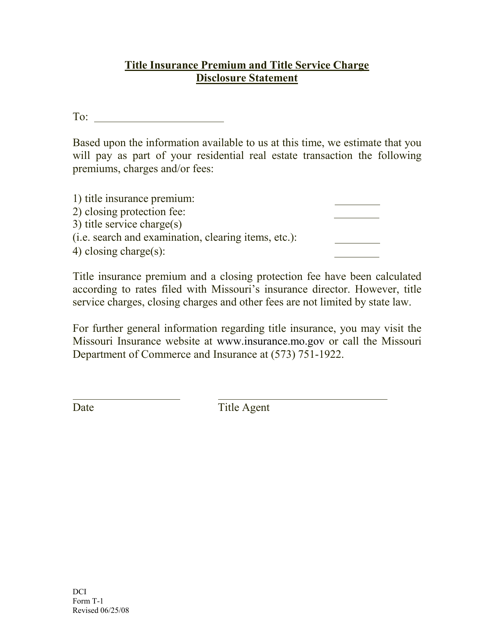

This Form is used for disclosing the title insurance premium and title service charge in Missouri.

This document is used for a lender to provide protection against losses for a borrower during the closing process in Missouri.